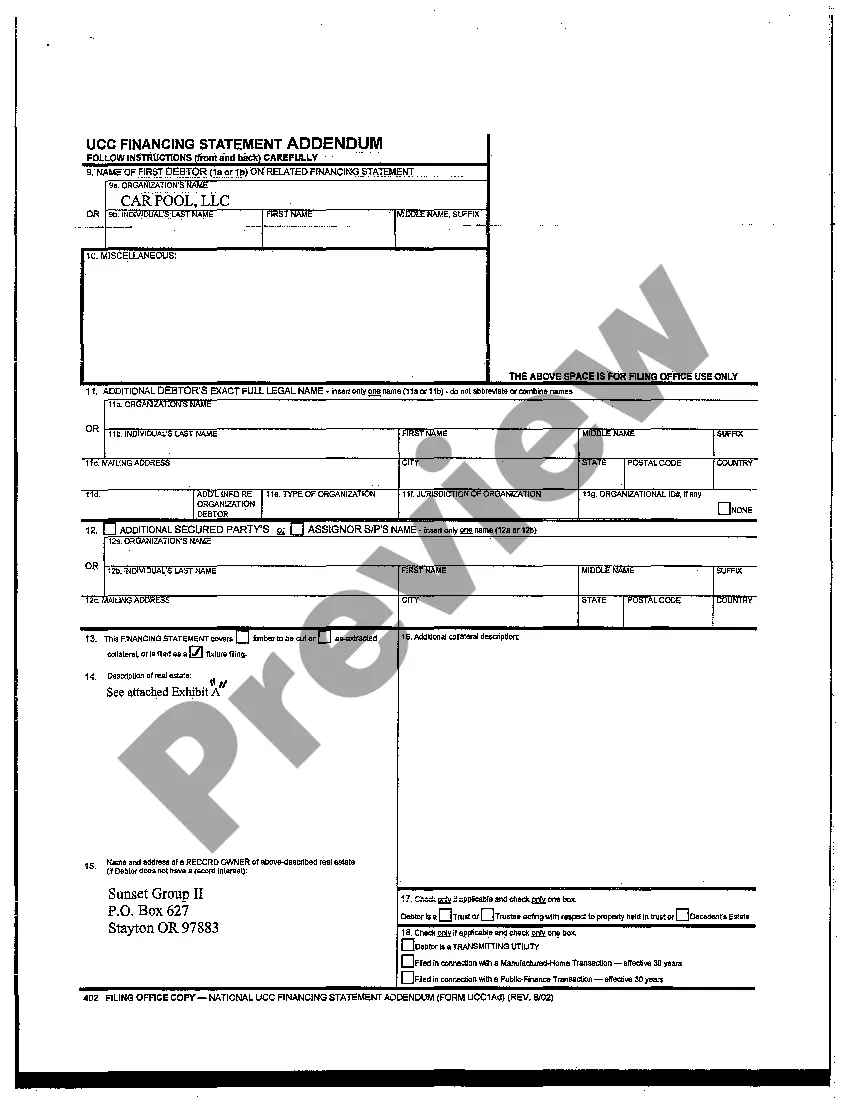

UCC filing, also known as Uniform Commercial Code filing, is a legal process that is commonly used in the state of Oregon to establish a publicly recorded lien or security interest in personal property. UCC filing is often required when multiple owners have an interest in the property involved. It provides clear documentation of ownership and helps protect the rights of parties involved in transactions, such as lenders, buyers, and sellers. In Oregon, there are several types of UCC filings that can be relevant when dealing with multiple owners. Here are the main types: 1. UCC-1 Financing Statement: This is the most common type of UCC filing and is used to establish a security interest in personal property. It includes detailed information such as the names and addresses of the debtors (multiple owners), the secured party (typically lenders), and a description of the collateral involved. 2. UCC-3 Amendment: This filing is used to modify or amend an existing UCC-1 financing statement. If there are changes in the ownership or any other relevant information, an amendment ensures that the public record remains accurate and up to date. 3. UCC-5 Information Statement: This filing is not directly related to ownership in the traditional sense, but it allows multiple owners or other parties to provide additional information related to a UCC-1 financing statement. It is often used to provide collateral or other relevant details not included in the initial filing. 4. UCC-11 Information Request: This is a request made by individuals, such as lenders or buyers, to obtain information about existing UCC filings. It helps in conducting due diligence and gaining insight into the ownership and encumbrances on certain personal property. When dealing with UCC filings in Oregon involving multiple owners, it is crucial to ensure that all parties are properly listed, and their rights and interests are accurately reflected in the filing. Compliance with the UCC filing requirements is essential for maintaining the legitimacy and enforceability of the security interests involved. Seeking legal advice or consulting with a UCC filing professional is recommended to navigate the complexities and ensure proper compliance.

Ucc Filing Oregon With Multiple Owners

Description

How to fill out Ucc Filing Oregon With Multiple Owners?

The Ucc Filing Oregon With Multiple Owners you see on this page is a reusable legal template drafted by professional lawyers in line with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Ucc Filing Oregon With Multiple Owners will take you only a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it fits your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Choose the format you want for your Ucc Filing Oregon With Multiple Owners (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers again. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

A UCC 3 Subordination is a form used when more than one lender has an interest in the same collateral. In this situation, a subordination agreement should be signed in order to establish the order in which the lenders will be refunded the money.

The UCC-3 is the Swiss-Army-Knife of forms. Unlike a UCC 1, a UCC-3 can be used for multiple purposes. The actions one can take are Amendment, Assignment, Continuation, and Termination.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

?Fixtures,? is defined by UCC Section 9?102(a)(41) as goods that have become so related to particular real property that an interest in them arises under real property law. Under this definition, fixtures have characteristics of both personal property and real property.

There are two basic ways to perform a search with the Oregon UCC office. You can conduct an uncertified search yourself through our site or request our office to perform a certified search for you for a fee.