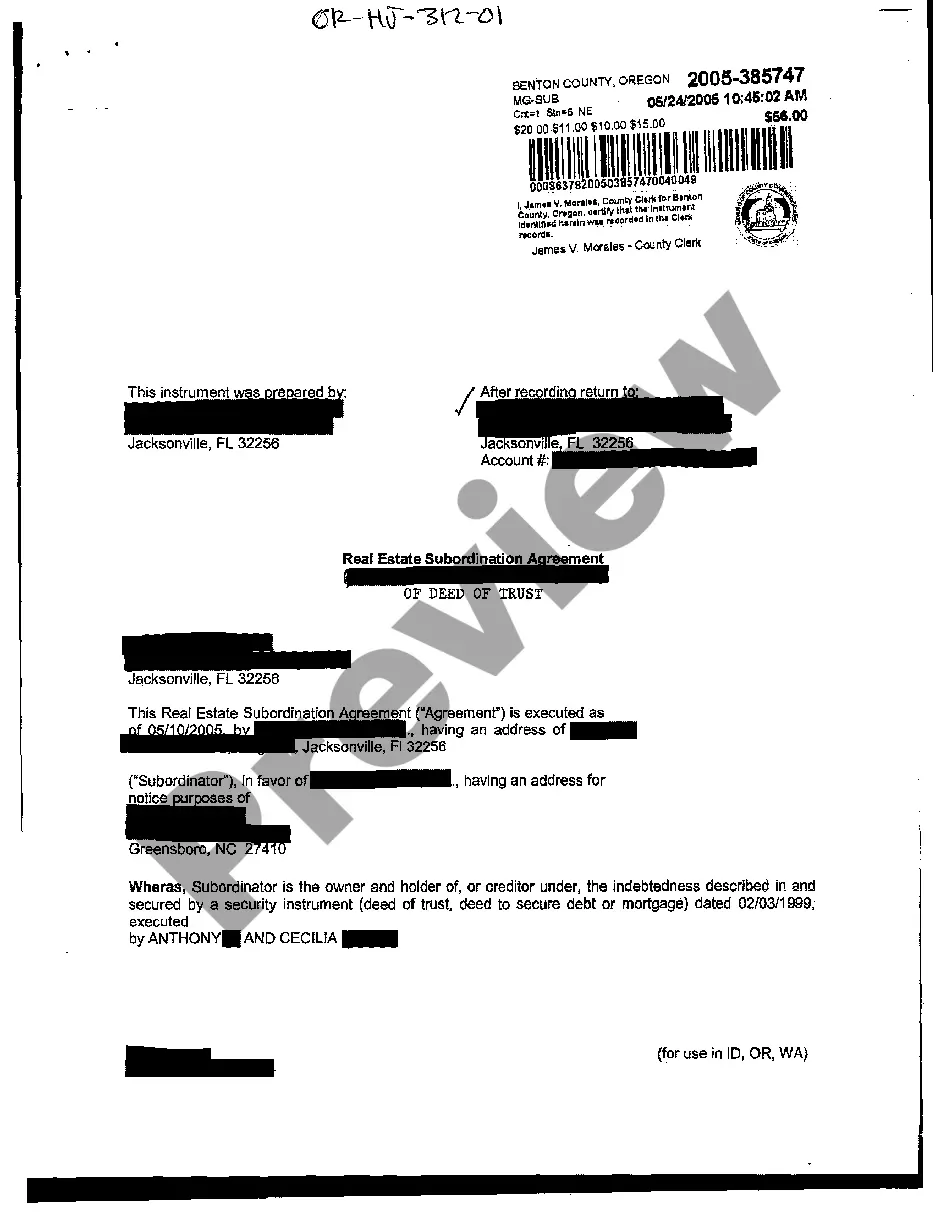

Blank Subordination Agreement Form

Description

How to fill out Oregon Real Estate Subordination Agreement?

Individuals typically link legal documentation with something intricate that only an expert can handle.

