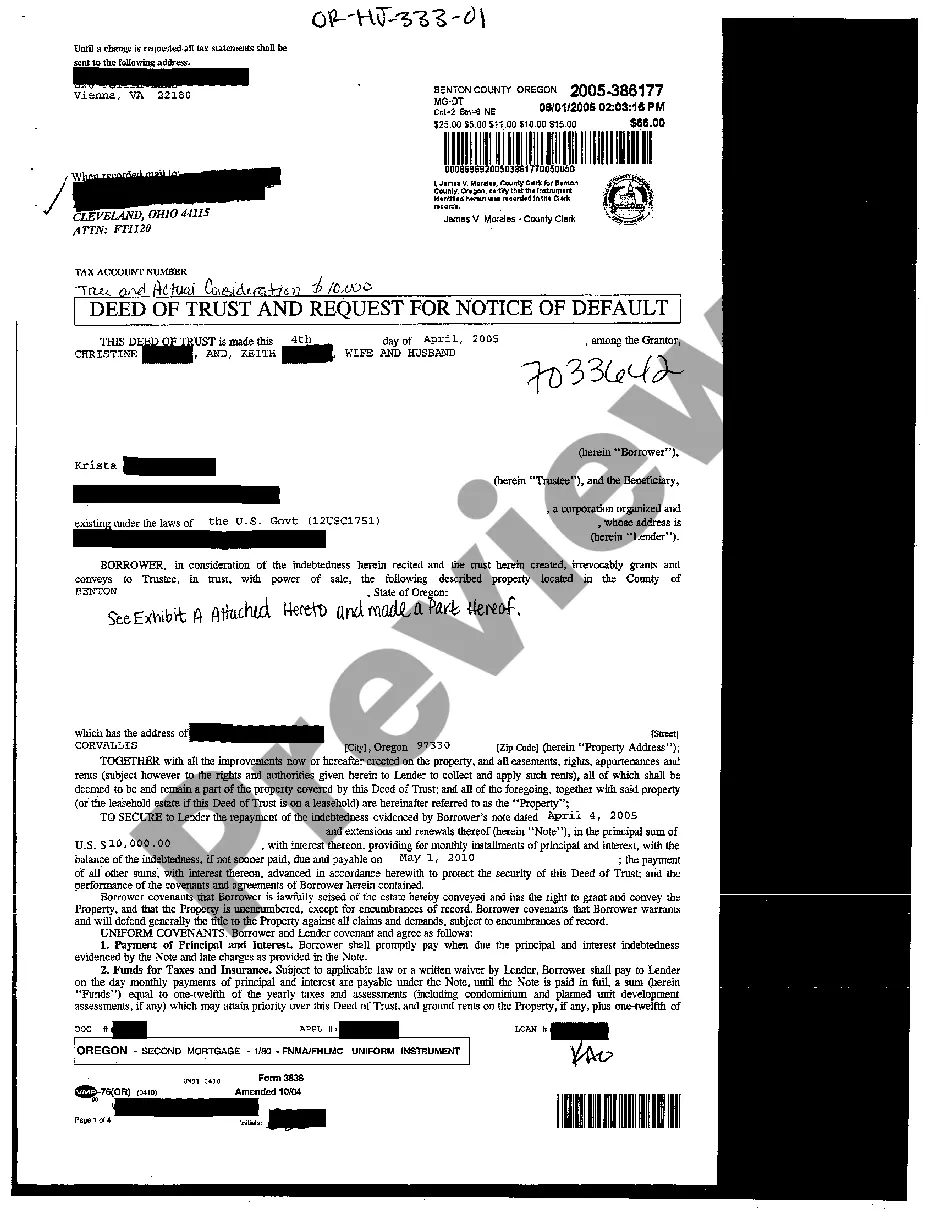

Oregon Trust Deed Act Form

Description

How to fill out Oregon Deed Of Trust And Request For Notice Of Default?

There's no longer a necessity to spend hours searching for legal documents to comply with your local state requirements. US Legal Forms has gathered all of them in one location and streamlined their accessibility.

Our platform provides over 85k templates for various businesses and individual legal cases organized by state and area of application. All forms are correctly drafted and verified for accuracy, so you can be assured of obtaining a current Oregon Trust Deed Act Form.

If you are accustomed to our platform and already possess an account, ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. Additionally, you can revisit all saved documents anytime by opening the My documents tab in your profile.

Print your form to fill it out manually or upload the sample if you prefer to do so using an online editor. Preparing official documentation under federal and state regulations is fast and easy with our library. Try out US Legal Forms today to keep your paperwork organized!

- If you haven't used our platform before, the process will require a few extra steps to finalize.

- Here's how new users can acquire the Oregon Trust Deed Act Form from our catalog.

- Examine the page content closely to ensure it includes the sample you require.

- To do this, utilize the form description and preview options if available.

- Use the Search field above to find another template if the first one doesn't suit your needs.

- Click Buy Now beside the template title when you discover the correct one.

- Select the desired pricing plan and create an account or Log In.

- Make your payment for the subscription via card or PayPal to continue.

- Choose the file format for your Oregon Trust Deed Act Form and download it to your device.

Form popularity

FAQ

To determine your deed type, you can check your property records at the county recorder’s office where the property is located. You may find your deed type listed in the legal description or language of the document. If you want clarity and reassurance regarding your deed's legal standing, exploring the Oregon trust deed act form can also provide essential context and guidance.

To obtain the deed for your house in Oregon, you can visit your county's recorder's office, where property records are maintained. You will need to provide your property's details, such as its address or parcel number. Additionally, if you have difficulty locating the deed, using the Oregon trust deed act form can simplify the process and ensure you have the necessary legal documentation.

