Pa Secretary State Withholding Tax Rate 2023

Description

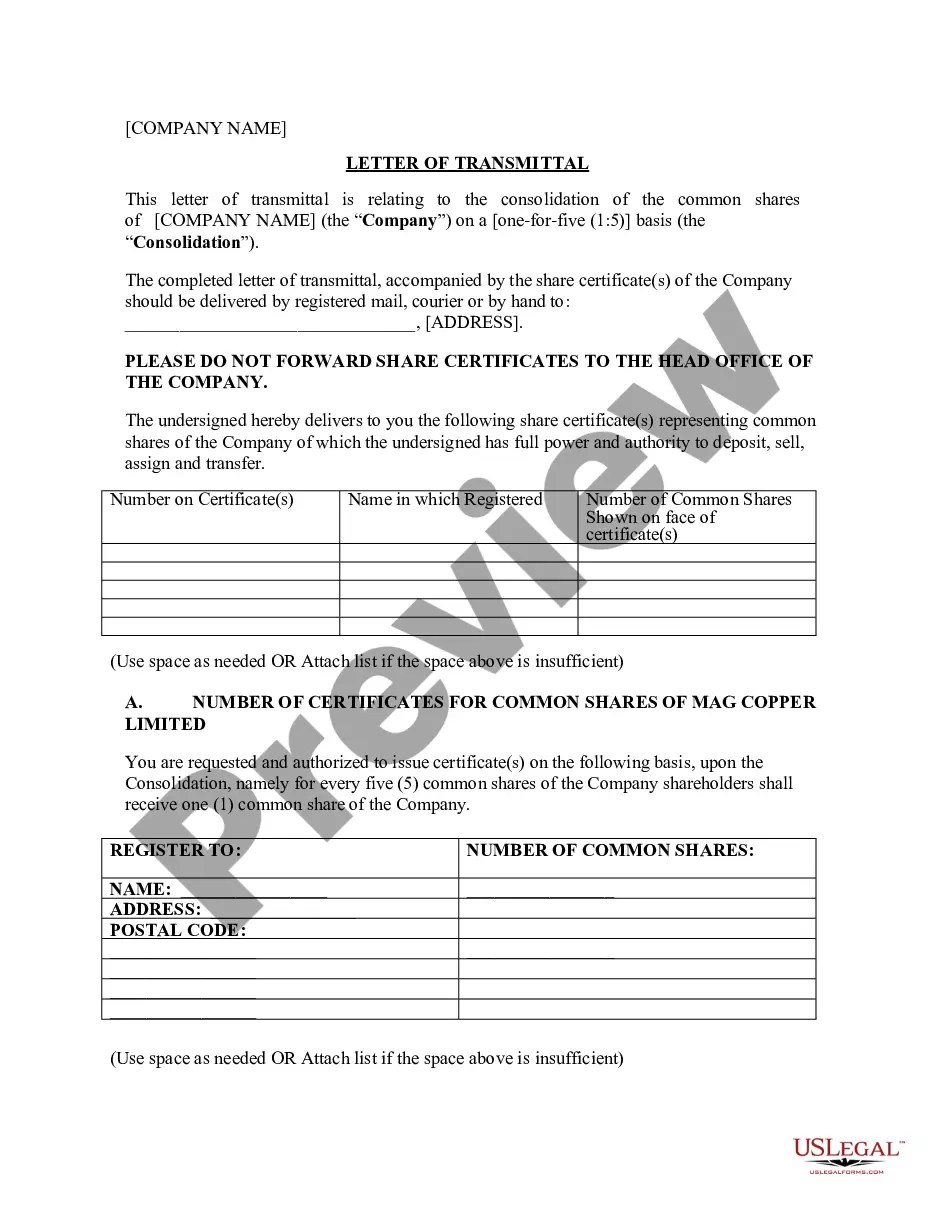

How to fill out Pennsylvania Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

Engaging with legal paperwork and processes can be a laborious enhancement to your daily routine.

Pennsylvania Secretary of State Withholding Tax Rate 2023 and documents similar to it frequently necessitate that you research them and figure out how to fulfill them accurately.

As a result, no matter if you are managing financial, legal, or personal affairs, possessing a comprehensive and straightforward online directory of documents when required will be extremely beneficial.

