Furnish A Work Permit Without A Social Security Number

Description

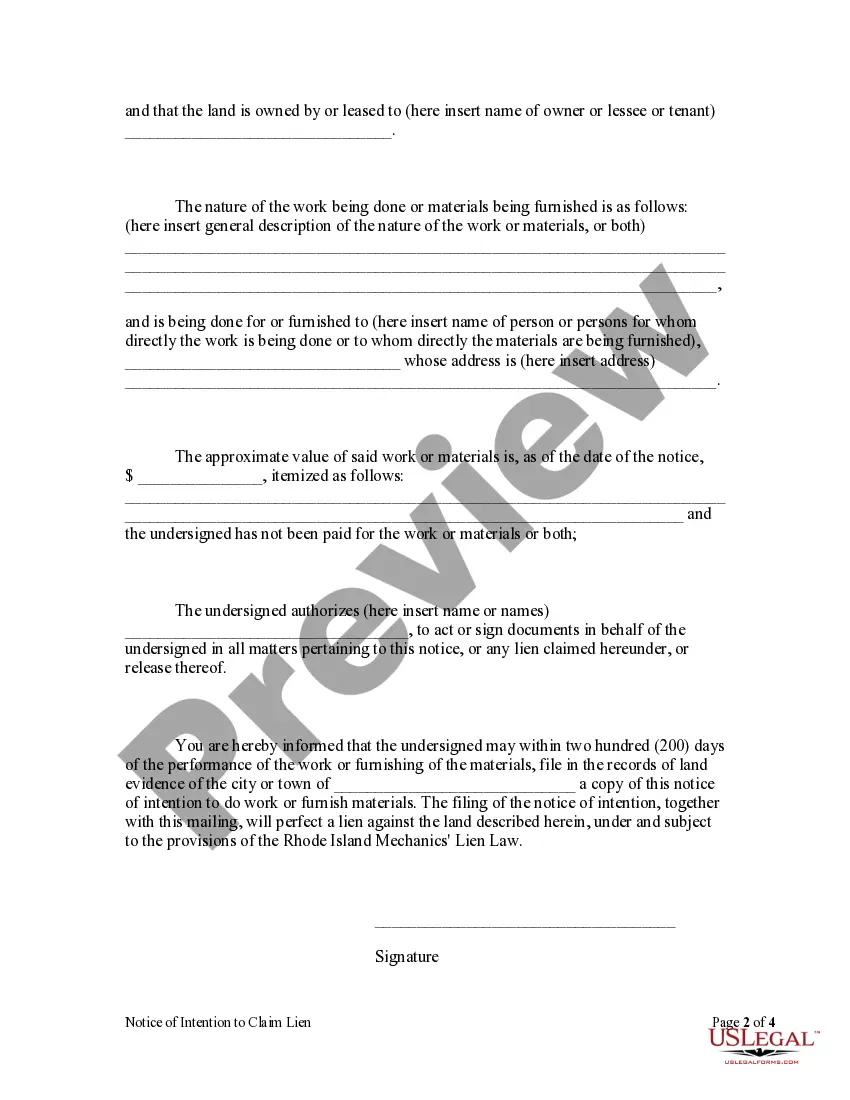

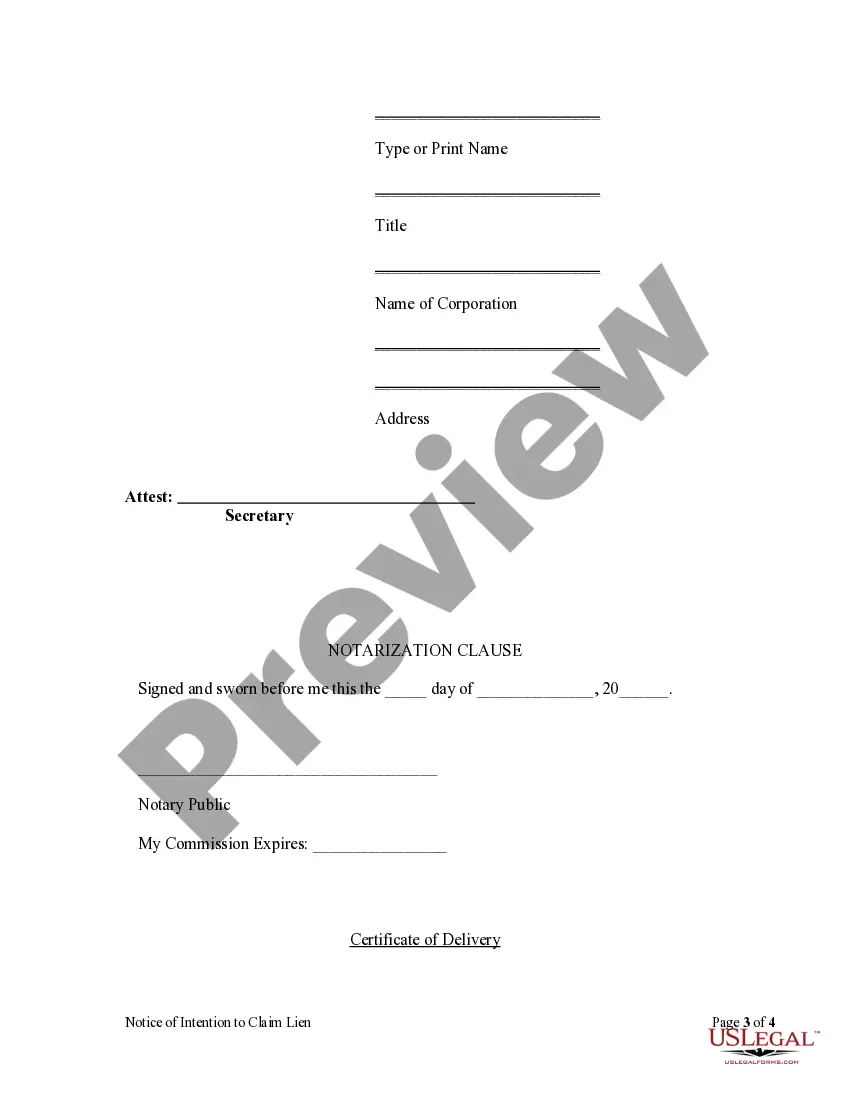

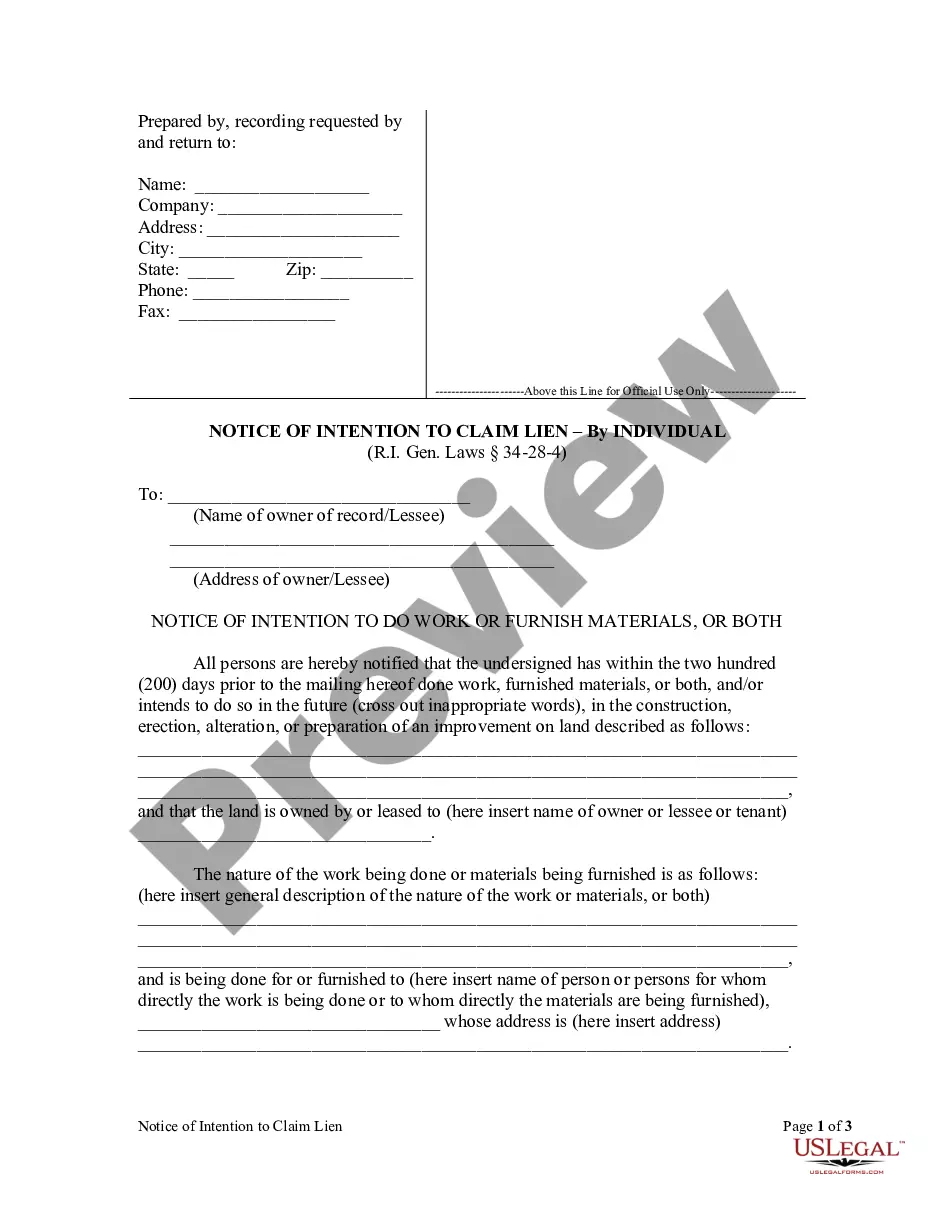

How to fill out Rhode Island Notice Of Intention To Do Work Or Furnish Materials - Corporation?

The Provide A Work Permit Without A Social Security Number displayed on this page is a reusable legal template crafted by expert attorneys in adherence to federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific documents for any commercial and personal situation. It’s the quickest, most direct, and most dependable method to secure the documentation you require, as the service assures the utmost level of data privacy and anti-malware safeguarding.

Select the format you wish for your Provide A Work Permit Without A Social Security Number (PDF, DOCX, RTF) and download the sample onto your device.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search function to find the suitable one. Click Buy Now when you have found the template you are looking for.

- Enroll and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

If you do not have a Social Security card, you can use other forms of identification for employment verification. Common alternatives include a government-issued photo ID, a birth certificate, or a work permit. Employers often accept these documents in conjunction with your work permit to verify your eligibility. Ensuring you have the right documents on hand can help you furnish a work permit without a social security number and secure your employment.

