Partial Reconveyance With Real Estate

Description

Form popularity

FAQ

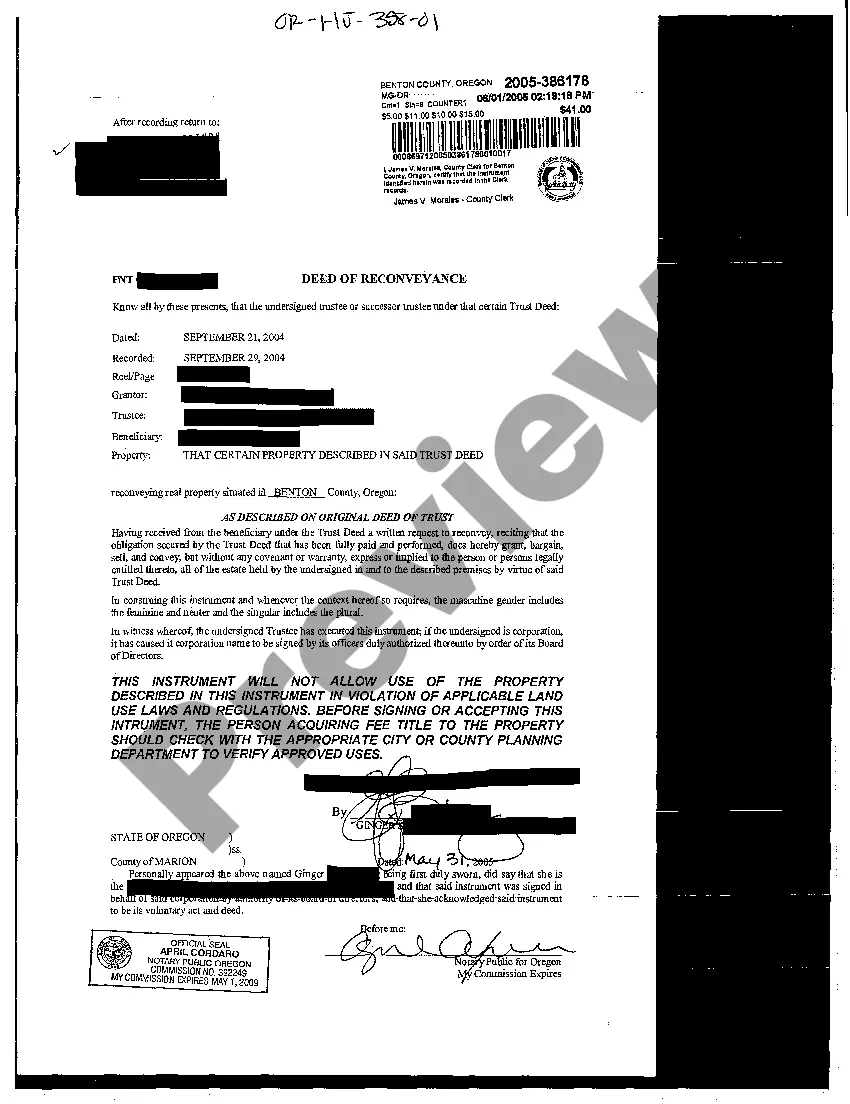

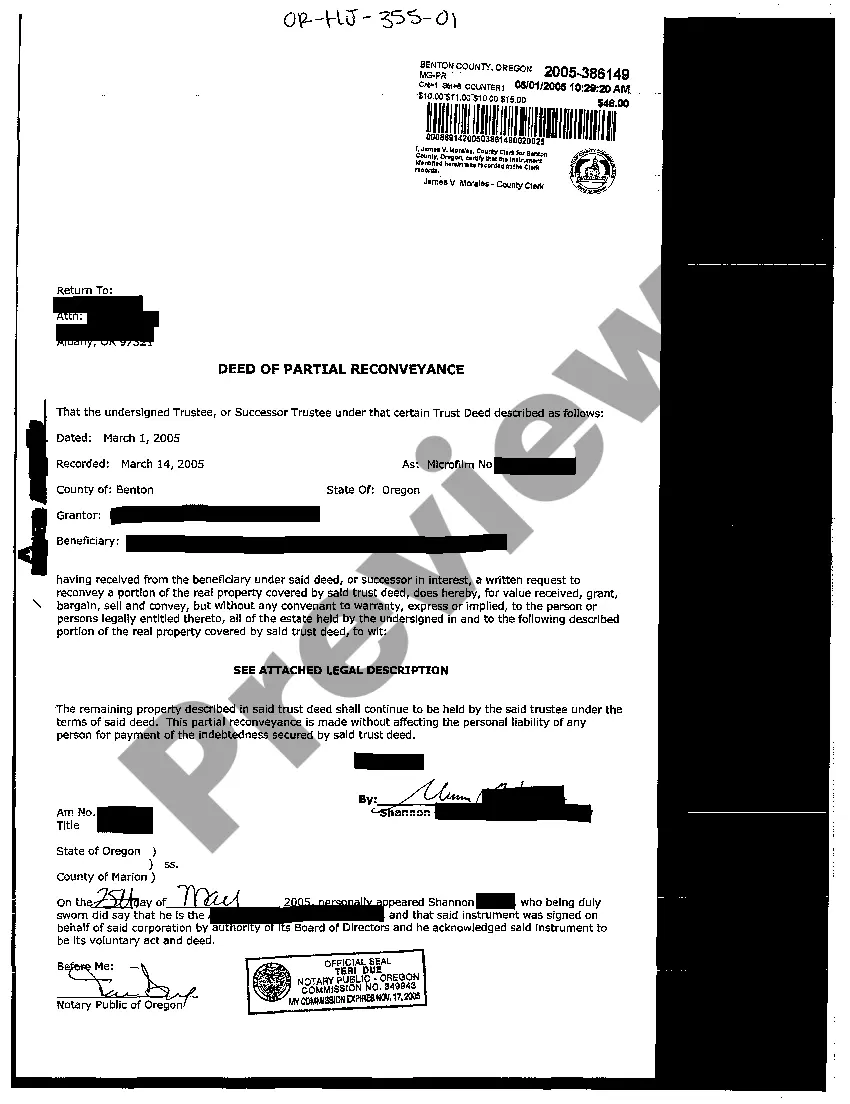

Partial reconveyance involves returning a portion of the property title to the borrower while a debt remains on the property. This can occur when the borrower pays off a part of their mortgage, allowing them to release a specific portion of the asset. It serves as a valuable tool for property owners seeking to manage sizes and values of their real estate investments. If you need assistance, USLegalForms offers resources to navigate the process of partial reconveyance with real estate.

Half interest of property indicates that an individual owns 50% of the rights to the property in question. This can occur in joint ownership scenarios, like partnerships or family inheritance. In such situations, understanding partial reconveyance with real estate is vital for clarifying ownership and ensuring that everyone’s stake is recognized and respected.

The partial interest rule is a legal principle that addresses how ownership rights are shared among co-owners of a property. It dictates that no owner can sell or encumber the property without consent from other owners, thereby protecting everyone's interests. Being aware of partial reconveyance with real estate allows you to navigate these rules more effectively and maintain equitable ownership.

The owner’s full or partial interest in real property is conveyed through legal documents, such as deeds, titles, or contracts. These documents specify the extent of ownership and any associated rights or obligations. Engaging with partial reconveyance with real estate can enhance clarity around these interests and make transactions smoother.

Partial interest in real estate means that an individual owns a share of the property but not the whole. This situation commonly arises in partnerships, co-ownerships, or when properties are inherited. Understanding partial reconveyance with real estate is key to navigating the complexities of shared ownership and ensuring that your interests are protected.

