Joint Tenants Form 17

Description

Form popularity

FAQ

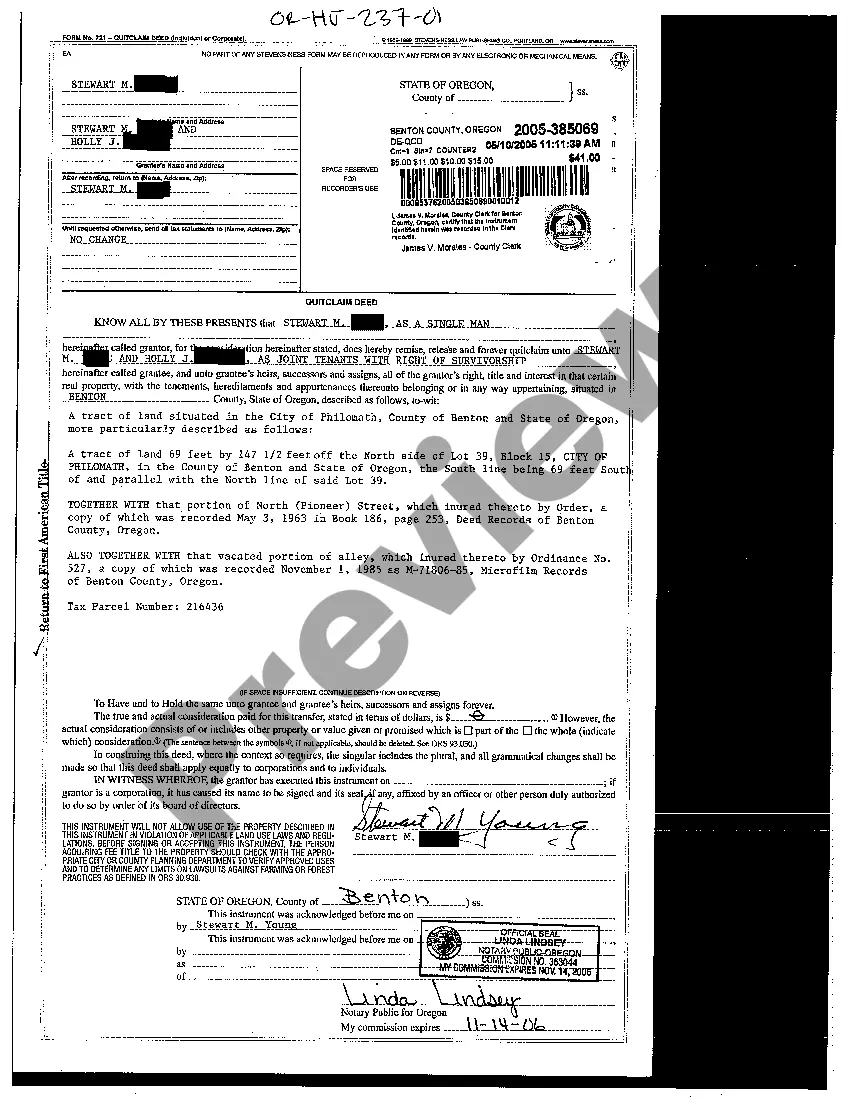

The step-up basis for joint tenancy right of survivorship means that the value of the property can be adjusted upwards at the time of a joint tenant's death. This adjustment helps minimize capital gains taxes for the surviving tenant, offering a financial advantage. The Joint tenants form 17 serves as a vital tool for ensuring that this process is documented correctly, making it easier for beneficiaries.

For surviving joint tenants, the tax basis is generally stepped-up to the fair market value of the property at the deceased owner's date of death. This means that any potential capital gains tax the surviving tenant could face is often reduced. Using the Joint tenants form 17 ensures this transition is clear, providing peace of mind and financial clarity.

The tax basis of a remainderman typically refers to the value of the property when they inherit it at the time of the original owner's death. In a joint tenancy, the joint tenants form 17 may affect how this basis is calculated, especially in terms of stepped-up value. Thus, understanding this can help in planning for future taxes and capital gains.

When you hold property as joint tenants, each owner has equal rights to the property. The tax implications can vary, but generally, when one joint tenant passes away, their share automatically transfers to the surviving tenant. This transfer can lead to potential estate tax benefits, making the Joint tenants form 17 a beneficial choice for asset planning.

The Form 17 procedure involves a series of steps for declaring joint ownership of property. First, complete Joint Tenants Form 17 with accurate details of the property and all joint tenants. Next, sign the form before a notary to authenticate it. Finally, file the form with your local jurisdiction or land registry office to ensure your ownership is officially recognized. Using resources available at US Legal Forms can simplify this process significantly.

To fill out a tax amendment form, start by accessing the appropriate IRS form for amendments, like form 1040X. Clearly indicate the changes you wish to make, referencing your original tax return and including any pertinent information regarding Joint Tenants Form 17 if relevant. Make sure to revise your calculations accurately and attach any supporting documents. If you're unsure, consider using resources like US Legal Forms for guided support.

You can order IRS Publication 17, which provides essential guidance on federal tax implications related to joint tenants, through the IRS website or by calling the IRS directly. It is crucial to have this publication on hand for understanding the complexities of tax regulations that might apply to Joint Tenants Form 17. If you require further assistance, platforms like US Legal Forms can help navigate these tax intricacies with ease.

To use Joint Tenants Form 17, begin by filling out the necessary information about the property and the individuals involved. You must accurately provide names, addresses, and details regarding ownership interests. After completing the form, you should have it signed and notarized to ensure its legal validity. This form facilitates smooth property transactions and ownership clarity between parties.

Tax Form 17 is often referred to as the Joint Tenants Form 17. This form allows individuals to indicate their agreement to hold property as joint tenants with rights of survivorship. It serves as an important legal document that clarifies property ownership and can facilitate the transfer of ownership upon the death of one of the joint tenants. Understanding the details of Joint Tenants Form 17 can help simplify estate planning for you.