The phrase 'Can you furnish a work permit' essentially refers to your ability to provide proof of your authorization to work legally in the United States. Furnishing a work permit indicates that you have the necessary documentation that allows you to seek employment. This is crucial for both you and your employer, as it ensures compliance with labor laws. If you're unsure about the process, platforms like uslegalforms can assist you in obtaining the right documents to furnish a work permit without a social security number.

Yes, you can still secure a job without a Social Security number, especially if you possess a valid work permit. Many employers are willing to hire individuals who are authorized to work in the United States, even if they lack a Social Security number. You might need to provide other forms of identification and documentation, which can help streamline the hiring process. Remember, you can furnish a work permit without a social security number and still pursue your career goals.

Yes, you can work with a work permit even if you do not have a Social Security number. Employers are often required to verify your eligibility to work, which includes reviewing your work permit. However, you may need to apply for a Social Security number later to receive certain benefits or for tax purposes. It's important to understand your rights and responsibilities while seeking to furnish a work permit without a social security number.

What documents are required to apply for a Canadian work permit? Completed application forms. Proof of status in Canada (if applicable) Family member's proof of status (if applicable) Labour Market Impact Assessment (if applicable) Written offer of employment (if applicable) CV/ resume

Finding and Filling Your Work permit Application - YouTube YouTube Start of suggested clip End of suggested clip Select the country that issued the passport. You used for coming to canada. Select your status fromMoreSelect the country that issued the passport. You used for coming to canada. Select your status from the list. If your refugee claim has been accepted.

How do I fill out MM 1295 Form? Your personal information (name, date of birth, place of birth) Information about your family members. Information about your job (present and future in Canada) Some medical information. Background information (visas, police background, previous countries of living)

Foreign nationals may work in Canada without a work permit if their activity is described in paragraphs 186(a) to 186(x) of the Immigration and Refugee Protection Regulations (IRPR) or under the Global Skills Strategy public policy for short-term work and 120-day work for researchers.

Foreign workers may seek employment in Canada without a work permit if they work in one of the following jobs(Canadian jobs without work permit): Business Visitor. Foreign Representatives and Their Family Members. Military Personnel.