Pa Attorney Pennsylvania Withholding

Description

How to fill out Pennsylvania General Power Of Attorney?

Finding a reliable source for obtaining the most updated and suitable legal templates is a significant part of navigating bureaucracy.

Acquiring the correct legal documents requires precision and carefulness, which is why it is vital to obtain samples of Pa Attorney Pennsylvania Withholding solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and impede your current situation.

Once you have the form saved on your device, you can edit it with the editor or print it to complete it manually. Eliminate the hassle associated with your legal paperwork. Discover the extensive US Legal Forms library where you can locate legal templates, assess their relevance to your circumstances, and download them immediately.

- Utilize the catalog navigation or search bar to find your template.

- Review the form’s description to determine if it meets the criteria of your state and region.

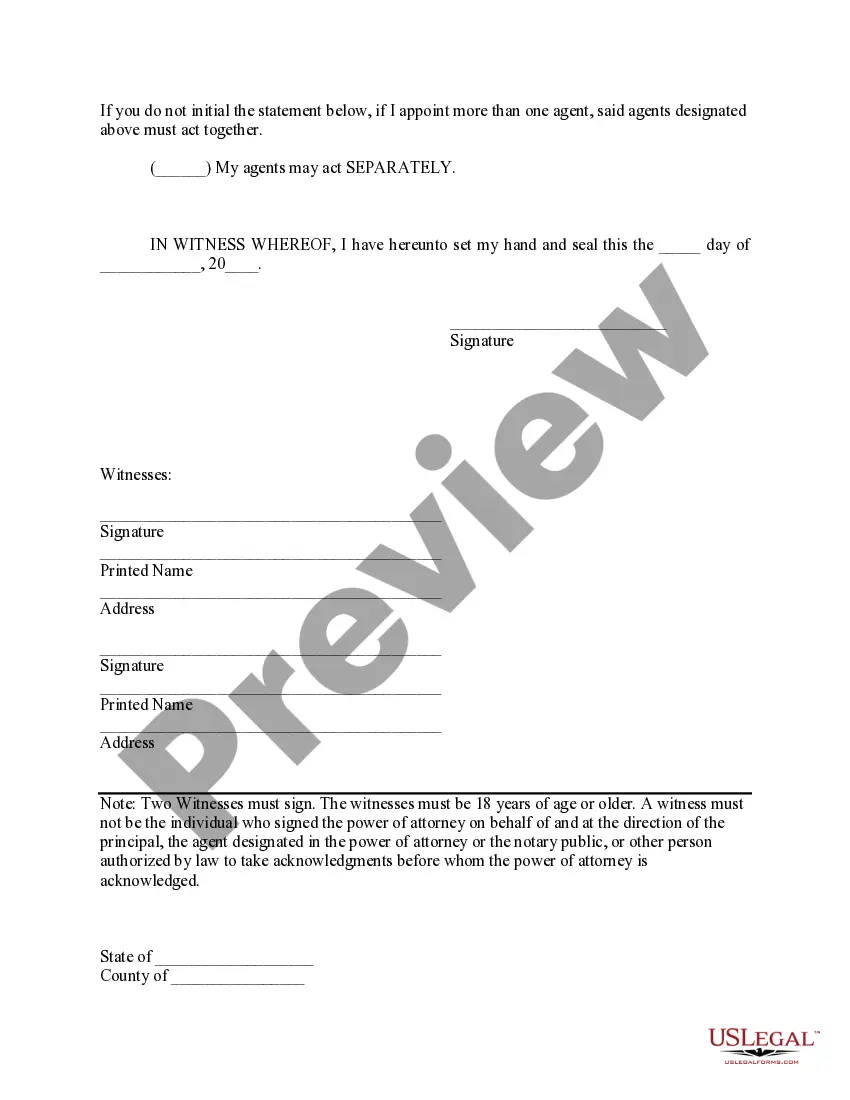

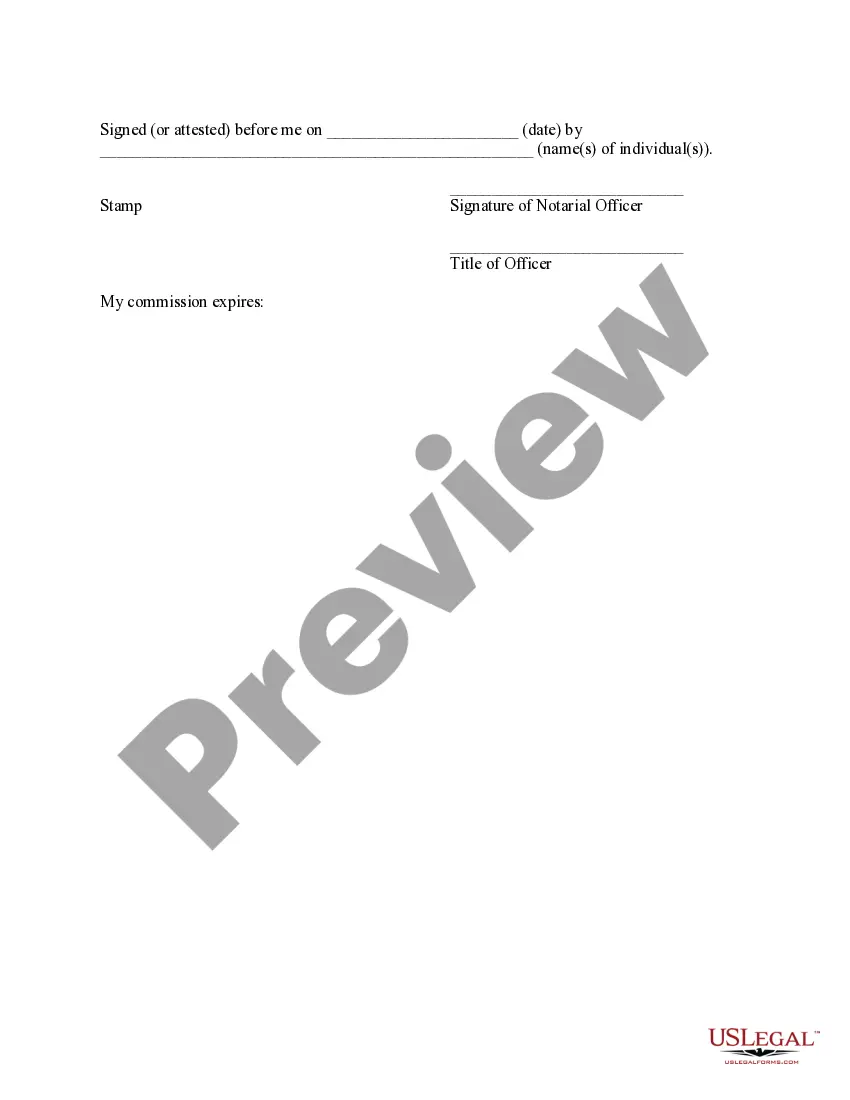

- Access the form preview, if available, to confirm the template is indeed what you seek.

- Return to the search to find the appropriate document if the Pa Attorney Pennsylvania Withholding does not fulfill your needs.

- When you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that meets your needs.

- Proceed to complete your registration to finalize your purchase.

- Conclude your purchase by selecting a payment option (credit card or PayPal).

- Select the file format for downloading the Pa Attorney Pennsylvania Withholding.

Form popularity

FAQ

File Arizona Form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an Arizona Partnership Income Tax Return.

