Pennsylvania Records Corporations With Established Credit

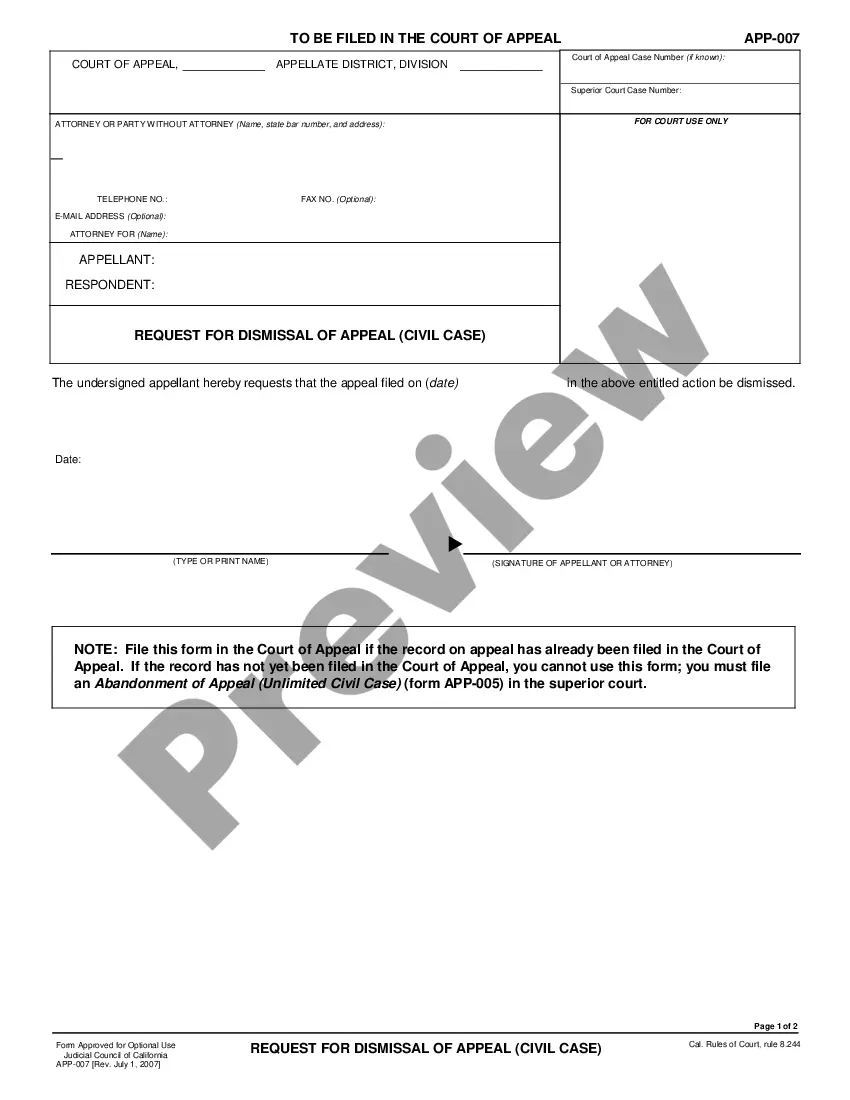

Description

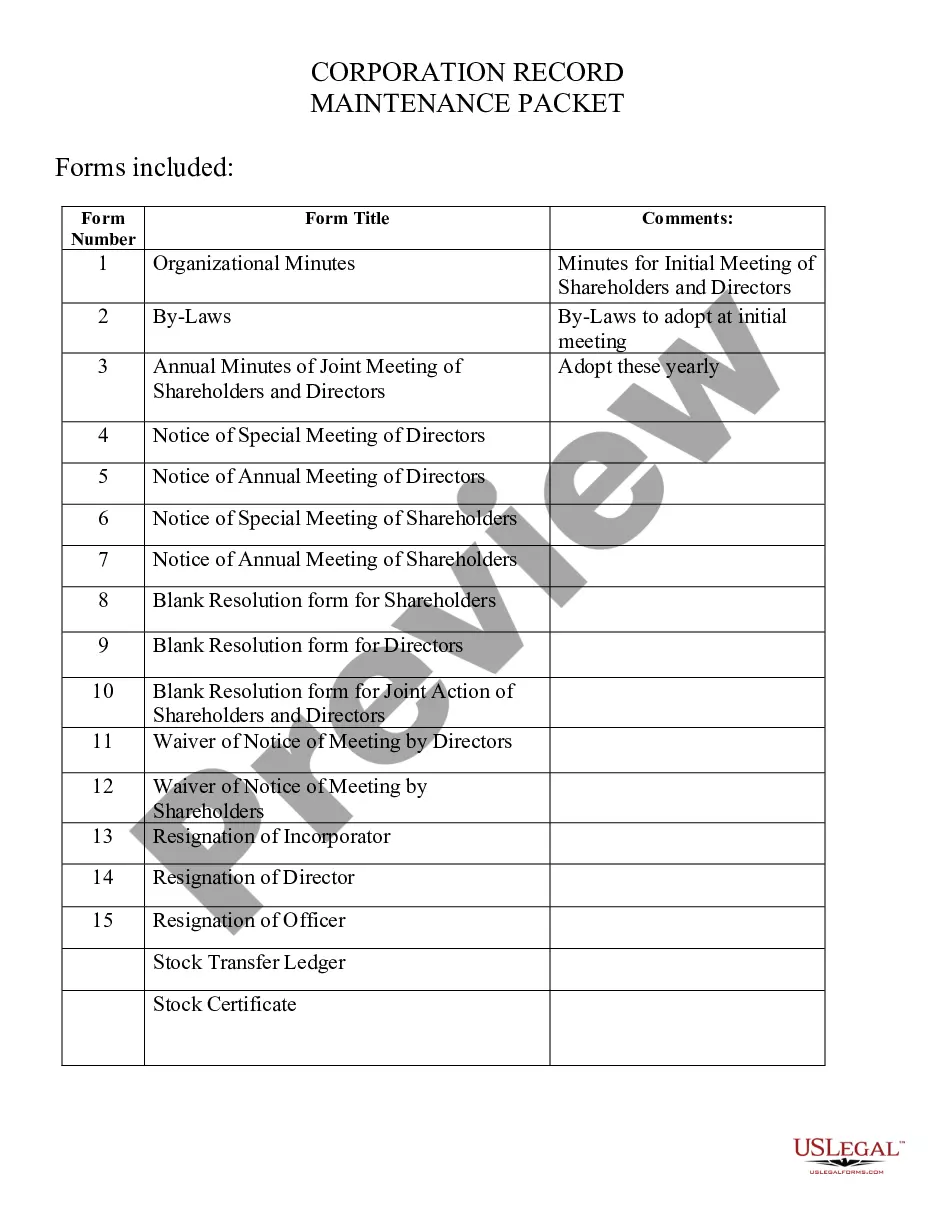

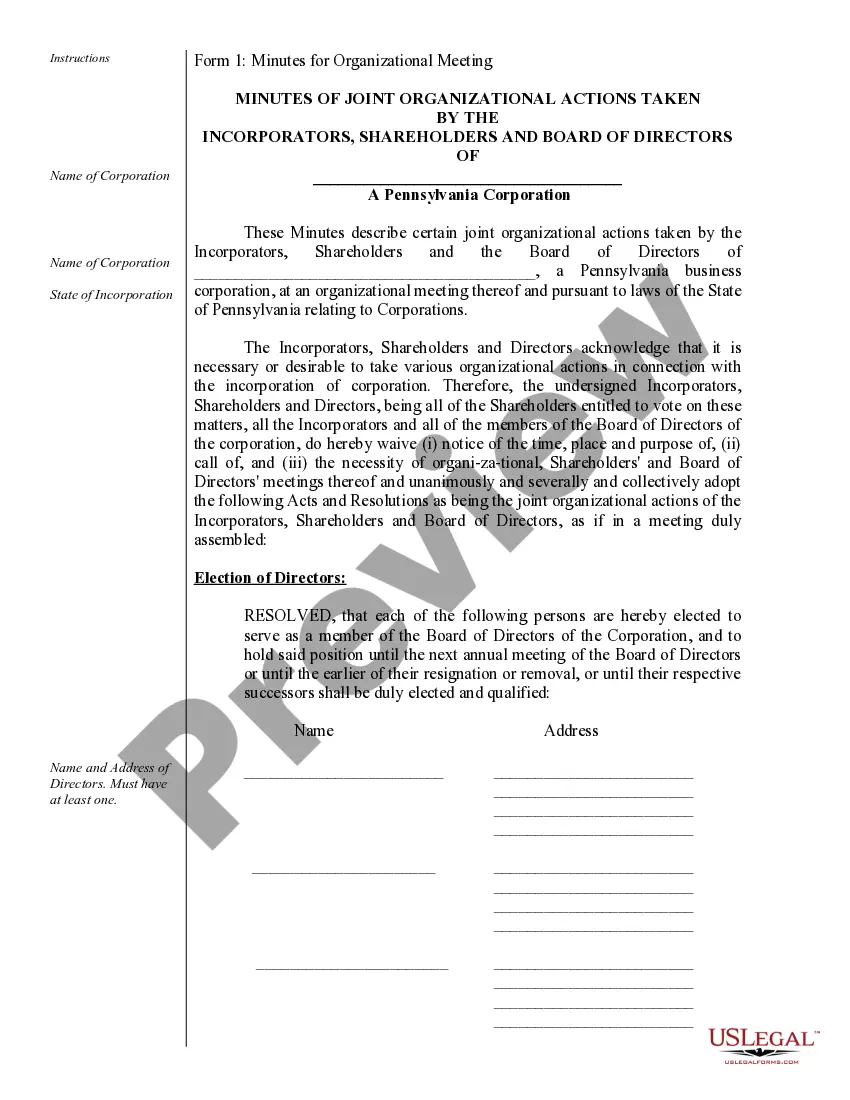

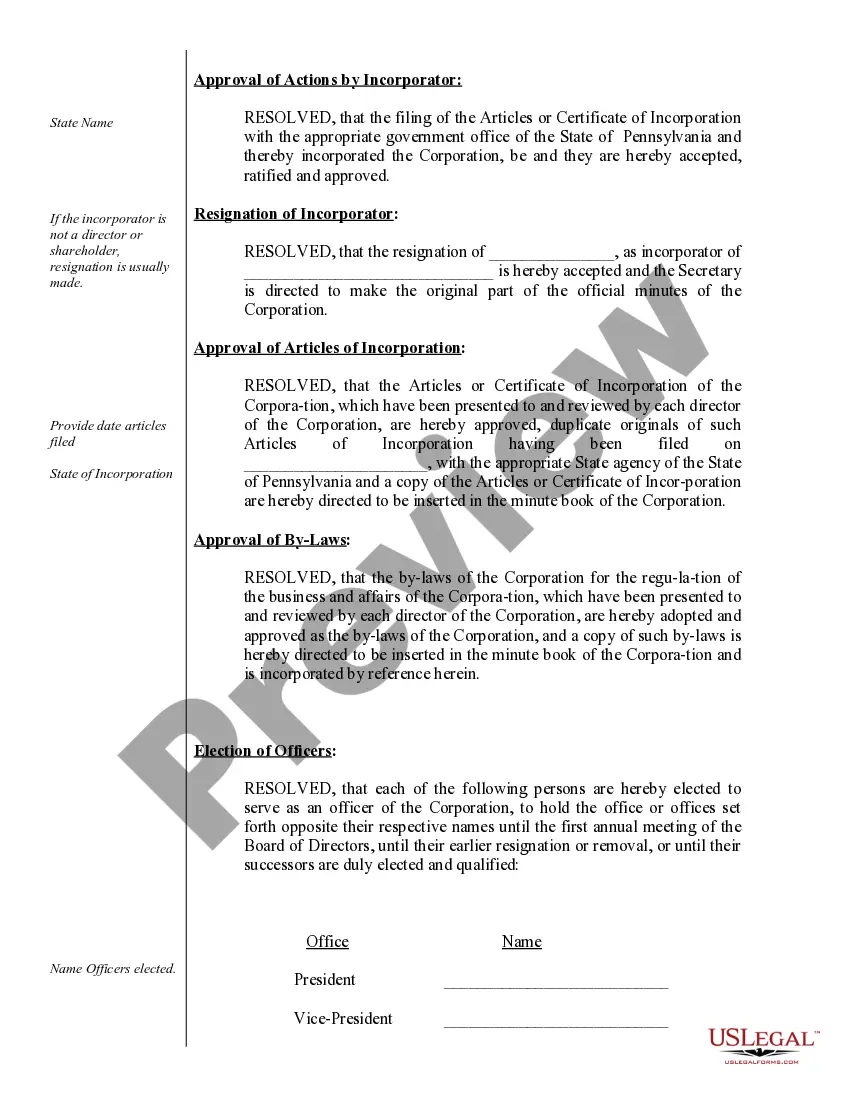

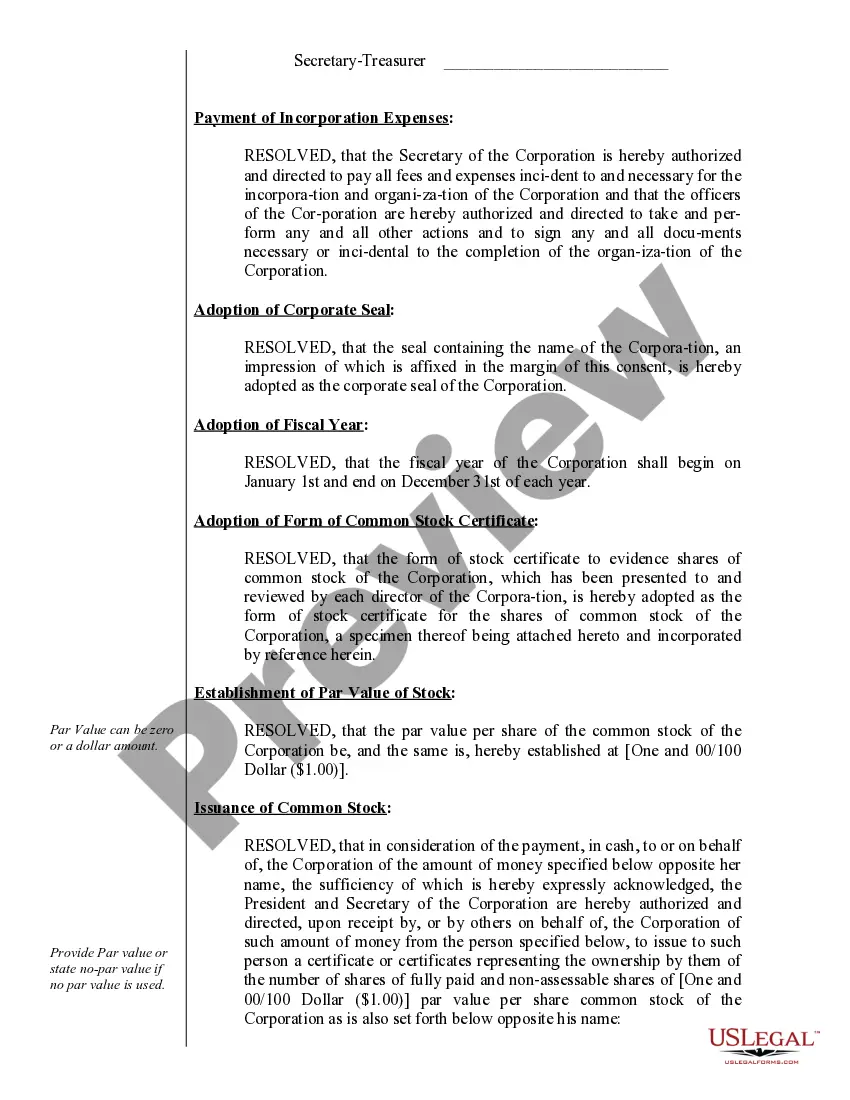

How to fill out Pennsylvania Corporate Records Maintenance Package For Existing Corporations?

Obtaining legal document samples that comply with federal and local regulations is crucial, and the internet offers many options to pick from. But what’s the point in wasting time looking for the appropriate Pennsylvania Records Corporations With Established Credit sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all files collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Pennsylvania Records Corporations With Established Credit from our website.

Obtaining a Pennsylvania Records Corporations With Established Credit is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template using the Preview feature or via the text description to make certain it meets your requirements.

- Browse for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Pennsylvania Records Corporations With Established Credit and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Disallowed deductions include the federal standard deduction and itemized deductions (with the limited exception for unreimbursed employee business expenses deducted from gross compensation).

When filing an RCT-101, PA Corporate Net Income Tax Report, all corporate taxpayers are required to include forms and schedules to support the calculation of the tax liability. The type of information required depends on how the entity reports income to the IRS.

A person is considered a statutory resident of PA unless: the person spends more than 181 days (midnight to midnight) of the tax year outside PA; or. the person has no permanent abode in PA for any part of the tax year.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report). However, starting in 2025, the new Annual Report requirement will replace the old Decennial Report.

The resident credit calculation on Schedule G-L limits the amount of allowable credit when the income subject to tax in a class of income in another state is greater than the income subject to tax in Pennsylvania in the same class of income.