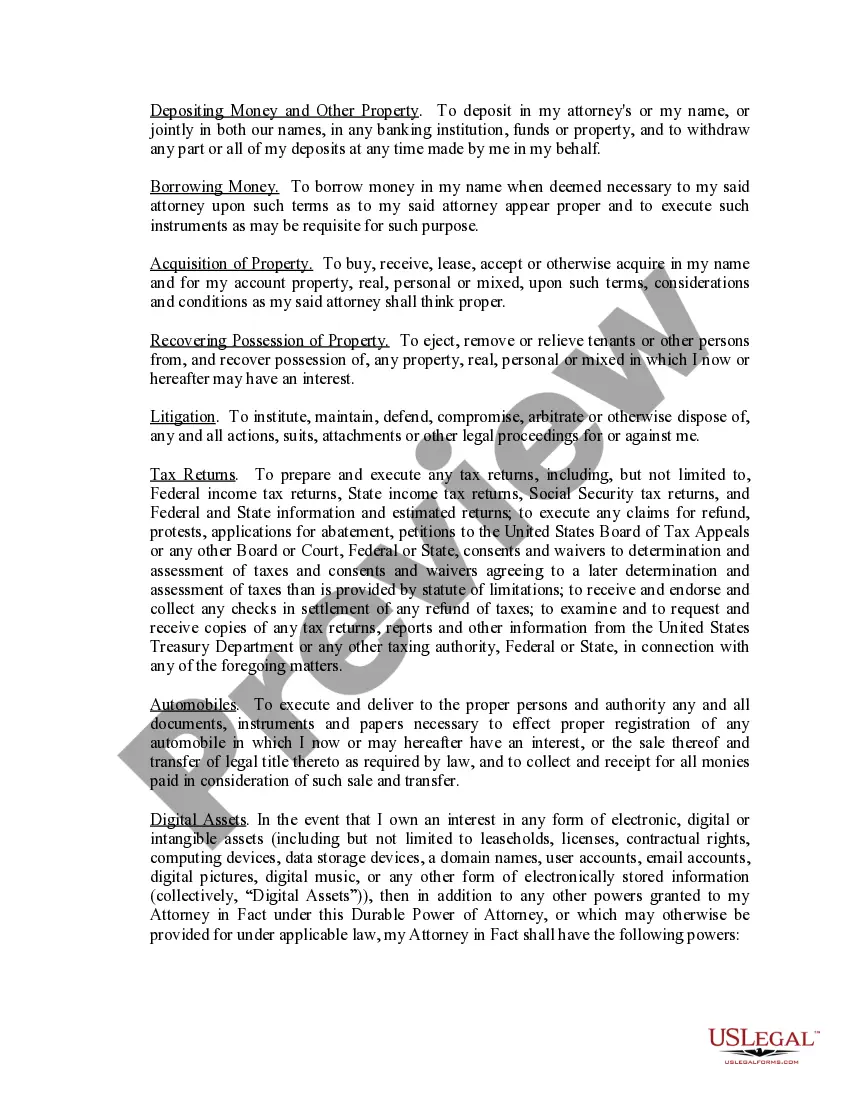

Durable Power of Attorney Pennsylvania Requirements: A Comprehensive Overview In Pennsylvania, a durable power of attorney (DOA) is a legally binding document that grants a chosen individual, known as the agent or attorney-in-fact, the authority to handle financial and legal matters on behalf of another person, commonly referred to as the principal. The DOA requirements in Pennsylvania are regulated under the Pennsylvania Consolidated Statutes, specifically Title 20, Chapter 56. To ensure the validity and legality of a durable power of attorney in Pennsylvania, there are several key requirements that must be met: 1. Legal Capacity: The principal must be at least 18 years old and of sound mind at the time of creating the DOA. Sound mind implies having the mental capacity to understand the implications and consequences of granting power to the agent. 2. Written Form: A durable power of attorney in Pennsylvania must be in writing and signed by the principal or by someone in the principal's presence and at their direction. If the principal is unable to sign due to physical limitations, they may direct another person to do so on their behalf, in their presence, and in the presence of witnesses. 3. Notarization: It is highly recommended, although not mandatory, to have the DOA document notarized in Pennsylvania for added legal credibility. The notary public will verify the identity of the principal and witnesses and attest to the execution of the document. 4. Witness Requirements: Two witnesses are required for a durable power of attorney in Pennsylvania. These witnesses must be at least 18 years old and cannot be the agent or the agent's spouse or a blood relative of the principal. Types of Durable Power of Attorney in Pennsylvania: 1. Limited Durable Power of Attorney: This type of DOA grants the agent specific powers and limits their authority to certain financial and legal matters. For instance, the agent may be authorized to handle particular real estate transactions or manage specific investments on behalf of the principal. 2. General Durable Power of Attorney: A General DOA gives broad authority to the agent, allowing them to handle a wide range of financial and legal matters on behalf of the principal. This typically includes managing bank accounts, paying bills, filing taxes, entering contracts, and making healthcare decisions. 3. Springing Durable Power of Attorney: Unlike the standard durable power of attorney, a springing DOA becomes effective only when a specified event occurs, usually the incapacity or disability of the principal. The document must include detailed provisions outlining when and how the power of attorney is activated. In conclusion, a durable power of attorney in Pennsylvania is a crucial legal document that must meet specific requirements to be considered valid. Whether it is a limited, general, or springing DOA, careful consideration should be given when selecting an agent, and professional legal advice is highly recommended ensuring compliance with Pennsylvania's laws and regulations.