In a sense, this is accurate, as creating a Blank Subordination Agreement Form necessitates comprehensive understanding of subject requirements, encompassing state and county laws.

Nevertheless, with US Legal Forms, everything has become simpler: pre-prepared legal templates for any life and business situation tailored to state regulations are compiled in a single online repository and are now accessible to everyone.

Establish an account or Log In to move on to the payment page. Pay for your subscription via PayPal or using your credit card. Choose the format for your file and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: after purchase, they remain saved in your profile. You can access them anytime via the My documents tab. Explore the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and area of usage, so searching for a Blank Subordination Agreement Form or any specific template takes only a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users of the platform need to first create an account and subscribe before they can save any documentation.

- Follow this step-by-step guide to obtain the Blank Subordination Agreement Form.

- Examine the content of the page thoroughly to ensure it meets your requirements.

- Review the form description or assess it using the Preview option.

- Find another example using the Search field above if the previous one does not meet your needs.

- Click Buy Now when you discover the appropriate Blank Subordination Agreement Form.

- Select the subscription plan that aligns with your requirements and budget.

Form popularity

FAQ

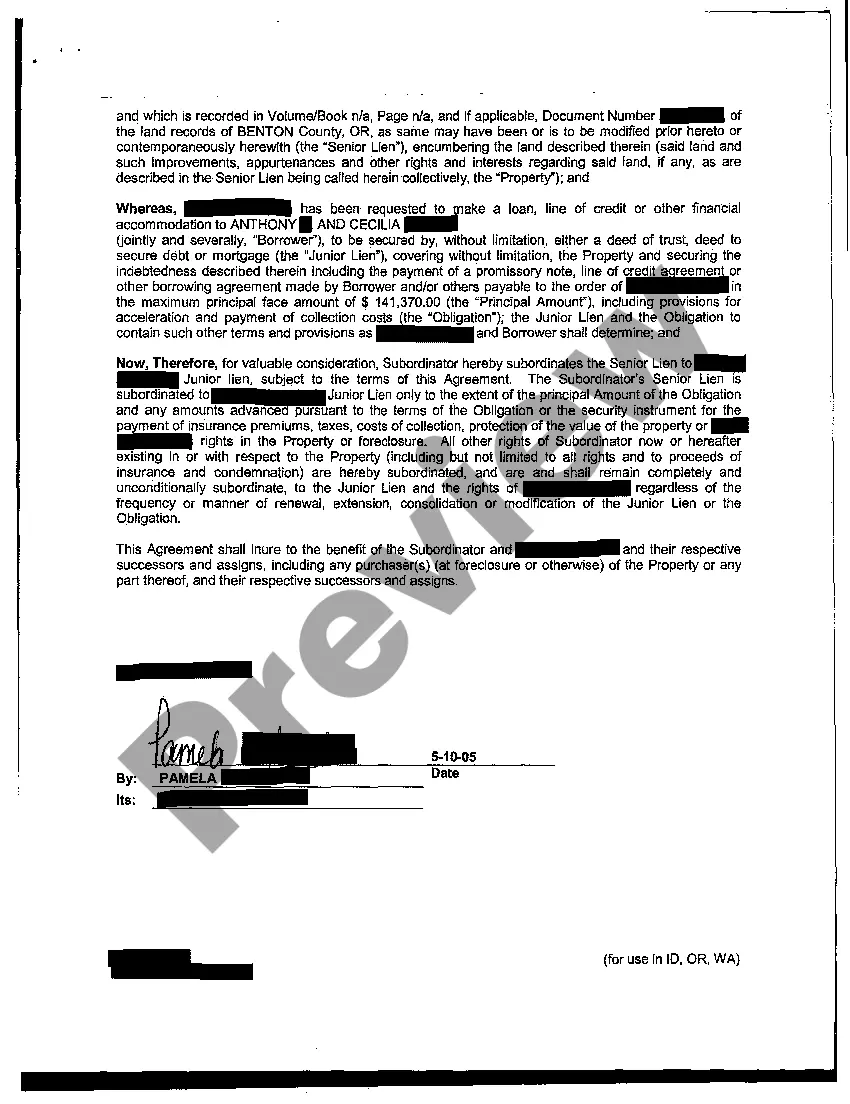

Subordination agreements are usually carried out when property owners take a second mortgage on their property. As a result, the second loan becomes the junior debt, and the primary loan becomes the senior debt. Senior debt has higher claim priority over junior debt.

