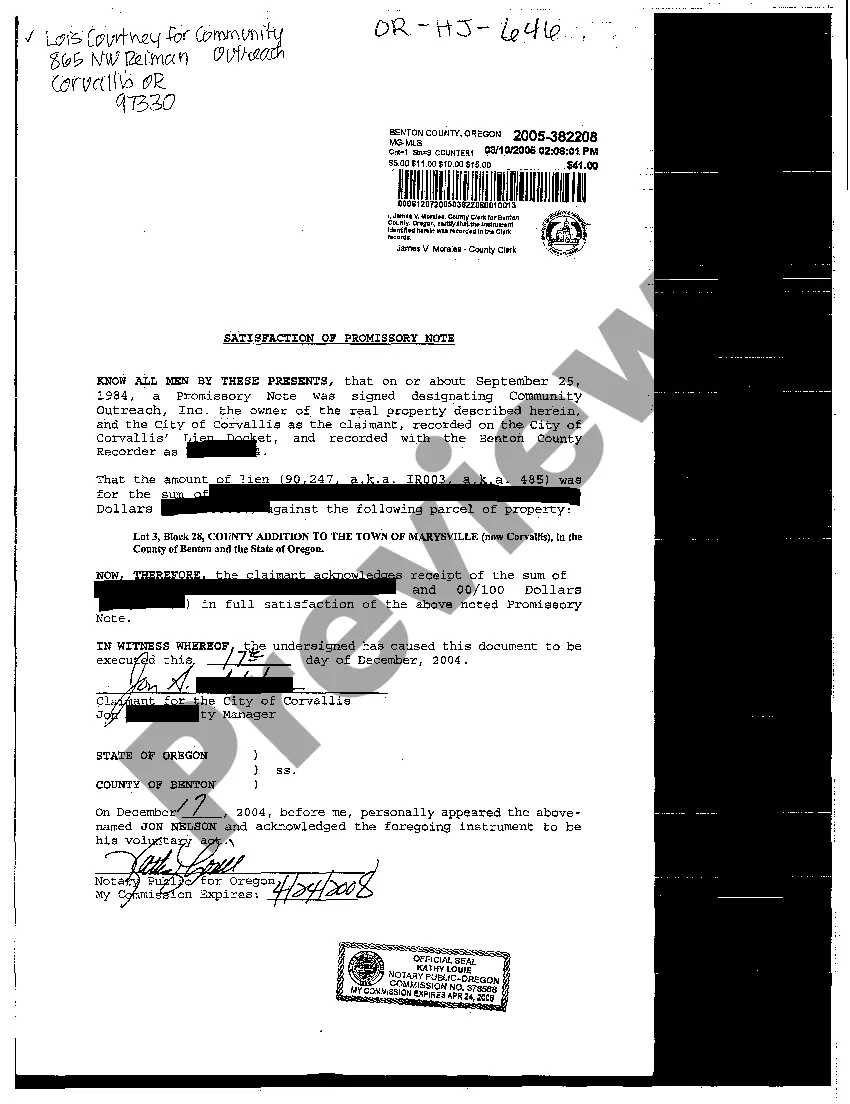

Satisfaction Of Promissory Note With Details

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Individuals often link legal documentation with a task that is intricate and can only be handled by an expert.

In a manner, this is accurate, as composing a Satisfaction Of Promissory Note With Details necessitates considerable knowledge of subject matter, which includes state and county laws.

However, with US Legal Forms, everything has turned more straightforward: a collection of ready-made legal templates for any personal and business scenario, tailored to state regulations, has been gathered in a singular online repository and is now accessible to all.

Select a subscription plan that aligns with your requirements and financial plan. Establish an account or Log In to continue to the payment page. Process your subscription payment using PayPal or your credit card. Choose the format for your document and click Download. Print your paperwork or upload it to an online editor for quicker completion. All templates in our library are reusable: once acquired, they remain stored in your profile. You can access them anytime needed via the My documents tab. Explore the advantages of utilizing the US Legal Forms platform. Sign up today!

- US Legal Forms offers more than 85k current documents categorized by state and utilization area, making the search for Satisfaction Of Promissory Note With Details or any other specific template quick and easy.

- Registered users with an active membership must sign in to their account and click Download to acquire the form.

- New users on the platform will first have to create an account and subscribe before they can store any paperwork.

- Here are the step-by-step directions to obtain the Satisfaction Of Promissory Note With Details.

- Inspect the page content thoroughly to confirm it meets your requirements.

- Review the form description or check it through the Preview option.

- If the previous template does not fit your needs, find another sample using the Search bar above.

- Hit Buy Now once you discover the suitable Satisfaction Of Promissory Note With Details.

Form popularity

FAQ

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Forgiving a promissory note is as straightforward as destroying the document or returning it to the debtor. In court, a promissory note is a legal document that proves a debt, and without that document, there is generally no proof of the agreement.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.