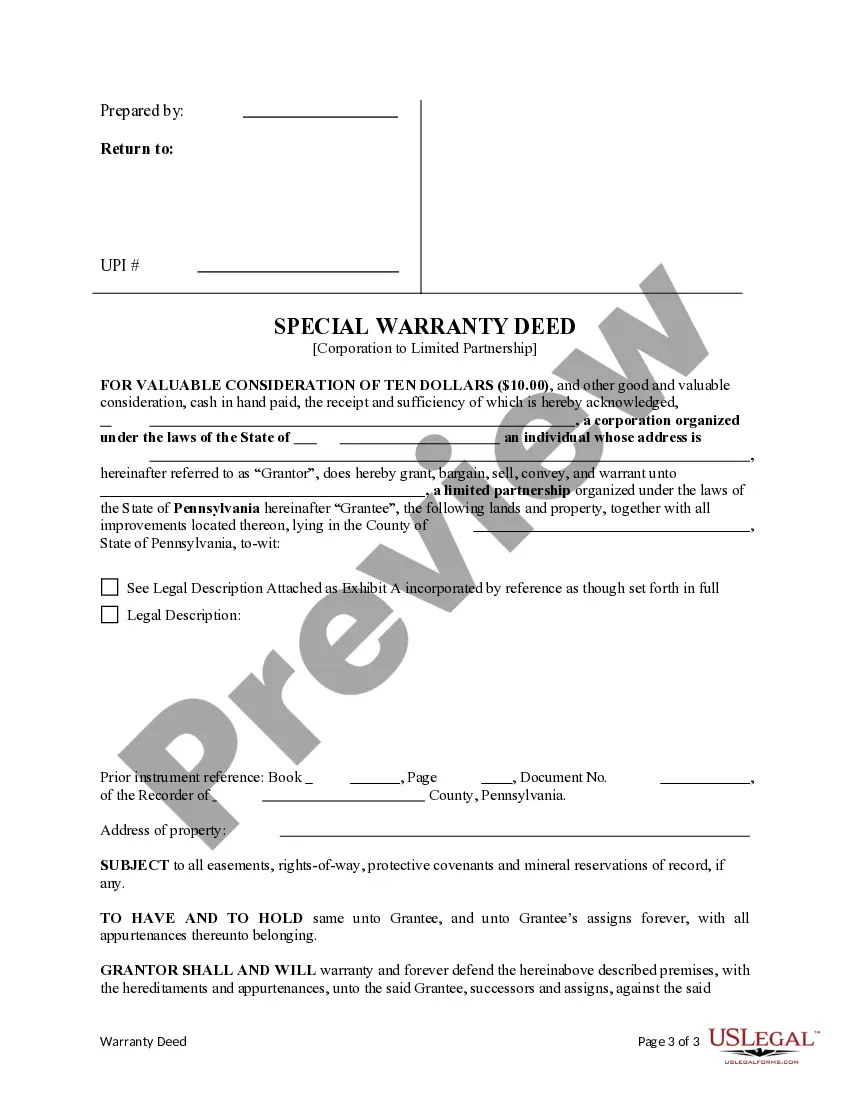

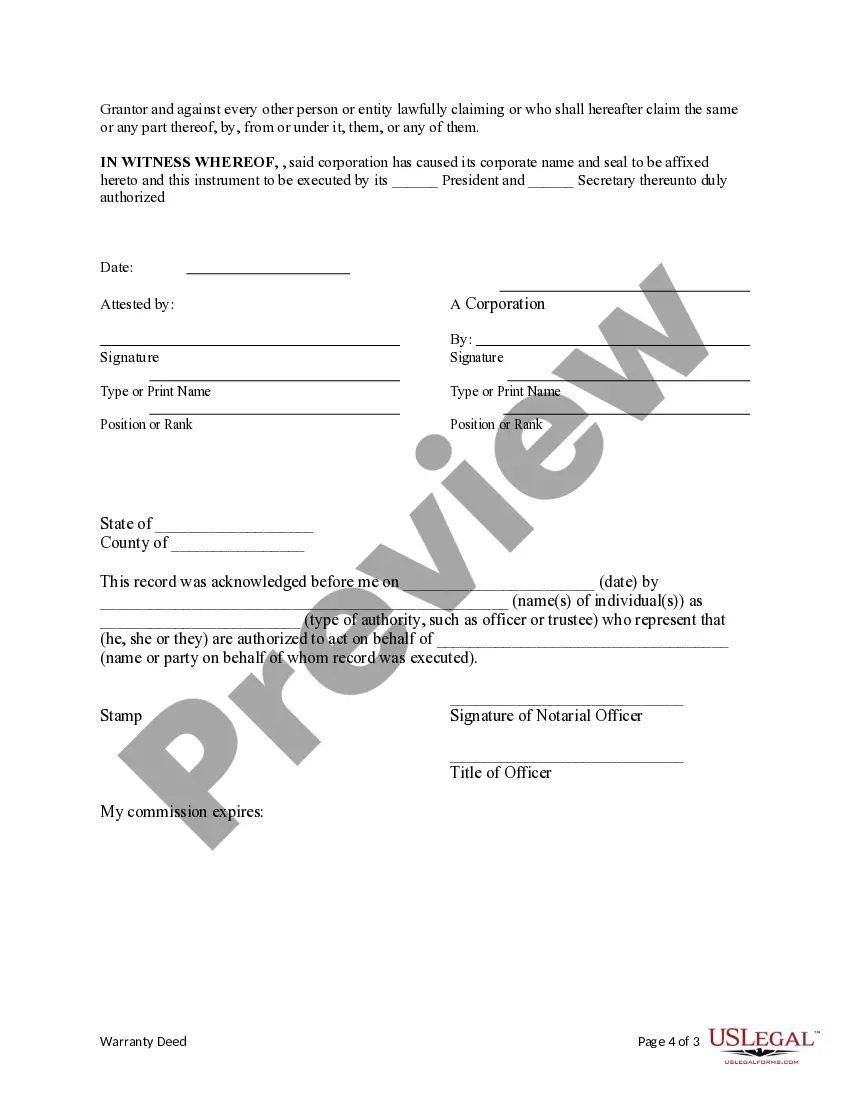

This form is a Special Warranty Deed where the Grantor is a corporation and the Grantee is a limited partnership. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Pennsylvania Limited Partnership Form

Description

Form popularity

FAQ

To create a limited partnership, you must file a Pennsylvania limited partnership form with the state. This form includes essential details such as the partnership name, the address, and the names of the general and limited partners. Once filed, it's crucial to draft a partnership agreement detailing management, profit sharing, and other operational aspects. US Legal Forms provides templates and helpful resources to guide you through this process.

A limited partnership consists of at least one general partner and one limited partner. The general partner manages the day-to-day operations and assumes personal liability, while limited partners contribute capital and have limited liability. The Pennsylvania limited partnership form requires you to clearly define these roles and responsibilities, which helps in avoiding conflicts. Always consider consulting an expert or using US Legal Forms to ensure proper documentation.

Yes, you can create your own liquidity pool, but it involves more than just filing paperwork. First, you must understand the legal implications and create a solid business plan. While the Pennsylvania limited partnership form establishes your legal structure, ongoing compliance and management practices ensure your liquidity pool operates smoothly. Resources from US Legal Forms can assist with creating and maintaining your partnership structure.

Creating a limited partnership (LP) involves filing a Pennsylvania limited partnership form with the Pennsylvania Department of State. You need to designate at least one general partner and one limited partner. It's essential to outline the partnership's purpose in the formation documents. Utilizing platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance.

To form a limited partnership in Pennsylvania, you need to complete the Pennsylvania limited partnership form. First, choose a unique name for your partnership that complies with state regulations. Next, file the form with the Pennsylvania Department of State, ensuring you include all required details, such as the partnership's address and the names of the general and limited partners. Additionally, consider using US Legal Forms to simplify the process, as they provide templates and guidance to ensure you accurately complete your filing.

