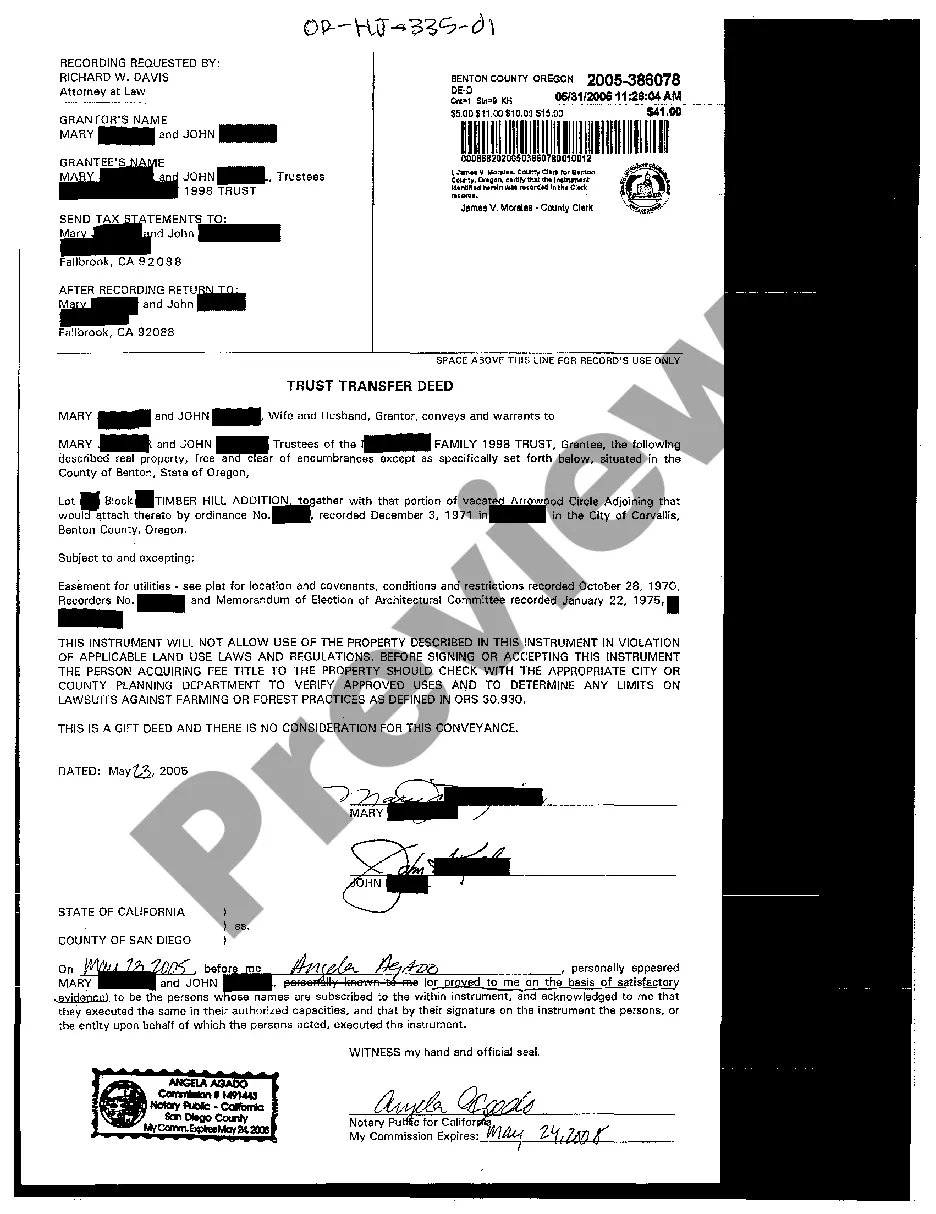

Trust Deed Transfer Of Property

Description

How to fill out Oregon Trust And Transfer Deed?

What is the most reliable service to obtain the Trust Deed Transfer Of Property and other current iterations of legal documents? US Legal Forms is the solution! It's the largest repository of legal forms for any purpose.

Each document is properly prepared and verified for adherence to federal and local laws and regulations. They are organized by region and state of use, making it easy to find what you need.

Alternative document search. If there are any discrepancies, utilize the search bar in the page header to locate a different document. Click Buy Now to select the suitable one. Registration and subscription acquisition. Choose the most suitable pricing plan, Log In or create your account, and pay for your subscription via PayPal or credit card. Downloading the paperwork. Select the format you wish to save the Trust Deed Transfer Of Property (PDF or DOCX) and hit Download to retrieve it. US Legal Forms is an excellent option for anyone handling legal documentation. Premium subscribers can gain even more as they can complete and approve previously saved documents electronically at any time within the integrated PDF editing tool. Check it out now!

- Experienced users of the platform just need to Log In to the system, verify their subscription status, and click the Download button next to the Trust Deed Transfer Of Property to retrieve it.

- Once saved, the document remains accessible for future use within the My documents section of your profile.

- If you still lack an account with our library, here are the steps you need to follow to create one.

- Form compliance verification. Before you purchase any template, ensure it meets your usage criteria and your state or county's regulations. Read the form description and utilize the Preview if available.

Form popularity

FAQ

Yes, you can obtain a trust deed, provided you meet the necessary legal requirements in your state. Whether you choose to draft one yourself or use a professional service, the process is accessible. Resources like USLegalForms are available to guide you through the trust deed transfer of property, making it simpler than you might expect.

The trust deed is typically created by the person establishing the trust, known as the trustor or grantor. However, many individuals choose to consult a lawyer or use online services for this task. Utilizing a service like USLegalForms can simplify the process and help you create a legally sound trust deed transfer of property with ease.

Obtaining a trust deed involves creating a legal document that outlines the trust arrangements for your property. You can draft this document yourself, but it is often wise to seek professional help to ensure compliance with local laws. Platforms such as USLegalForms provide pre-prepared templates and assistance to streamline the trust deed transfer of property process.

To establish a trust deed for property, you generally need a legal document that details the terms of the trust. This includes the names of all parties involved, property description, and the trustee’s duties. Additionally, some states may require notarization and/or witnesses for the document to be valid. Using a platform like USLegalForms can help ensure you meet all the legal requirements for a trust deed transfer of property.

The purpose of a trust deed is to establish a formal arrangement for managing and distributing property according to an individual's wishes. This arrangement protects your property from probate and can streamline the transfer process. By utilizing resources like US Legal, you can ensure that your trust deed transfer of property effectively meets your goals.

A trust deed is a legal document that outlines the agreement between the property owner and the trustee. It specifies how the property is to be managed and distributed. Understanding this definition clarifies the role of trust deeds in the trust deed transfer of property process, ensuring your intentions for the property are honored.

A trust deed generally does not directly affect your bank account unless the account is part of the trust assets. Funds transferred into the trust may become subject to the terms of the trust. Therefore, it’s essential to consult with a professional to understand how the trust deed transfer of property impacts your financial assets.

Despite their advantages, trust deeds have disadvantages such as potential costs related to filing and maintenance. Furthermore, they may lack flexibility in terms of changes once established. Engaging with platforms like US Legal can help clarify the implications of a trust deed transfer of property before you decide.

At the end of a trust deed, the property usually transfers to the beneficiaries as defined in the trust document. Any remaining assets will also be distributed accordingly. Understanding these details is crucial, and US Legal provides resources to help you navigate these final steps smoothly.

A trust transfer refers to the process of changing ownership of an asset, such as property, into a trust. This ensures that the asset is managed according to the terms outlined in the trust. It simplifies the trust deed transfer of property, making it easier to handle estate planning and asset distribution.