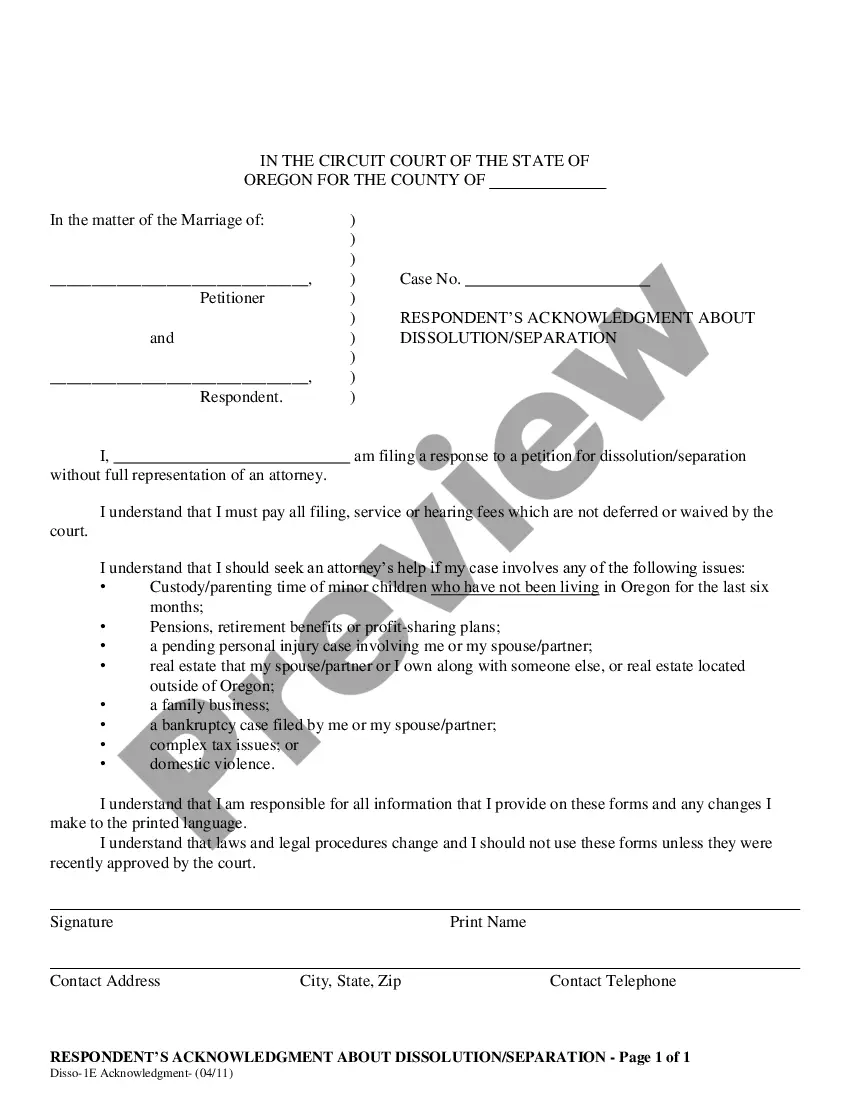

This form states that you are filing for dissolution/divorce without full representation of an attorney. It also states that that you will be responsible for court fees and will seek advice of an attorney if your spouse contests or disagrees with the divorce or the terms of the divorce.

Oregon Divorce And 401k

Description

Form popularity

FAQ

Avoiding alimony in Oregon often requires demonstrating financial independence or a change in circumstances. Establishing that your ex-spouse does not require support due to their earnings or assets is essential. Moreover, if you are dealing with Oregon divorce and 401k assets, presenting a fair division of retirement funds may also influence the alimony issue. For assistance in crafting your strategy, uslegalforms can provide templates and information tailored to your needs.

Disqualification from alimony in Oregon often arises from circumstances such as cohabitation with a new partner or a significant change in financial circumstances. Additionally, if the requesting spouse is capable of supporting themselves through income or assets, this may affect their eligibility for alimony. When considering an Oregon divorce and 401k arrangements, it’s important to understand these disqualifying factors. Uslegalforms can guide you in gathering the necessary documentation to present your case effectively.

Several factors determine spousal support in Oregon, including the financial needs of the requesting spouse and the ability of the paying spouse to provide support. The court also considers the length of the marriage and the standard of living established during the marriage. Understanding how Oregon divorce and 401k plans fit into this equation can be challenging. Uslegalforms can offer insights and resources to help you assess your financial situation clearly.

In Oregon, spousal support is not automatically mandatory. The court determines whether to award spousal support based on various factors, such as the length of the marriage and the financial situation of each spouse. It's crucial to understand how Oregon divorce and 401k assets may affect the spousal support decision. If you need help navigating these complexities, uslegalforms can provide valuable resources tailored to your situation.

Yes, Oregon is considered a 50/50 state, meaning marital property is typically divided equally between both spouses during a divorce. This division applies to various assets, including homes, savings accounts, and retirement funds such as a 401k. However, the specifics can vary based on individual circumstances, making it crucial to assess each case carefully. Understanding your rights in an Oregon divorce can lead to a fair settlement.

To enforce a divorce decree and split a 401k in Oregon, you’ll need to ensure that a QDRO is properly filed with the court. This legal document instructs the 401k plan administrator on how to divide the funds according to the divorce agreement. If issues arise, you may want to seek legal help to navigate compliance and enforce your rights. Utilizing platforms like USLegalForms can simplify preparing these important documents.

In an Oregon divorce, a wife is entitled to a fair division of marital assets, which typically includes property, income, and retirement accounts like a 401k. Furthermore, the court may consider the contributions made by both spouses, which can affect the final settlement. It’s important to gather all necessary financial documents and consult with a divorce attorney to ensure all entitlements are met. This process can empower you to advocate for your rights.

In Oregon, when a marriage ends, the 401k funds accumulated during the marriage are usually divided between both spouses. Depending on the circumstances, a portion may be awarded to the non-employee spouse through a QDRO. The division does not automatically happen, so it’s essential to address this in your divorce agreement. Taking the right steps can help you secure your financial future.

In Oregon, a 401k is typically considered a marital asset, meaning it is subject to division during divorce proceedings. The division can be achieved through a Qualified Domestic Relations Order (QDRO), which allows funds to be transferred without tax penalties. Consulting with a legal expert specializing in Oregon divorce and 401k matters can clarify this process for you. This approach ensures you receive your fair share while complying with legal guidelines.

In an Oregon divorce, the responsibility for debts often depends on whether they are classified as marital or separate debts. Generally, marital debts incurred during the marriage are divided between both spouses, regardless of whose name is on the account. It is crucial to review any shared financial obligations thoroughly. Understanding how Oregon divorce laws apply to debts can help you navigate these responsibilities better.