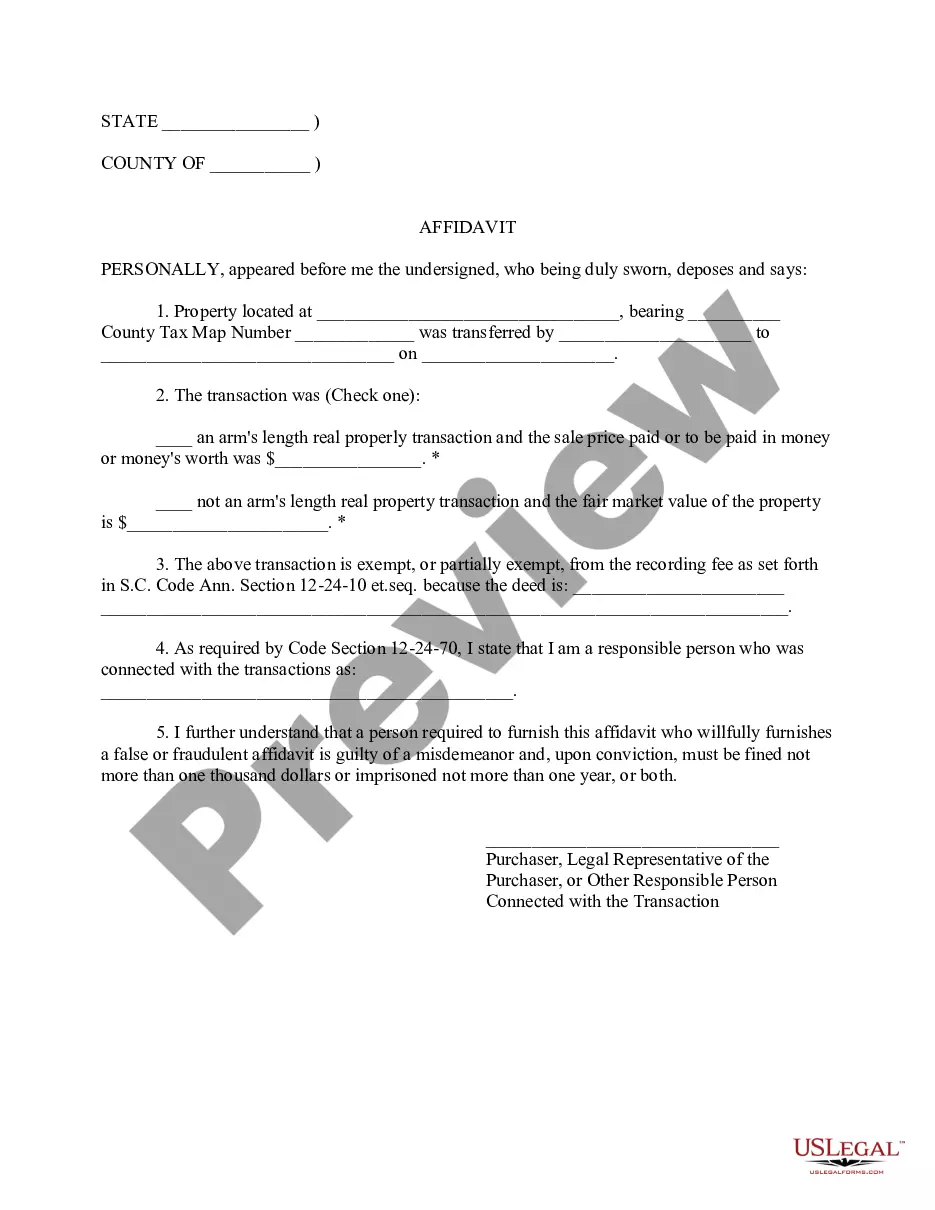

South Carolina Affidavit Of True Consideration

Description

How to fill out South Carolina Affidavit Of Property Value?

Whether you manage documentation regularly or you occasionally need to dispatch a legal record, it is essential to obtain a helpful resource where all the models are applicable and current.