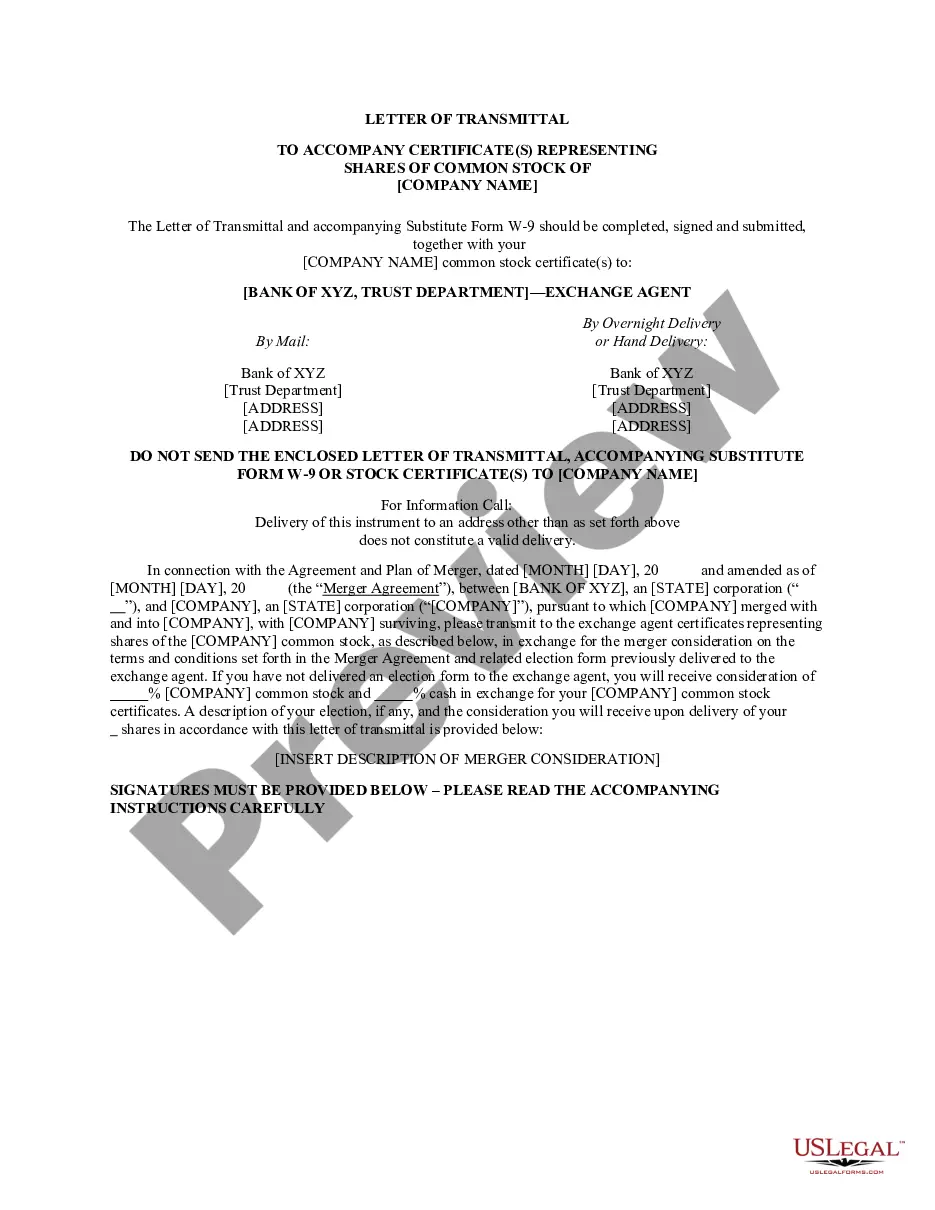

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and a range of tools that will assist you in completing your paperwork effortlessly.

Simply Log In to your account, locate Pennsylvania Secretary of State Withholding Tax Rate 2023, and obtain it instantly within the My documents section. You can also access previously saved documents.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific documents ready for download at any time.

- Safeguard your document management processes with a premium service that enables you to prepare any form within minutes without any extra or concealed fees.

