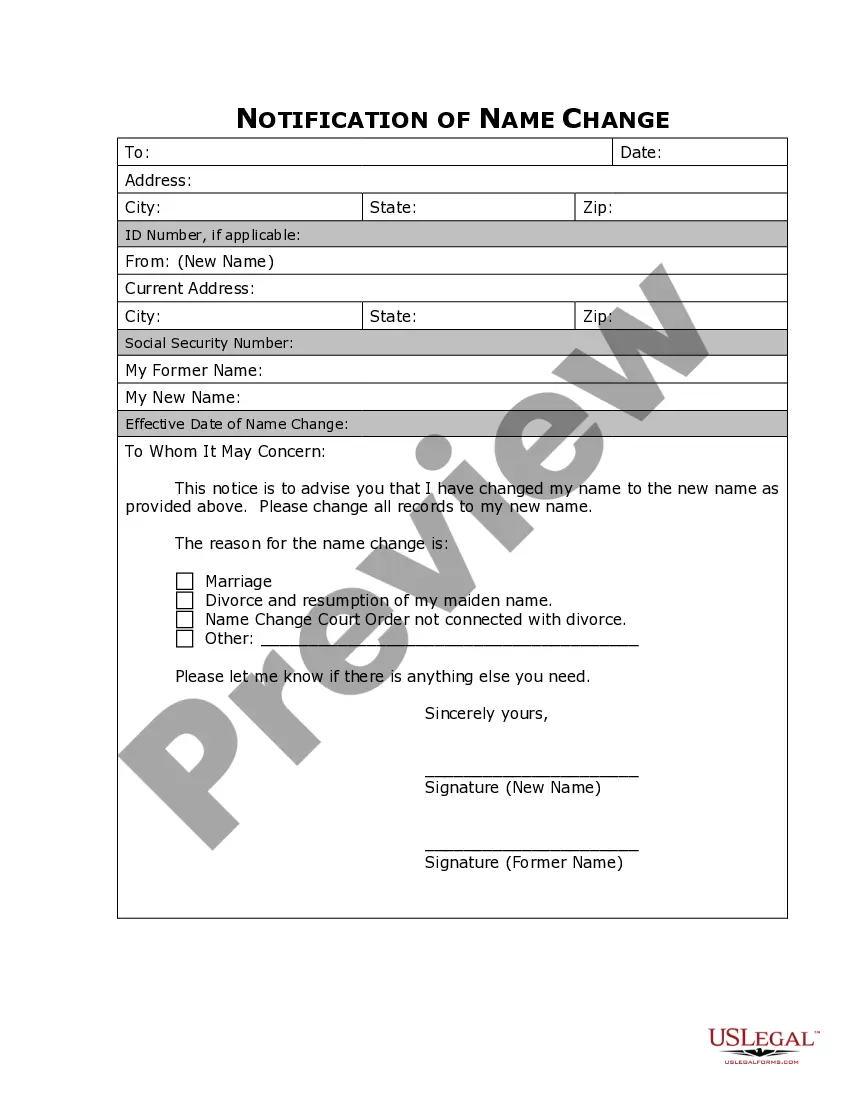

Name Change Form Pa Withholding

Description

How to fill out Pennsylvania Name Change Notification Form?

The Name Alteration Document Pa Tax Withholding available on this site is a reusable legal template crafted by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 verified, state-specific documents for any commercial and personal situation. It’s the fastest, simplest, and most trustworthy method to obtain the paperwork you require, as the service assures the utmost level of data security and anti-malware defense.

Register for US Legal Forms to have verified legal templates for all of life's circumstances readily available.

- Look for the document you require and examine it.

- Browse through the sample you searched and preview it or read the form description to confirm it meets your requirements. If it doesn’t, utilize the search bar to find the suitable one. Click Buy Now when you have found the template you need.

- Select and sign in.

- Pick the pricing plan that fits you best and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Choose the file format you desire for your Name Alteration Document Pa Tax Withholding (PDF, Word, RTF) and save the sample on your device.

- Complete and endorse the document.

- Print the template to fill it out manually. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately complete and endorse your form with a legally-binding electronic signature.

- Download your documents again.

- Reopen the document any time it’s necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

Filling out the PA W-2 Reconciliation Worksheet requires you to gather all your W-2 forms for the tax year. You'll need to report your total wages, tax withheld, and any other relevant information on the worksheet. Accurate completion ensures you meet your tax obligations and avoid penalties. For a user-friendly experience on the Name change form pa withholding, check out USLegalForms.

Change your tax withholding Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments. Then submit it to the organization paying you.

Pennsylvania law requires employers to withhold Pennsylvania personal income tax from employees' compensation in two common cases: When resident employees perform services within or outside Pennsylvania; and. When nonresident employees perform services within Pennsylvania.

Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments. Then submit it to the organization paying you.

The Tax Division also pursues criminal investigations and prosecutions against those individuals and entities who willfully fail to comply with their employment tax responsibilities, as well as those who aid and assist them in failing to meet those responsibilities.

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial sit- uation changes. Photocopies of this form are acceptable.