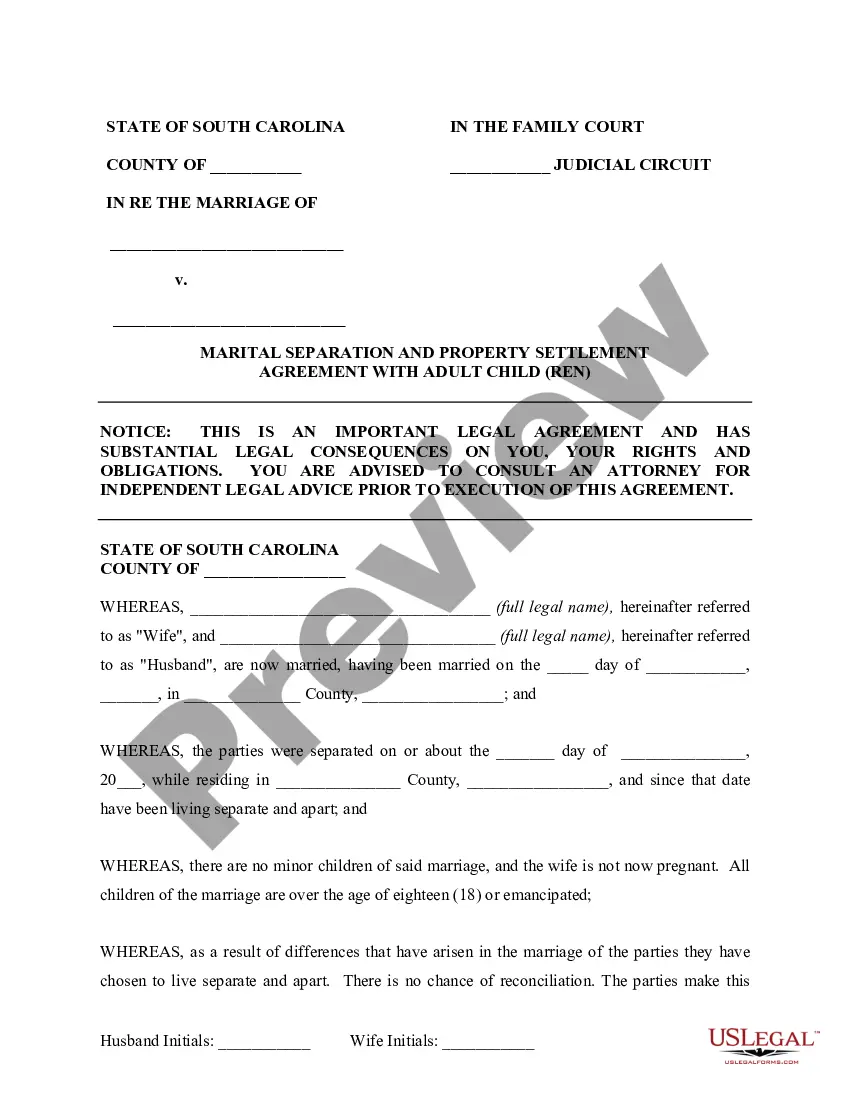

Separation Agreement Template South Carolina For Divorce

Description

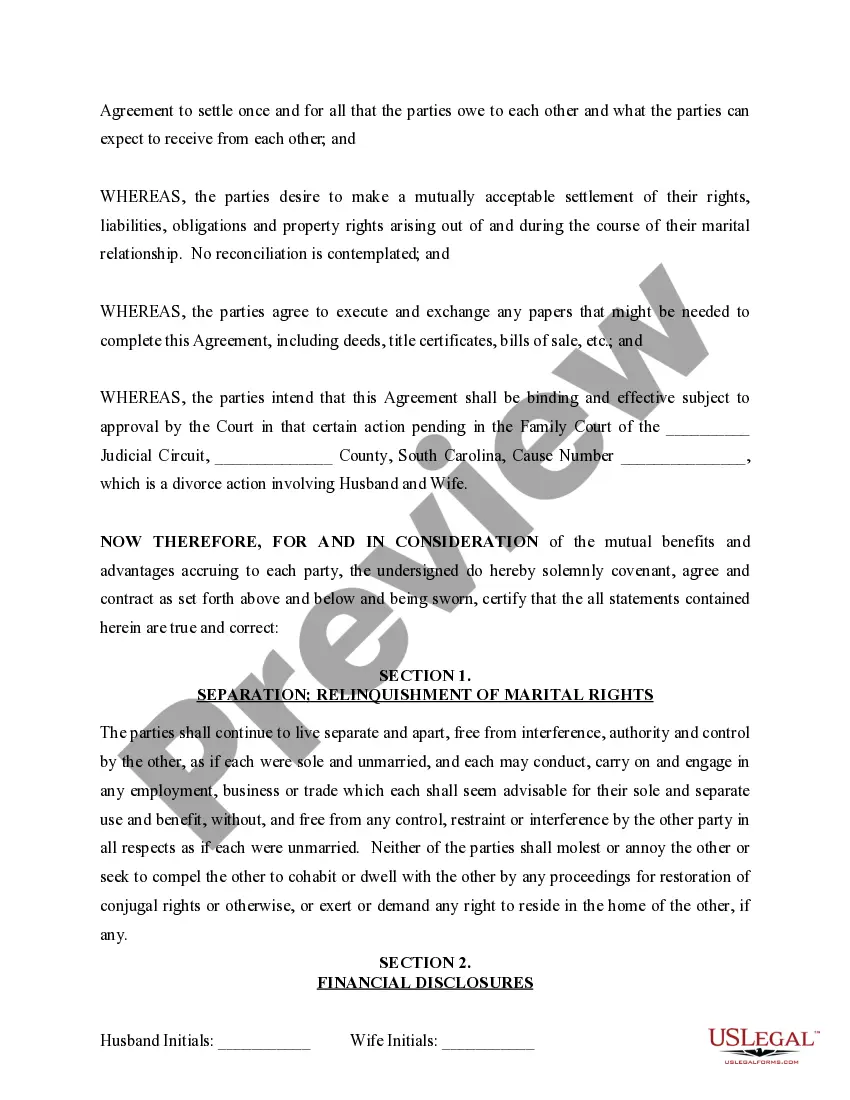

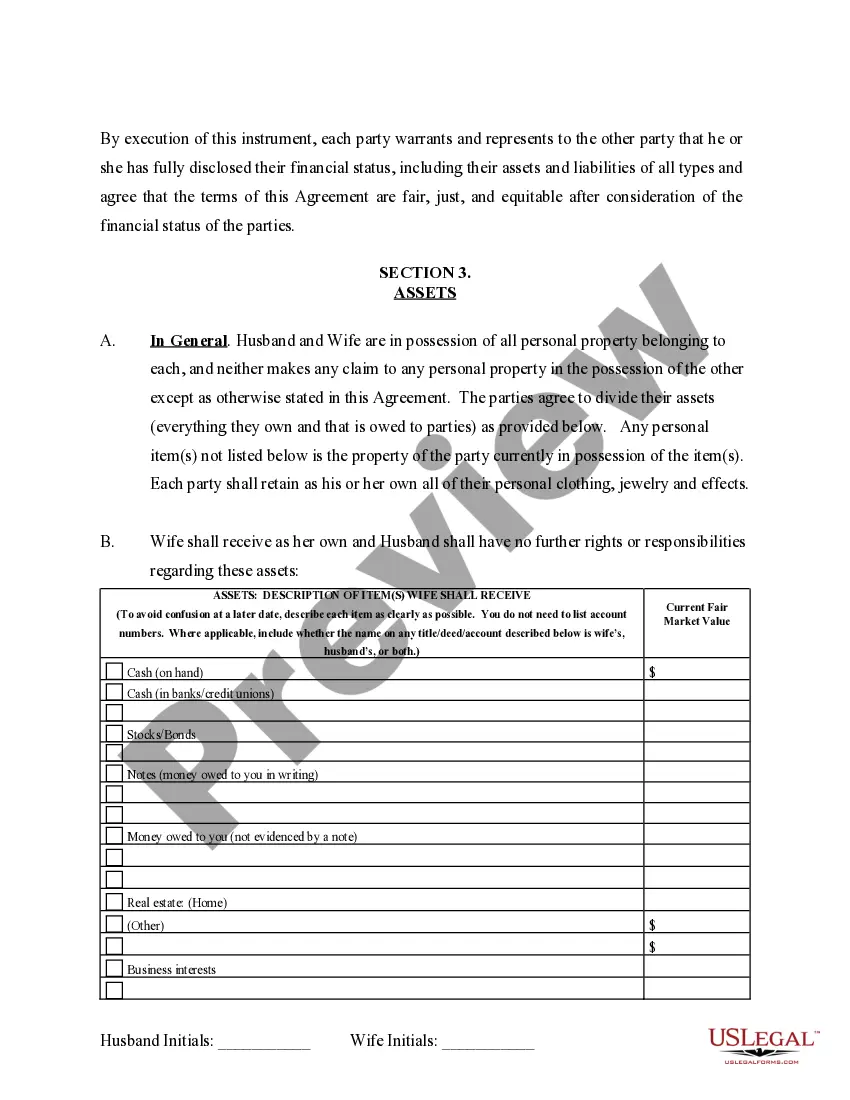

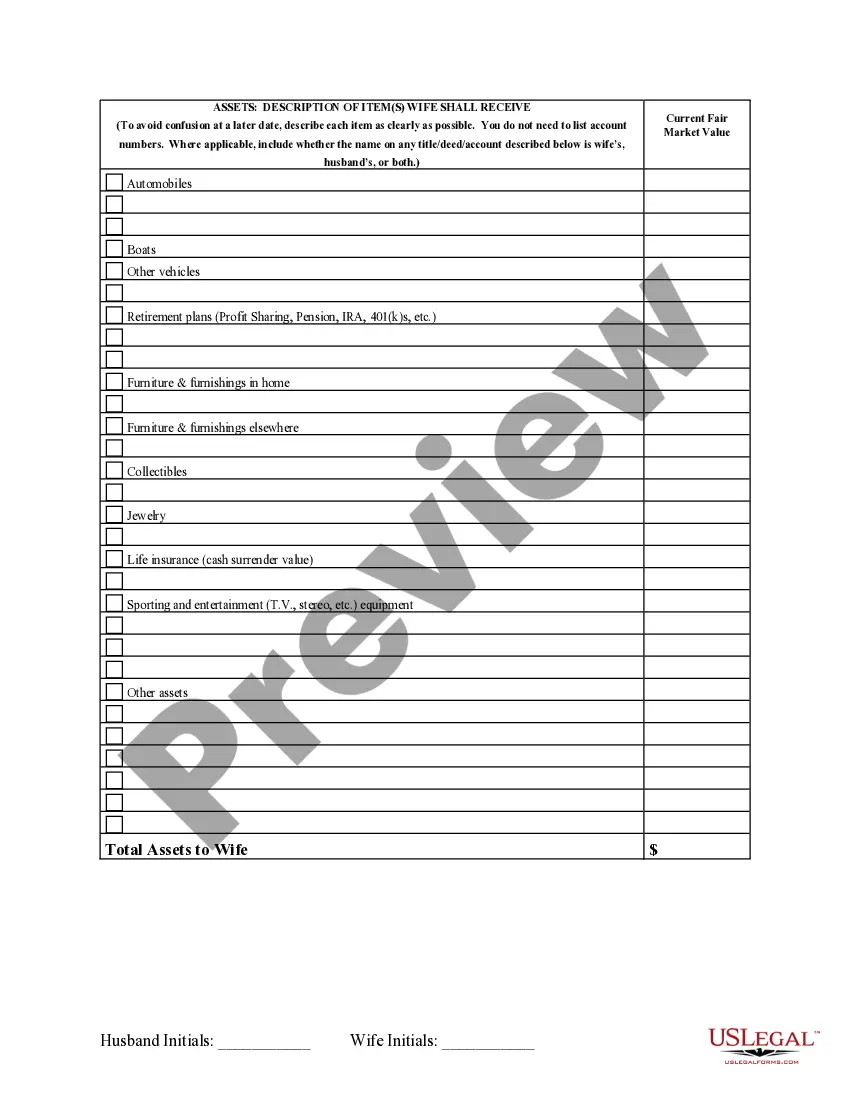

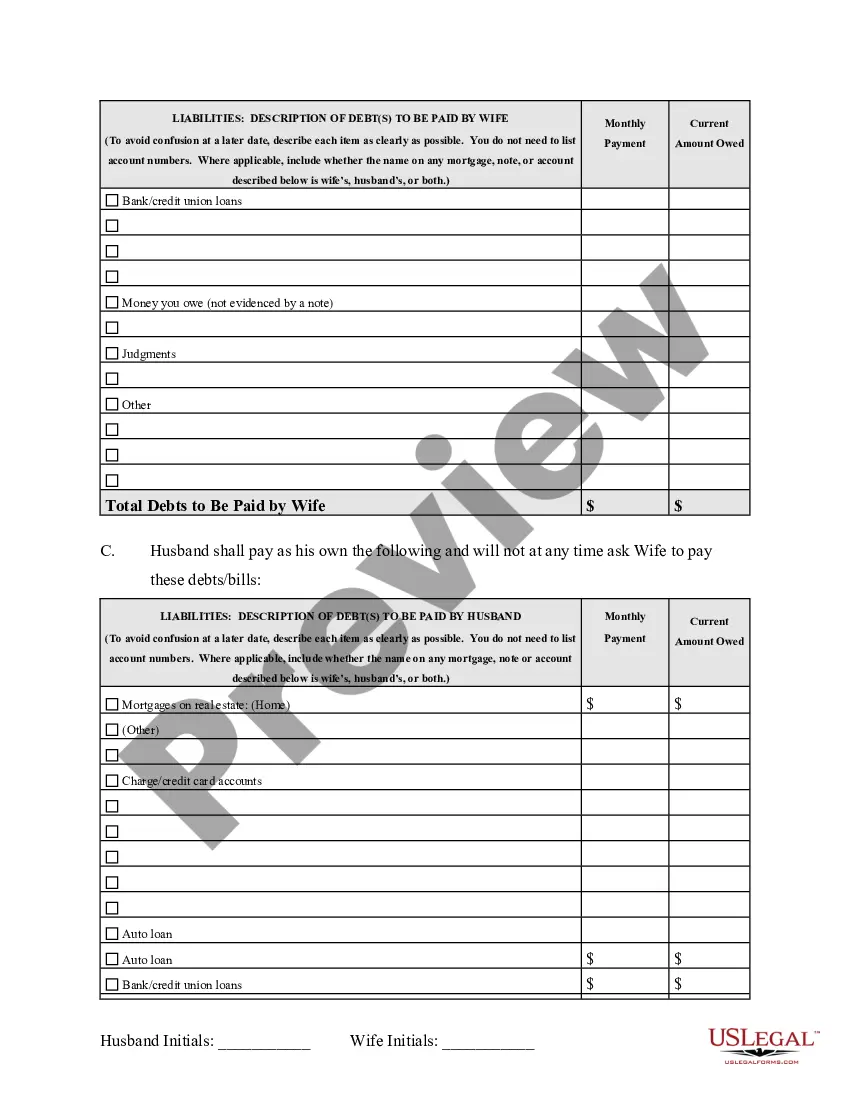

How to fill out South Carolina Marital Domestic Separation And Property Settlement Agreement Adult Children?

Regardless of whether it's for corporate reasons or personal issues, every individual will encounter legal circumstances at some point in their lives. Completing legal documents requires meticulous care, beginning with selecting the suitable form template. For instance, if you choose an incorrect version of a Separation Agreement Template South Carolina For Divorce, it will be rejected upon submission. Hence, it is vital to have a trustworthy source for legal documents such as US Legal Forms.