In California, the statute of limitations on a deed of trust is typically four years from the date of default. This limitation sets a timeframe for creditors to enforce repayment of debts secured by the property. Once the time passes, the lender may lose the right to collect the debt. Understanding these timelines is crucial when navigating a Partial reconveyance with real estate, as it affects how and when you protect your rights.

In California, a lender must record a reconveyance within 21 days after receiving the payoff. This requirement ensures that homeowners can quickly receive their clear title. Delays in recording can complicate ownership verification and future transactions. Therefore, staying informed about the Partial reconveyance with real estate process can help ensure timely documentation.

To record a reconveyance, first, complete the reconveyance deed with all necessary details. Then, submit the signed document to the county recorder's office where the property is located. This step officially updates public records to show that the lien has been released. Understanding the steps in the Partial reconveyance with real estate process can help avoid potential delays and issues.

In California, the recording of a deed usually takes a few days to a couple of weeks. The timeframe can depend on the county and the workload of the county clerk's office. Once recorded, the deed is public record, ensuring your interests are legally recognized. For a Partial reconveyance with real estate, it is essential to confirm that the deed is officially recorded to protect your ownership rights.

To conduct a partial release appraisal, you first need to assess the specific portion of the property being released. Document its current market value based on recent sales of comparable properties in the area. This will help determine the fair value for the partial reconveyance with real estate. It is advisable to work with a certified appraiser who can provide an objective evaluation and assist in the appraisal process, ensuring compliance with lending requirements.