Right To Cure Letter Foreclosure

Description

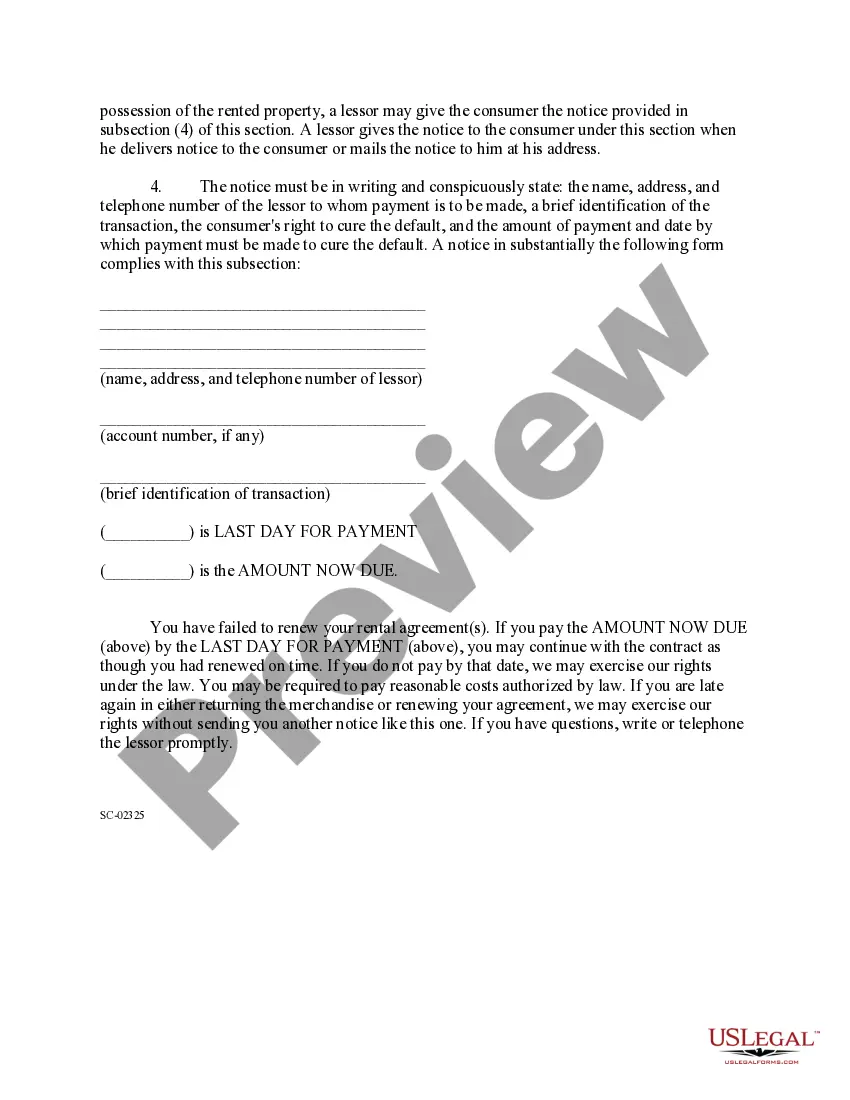

How to fill out South Carolina Notice Of Consumer's Right To Cure Default?

Legal papers management might be overwhelming, even for skilled professionals. When you are searching for a Right To Cure Letter Foreclosure and don’t have the time to commit searching for the correct and up-to-date version, the procedures could be demanding. A robust online form library might be a gamechanger for anyone who wants to manage these situations efficiently. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you at any moment.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you might have, from personal to business documents, all-in-one spot.

- Make use of innovative resources to finish and control your Right To Cure Letter Foreclosure

- Gain access to a useful resource base of articles, instructions and handbooks and resources related to your situation and requirements

Help save effort and time searching for the documents you need, and use US Legal Forms’ advanced search and Preview feature to find Right To Cure Letter Foreclosure and get it. For those who have a membership, log in in your US Legal Forms account, look for the form, and get it. Review your My Forms tab to see the documents you previously saved and to control your folders as you can see fit.

If it is your first time with US Legal Forms, make a free account and get unlimited access to all advantages of the library. Listed below are the steps for taking after accessing the form you need:

- Confirm it is the correct form by previewing it and looking at its information.

- Ensure that the sample is recognized in your state or county.

- Select Buy Now when you are all set.

- Select a subscription plan.

- Find the formatting you need, and Download, complete, eSign, print and deliver your document.

Enjoy the US Legal Forms online library, backed with 25 years of experience and trustworthiness. Transform your daily document management in a easy and user-friendly process today.

Form popularity

FAQ

If you are behind in mortgage payments you are in ?default.? If you pay the bank all the payments you missed, you can ?cure the default?. The bank must send you a notice that says you have the right to pay the money you owe.

Tips for Writing a Hardship Letter Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan. ... Talk to a Financial Coach.

The right to cure letter, in simple terms, is a legal document that a mortgage lender sends to a borrower who has fallen behind on their payments. This letter serves as a formal notification and gives the borrower a specific period ? typically 30 to 120 days ? to resolve the default by paying the overdue amount.

You have the right to get the notice just once per 12 month period. After sending the ?right to cure? the lender must wait for an additional 20 days for you to cure the default. If you have not cured the default by the end of the 20 days, the lender may repossess the vehicle.

Guidelines For Writing a Foreclosure Letter Address the letter to the head of the financial institution. ... Subject must be on point. In the body, always mention your name and loan account number. If you don't know the foreclosing procedure, then ask them to guide you.