Corporations taxed as S Corporations under Subchapter S of the Internal Revenue Code (IRC) must file Arizona Form 120S. Qualified subchapter S subsidiaries are not treated as entities separate from the parent corporation and would be included on a single Arizona Form 120S filed by the parent S Corporation.

Arizona law does not restrict the number or type of partners. A corporation or other business entity may be a partner. The partnership is liable for the acts of each partner in the ordinary course of business, and each partner is jointly and severally liable for all obligations of the partnership.

In a general partnership, all parties share legal and financial liability equally. The individuals are personally responsible for the debts the partnership takes on. Profits are also shared equally.

If you desire to conduct business as any limited partnership, you must file with our office to receive that designation. Limited partnerships consist of three types: limited partnership (?LP?), limited liability partnerships (?LLP?), and limited liability limited partnerships (?LLLP?).

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can, in turn, sue the other partners for their share of the debt), and.

The New LLC Act requires an LLC to reimburse a member (present or former) of a member-managed LLC or manager of a manager-managed LLC for any payment previously made by the member or manager if: ?payment made by the member or manager in the course of the member's or manager's activities on behalf of the company if the ...

A. Except as provided in subsections B and C of this section, every partnership shall make a return for each taxable year, stating the taxable income computed in ance with subtitle A, chapter 1, subchapter K of the internal revenue code and any adjustments required pursuant to chapter 14 of this title.