The first action to take with a South Carolina Affidavit Of True Consideration is to ensure that it is its latest version, as it determines whether it is eligible for submission.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

Forget about the confusion associated with legal documentation. All your templates will be orderly and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes virtually any document template you may need.

- Look for the forms you require, examine their relevance immediately, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various sectors.

- Discover South Carolina Affidavit Of True Consideration samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will enable you to access all the templates you need with greater ease and reduced hassle.

- You only need to click Log In in the website header and access the My documents section with all the forms you require readily available, eliminating the need to spend time searching for the correct template or verifying its legitimacy.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

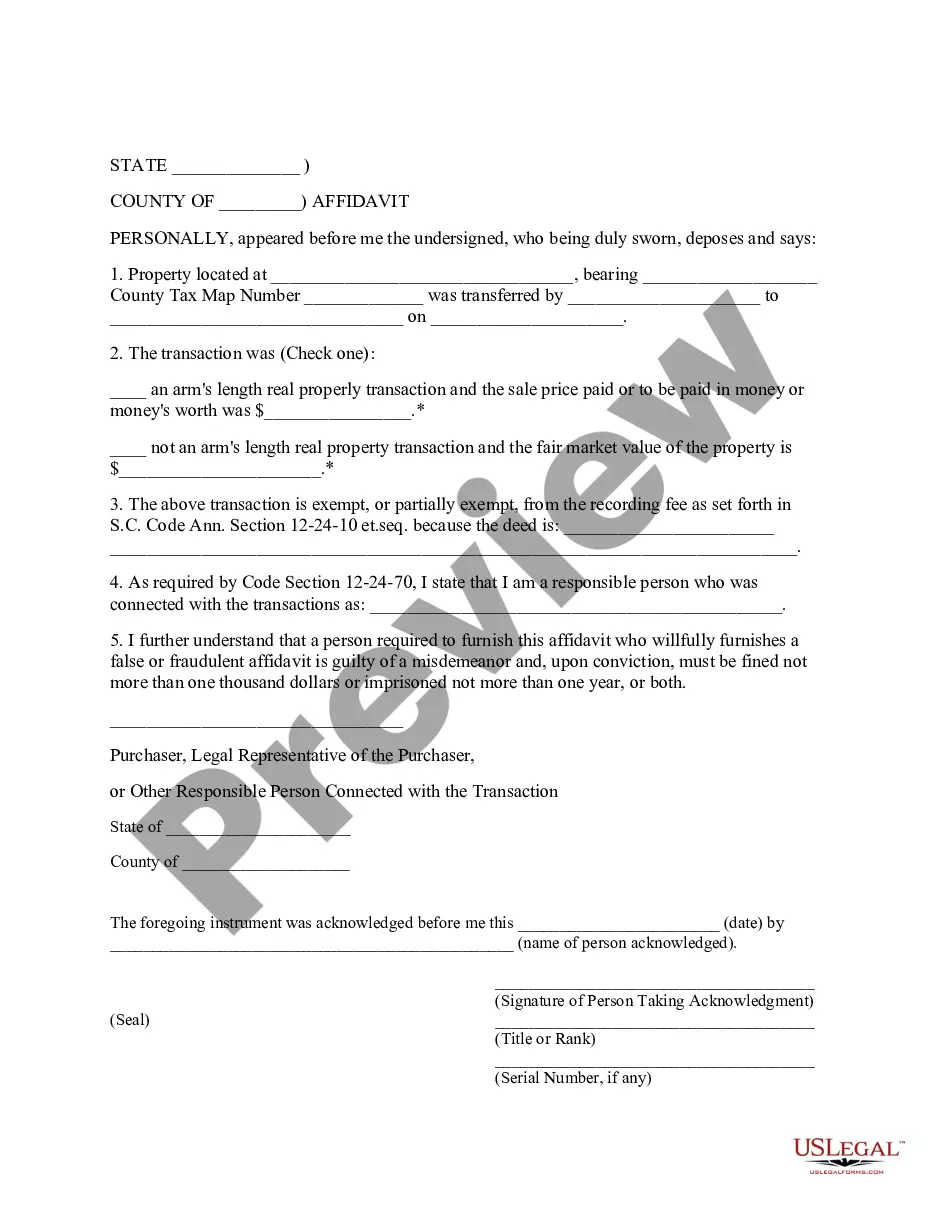

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

The fee is $1.85 on realty value of $100-$500 and $1.85 ($1.30 for state portion and $0.55 for county portion) for each $500 increment afterwards.

