Rhode Island Divorce Law Foreclosure

Description

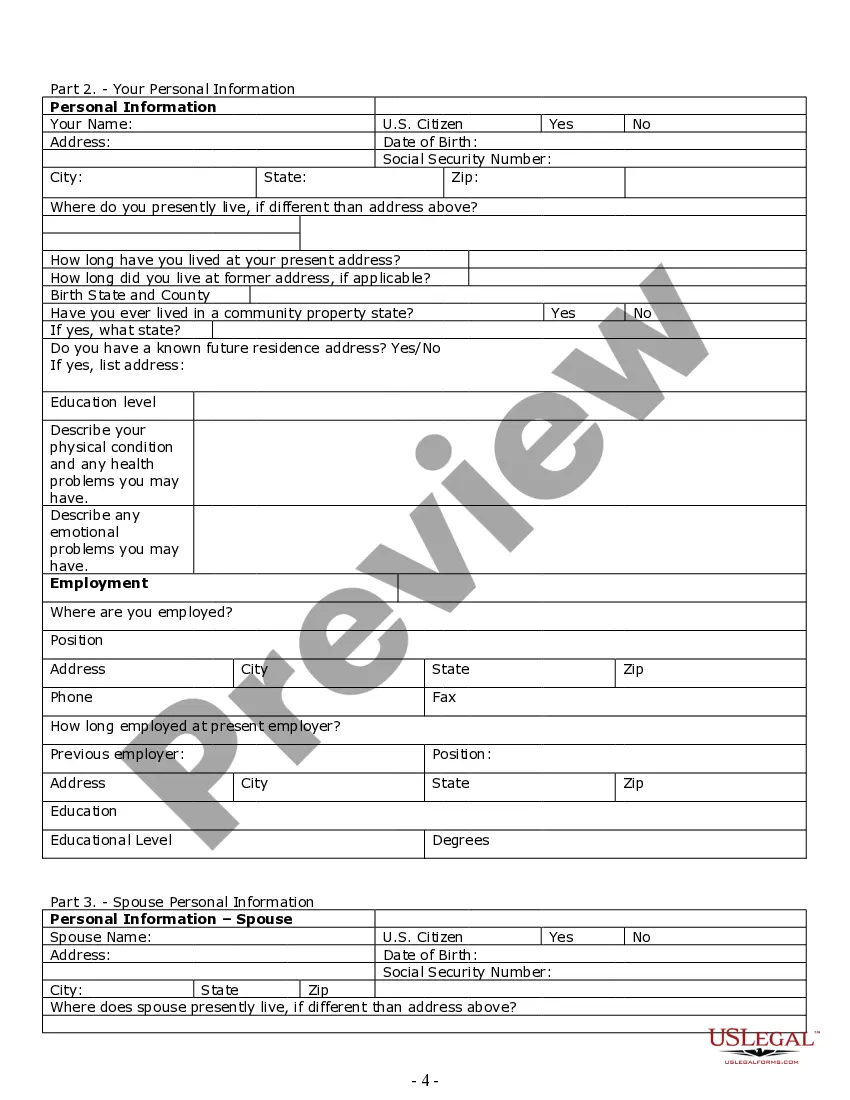

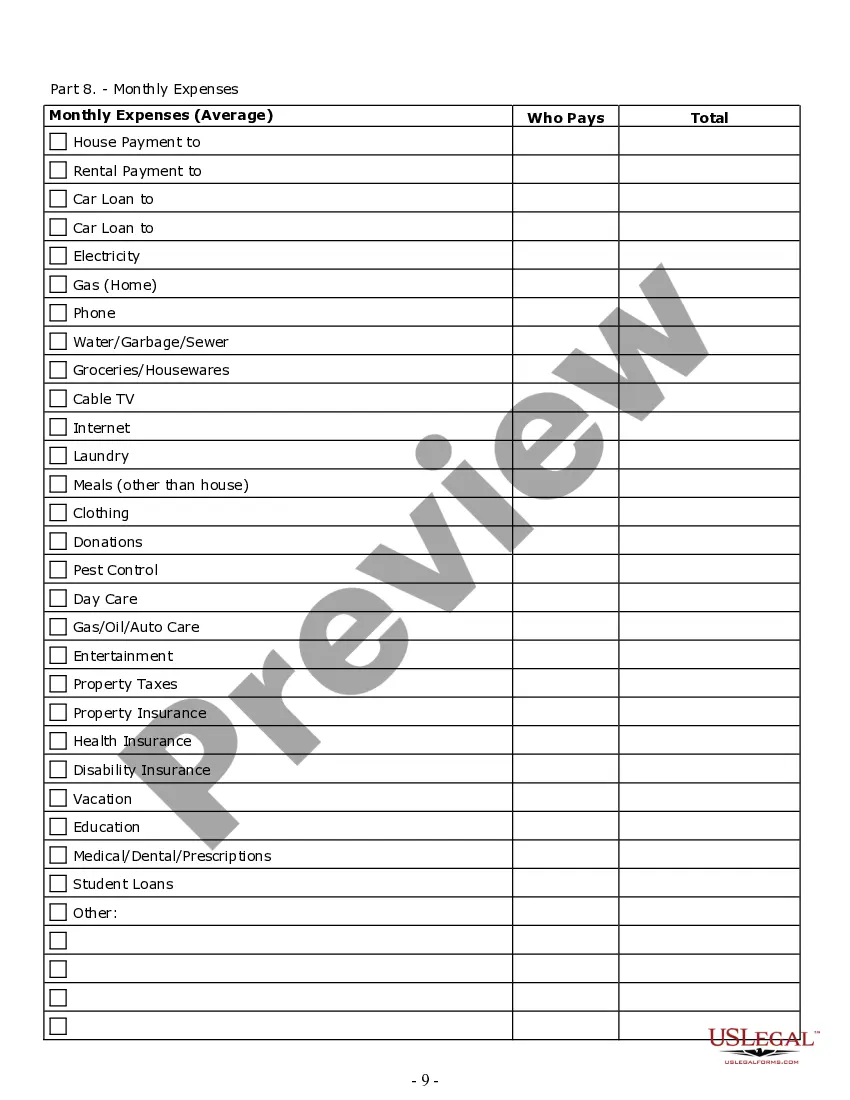

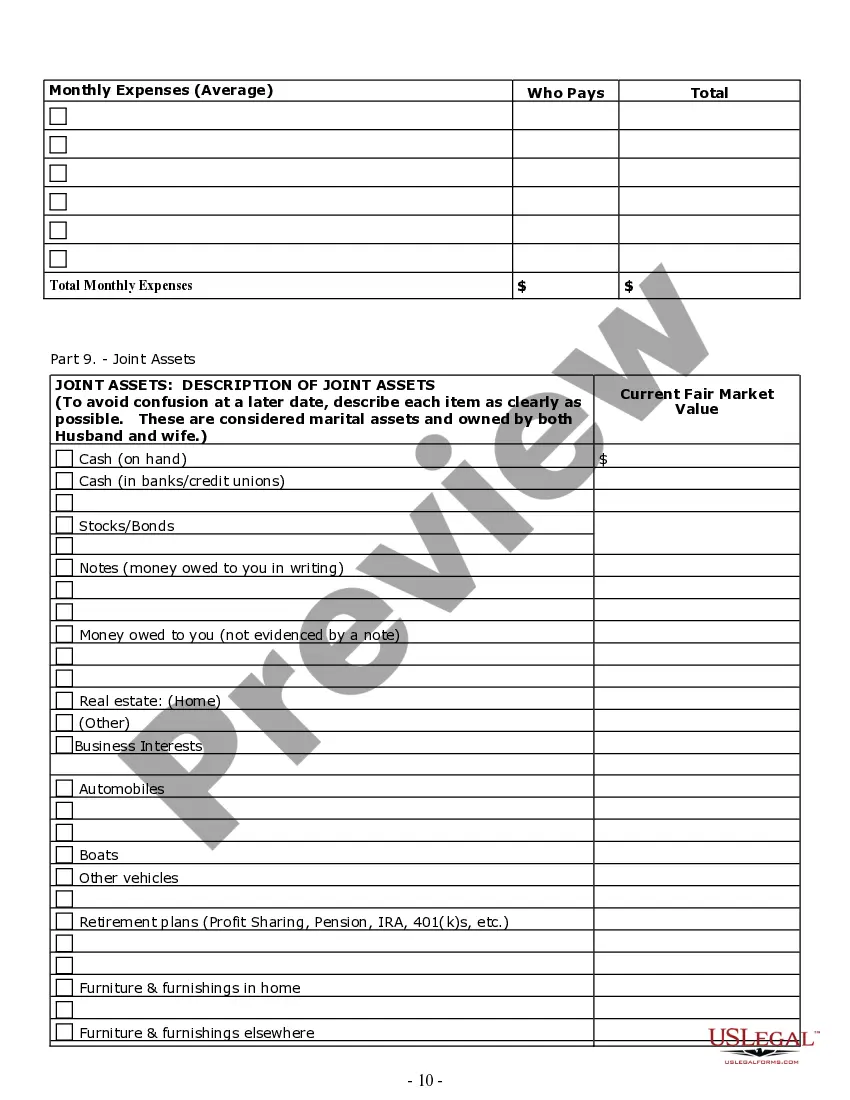

How to fill out Rhode Island Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Utilizing legal document examples that adhere to federal and state regulations is essential, and the internet provides numerous choices to select from.

However, why spend time searching for the suitable Rhode Island Divorce Law Foreclosure example online when the US Legal Forms online library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for various professional and personal situations.

Review the template using the Preview option or through the text outline to confirm it meets your requirements.

- They are simple to navigate with all documents organized by state and intended use.

- Our experts keep up with legal developments, ensuring your documentation is current and compliant when obtaining a Rhode Island Divorce Law Foreclosure from our site.

- Acquiring a Rhode Island Divorce Law Foreclosure is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you are new to our platform, follow the steps outlined below.

Form popularity

FAQ

The 37-day foreclosure rule refers to the timeline lenders must follow before proceeding with foreclosure after a missed payment. This period includes a grace phase where homeowners can potentially rectify their situation. Understanding