If you need to acquire a Separation Agreement Template South Carolina For Divorce template, follow these straightforward steps.

With an extensive US Legal Forms catalog available, you will never have to waste time searching for the appropriate template online. Utilize the library’s straightforward navigation to find the right form for any occasion.

- Obtain the sample you need by using the search box or browsing the catalog.

- Verify the form’s details to ensure it aligns with your case, jurisdiction, and area.

- Click on the form’s preview to examine it.

- If it's the incorrect form, return to the search tool to find the Separation Agreement Template South Carolina For Divorce template you're looking for.

- Acquire the template if it meets your specifications.

- If you already have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can pay using a credit card or PayPal account.

- Select the document format you prefer and download the Separation Agreement Template South Carolina For Divorce.

- Once downloaded, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

The Tennessee Fair Debt Collection Practices Act is a set of laws that protect consumers from being harassed or abused by debt collectors. These laws also limit how and when a debt collector can contact a consumer.

The FDCPA creates a structure within which debt collectors are allowed to work in an attempt to make debt collection a fair and nonaggressive process. The law limits the time of day when collectors may call, the type of language they may use, and how they represent themselves.

If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days. But at that point, the debt is considered valid, and a debt collector is still legally allowed to continue contacting you.

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted. Ask for the debt collector's mailing address at this time as well, in case you decide to request a debt verification letter.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

The Tennessee Fair Debt Collection Practices Act is a set of laws that protect consumers from being harassed or abused by debt collectors. These laws also limit how and when a debt collector can contact a consumer.

§ 1692c(b) of the FDCPA prohibits, with certain exceptions, debt collectors from communicating, ?in connection with the collection of any debt,? with any person other than the consumer.