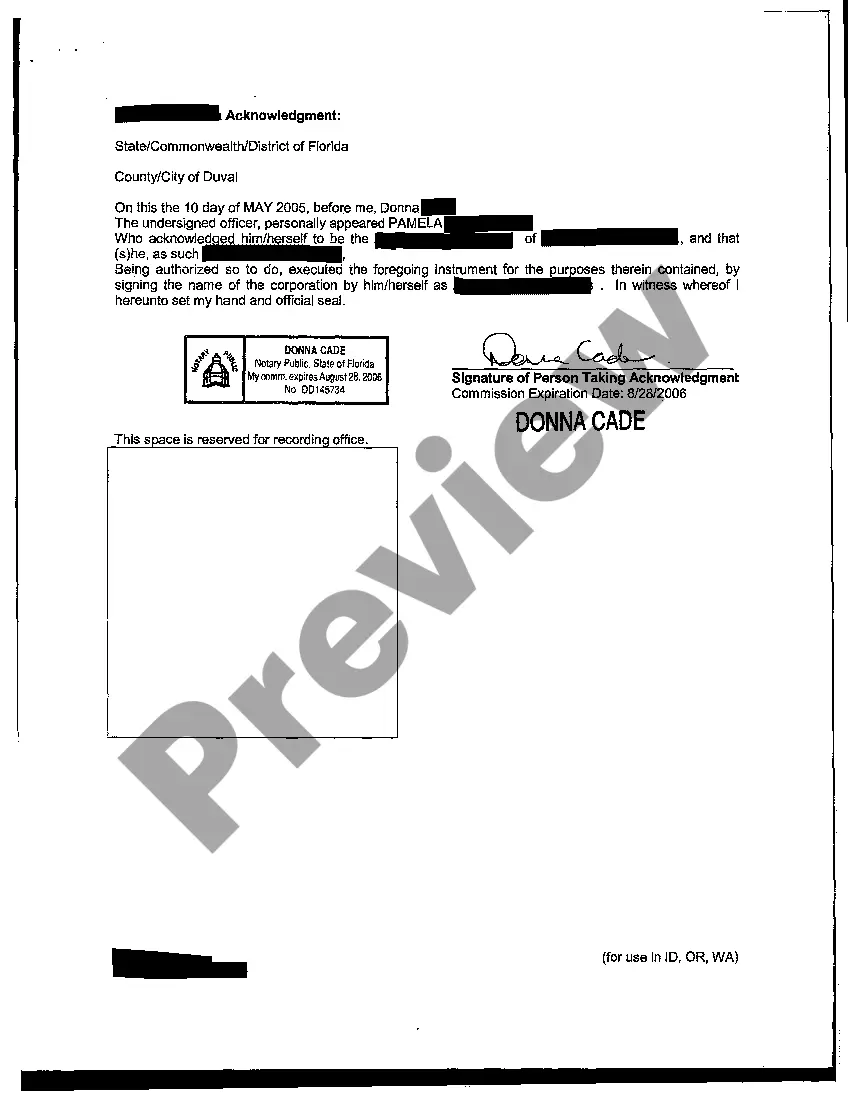

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Here's an example of how subordination clauses in mortgage notes work for a better understanding: John decides to buy a house. John's bank agrees to lend him the money to purchase a home on the condition that they take repayment priority. John's bank uses a subordination clause to secure its rights.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.