Pennsylvania Limited Liability Company Without Operating Agreement

Description

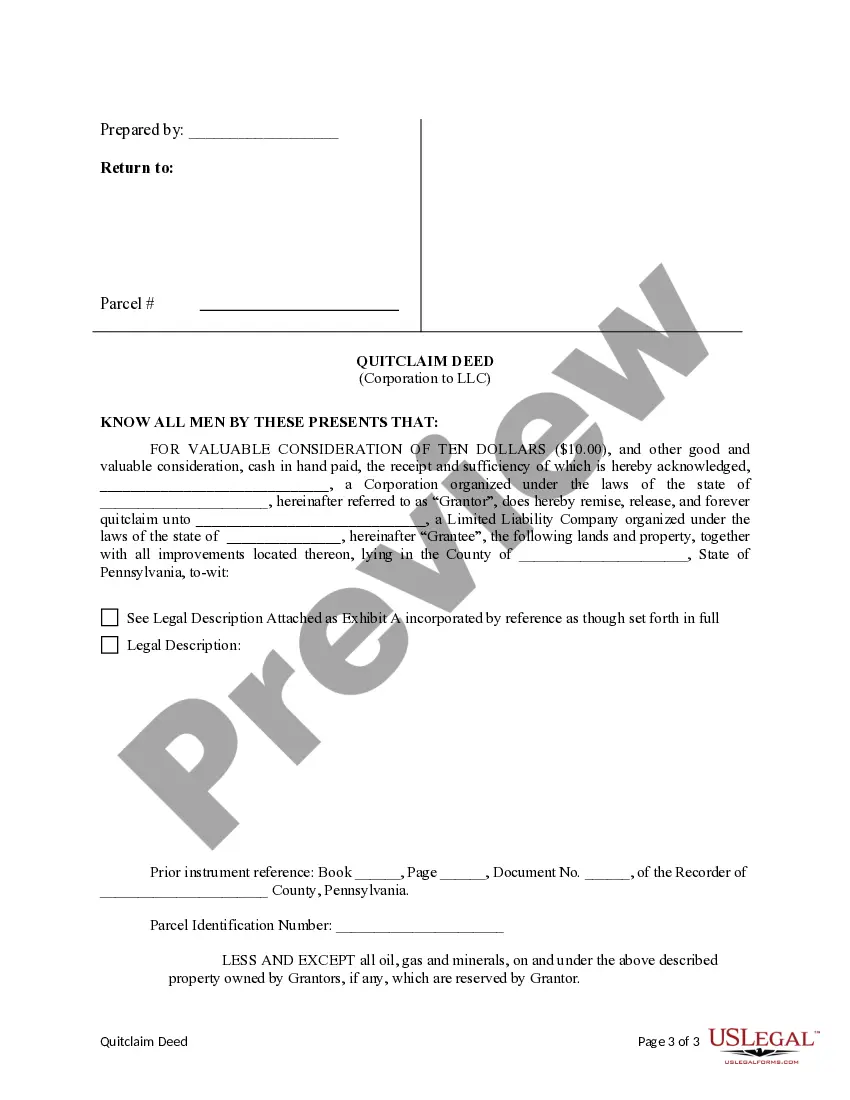

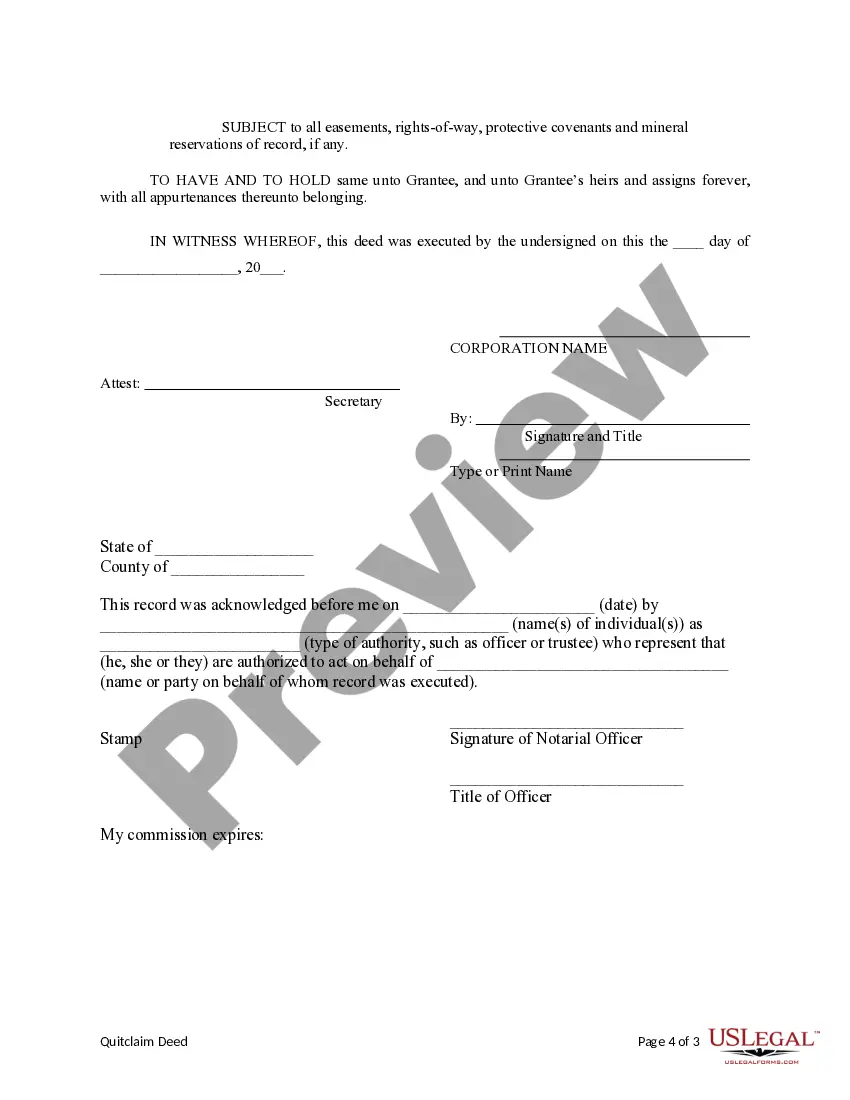

How to fill out Pennsylvania Quitclaim Deed From Corporation To LLC?

When you have to present a Pennsylvania Limited Liability Company Without Operating Agreement that adheres to your local state's laws, there can be many options available.

There's no need to scrutinize every document to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Navigating through the suggested page and verifying its alignment with your requirements.

- US Legal Forms is the largest online directory with an archive of over 85k ready-to-use documents for business and personal legal situations.

- All templates are confirmed to comply with each state's statutes and regulations.

- As a result, when downloading the Pennsylvania Limited Liability Company Without Operating Agreement from our site, you can be assured that you have a legitimate and current document.

- Obtaining the necessary template from our platform is remarkably easy.

- If you already possess an account, simply Log In to the system, check that your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and keep the Pennsylvania Limited Liability Company Without Operating Agreement accessible at any time.

- If it's your initial engagement with our site, please follow the instructions provided.

Form popularity

FAQ

It provides a reference for how to solve problems and disagreements, and it serves to protect all members and the business itself. Although LLC Operating Agreements are not legally required in Pennsylvania, it is always good to have one.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

A Pennsylvania LLC operating agreement is a legal document that would be used by various sized businesses for the purpose of establishing certain policies, procedures, member duties, and responsibilities, among other important aspects of the company.

Starting an LLC in PA is EasySTEP 1: Name your Pennsylvania LLC.STEP 2: Choose a Registered Office for Your Pennsylvania LLC.STEP 3: File Your Pennsylvania LLC Certificate of Organization.STEP 4: Create Your Pennsylvania LLC Operating Agreement.STEP 5: Get a Pennsylvania LLC EIN.

Starting an LLC in PA is EasySTEP 1: Name your Pennsylvania LLC.STEP 2: Choose a Registered Office for Your Pennsylvania LLC.STEP 3: File Your Pennsylvania LLC Certificate of Organization.STEP 4: Create Your Pennsylvania LLC Operating Agreement.STEP 5: Get a Pennsylvania LLC EIN.19-Apr-2022