Deed In Lieu Form With A Second Mortgage

Description

How to fill out Deed In Lieu Form With A Second Mortgage?

There's no further justification to squander time searching for legal documents to fulfill your local state obligations. US Legal Forms has gathered all of them in one centralized location and enhanced their accessibility.

Our platform offers over 85,000 templates for various business and personal legal situations categorized by state and purpose. All forms are expertly crafted and verified for authenticity, so you can trust in acquiring an updated Deed In Lieu Form With A Second Mortgage.

If you are acquainted with our service and already possess an account, make sure your subscription is active prior to obtaining any templates. Log In to your account, select the document, and click Download. You can also revisit all acquired documents at any time by accessing the My documents tab in your profile.

Select the file format for your Deed In Lieu Form With A Second Mortgage and download it to your device. Print out your form to complete it manually or upload the template if you prefer to do it in an online editor. Preparing legal documentation under federal and state laws and regulations is quick and simple with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you haven't utilized our service before, the process will necessitate some additional steps to finish.

- Here's how new users can locate the Deed In Lieu Form With A Second Mortgage in our inventory.

- Examine the page content thoroughly to confirm it includes the sample you seek.

- To achieve this, utilize the form description and preview options if available.

- Leverage the Search field above to search for another template if the previous one didn't meet your needs.

- Click Buy Now next to the template title once you identify the appropriate one.

- Select the most suitable subscription plan and create an account or Log In.

- Make the payment for your subscription with a credit card or through PayPal to proceed.

Form popularity

FAQ

Yes, you can obtain a deed in lieu even if you have a second mortgage, but it requires careful negotiation with both lenders. It’s crucial that the first mortgage lender agrees to this arrangement, as they hold priority on the property. The second mortgage lender may also need to agree to forgive the remaining balance, which can complicate the process or require additional discussions. To simplify this, using a deed in lieu form with a second mortgage can be facilitated through platforms like uslegalforms, ensuring you have the right documentation and guidance.

A major disadvantage for lenders accepting a deed in lieu is the risk of losing value on the property. If the market is down or the home is in disrepair, the lender may be stuck with a property worth less than what was owed. Additionally, lenders have to manage the legal implications and costs associated with taking back the property. To mitigate such risks, those looking into a deed in lieu form with a second mortgage should explore various options or seek professional advice.

One notable disadvantage of a deed in lieu of foreclosure is the potential tax implications. When you transfer the property back to the lender, you might incur a tax liability on any remaining debt forgiven. This can come as a surprise and significantly affect your finances. By considering a deed in lieu form with a second mortgage, you may want to consult with a tax professional to understand all potential consequences before proceeding.

A deed in lieu can negatively impact your credit score for up to seven years, similar to a foreclosure. This event is typically reported on your credit report, signaling to lenders that you had trouble making mortgage payments. It may affect your ability to secure future loans, but the impact diminishes over time. While this can be daunting, using a deed in lieu form with a second mortgage can sometimes be a better choice than facing prolonged foreclosure.

