Ucc Search In Oregon

Description

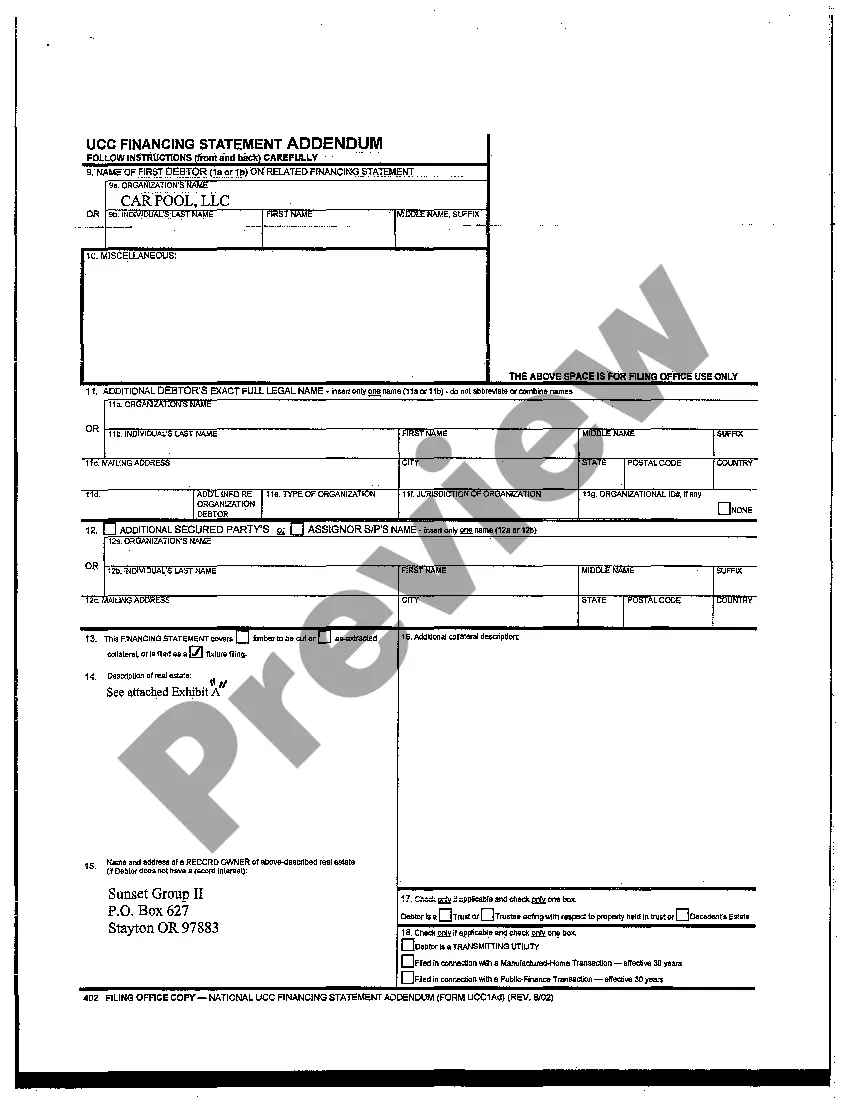

How to fill out Oregon UCC Financing Statement?

Identifying a primary resource for the most up-to-date and pertinent legal templates constitutes a significant portion of navigating bureaucracy.

Securing the proper legal documents requires carefulness and meticulousness, which is why it is crucial to obtain samples of Ucc Search In Oregon exclusively from trustworthy sources, such as US Legal Forms.

Once you have the form on your device, you can edit it using the editor or print it out and fill it in by hand. Eliminate the hassle associated with your legal paperwork. Explore the comprehensive US Legal Forms library to discover legal templates, assess their suitability for your circumstances, and download them immediately.

- Utilize the catalog browsing or search function to find your template.

- Review the description of the form to confirm if it fulfills the specifications of your state and locality.

- Check the form preview, if it exists, to ensure that the template is indeed what you are seeking.

- Return to the search and look for the suitable template if the Ucc Search In Oregon does not meet your expectations.

- Once you are certain about the form's appropriateness, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to purchase the form.

- Choose the pricing plan that aligns with your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the format for downloading Ucc Search In Oregon.

Form popularity

FAQ

A UCC filing is a legal notice that a lender has an interest in a debtor's assets. It is used primarily to secure loans or credit agreements. If you are interested in understanding how to conduct a UCC search in Oregon, think of it as a way to look up existing claims against property or businesses. For a simplified overview, resources from USLegalForms can provide clear explanations and useful templates.

You can look up a UCC filing through state databases or online platforms that specialize in legal documents, such as US Legal Forms. This process is typically straightforward, allowing you to search by name or filing number. Utilizing a UCC search in Oregon through reliable resources will give you accurate and current information on existing liens. Taking the initiative to perform this search can give you peace of mind and help you make informed decisions.

A UCC search is conducted to investigate whether a lien has been filed on a person's or business's assets. It helps potential lenders understand the existing financial obligations of an individual or company. By conducting a UCC search in Oregon, you can gain insight into liens that may impact your lending or borrowing decisions. This informed approach can reduce risks associated with transactions.

The duration of a UCC search in Oregon can vary depending on several factors. Generally, you can expect to receive results within a few business days if you submit your request online. However, processing times can extend if you choose mail or in-person requests. It's best to plan ahead to avoid delays.

Luckily, this process is simple, and all you have to do is request your lender file a UCC-3 termination statement with your last loan payment. This will remove the UCC-1 lien and free you up for other loans.

"Assignment" is an amendment that assigns all or part of a secured party's power to authorize an amendment to a financing statement. "Information Statement" means a UCC record that indicates that a financing statement is inaccurate or wrongfully filed.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

There are two basic ways to perform a search with the Oregon UCC office. You can conduct an uncertified search yourself through our site or request our office to perform a certified search for you for a fee.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.