To form an LLC in Pennsylvania, start by selecting a unique name for your business that complies with state regulations. Next, complete the Pennsylvania limited partnership form, ensuring you include the required information about the business structure. After filing your Articles of Organization with the Pennsylvania Department of State, consider creating an operating agreement to define the management of your LLC. You can utilize uslegalforms to help guide you through the necessary steps and paperwork for forming your LLC.

To form a limited partnership in Pennsylvania, you need to file a Pennsylvania limited partnership form with the Department of State. This form requires details about the general partners and limited partners, as well as the partnership's name and registered office. Additionally, you should create a partnership agreement that outlines each partner's roles and contributions. By using uslegalforms, you can easily access the necessary forms and guidance for a smooth registration process.

To form a limited partnership in Pennsylvania, you need to file a Certificate of Limited Partnership with the Pennsylvania Department of State. This document requires specific information, such as the names of the general and limited partners. Make sure you also have a solid agreement in place, which you can draft with the help of the Pennsylvania limited partnership form to ensure all legal requirements are met.

To write a limited partnership agreement, begin with identifying the partners and their respective roles. Clearly define the terms concerning management responsibilities, profit distribution, and how conflicts will be resolved. Using the Pennsylvania limited partnership form can provide a helpful framework to ensure all important aspects are covered.

Three requirements for a limited partnership include having at least one general partner, at least one limited partner, and a formal written agreement. This agreement must outline the partnership’s purpose, management structure, and profit allocation. To ensure compliance with Pennsylvania regulations, using the correct Pennsylvania limited partnership form is essential.