Pa Corporation Pennsylvania Form Pa-65 Instructions 2021

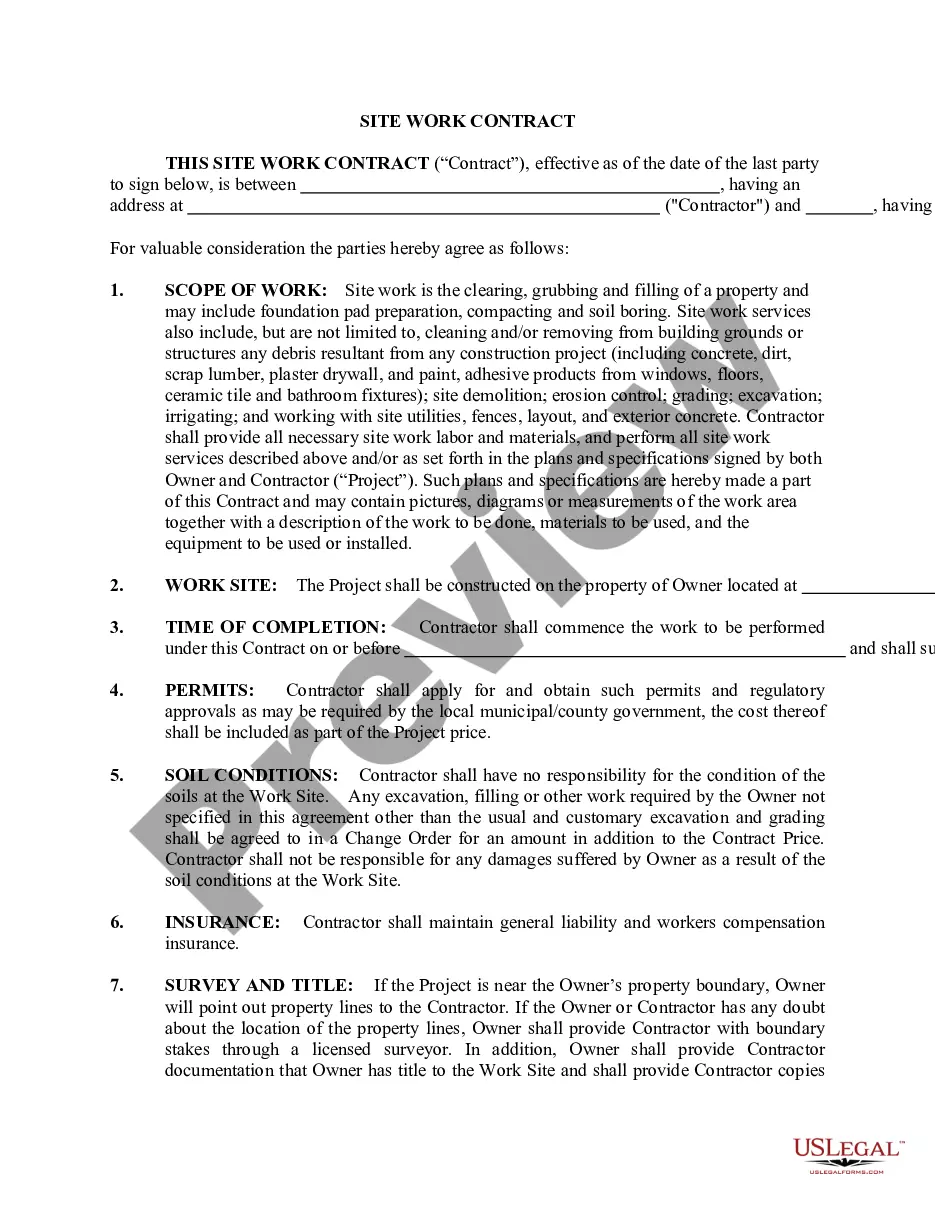

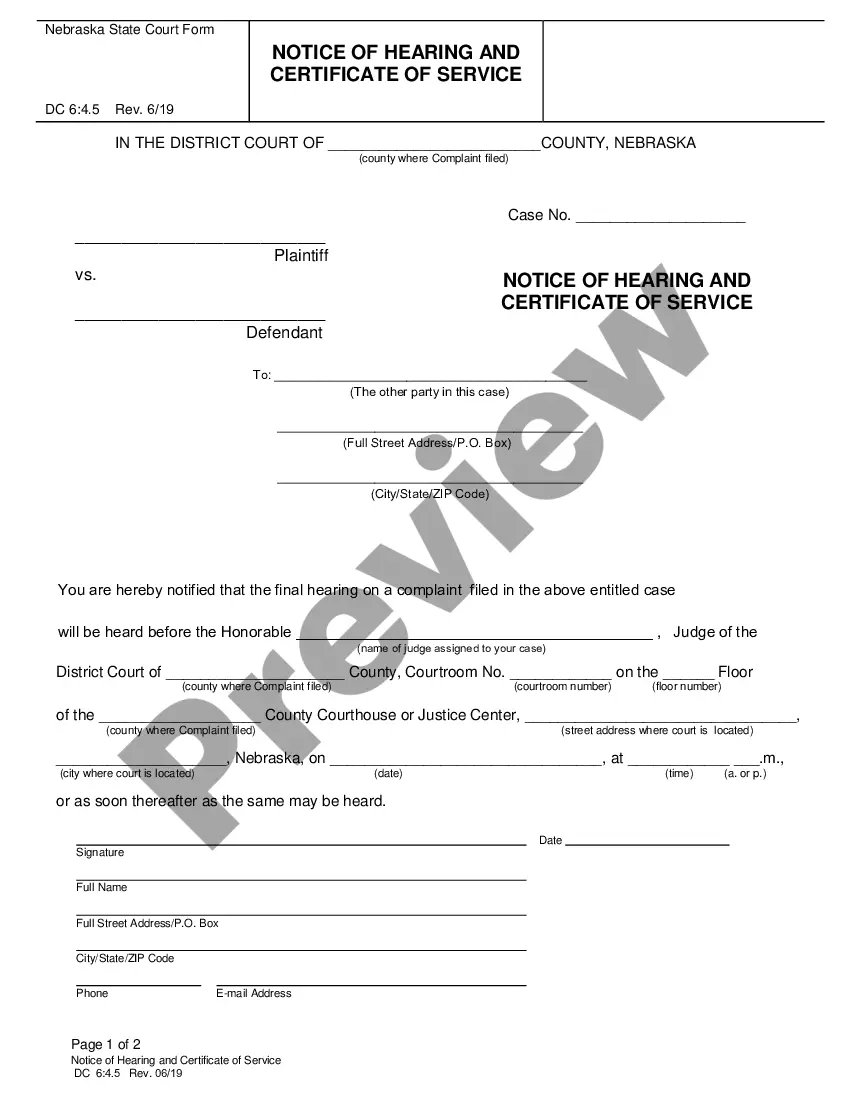

Description

How to fill out Pennsylvania Bylaws For Corporation?

Handling legal documents can be tedious, even for seasoned professionals.

If you are looking for a Pennsylvania Form Pa-65 Instructions 2021 for a Pa Corporation and struggle to find the correct and current version, the experience may become overwhelming.

With US Legal Forms, you can.

Benefit from sophisticated tools to complete and handle your Pennsylvania Form Pa-65 Instructions 2021.

Here are the steps to follow after downloading the required form.

- Tap into a collection of articles, guides, and resources pertinent to your circumstances and requirements.

- Save time and energy searching for necessary documents, utilizing US Legal Forms’ advanced search and Review feature to locate and obtain the Pennsylvania Form Pa-65 Instructions 2021.

- For existing subscribers, Log In to your US Legal Forms account, find the form, and retrieve it.

- Refer to the My documents tab to review the documents you have downloaded previously and manage your folders as needed.

- If you're new to US Legal Forms, create an account to gain unlimited access to all platform benefits.

- Utilize a comprehensive online form library that can significantly aid anyone seeking to navigate these challenges proficiently.

- US Legal Forms stands as a frontrunner in digital legal documents, offering over 85,000 state-specific legal forms accessible to you at any time.

- Access legal and business forms that are specific to your state or county.

Form popularity

FAQ

Who must file the PA-65 Corp, Directory of Corporate Partners (PA-65 Corp)? A partnership wholly owned by C corporations submits a PA-65 Corp and a complete copy of federal Form 1065, including all federal schedules and federal Form 1065 Schedules K-1.

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations.

Business income is apportioned to PA by multiplying total transportation income by a factor. The factor is derived by taking the numerator which is total revenue miles within PA for a taxable period and dividing it by the denominator, total revenue miles everywhere.

For the partner who is a partnership, the PA-20S/PA-65 Schedule H-Corp ensures that if the partnership, as an owner, has corporate partners, the corporate partners will have the necessary documentation for apportionment to calculate PA corporate net income tax.

PURPOSE OF SCHEDULE Use PA-20S/PA-65 Schedule A to report interest income of PA S corporations, partnerships and limited liability companies filing as partnerships or PA S corporations for federal income tax purposes.