Right To Cure Letter With Credit Card

Description

How to fill out South Carolina Notice Of Consumer's Right To Cure Default?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal papers requirements accuracy and attention to detail, which explains why it is important to take samples of Right To Cure Letter With Credit Card only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the details about the document’s use and relevance for your circumstances and in your state or region.

Take the following steps to finish your Right To Cure Letter With Credit Card:

- Make use of the library navigation or search field to locate your template.

- View the form’s information to see if it fits the requirements of your state and region.

- View the form preview, if available, to make sure the template is the one you are searching for.

- Go back to the search and look for the appropriate document if the Right To Cure Letter With Credit Card does not suit your needs.

- When you are positive about the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (credit card or PayPal).

- Choose the document format for downloading Right To Cure Letter With Credit Card.

- When you have the form on your gadget, you may alter it using the editor or print it and finish it manually.

Remove the headache that accompanies your legal documentation. Explore the comprehensive US Legal Forms library where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

A cure or termination letter should begin where the problems began and tell the story chronologically. Bullet points work well to sum up this information. A contractor should be specific on the important dates, or if specific dates are not available, reference relevant time frames.

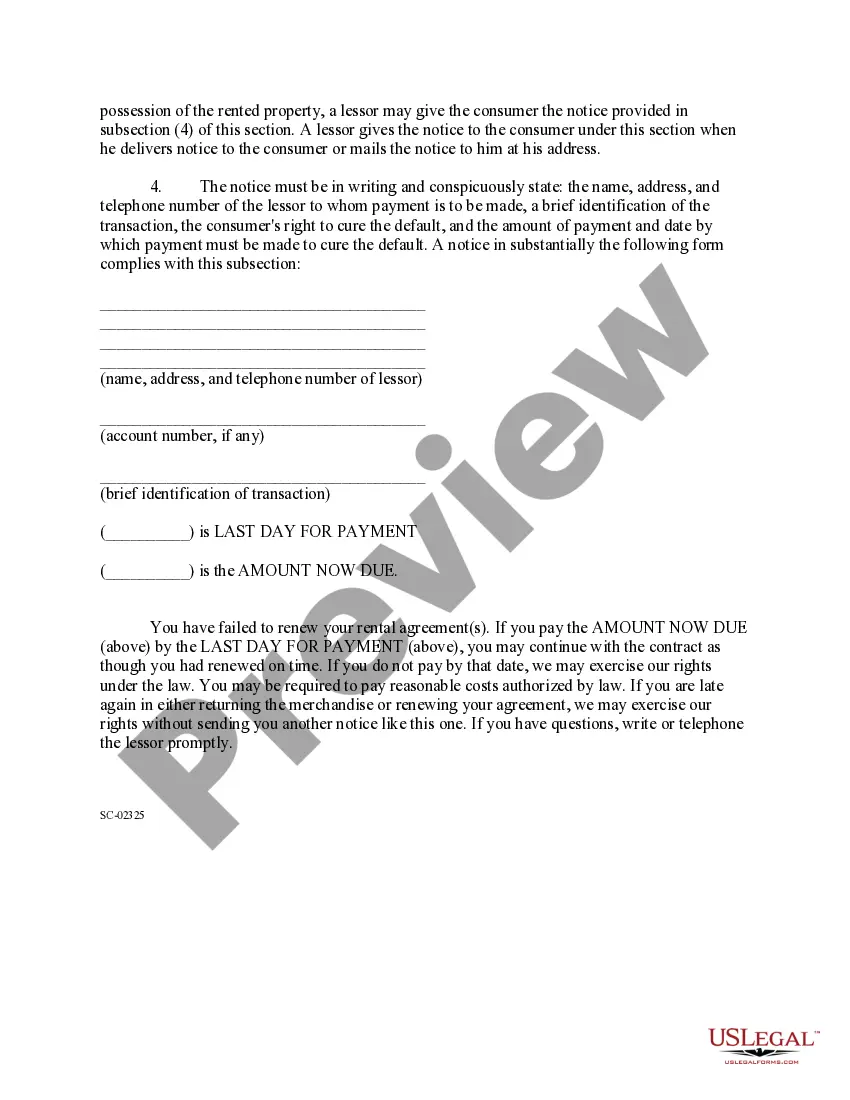

Notice and right to cure clause samples. VI. NOTICE AND RIGHT TO CURE. Each party shall be entitled to written notice of any default and shall have: (i)five (5) days from receipt of such notice to cure a failure to close the purchase of the Property or provide the insurance requirements specified in Section2.

The notice must tell you that you are in default and that you have 30 days to cure the default. The Right to Cure Notice says that if you do not get caught up on your payments, ?cure your default,? the bank can begin foreclosure proceedings to take your house.

These notices are produced instead of late notices. They provide delinquent customers the opportunity to ?cure? the delinquency and avoid repossession of collateral by paying delinquent amounts by a specific date.

A ?default? is a failure to comply with a provision in the lease. ?Curing? or ?remedying? the default means correcting the failure or omission. A common example is a failure to pay the rent on time.