Durable Power Of Attorney Pennsylvania Requirements

Description

How to fill out Durable Power Of Attorney Pennsylvania Requirements?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of handling bureaucracy. Finding the right legal papers requirements precision and attention to detail, which is the reason it is important to take samples of Durable Power Of Attorney Pennsylvania Requirements only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the information regarding the document’s use and relevance for the situation and in your state or county.

Consider the listed steps to finish your Durable Power Of Attorney Pennsylvania Requirements:

- Use the library navigation or search field to locate your sample.

- Open the form’s description to check if it suits the requirements of your state and area.

- Open the form preview, if there is one, to ensure the template is definitely the one you are interested in.

- Get back to the search and look for the right document if the Durable Power Of Attorney Pennsylvania Requirements does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Choose the document format for downloading Durable Power Of Attorney Pennsylvania Requirements.

- When you have the form on your device, you may change it using the editor or print it and complete it manually.

Get rid of the headache that comes with your legal paperwork. Explore the comprehensive US Legal Forms collection where you can find legal templates, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

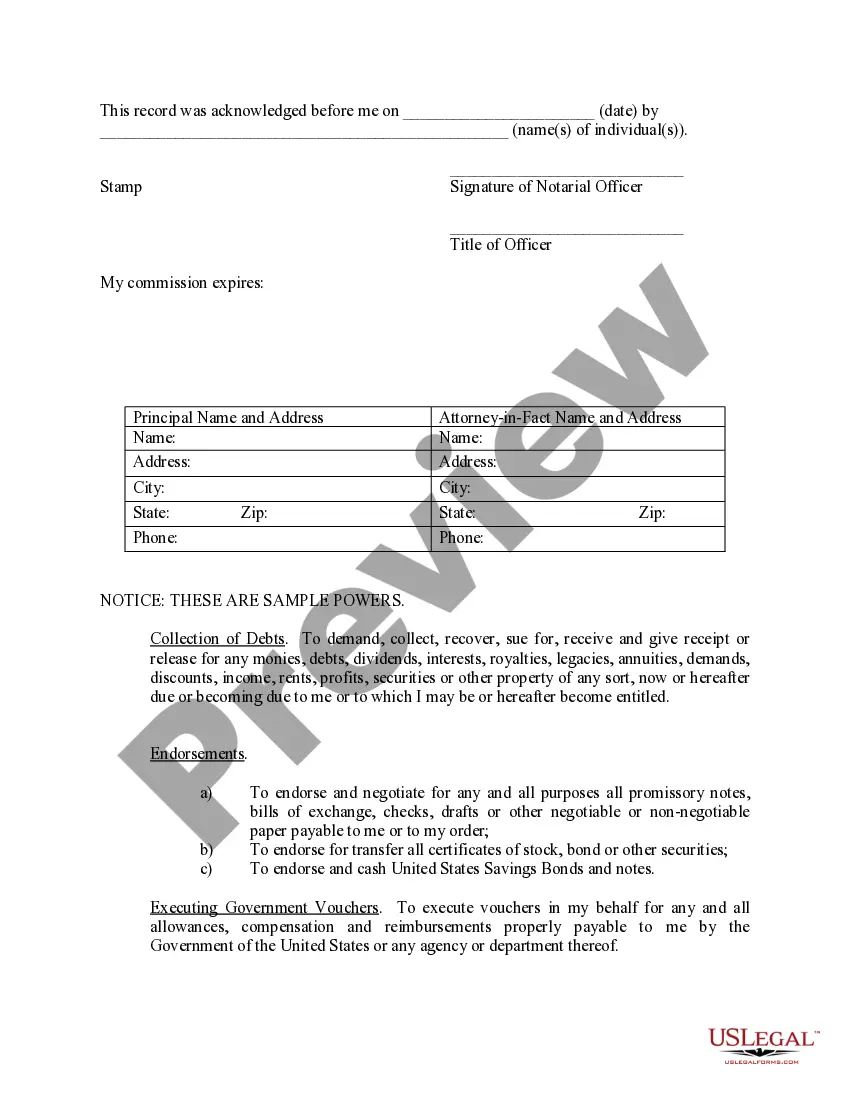

A POA in Pennsylvania must be dated, signed by the principal, witnessed by two adults, and notarized. If the principal is not able to write, he or she may sign by making a mark (such as an "X") or by directing another person to sign on his or her behalf.

Pennsylvania law requires the POA to include a Notice provision and before the Agent can act, the Agent must execute and affix to the POA an Acknowledgement. The Notice and the Acknowledgement must comply with Pennsylvania law.

New Requirements for Executing a POA: The principal must execute the POA before a notary public and 2 independent witnesses; New Formalities Required: The first page of the POA must include a statutory ?notice? in capital letters signed by the principal.

For most people, the best option is to have a general durable power of attorney because it gives your agent broad powers that will remain in effect if you lose the ability to handle your own finances. An attorney can customize a general POA to limit powers even more?or add powers, Berkley says.

A durable Power of Attorney will continue in effect after you become incapacitated. A nondurable Power of Attorney will end if you become incapacitated. However, in Pennsylvania all Powers of Attorney signed on or after December 16, 1992 are durable unless the document specifically states otherwise.