In Oregon, a quitclaim deed transfers the owner's interest in a property, but it does not guarantee that the ownership is clear or valid. Essentially, this document provides the grantee with whatever rights the grantor has in the property, if any. Therefore, it is crucial to ensure that the previous owner had valid title and that no liens or encumbrances exist. For more detailed documentation, you may wish to explore the Oregon trust deed act form as it can clarify title transfers.

A common mistake parents make when setting up a trust fund is failing to fund it appropriately, which can render the trust ineffective. Many people overlook the importance of transferring assets into the trust, leading to complications when the trust is needed. To avoid this issue, utilize the Oregon trust deed act form and work with professionals to ensure everything is correctly managed.

Yes, you can create your own trust in Oregon, provided you follow legal requirements and complete the Oregon trust deed act form correctly. This process allows you to dictate how your assets are managed and distributed. However, consider consulting an attorney for complex assets or family situations to ensure that your trust is valid and serves your intentions effectively.

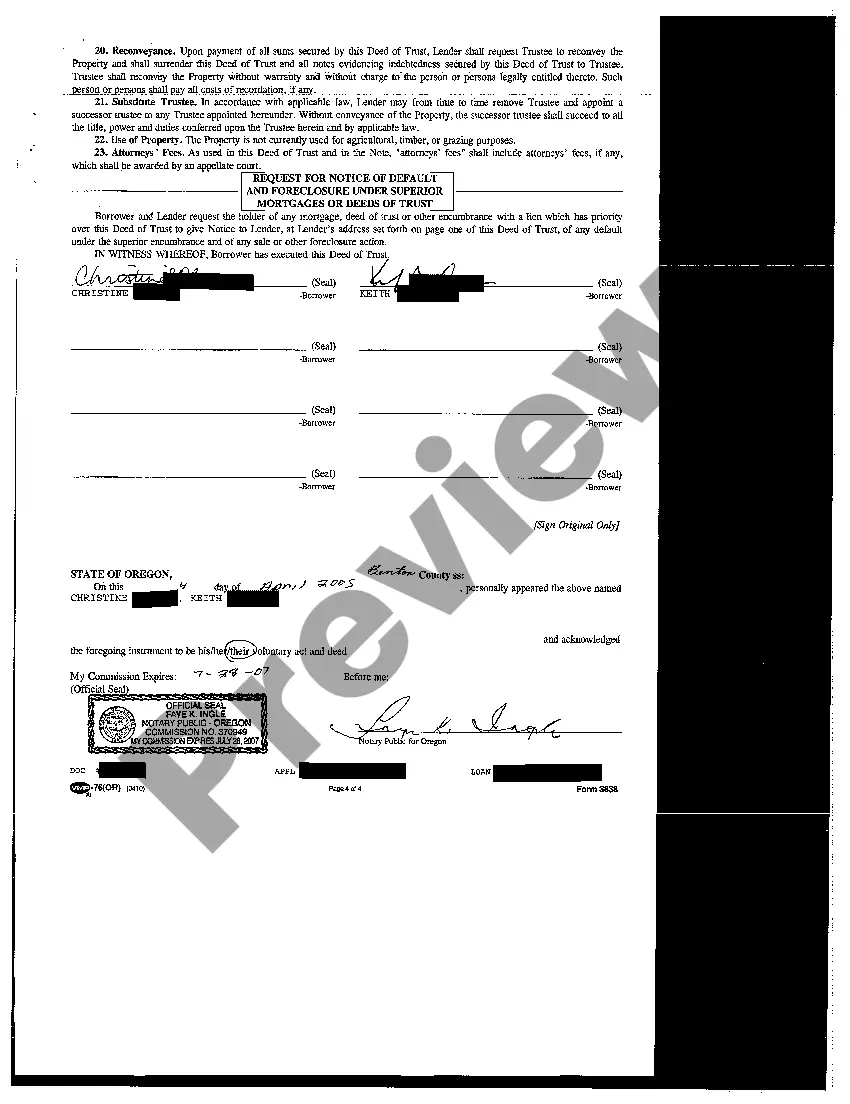

To file a trust in Oregon, you typically need to complete the necessary documentation, including the Oregon trust deed act form. After preparing the form, sign it in the presence of a notary and transfer your assets into the trust. It is advisable to consult a legal professional to ensure your trust complies with state laws and to understand the specific requirements.

In Oregon, deciding between a will and a trust depends on your personal situation. A trust can help you avoid probate and ensure your assets are managed according to your wishes during your lifetime and after your passing. On the other hand, a will is simpler and may be sufficient for those with fewer assets. Consider using the Oregon trust deed act form to establish a trust tailored to your needs.

The Oregon trust deed Act provides the legal framework governing trust deeds in Oregon. It outlines the rights and responsibilities of parties involved, including borrowers, lenders, and trustees. By using the Oregon trust deed act form, individuals can ensure compliance with state laws and secure their financial interests in real estate transactions. This Act is essential for protecting both lenders and borrowers during the lending process.

Yes, Oregon is a deed of trust state, which means it allows lenders to secure loans against property using deeds of trust instead of mortgages. This process provides a third party, the trustee, to handle the property in case of default. Understanding how the Oregon trust deed act form operates within this framework can benefit both borrowers and lenders. Being informed about this can help you navigate the complexities of property financing in Oregon.

In Oregon, a deed does not need to be recorded to be valid; however, recording is highly advisable. Recording a deed protects your ownership rights against future claims and ensures public notice of your property interest. It is particularly important to record the Oregon trust deed act form to establish legal priority over other claims. Always consider filing for recording to safeguard your property.