Writ Of Execution South Carolina Without A Will

Description

How to fill out South Carolina Writ Of Execution?

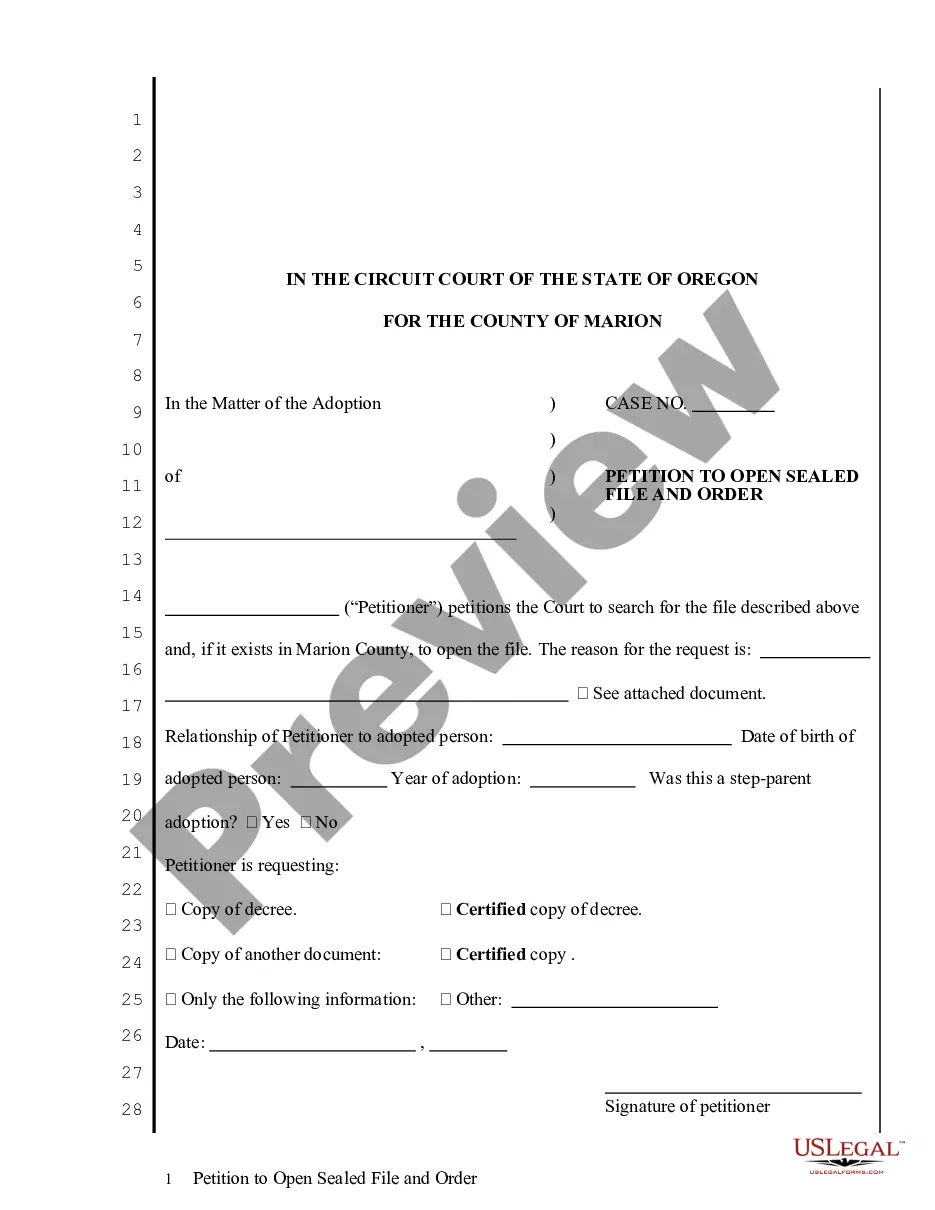

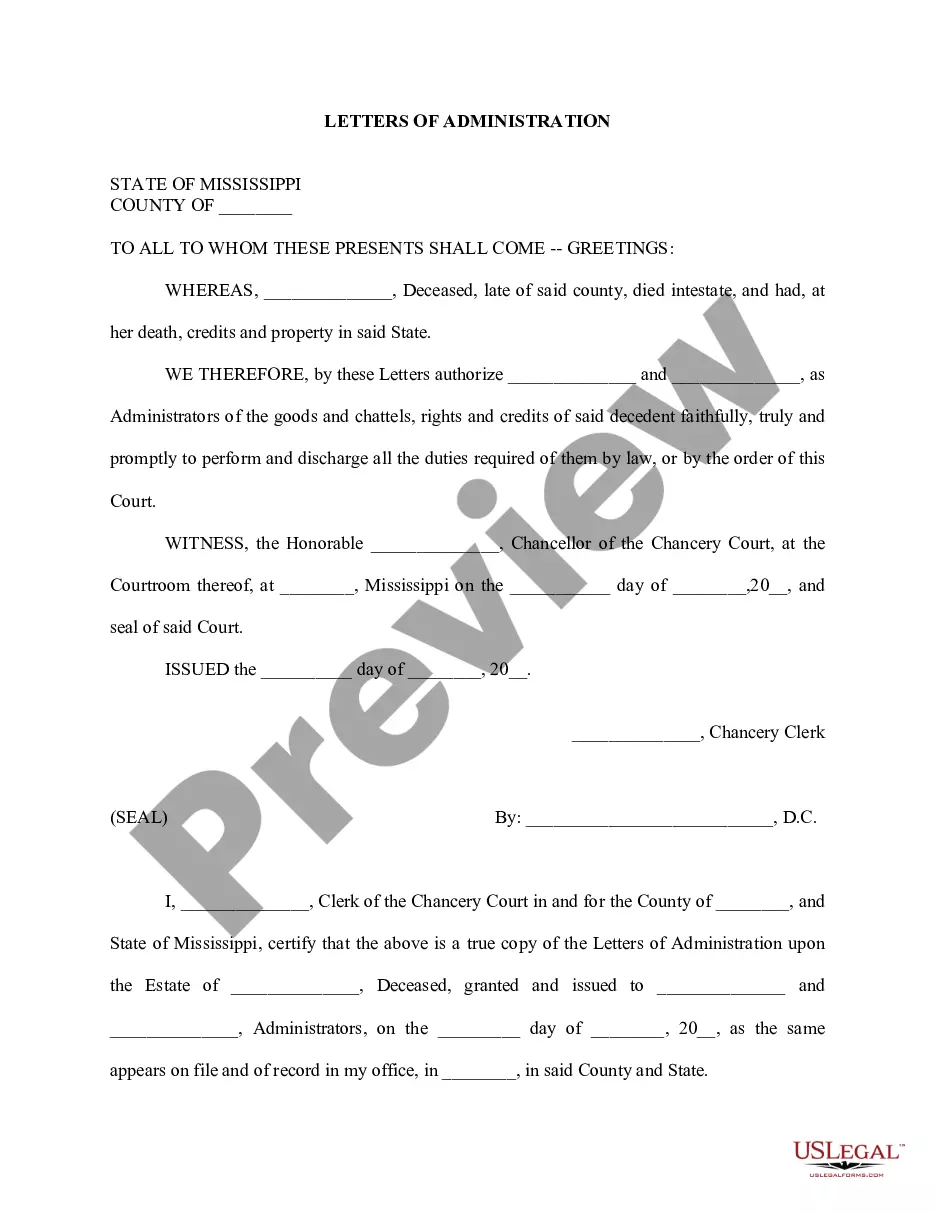

The Writ of Execution South Carolina Without a Will displayed on this page is a reusable legal template crafted by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal circumstances. It is the quickest, most direct, and most trustworthy method to acquire the paperwork you require, as the service ensures the utmost level of data security and malware defense.

Subscribe to US Legal Forms to access verified legal templates for all of life's circumstances.

- Search for the document you require and examine it.

- Choose the subscription plan that fits your needs and create an account. Use PayPal or a credit card for a swift payment. If you have an existing account, Log In and verify your subscription to continue.

- Retrieve the editable template.

- Fill out and sign the document.

- Re-download your paperwork when necessary.

Form popularity

FAQ

In South Carolina, you typically have up to one year from the date of the deceased's death to file a claim against the estate. If no will exists, navigating the process may become complex, especially if you seek a writ of execution south carolina without a will. It is essential to act promptly, as delays can jeopardize your claim. For assistance, consider using platforms like USLegalForms, which provide guidance and resources for making claims effectively.

If there is no will, South Carolina intestacy laws determine who receives the estate. Typically, the surviving spouse and children receive priority, followed by parents or siblings if no immediate family exists. It is essential to realize that the court plays a significant role in this distribution process, and a writ of execution south carolina without a will may be necessary when heir disputes arise.

The next of kin order in South Carolina usually follows the intestacy laws. First, the surviving spouse inherits, then children, parents, and siblings in that sequence. If no immediate family exists, the estate may be passed down to more distant relatives. Understanding this order can be vital when dealing with a writ of execution south carolina without a will.

