Ucc Filing Explained

Description

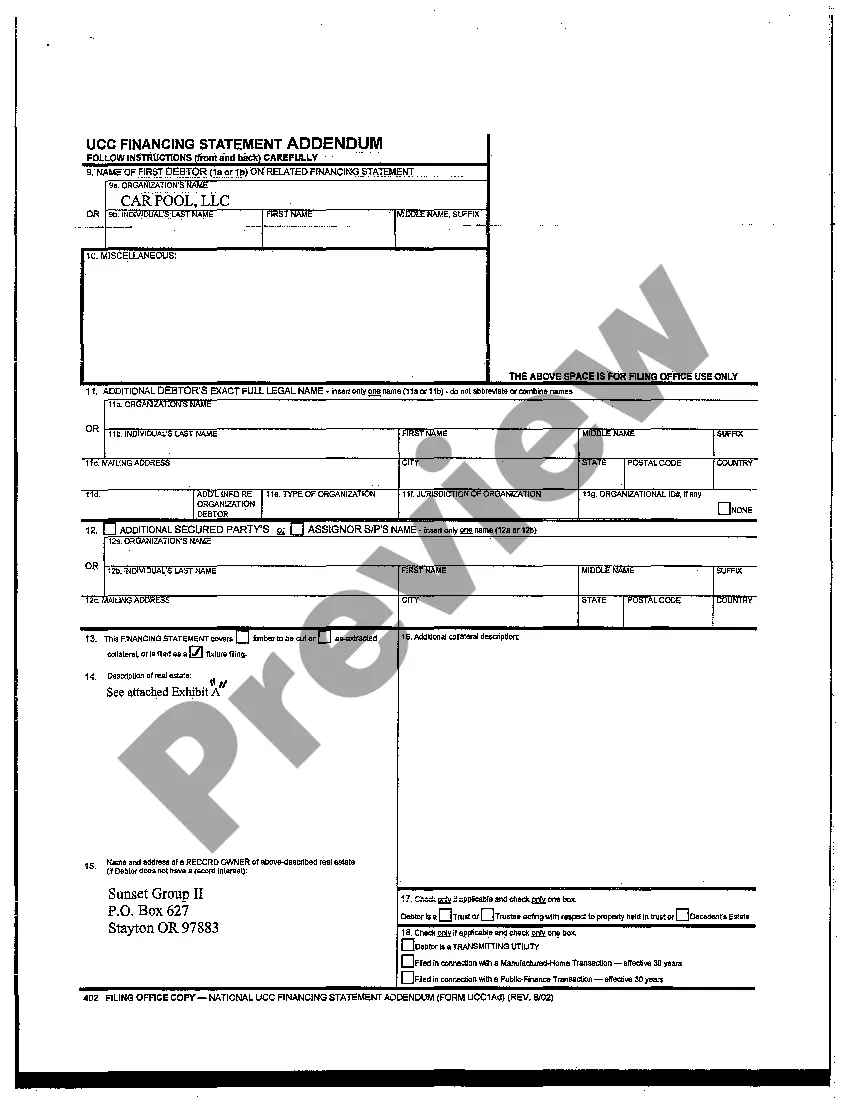

How to fill out Oregon UCC Financing Statement?

It’s clear that you cannot transform into a legal specialist in a single night, nor can you quickly understand how to draft Ucc Filing Explained without a dedicated background.

Generating legal documents is a lengthy endeavor that necessitates particular education and expertise. So why not delegate the development of Ucc Filing Explained to the professionals.

With US Legal Forms, one of the most extensive legal template repositories, you can find everything from court documents to templates for internal corporate correspondence.

If you require a different form, start your search anew.

Create a free account and choose a subscription plan to acquire the form.

- We understand how crucial compliance and adherence to federal and state laws and regulations are.

- That’s why, on our website, all templates are region-specific and current.

- Here’s how to get started with our platform and obtain the document you need in just minutes.

- Locate the document you want by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Ucc Filing Explained is what you are looking for.

Form popularity

FAQ

The purpose of a UCC filing is to establish a legal claim on a borrower’s assets to protect a lender's interests. It allows lenders to notify other potential creditors about their secured interest, preventing others from claiming those assets. This legal notification can facilitate smoother transactions and foster confidence between parties. When seeking to understand the intricacies of business finance, having a UCC filing explained can provide valuable insights.

To obtain a copy of a UCC filing, you typically need to contact the Secretary of State's office in the state where the filing occurred. Most states provide online databases where you can search for UCC filings using the debtor's name or the filing number. Alternatively, you can visit the office in person to make your request. Understanding how to access these documents helps ensure you have all necessary records in your financial dealings.

When a UCC filing occurs, it establishes a public record of a secured party's interest in specific personal property. This filing helps protect the lender's right to recover assets if the borrower defaults. As a result, it clarifies ownership and priority of claims in case of bankruptcy or liquidation. Understanding this process is crucial, and our UCC filing explained guide can help clarify the specifics.

If none of the persons listed under Paragraphs (A)(1) through (10) of this Section are reasonably available, then the patient's attending physician shall have the discretion to provide or perform any surgical or medical treatment or procedures, including but not limited to an autopsy, and may also make decisions ...

The two most common advance directives for health care are the living will and the durable power of attorney for health care. Living will: A living will is a legal document that tells doctors how you want to be treated if you cannot make your own decisions about emergency treatment.

Unlike medical power of attorney documents, Five Wishes goes beyond just medical and healthcare topics to express spiritual, emotional and personal wishes. It aims to be a more holistic way of planning for the end of life.

A Do Not Resuscitate (DNR) order is another kind of advance directive. A DNR is a request not to have cardiopulmonary resuscitation (CPR) if your heart stops or if you stop breathing. (Unless given other instructions, hospital staff will try to help all patients whose heart has stopped or who have stopped breathing.)

The most common types of advance directives are the living will and the durable power of attorney for health care (sometimes known as the medical power of attorney). There are many advance directive formats.

Louisiana Advance Directive Forms. An advance directive is a legally binding document that gives instructions for your healthcare in the event that you are no longer able to make or communicate those decisions yourself.

Louisiana law recognizes two types of advance directives: 1) A living will (also known as a declaration); and 2) A health care power of attorney. For your convenience, we have included a living will that is compliant with Louisiana law in this booklet.