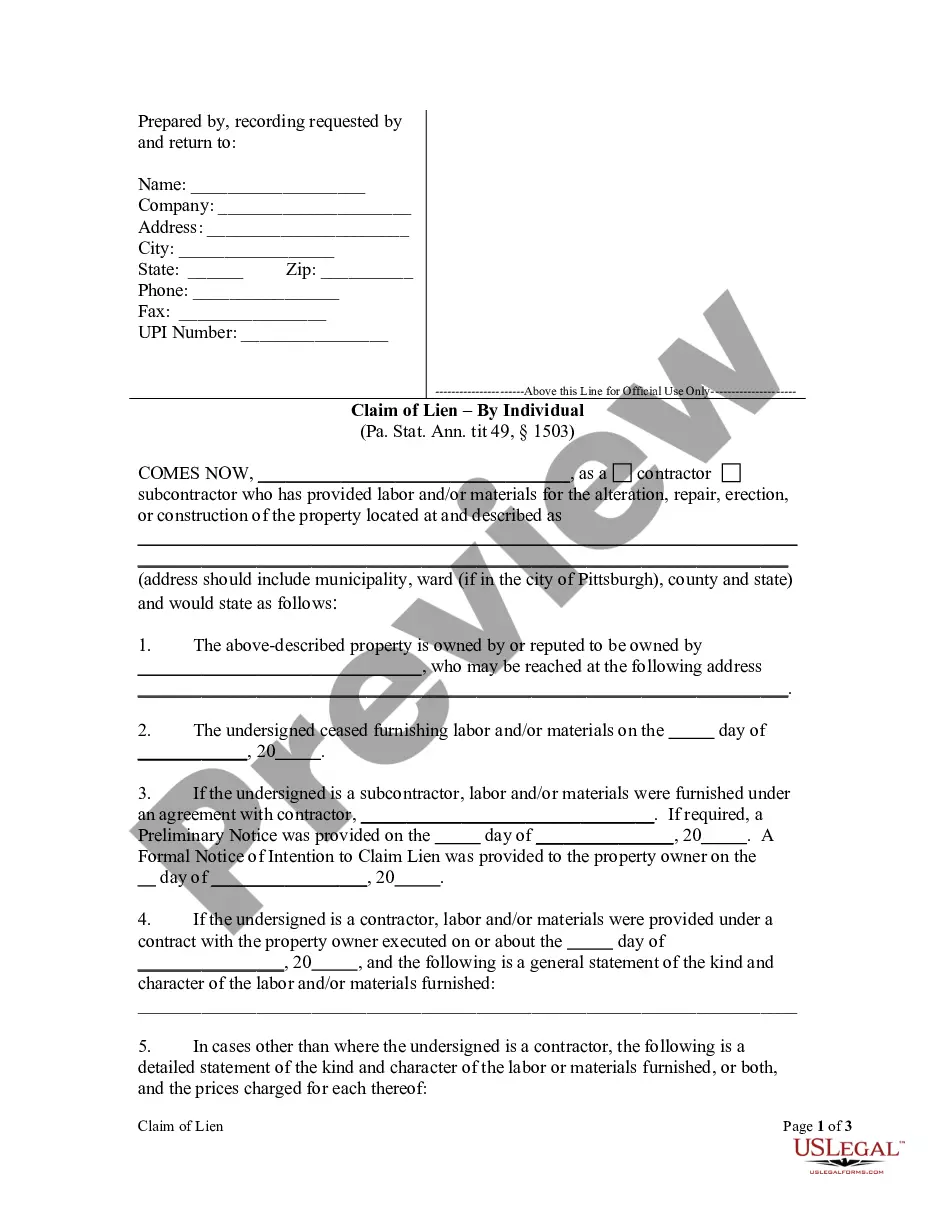

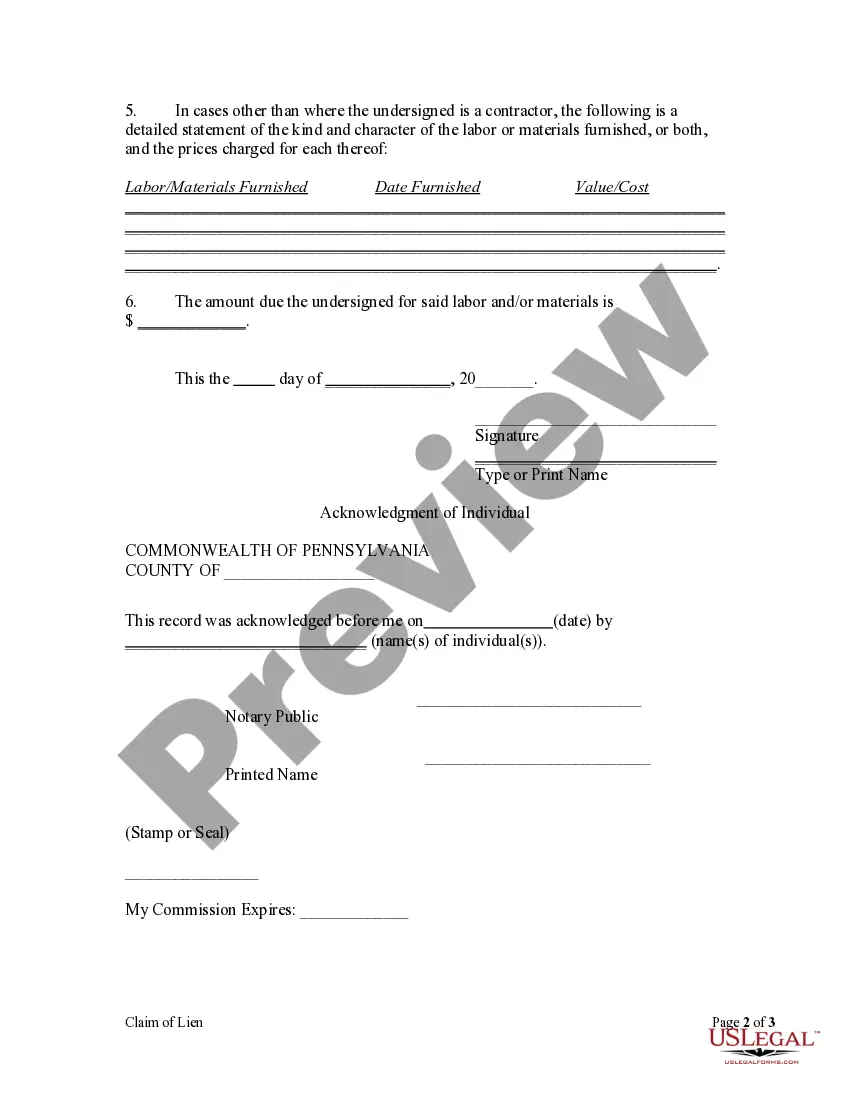

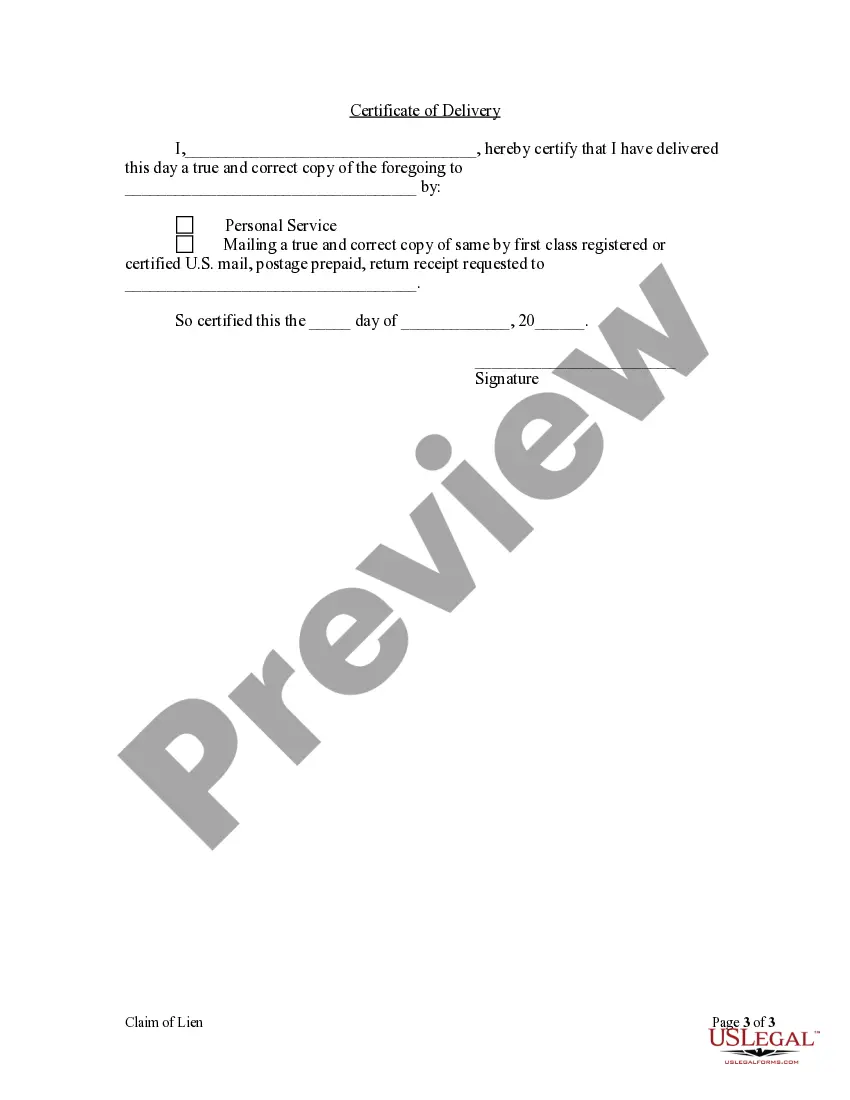

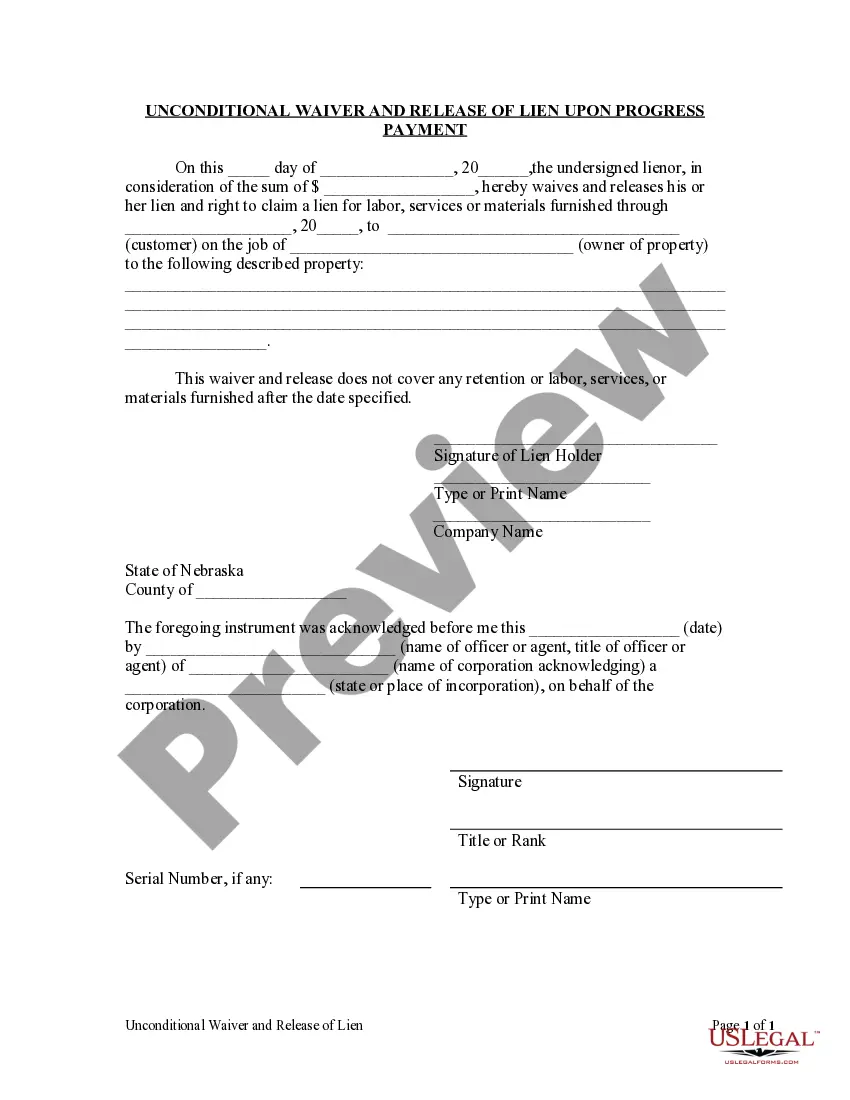

To perfect a lien in Pennsylvania, a contractor or subcontractor must file a lien claim with the prothonotary of the county in which the property is situated, within four (4) months after the completion of work. A notice of this filing must be served upon the property owner within (1) month of filing and an affidavit of said service must be filed within twenty (20) days of service.

Pennsylvania Property Lien Form

Description

Form popularity

FAQ

Yes, liens are considered public records in Pennsylvania. This means that anyone can access information about liens filed against a property. Awareness of this public nature is important for both buyers and sellers. Using a Pennsylvania property lien form can help ensure transparency and proper documentation in these transactions.

