Correctly composed official documentation is among the crucial assurances for steering clear of problems and legal disputes, yet securing it without an attorney's assistance could require time.

Whether you require to swiftly locate an updated Oregon Mortgage Release With Taxes or any other documents for employment, familial, or commercial circumstances, US Legal Forms is consistently available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the chosen document. Furthermore, you can access the Oregon Mortgage Release With Taxes at any time later, as all documents ever procured on the platform remain accessible within the My documents tab of your account. Conserve time and money on preparing formal documentation. Try US Legal Forms today!

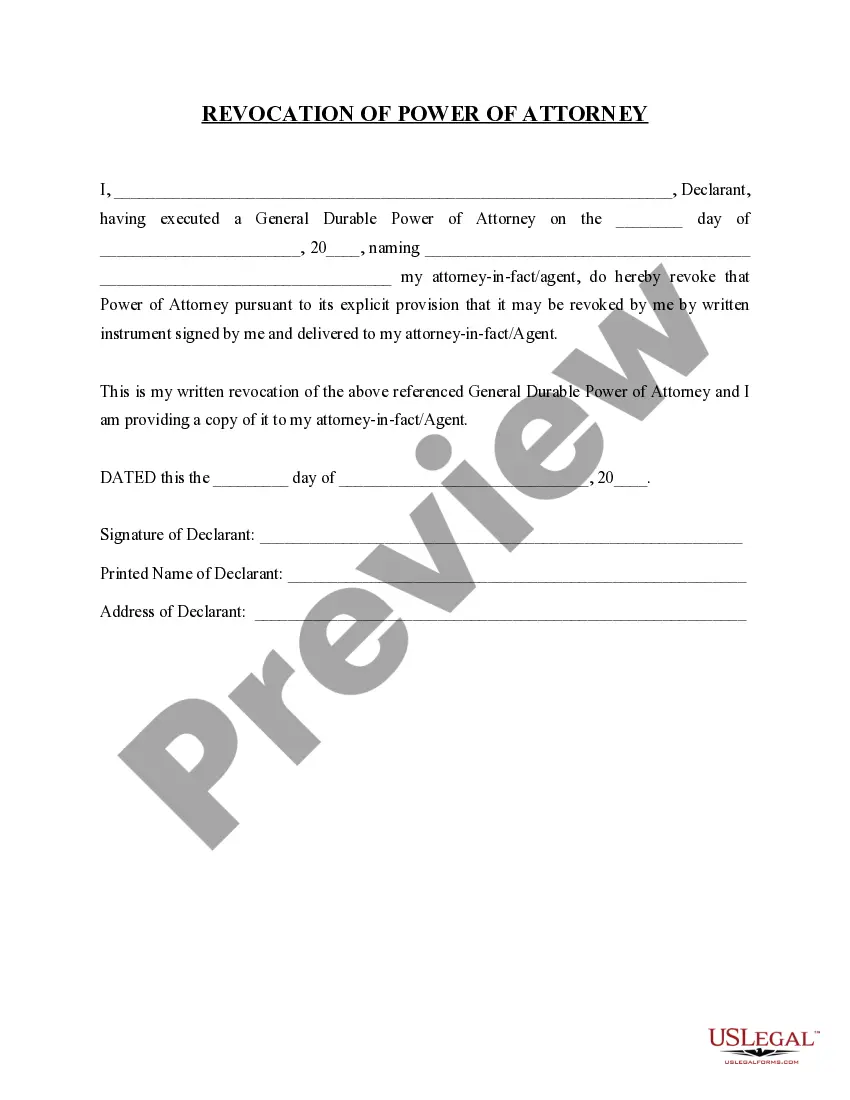

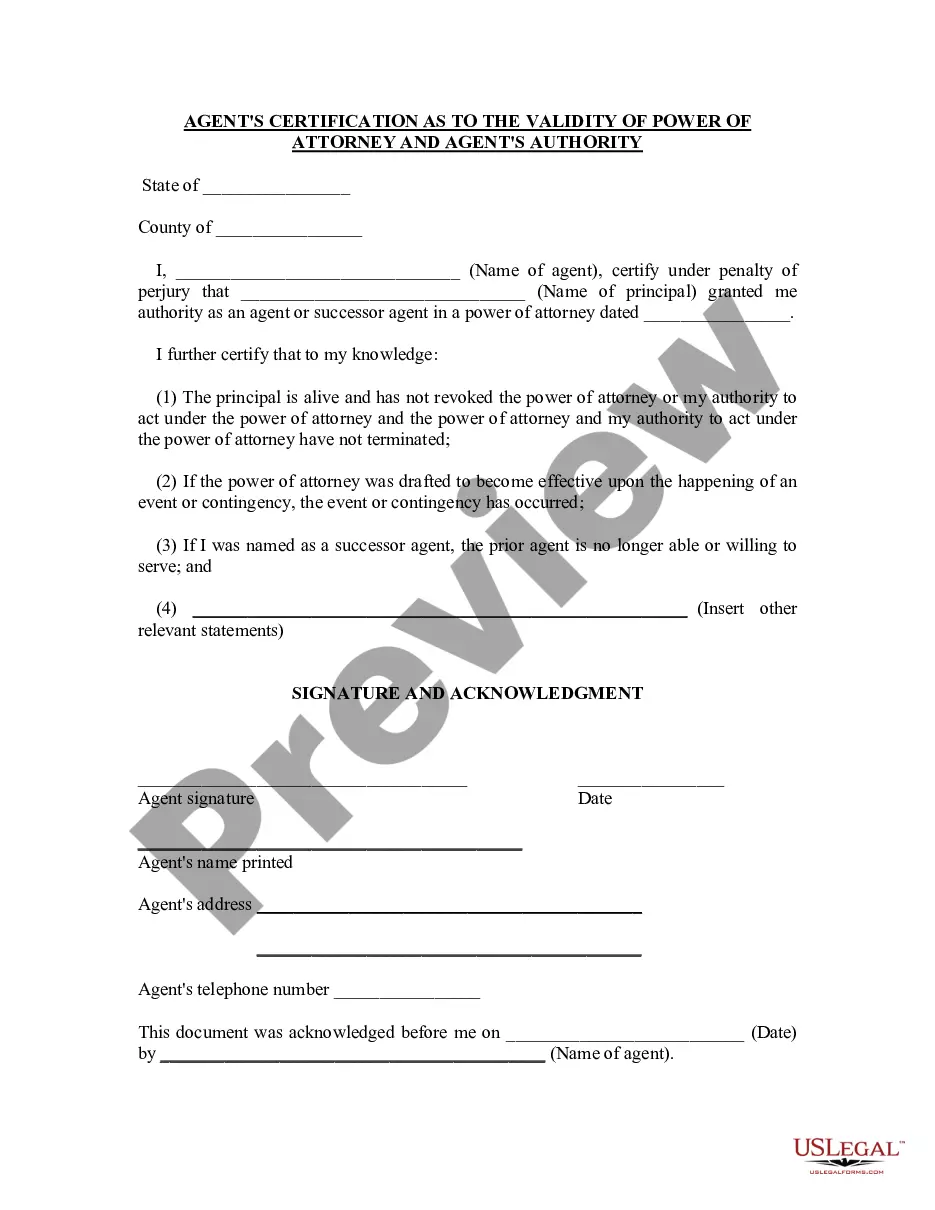

- Ensure that the document is appropriate for your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Select Buy Now once you identify the relevant template.

- Choose the pricing option, Log In to your account or create a new one.

- Pick your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Oregon Mortgage Release With Taxes.

- Click Download, then print the template to complete it or upload it to an online editor.

All sales of real property in the state are subject to REET unless a specific exemption is claimed. Foreclosure procedures differ depending on the type of lien involved.For COVID-19 Mortgage Relief, all borrowers on the mortgage must be applicants. Q: What documents do I need to apply? Mortgage Records ; Document Type. Fee as of June 4, 2018. Qualified home mortgage interest; Points paid on a loan; Real estate taxes; Private mortgage insurance.