Satisfaction Of Promissory Note With Chattel Mortgage

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Well-crafted official documents are a key safeguard against issues and legal disputes, but acquiring them without the help of an attorney may require some time.

Whether you need to quickly locate a current Satisfaction Of Promissory Note With Chattel Mortgage or any other forms for employment, family, or business events, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If you have an active subscription, you just need to Log In to your account and click the Download button next to the desired file. Additionally, you can access the Satisfaction Of Promissory Note With Chattel Mortgage any time later, as all documents previously obtained on the platform can be found in the My documents section of your profile. Save time and money on preparing official documents. Experience US Legal Forms right away!

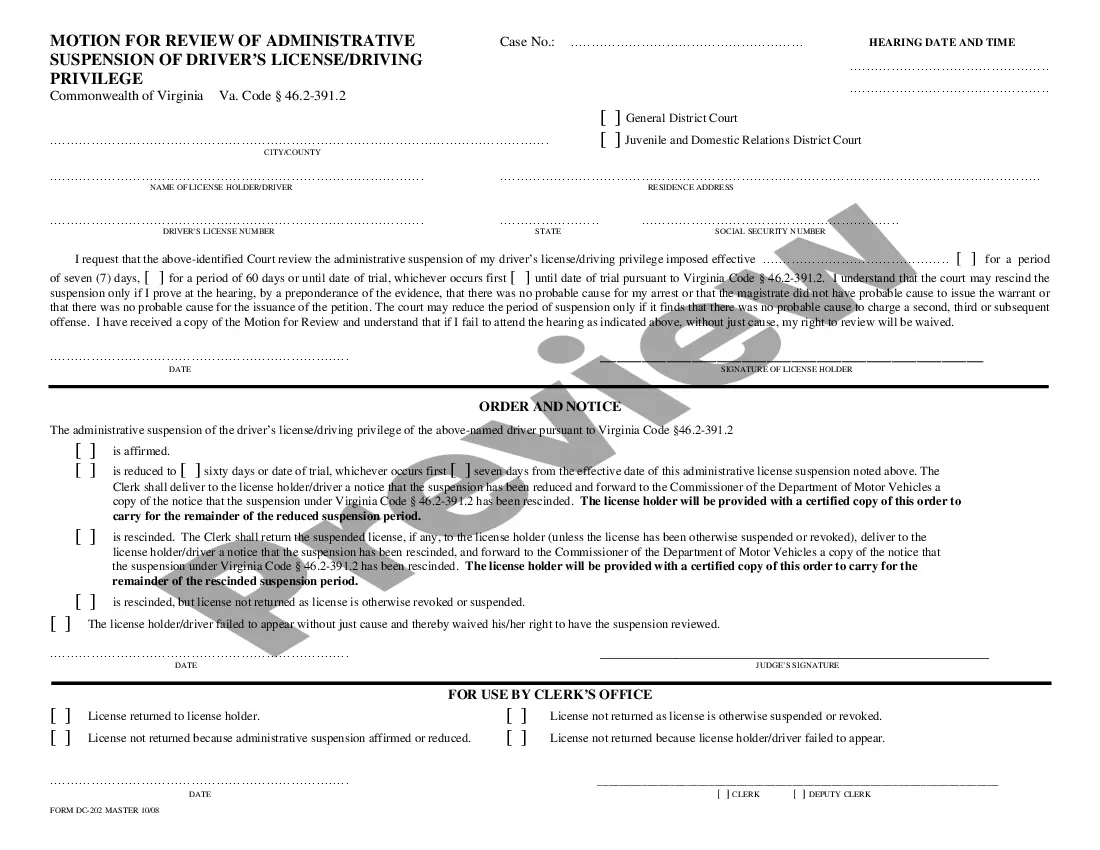

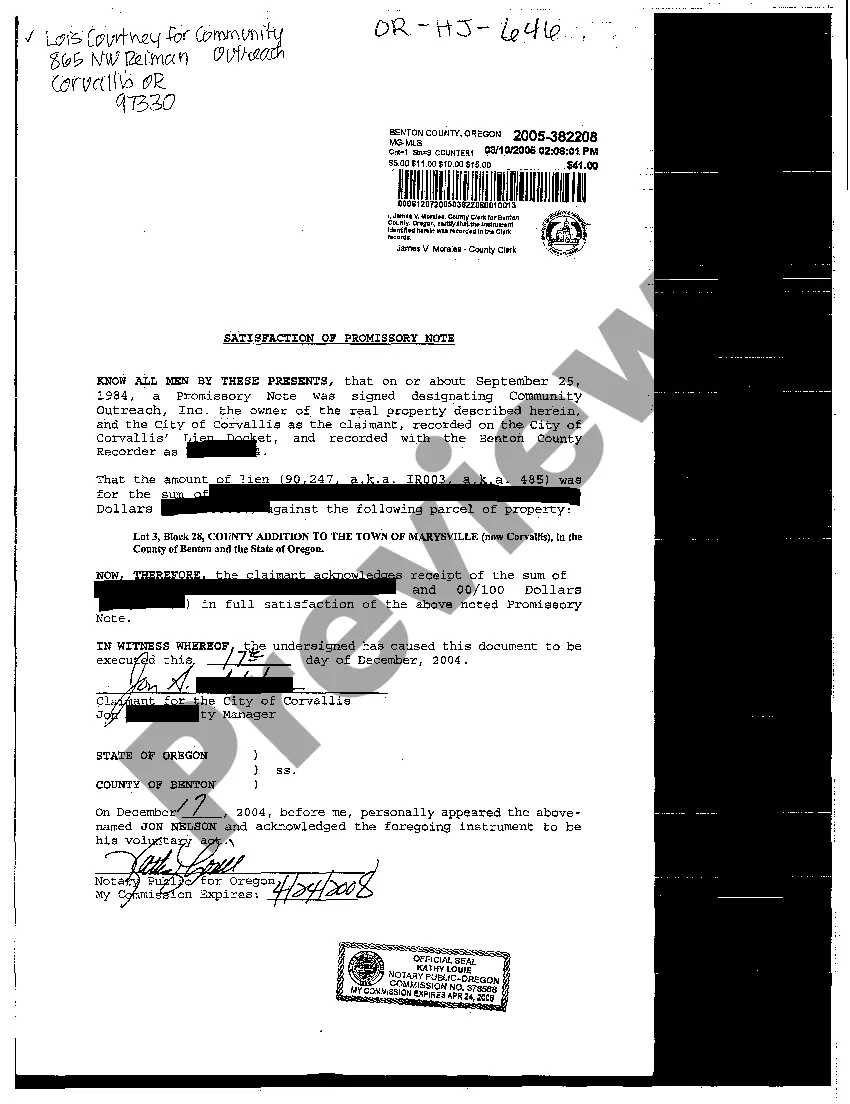

- Verify that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for additional examples (if necessary) using the Search bar in the page header.

- Press Buy Now once you find the right template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment option to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Satisfaction Of Promissory Note With Chattel Mortgage.

- Hit Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Multiply 750 by 0.75 to equal 562.50. Likewise, for a daily time period, multiply the product by the ratio of days to years. For example, for a 90-day promissory note, divide 90 by 365 (the number of days in a year) to equal 0.25. Multiply 750 by 0.25 to equal 187.50.

How to Complete a Satisfaction of MortgageStep 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage.Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued.Step 3 File and Record the Form.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.