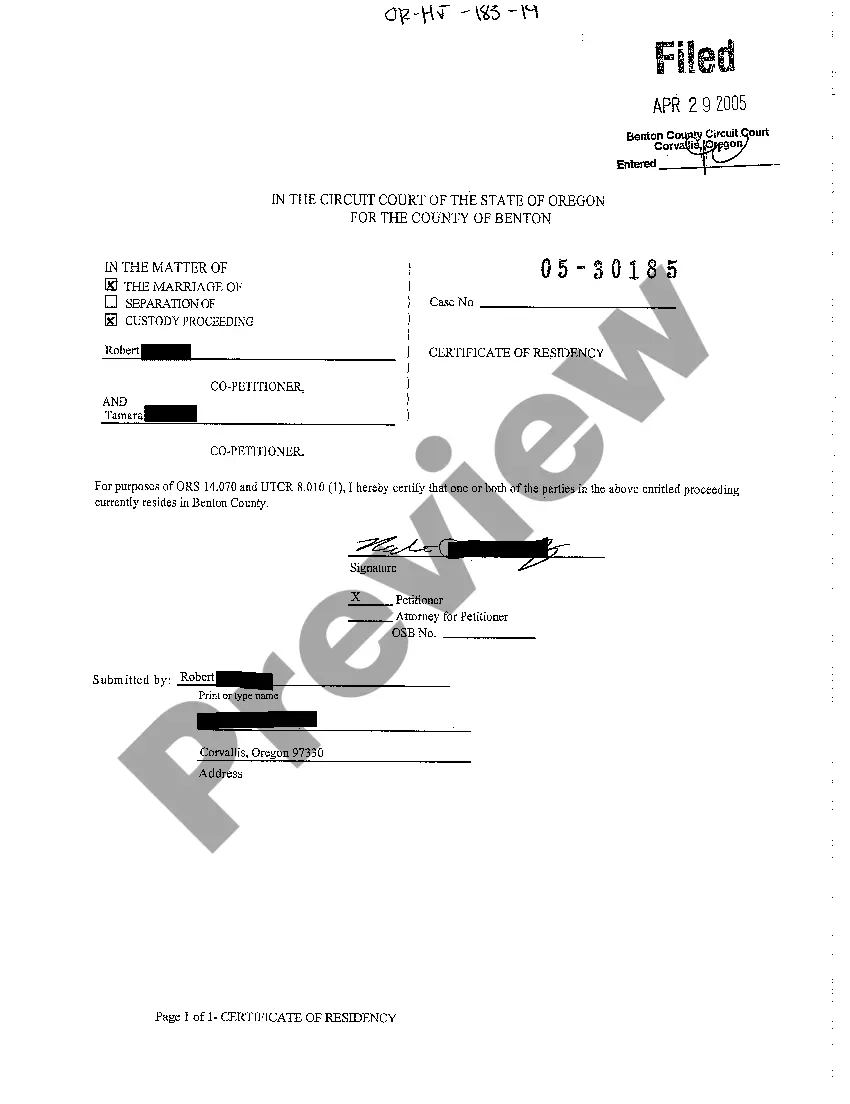

Certificate Of Residency Sample With Form 10f

Description

How to fill out Certificate Of Residency Sample With Form 10f?

There's no longer a requirement to waste time searching for legal documents to meet your state regulations.

US Legal Forms has gathered all of them in one location and made their access more straightforward.

Our website offers over 85,000 templates for any business and individual legal situations organized by state and application.

Use the search bar above to find another template if the prior one didn't meet your needs. Click Buy Now next to the template name when you identify the correct one. Choose the most suitable pricing plan and either create an account or sign in. Process your subscription payment via credit card or PayPal to proceed. Choose the file format for your Certificate Of Residency Sample With Form 10f and download it to your device. Print your form to fill it out by hand or upload the sample if you prefer to do it in an online editor. Creating formal documents under federal and state laws is quick and simple with our platform. Give US Legal Forms a try now to keep your documentation organized!

- All forms are professionally crafted and confirmed for accuracy, allowing you to confidently acquire an updated Certificate Of Residency Sample With Form 10f.