Yes, in South Carolina, you typically need to go to court to initiate the probate process if a will exists. If there is no will, the estate will still need to go through probate to determine asset distribution. The court oversees this process to ensure laws are followed. Engaging with a writ of execution south carolina without a will can hasten resolution when necessary.

If someone dies in South Carolina without a will, their estate will enter probate. The court will appoint an administrator to ensure assets are distributed according to intestacy laws. This process can be lengthy and may require a writ of execution south carolina without a will if complications arise among the heirs. Consider utilizing services like US Legal Forms to navigate this process more smoothly.

When someone dies without a will, their bank accounts are included in the probate process. The court will determine the rightful heirs based on intestacy laws. Meanwhile, the bank may freeze the account until the estate is settled, which can complicate access to funds. This scenario often involves navigating a writ of execution south carolina without a will, especially if disputes occur among heirs.

In South Carolina, the order of inheritance follows a specific sequence. First, the surviving spouse and children inherit the estate. If no children exist, parents inherit next, followed by siblings and their descendants. Understanding this order is crucial for those navigating a writ of execution south carolina without a will.

When a person passes away without a will, their assets are distributed according to South Carolina intestacy laws. This means that the estate will go through probate, where the court appoints an administrator to manage the estate. The process may seem complicated, but it ensures that assets are allocated fairly to eligible relatives. A writ of execution south carolina without a will may be necessary if disputes arise over asset distribution.