this rule, alongside Rhode island divorce law foreclosure, is vital as it offers you a crucial window to explore options and avoid losing your home. Resources like US Legal Forms can be instrumental in guiding you through this process.

If your house goes into foreclosure during a divorce, it can add significant stress to an already challenging situation. Typically, the mortgage holder may proceed with foreclosure despite the divorce, which means you may lose your home unless you act swiftly. Familiarizing yourself with Rhode island divorce law foreclosure can provide you with the knowledge needed to make informed decisions and potentially save your property.

A divorce does not automatically stop a foreclosure. While your marital status can complicate matters, lenders typically proceed with foreclosure if payments are missed regardless of divorce proceedings. Therefore, it is essential to be proactive and understand how Rhode island divorce law foreclosure affects your situation, ensuring you take necessary steps to protect your home.

The biggest mistake in divorce often involves neglecting to understand the financial implications. Many individuals overlook how their decisions, especially regarding properties, can affect them long-term, particularly in the context of Rhode island divorce law foreclosure. It is crucial to seek legal advice and ensure you make informed choices to protect your assets.

In a divorce, certain assets may be deemed untouchable, such as inheritances received by one spouse or gifts specifically given to one partner. Understanding the nuances of Rhode island divorce law foreclosure can help you identify what assets are protected during the divorce process. It’s also wise to consult with a legal professional who can guide you through the intricacies of asset division.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

How Can I Stop a Foreclosure in Rhode Island? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

Follow these simple steps to foreclose your home loan Inform the lender. Lenders have hundreds of loans running simultaneously. ... Get all the paperwork in order. ... Assessment of payments. ... Get a NOC. ... Remove Lien on the property. ... Retrieve security cheques. ... Get a New Encumbrance Certificate (EC) ... Retrieve the documents.

The lender must give notice of the sale by publication in some public newspaper at least once a week for three (3) successive weeks before the sale, with the first publication of the notice being at least twenty-one (21) days before the day of sale, including the day of the first publication in the computation.

Judicial foreclosure requires the lender to file a lawsuit against the borrower to satisfy the unpaid mortgage loan. Lenders typically cannot take this step until 120 days after the first missed payment (in other words, after the fourth consecutive missed monthly payment).