Pa Attorney Pennsylvania Form Pa-100

Description

How to fill out Pennsylvania General Power Of Attorney?

Legal papers managing may be overpowering, even for the most skilled specialists. When you are searching for a Pa Attorney Pennsylvania Form Pa-100 and do not have the a chance to spend searching for the appropriate and updated version, the processes can be stress filled. A robust web form library could be a gamechanger for everyone who wants to take care of these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any needs you may have, from personal to business paperwork, in one spot.

- Use advanced tools to accomplish and deal with your Pa Attorney Pennsylvania Form Pa-100

- Gain access to a resource base of articles, guides and handbooks and materials relevant to your situation and needs

Save time and effort searching for the paperwork you will need, and make use of US Legal Forms’ advanced search and Review tool to get Pa Attorney Pennsylvania Form Pa-100 and download it. If you have a monthly subscription, log in in your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to see the paperwork you previously saved and also to deal with your folders as you see fit.

Should it be the first time with US Legal Forms, register a free account and obtain limitless usage of all advantages of the platform. Listed below are the steps to consider after getting the form you need:

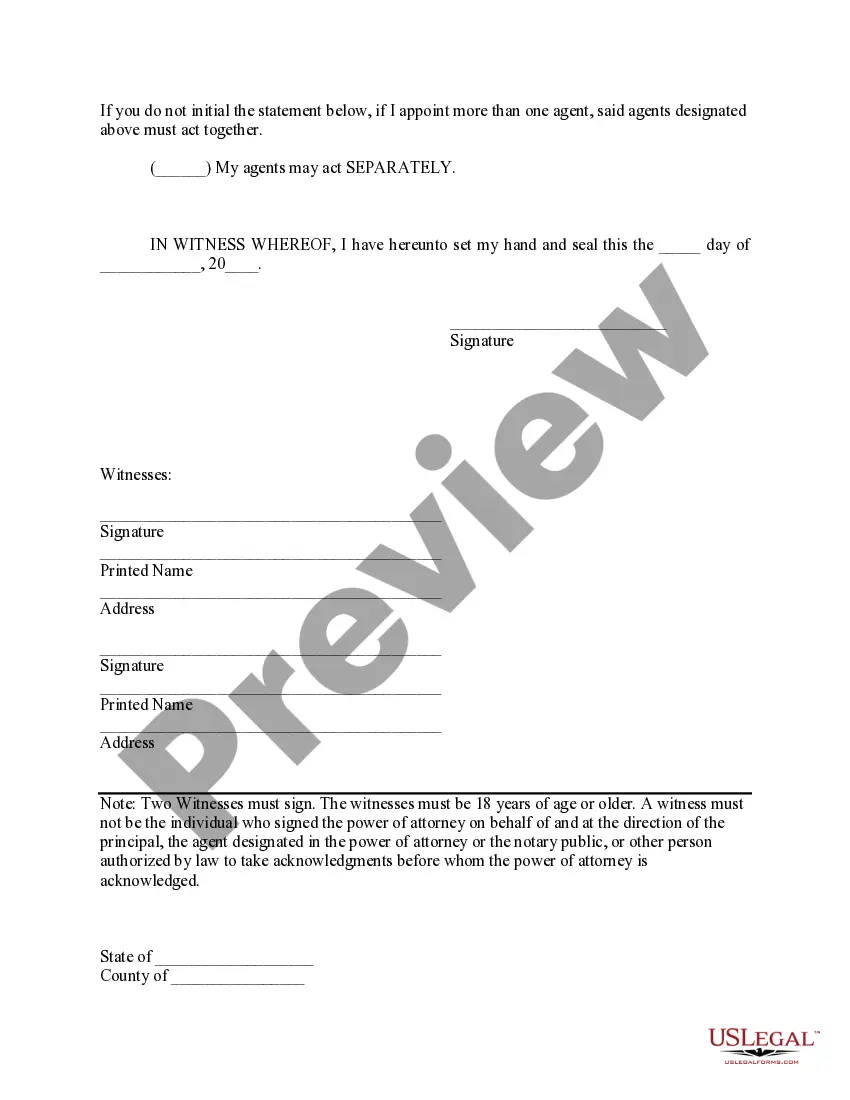

- Validate it is the proper form by previewing it and reading through its information.

- Be sure that the sample is approved in your state or county.

- Pick Buy Now once you are all set.

- Select a subscription plan.

- Find the file format you need, and Download, complete, sign, print out and deliver your papers.

Benefit from the US Legal Forms web library, supported with 25 years of expertise and stability. Transform your everyday papers administration in a smooth and intuitive process today.

Form popularity

FAQ

How to apply for a Pennsylvania sales tax license. You can apply online using PA Enterprise Registration Form (PA-100) and supplying information about your business such as its name, address, date of incorporation, and employer identification number (EIN). There is no application fee.

How to apply for a Pennsylvania sales tax license. You can apply online using PA Enterprise Registration Form (PA-100) and supplying information about your business such as its name, address, date of incorporation, and employer identification number (EIN). There is no application fee.

For each payroll period, an employer must calculate the tax to be withheld from an employee's compensation by multiplying such compensation subject to withholding by the current per- centage rate, 3.07%, which can be found by visiting the department's Online Customer Service Center at .revenue.pa.gov.

New businesses file PA-100 to set up state tax accounts. Existing businesses file PA-100 to add or amend state tax accounts.

If your company is not already registered to do business in Pennsylvania, you can register for new business taxes and services without needing to log in with a username and password. Access the myPATH homepage. Select the Pennsylvania Online Business Tax Registration link from the Registration panel.