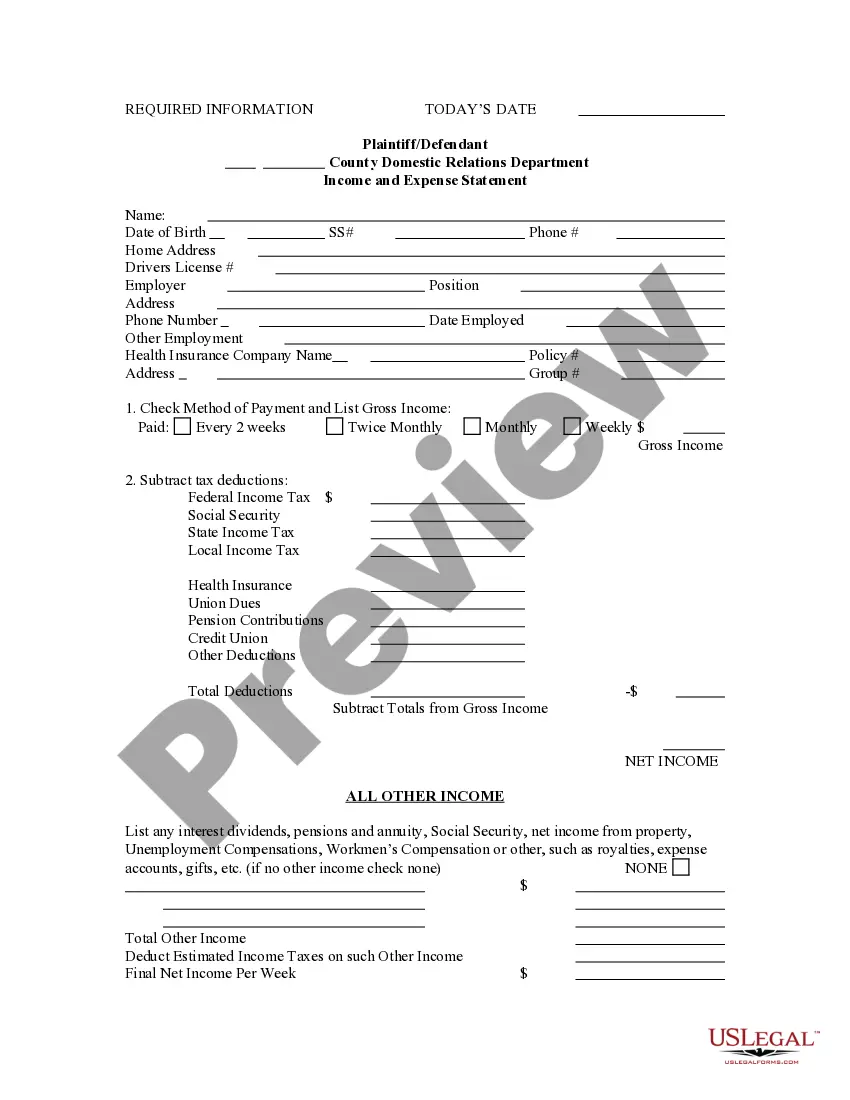

This is an Income and Expense Statement, to be used in causes of action where children are involved. This form provides the Court with basic information regarding employment, health insurance and the income and expenses of the parties.

Income And Expense Statement For Rental Property

Description

Form popularity

FAQ

Yes, you may receive a 1099 form if you earn rental income that meets certain thresholds, especially if your tenant is a business entity. This form reports the rental income to the IRS, ensuring you comply with tax regulations. Keeping an updated income and expense statement for rental property can help you track income and prepare for any necessary 1099 reporting.

Form 8825 is designed for partnerships and multi-member LLCs that conduct rental real estate activities. This form helps track income and expenses, similar to Schedule E, but it is tailored for entities rather than individuals. Completing an income and expense statement for rental property aids in filling out Form 8825 accurately.

Rental income is typically reported on Schedule E, rather than Schedule C, which is used for business income. Schedule E focuses specifically on passive income sources, such as rental payments from tenants. Utilizing an income and expense statement for rental property can make completing Schedule E more straightforward.

The primary form for reporting rental income and expenses is Schedule E of your tax return. Schedule E allows you to detail your income and expenses related to rental properties, ensuring that you receive appropriate deductions. An income and expense statement for rental property can simplify this process by providing a clear overview of your financials.

To prove your income from rental property, you typically need to provide an income and expense statement for rental property. This statement should include details such as rental income received, tenant agreements, and any related documents. Keeping thorough records not only supports your claims but also aids in tax filing and financial assessments.

Rental income expenses can include repairs, maintenance costs, property management fees, and advertising for new tenants. Each of these expenses can be deducted on your taxes, making it crucial to maintain a clear income and expense statement for rental property. Platforms like USLegalForms offer resources that help you compile this information effectively.

An example of a rent expense is the monthly mortgage payment on your rental property. This amount generally includes interest, property taxes, and insurance, all of which should be documented in your income and expense statement for rental property. Keeping these details organized will simplify your financial management and tax reporting.

You can itemize various expenses for rental property to reduce your taxable income, including mortgage interest, property management fees, maintenance costs, and utilities. Documenting these expenses effectively in your income and expense statement for rental property can provide significant tax benefits. Consider using USLegalForms for templates that help you itemize and organize your deductions properly.

Certain expenses are not deductible when it comes to rental property. For example, personal use of the property, improvements that add value, or capital expenses do not qualify. It’s essential to clarify these exclusions in your income and expense statement for rental property to avoid filing errors.

Yes, it's important to keep receipts for all rental expenses, as these documents validate the costs you claim. You need to provide a clear income and expense statement for rental property that outlines your deductions. Having organized records will help ensure you can fully support your claims during tax season.