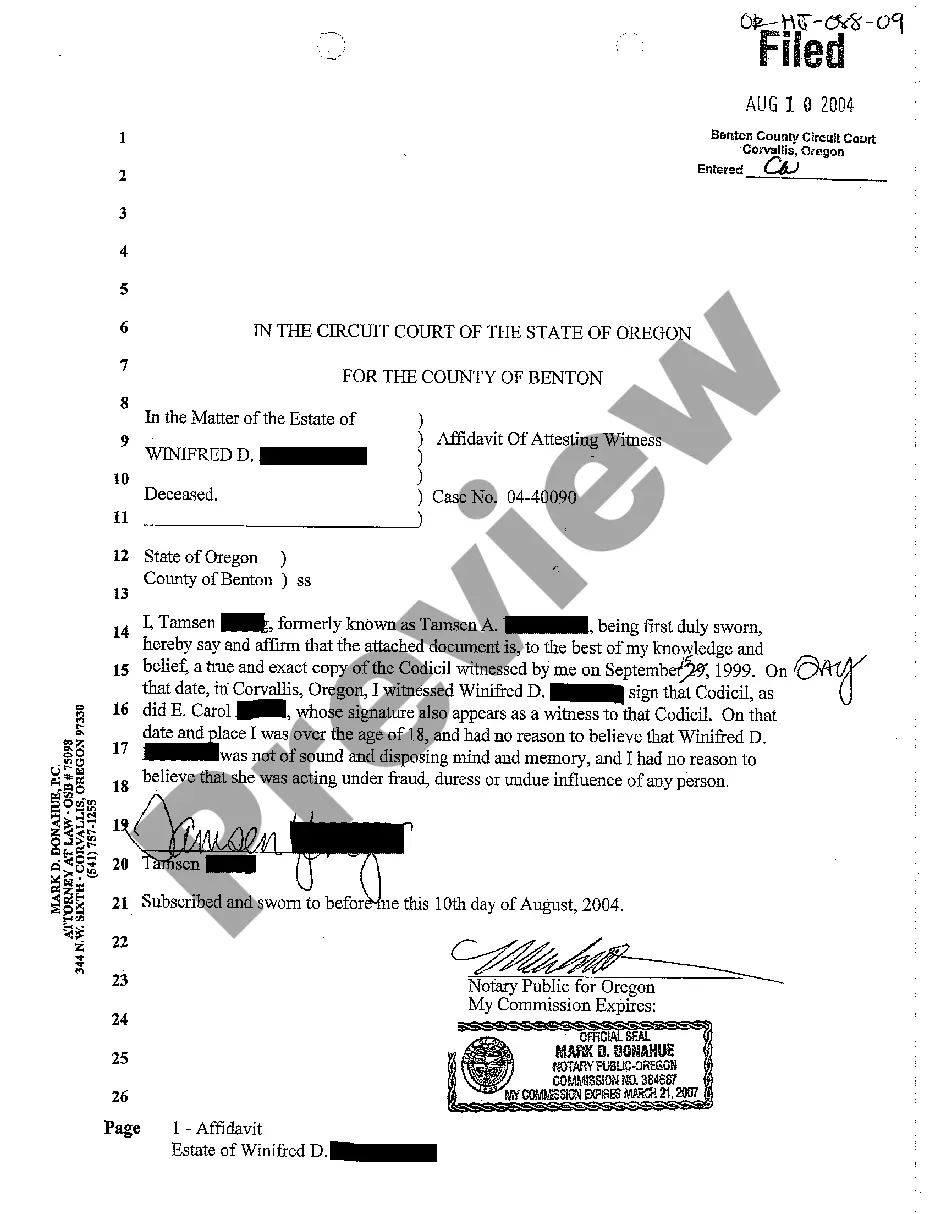

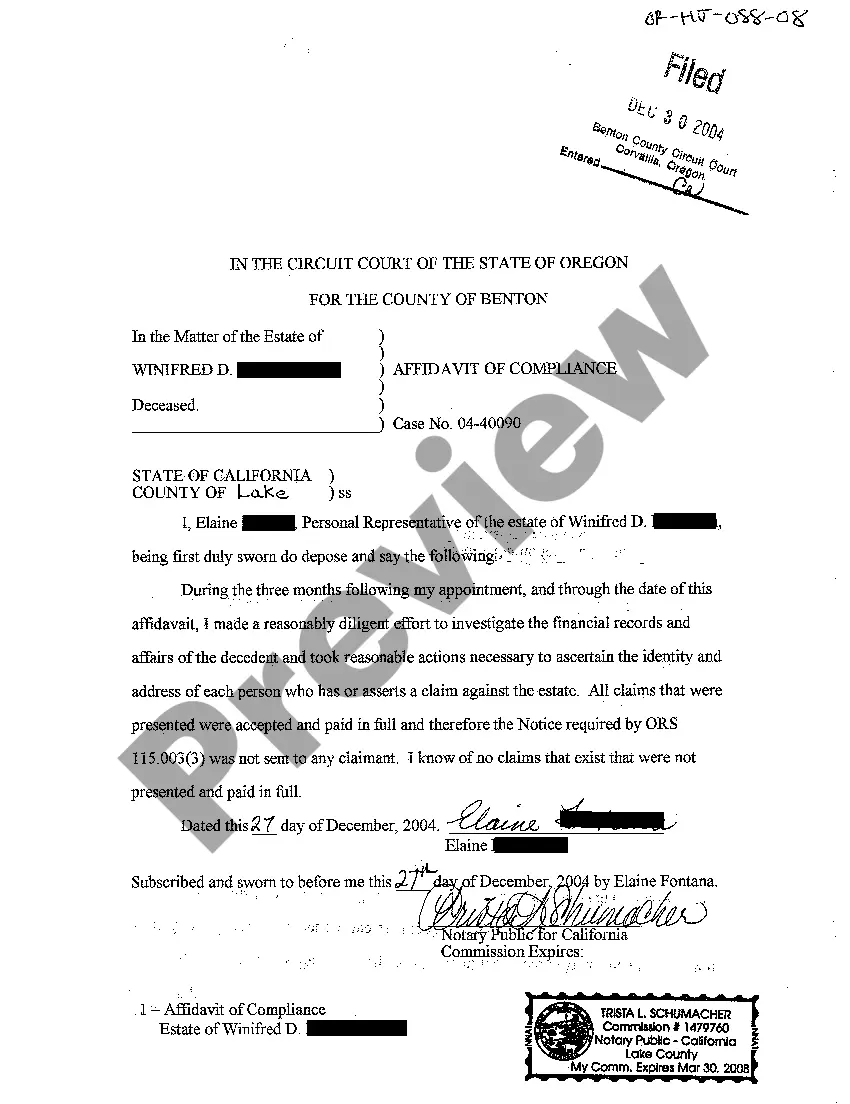

Oregon Probate Affidavit Of Compliance Form

Description

How to fill out Oregon Affidavit Of Compliance?

When you are required to finalize the Oregon Probate Affidavit Of Compliance Form according to your local state laws and regulations, there are various alternatives available.

There's no requirement to verify each form to ensure it meets all the legal prerequisites if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Utilizing expertly prepared official documents becomes straightforward with US Legal Forms. Additionally, Premium users can also benefit from the powerful integrated tools for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online library containing an archive of over 85k ready-to-use documents for both business and personal legal situations.

- Every template is verified to adhere to each state's regulations.

- Therefore, when acquiring the Oregon Probate Affidavit Of Compliance Form from our site, you can be confident that you maintain a valid and up-to-date document.

- Retrieving the necessary sample from our platform is exceptionally simple.

- If you already possess an account, just Log In to the system, confirm your subscription is active, and download the chosen file.

- Later, you can access the My documents section in your profile and retrieve the Oregon Probate Affidavit Of Compliance Form at any moment.

- If this is your initial experience with our library, please adhere to the instructions below.

- Review the suggested page and verify it for adherence to your requirements.

Form popularity

FAQ

Probate law doesn't stipulate how personal items should be divided among beneficiaries unless they've been specifically named in the Will. Such things are called specific legacies. A mother, for example, might wish her eldest daughter to receive her wedding and engagement rings.

An affidavit can be filed if the fair market value of the estate is $275,000 or less. Of that amount, no more than $200,000 can be attributable to real property and no more than $75,000 can be attributable to personal property.

Step 1 Wait Thirty (30) Days. The small estate affidavit can only be filed after thirty (30) days have passed since the decedent's death.Step 2 No Personal Representative.Step 3 Complete Forms.Step 4 File With Court.Step 5 Send to Estate Recipients.

Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer. A small estate proceeding cannot be filed until 30 days after death and is complete upon filing.

An Oregon small estate affidavit is a document that can be used to claim property from a deceased person's estate, so long as the estate meets certain criteria. The person completing the affidavit is known as an affiant, and the deceased person is known as the decedent.