- If you're acquainted with our platform and already possess an account, ensure your subscription is active prior to obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation at any time by accessing the My documents tab in your profile.

- If you have not previously used our platform, the procedure will require a few additional steps to finish.

- Here's how new users can find the Certificate Of Residency Sample With Form 10f in our catalog.

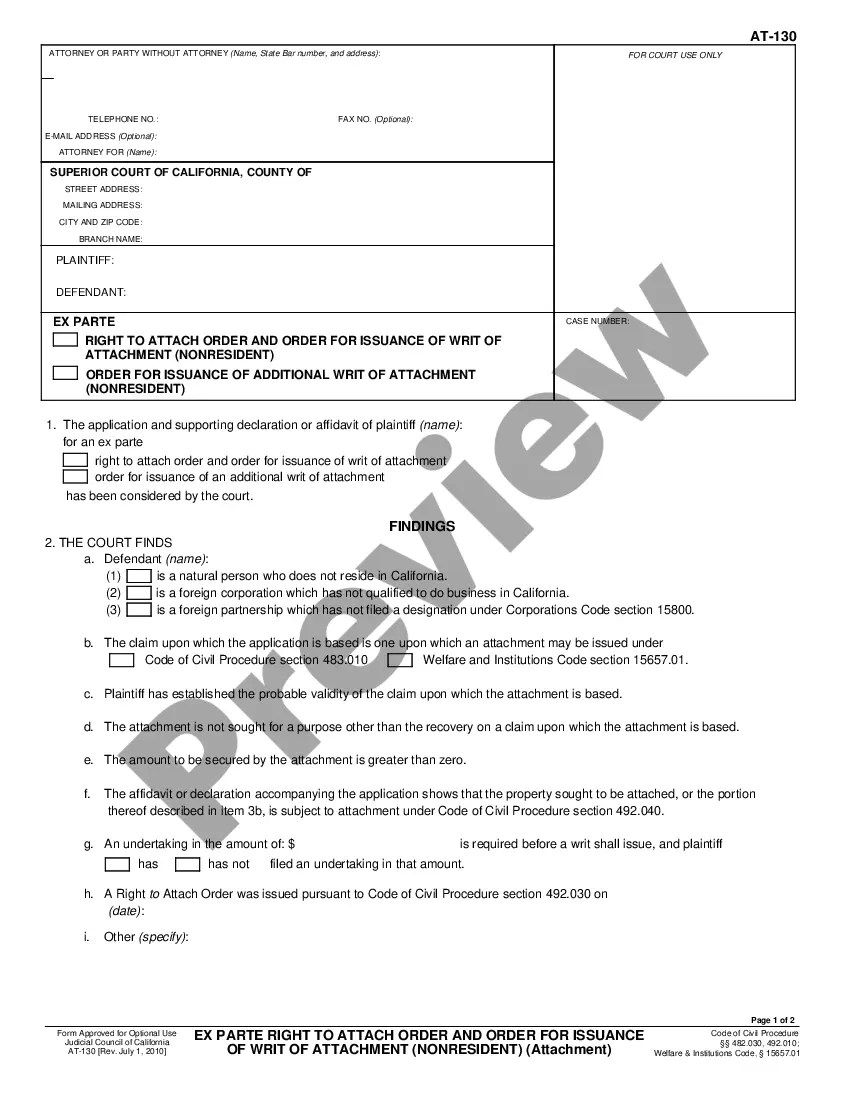

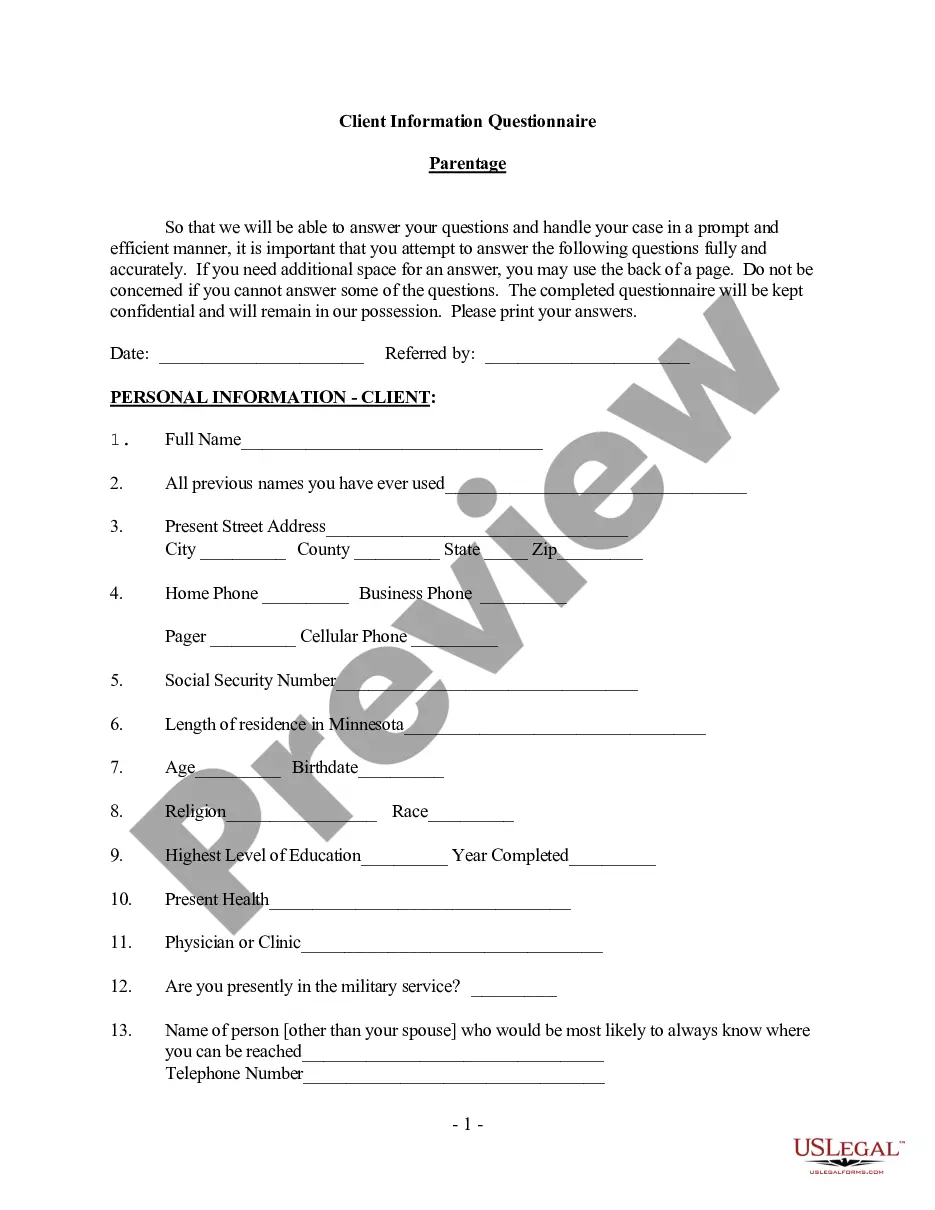

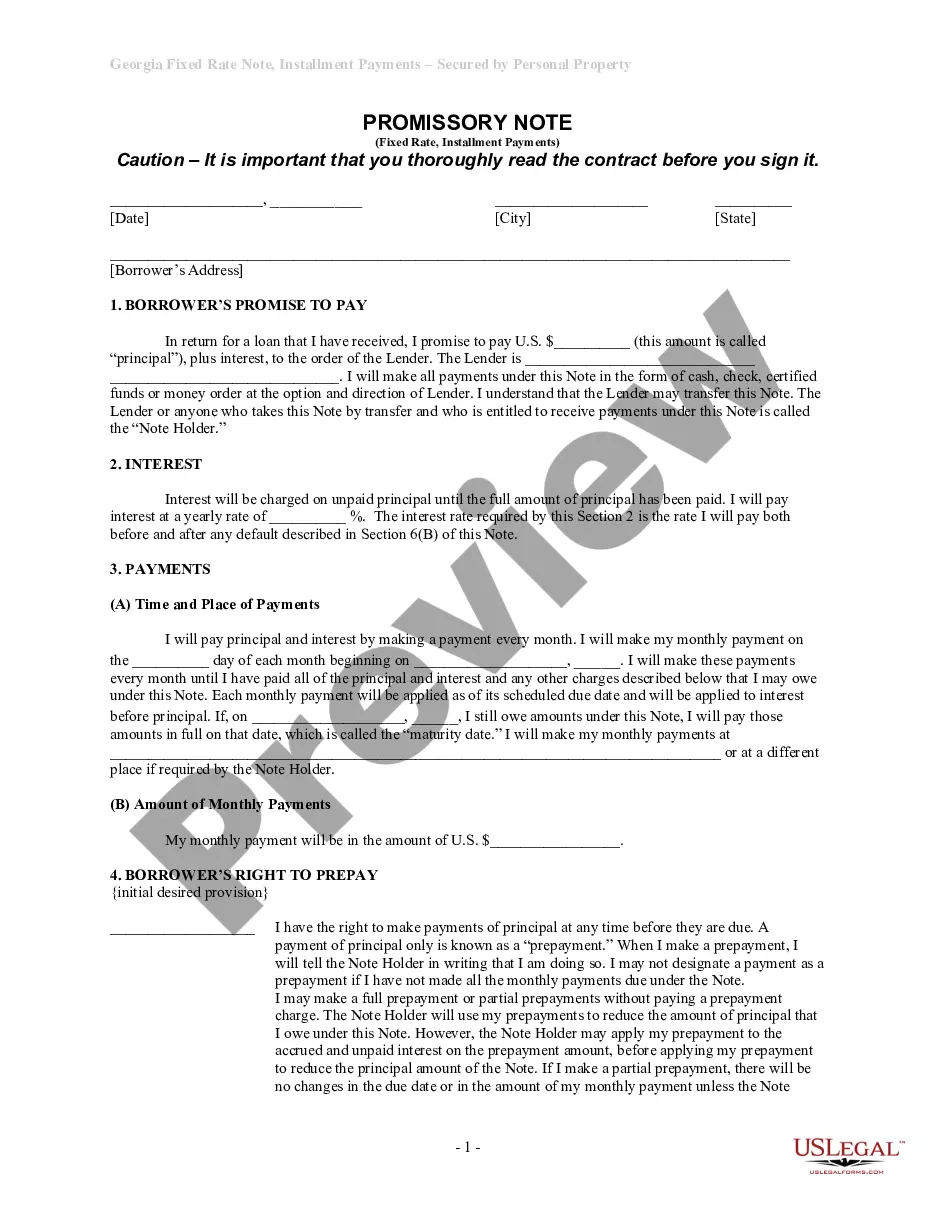

- Review the page content thoroughly to ensure it includes the sample you require.

- Use the form description and preview options if available.

Form popularity

FAQ

One has to file Form 10F, a tax residency certificate and self declaration in the prescribed format to the entity responsible for deducting tax at source.

Tax Residency Certificate (TRC) For Indian Resident Assessee An assessee, being a resident in India, shall, for obtaining a certificate of residence for the purposes of an agreement referred to in section 90 and section 90A, make an application in Form No. 10FA to the Assessing Officer.

Form 10F must be verified by the government of the country in which the assessee is a resident for the period applicable. It is a declaration that the assessee resided in the foreign country which is covered under a DTAA with India and hence, the tax rate applicable to the income is at the rate mentioned in the DTAA.

The purpose of Form 10F is to establish your identity, that you are an Indian citizen, non-resident of India, and pay taxes in the country where you do live. The period of residential status you list on Form 10F should be the same as the period of residential status listed on your tax residency certificate.

Section 90(5) of the Income Tax Act mandates the requirement of 10F in addition to TRC. Therefore to claim any benefit under DTAA, TRC & 10F are a must along with the No-PE declaration.