The South Carolina deed recording fee is imposed for the privilege of recording a deed, and is based on the transfer of real property from one person or business entity to another. The fee is generally imposed on the grantor of the real property, although the grantee may be secondarily liable for the fee.

As a buyer, you must collect this money at the closing and then pay the entire $365 at the end of the year. Attorney fees. The primary responsibility of the seller is to prepare the deed and deliver it to the buyer.

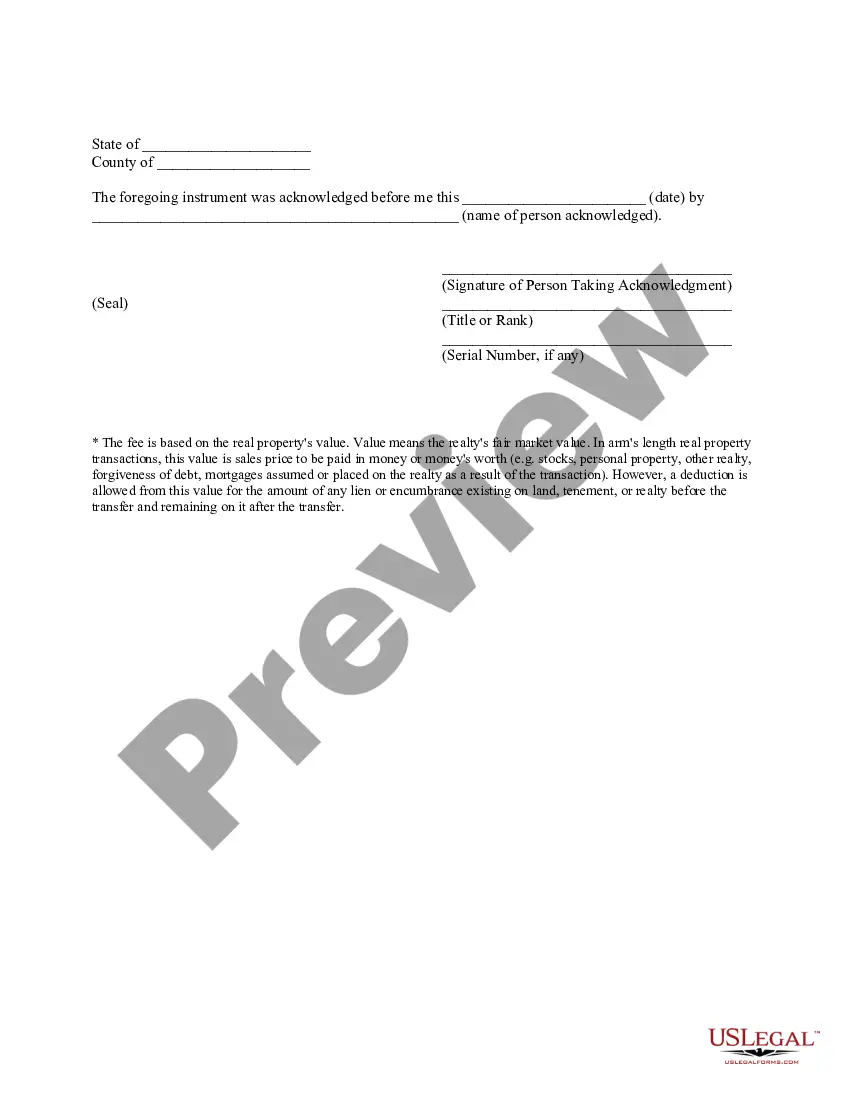

A South Carolina deed must include the original signature of the current owner (the grantor). Signatures should match and appear immediately above the signer's printed or typed name in the deed. Notarization. The current owner's execution of the deed must be acknowledged before a notary or other authorized officer.