A property lien in Pennsylvania generally lasts for five years. If the lien is not renewed during this period, it may become obsolete. This timeframe is essential to note, especially when managing your financial obligations related to a property. By correctly filling out a Pennsylvania property lien form, you can keep track of important deadlines.

Yes, a house can be sold even if there is a lien on it in Pennsylvania. However, the existing lien will typically need to be settled before the sale can be completed. This is a crucial point for sellers to understand, as unresolved liens can complicate the sale process. Utilizing a Pennsylvania property lien form promptly can help manage lien issues effectively.

To file a lien on property in Pennsylvania, you must first prepare the proper paperwork, specifically a Pennsylvania property lien form. You then need to file this form with the Prothonotary in the county where the property is located. This process requires accuracy and attention to detail, so consider utilizing online platforms like uslegalforms to ensure everything is completed correctly.

In Pennsylvania, a lien can remain on a property for a period of five years. After this time, the lien may become unenforceable unless renewed. It is crucial to manage these timelines effectively, especially when using the Pennsylvania property lien form. Staying informed about these durations can help you protect your interests.

The most common lien on property is a mortgage lien. When homeowners take out a mortgage, it creates a lien that gives the lender a stake in the property. If you need to assert your rights or clarify your obligations, utilizing a Pennsylvania property lien form through US Legal Forms can provide valuable assistance to navigate these legalities.

Yes, Pennsylvania is a tax lien state. This means local governments can file a tax lien against properties for unpaid property taxes and fees. Understanding this process is vital, and using a Pennsylvania property lien form can help property owners manage their obligations and avoid complications.

Contractors in Pennsylvania typically have a period of 6 months from the date of completing their work to file a lien. This time frame is crucial for securing payment for services rendered. Additionally, filling out the Pennsylvania property lien form accurately will strengthen your claim. Timely action is essential to protect your financial interests in this scenario.

In Pennsylvania, you generally have six months from the completion of work or delivery of goods to file a lien. This time frame ensures that you protect your rights efficiently. It's essential to be aware of this deadline so you can complete the Pennsylvania property lien form in a timely manner. Delaying the filing could complicate your ability to collect what is owed.

In Pennsylvania, a judgment can lead to the seizure of various personal properties to satisfy a debt. This may include bank accounts, wages, cars, and other valuables. However, certain exemptions apply, meaning that some assets cannot be touched, such as basic household items. Understanding these laws is crucial, and you may find resources on the Pennsylvania property lien form that clarify your rights.