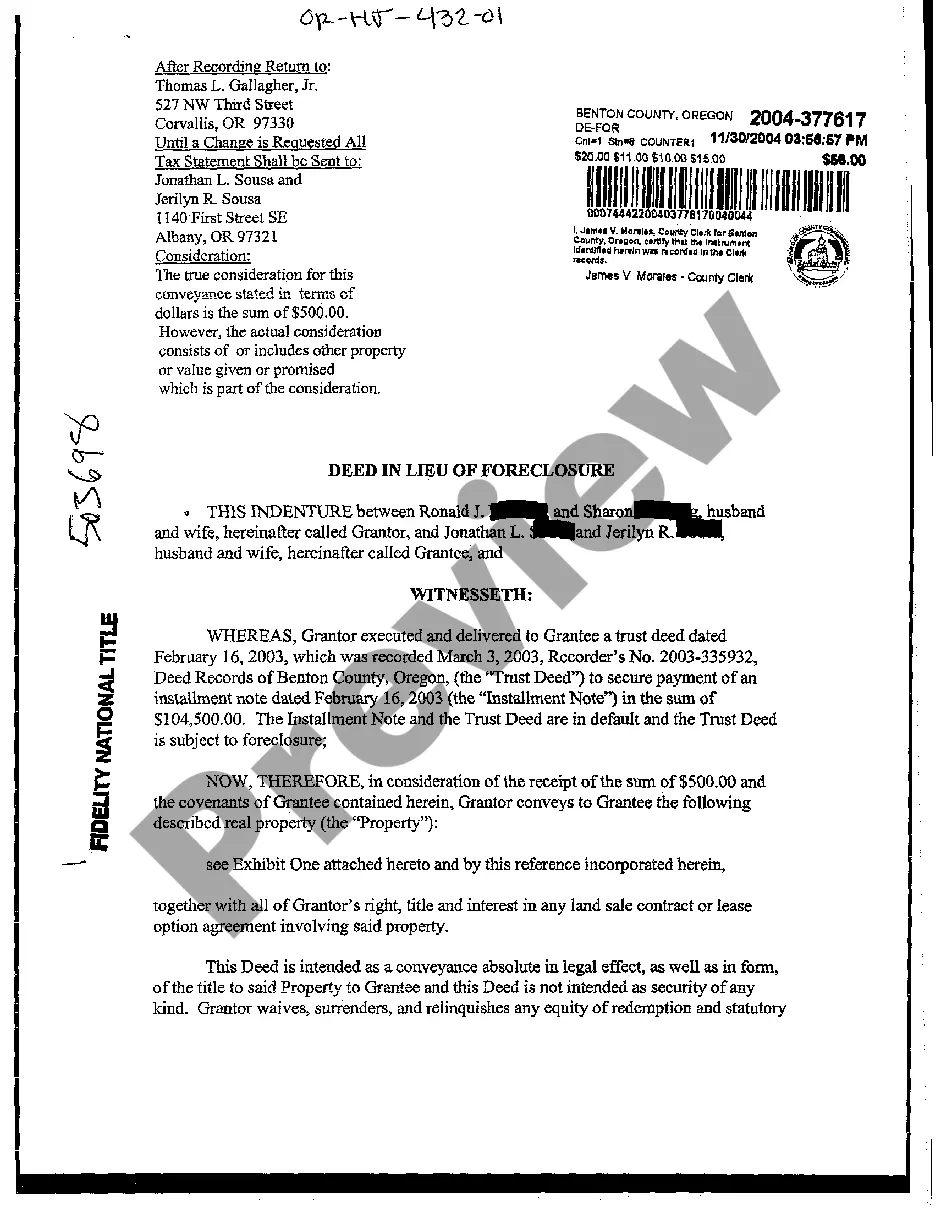

A deed in lieu of foreclosure is a legal document that allows a homeowner to voluntarily transfer property ownership to the lender to avoid foreclosure. This process typically involves filling out a deed in lieu form with a second mortgage if applicable. It provides a way to settle mortgage debt without the lengthy foreclosure process. Overall, it can lead to a more dignified resolution for homeowners.

Transferring a mortgage to another person is not as simple as handing over a deed. Generally, lenders must approve any transfer to ensure that the new borrower meets their requirements. If you wish to avoid complications, consider using a deed in lieu form with a second mortgage to manage obligations more effectively. Working with professionals can help navigate this process.

The biggest disadvantage for a lender using a deed in lieu of foreclosure is potential financial loss. When a borrower submits a deed in lieu form with a second mortgage, the lender may not recoup the full amount owed if the property value has decreased. Additionally, this method can lead to complications regarding any junior liens or loans attached to the property. Thus, lenders often weigh this option carefully.

Yes, you can transfer a second mortgage, but you need the lender's approval to do so. The process often involves completing a deed in lieu form with a second mortgage if you decide to avoid foreclosure. This form can help clarify the responsibilities of both parties. Overall, working closely with your lender can streamline the transfer process.