Form popularity

FAQ

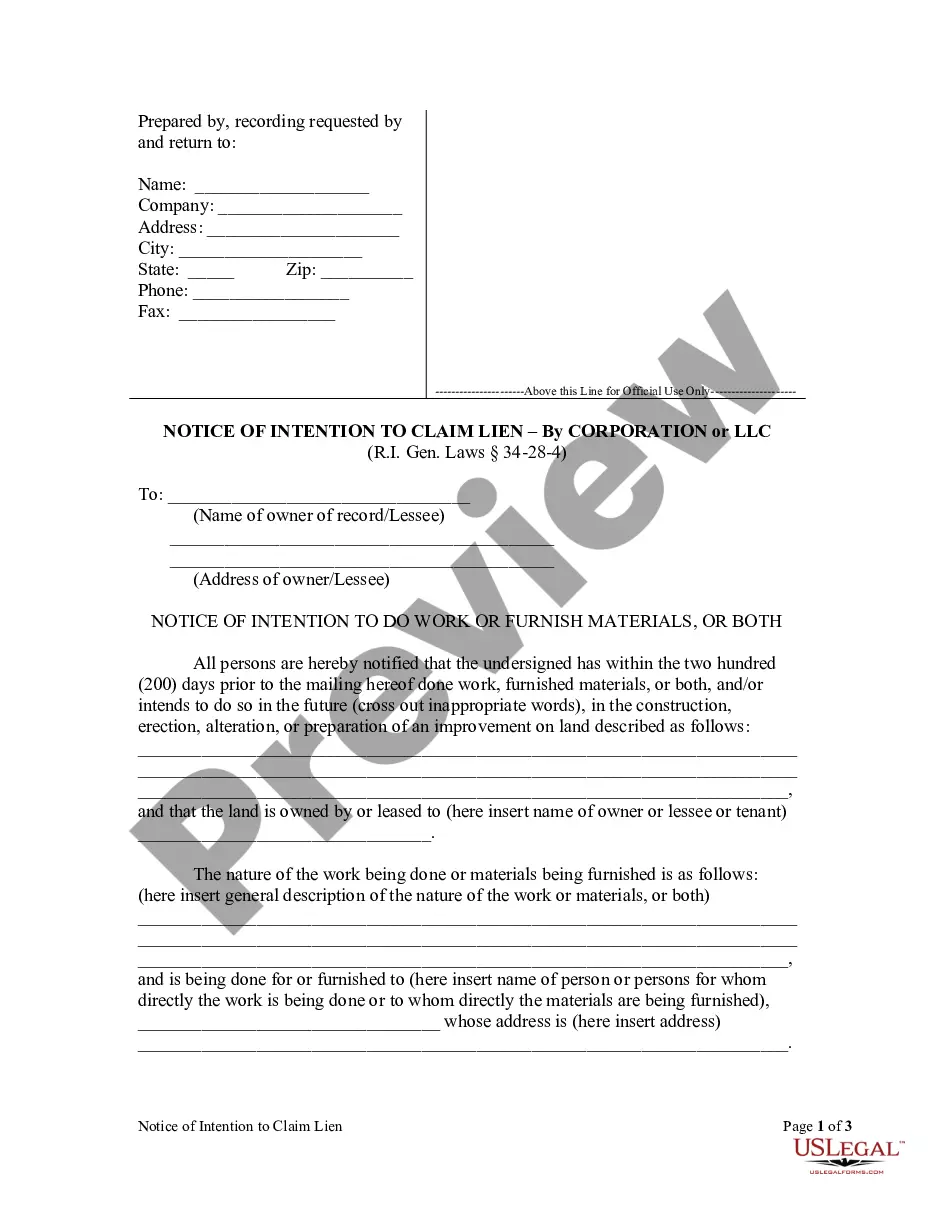

How do I file a PA W-3 Quarterly Reconciliation return for withholding tax? Log in to myPATH. If you have access to more than one taxpayer or client, you must select the Name hyperlink to file a return for a specific tax account. From the Summary tab, locate the Account panel for the tax you are filing.

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial sit- uation changes.

Pennsylvania Income Tax Rate The withholding rate for 2023 remains at 3.07%.

Definition of an Employer Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.