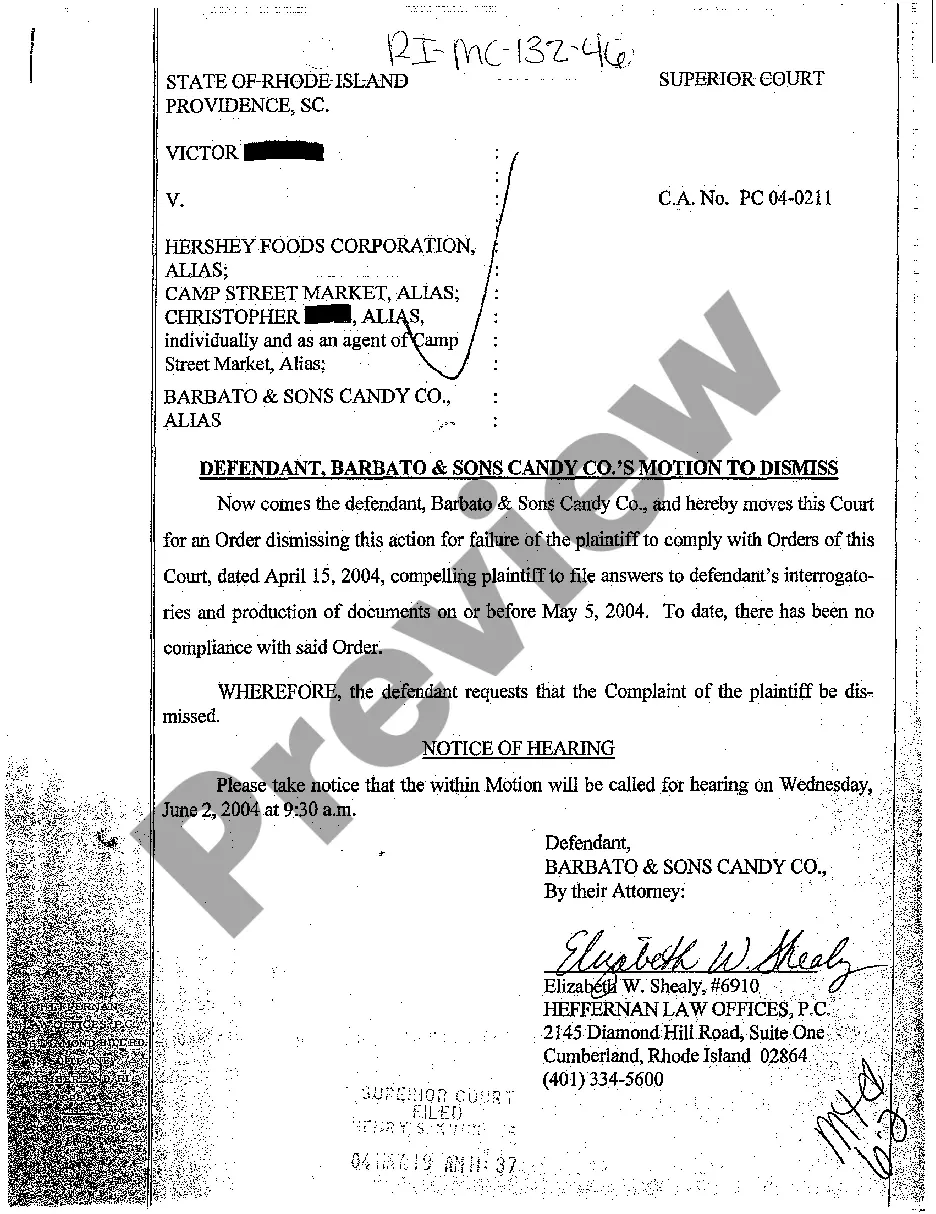

Rhode Island Candy Without Power

Description

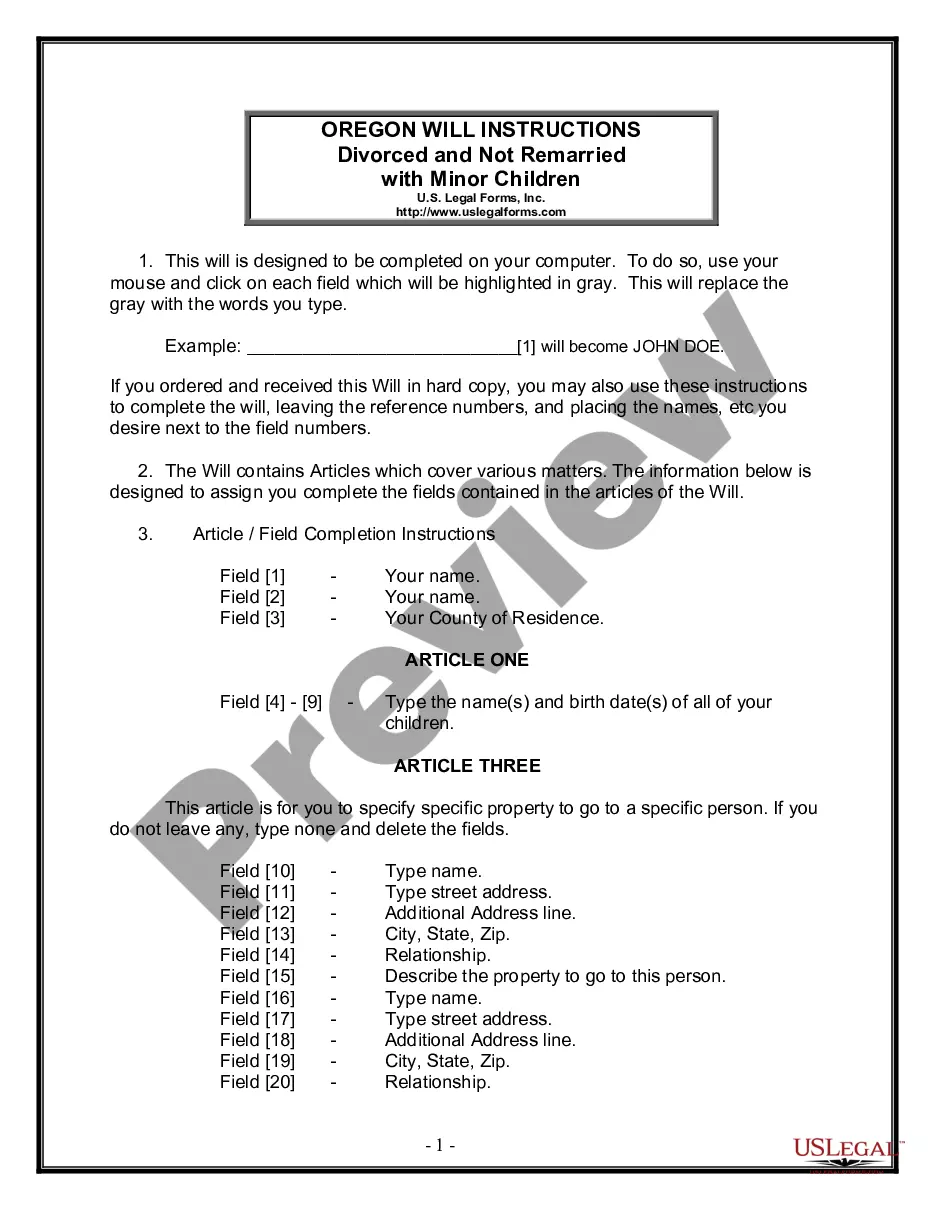

How to fill out Rhode Island Candy Without Power?

Well-crafted official documentation is one of the essential safeguards for preventing issues and legal disputes, but acquiring it without an attorney's assistance may require time.

Whether you need to swiftly locate an updated Rhode Island Candy Without Power or any other forms for employment, family, or business purposes, US Legal Forms is consistently available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Additionally, you can retrieve the Rhode Island Candy Without Power at any time later, as all documents ever acquired on the platform are accessible within the My documents section of your profile. Conserve time and funds on creating formal documents. Experience US Legal Forms today!

- Ensure that the document is appropriate for your needs and location by reviewing the description and preview.

- Search for an alternative example (if necessary) using the Search bar at the top of the page.

- Hit Buy Now when you find the relevant template.

- Choose the pricing plan, Log Into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Pick PDF or DOCX file format for your Rhode Island Candy Without Power.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Candy that does not require refrigeration is taxable even if sold as such. For example, a number of candy bars that are regularly marketed at room temperature in the candy aisle may also be found in the refrigerated section of a convenience store.

The candy tax is a parenting trend where you purport to teach your kids about responsibility by stealing some of their candy levying a "tax" on their trick or treat loot. The tax can be as much as one-third of the candy "earned" on Halloween.

Candy is food and taxed the same as food and food ingredients Ten states generally consider candy to be like any other food, and so generally tax it the same.

Glee Gum is headquartered in Providence and the company makes gum and gum pops that do not contain artificial flavors, colors, sweeteners or preservatives. It's candy you can feel good about.

Rhode Island (SST member): Candy is subject to sales tax; food and food ingredients are exempt.