Lien Filing Codes For New York

Description

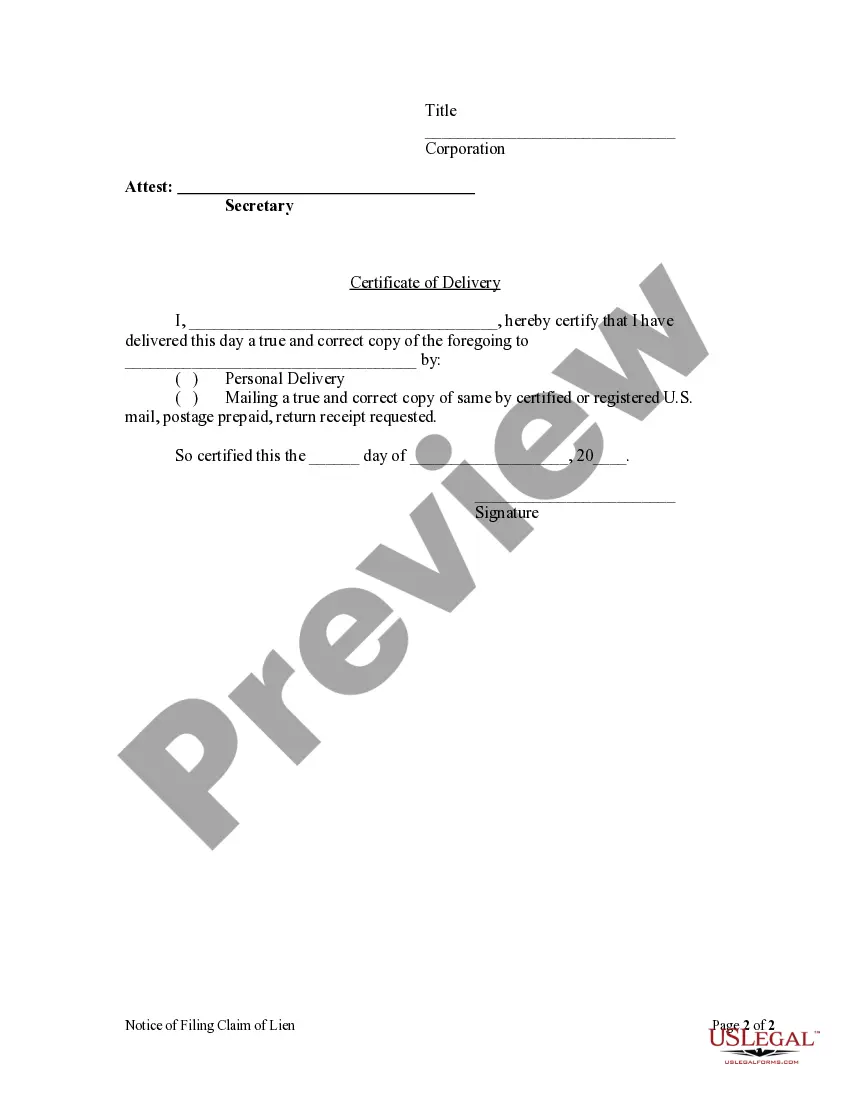

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- If you are a returning user, log into your account and download the required form template directly to your device by clicking the Download button.

- Confirm your subscription is active. If it's expired, renew it according to your payment plan.

- If you're a new user, start by checking the form preview and description to ensure you select the one that aligns with your requirements and complies with local jurisdiction.

- If necessary, use the Search tab to find alternative templates that meet your criteria.

- Proceed to purchase the document by clicking the Buy Now button and selecting your desired subscription plan. Registration is required to gain full access to our extensive library.

- Complete the purchase by entering your credit card information or using your PayPal account for subscription payment.

- Finally, download the chosen form and save it on your device. You can always access it later in the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by offering a robust collection of over 85,000 fillable and editable legal forms, ensuring that you can find the right documents at a competitive cost.

Whether you need assistance or detailed instructions, our premium experts are available to help you achieve precise and legally sound documentation. Start your legal journey today with US Legal Forms!

Form popularity

FAQ

In New York, various types of records are considered public, including property records, court filings, and certain business documents. These records help ensure transparency in legal matters, including lien filings. Familiarity with lien filing codes for New York can empower you to navigate these public records effectively. Use resources from US Legal Forms to gain insights into accessing and understanding these records.

In New York, the duration a lien remains on a property can vary based on the type of lien. Generally, a judgment lien lasts for 10 years, while other liens may have different timelines. If you understand the lien filing codes for New York, you can better assess the implications for your property. US Legal Forms offers guides on lien durations, helping you stay informed.

Yes, it is possible for someone to place a lien on your house without your knowledge, especially if they have a legal basis for doing so, such as unpaid debts. Liens can often be filed without notifying the property owner first. Staying informed about lien filing codes for New York can help you understand your rights. Tools and resources from US Legal Forms may assist you in monitoring for any unexpected liens.

Yes, liens are public records in New York. This means anyone can access information regarding liens on properties, typically available at local county offices. Understanding lien filing codes for New York can help you navigate these records more efficiently. By leveraging US Legal Forms, you can access comprehensive legal resources that clarify the process for you.

To find a lien on a property in New York, you can search the public records at the county clerk’s office or the local recorder’s office. Additionally, online databases often provide access to lien filing codes for New York, making it easier for you to locate the specific information you need. Using services like US Legal Forms can streamline your search by providing detailed resources related to property liens. Always ensure you have the correct property details to facilitate a smoother search.

To discharge a lien in New York, you must first obtain a lien discharge form, which often requires you to provide evidence that the debt has been satisfied. Once you complete the form, you should file it with the appropriate county clerk’s office, ensuring you include any necessary documentation. It's essential to follow the lien filing codes for New York closely, as they outline the legal steps and requirements for discharging a lien effectively. For a smoother process, consider using US Legal Forms, which provides resources and forms tailored to New York's legal requirements.

A lien holder is an individual or organization that has a legal right or claim on a property due to a debt. This can include lenders, mortgage companies, or mechanics who have not received payment. Understanding the roles of various lien holders can be essential, especially when dealing with lien filing codes for New York, as this can impact your property rights.

Your lien holder is the individual or institution that placed a lien on your property, typically because of an outstanding debt. Common lien holders include banks, credit unions, or contractors. To find your lien holder, you may want to check your mortgage documents or consult lien filing codes for New York, which may provide details regarding associated lien holders.

Yes, New York utilizes Electronic Lien and Title (ELT) systems to streamline the processing of liens and titles. This modernization allows for efficient recording, tracking, and retrieval of lien information, reducing paperwork and improving accuracy. As you explore lien filing codes for New York, understanding ELT can enhance your filing experience and ensure timely updates.

The lien holder code is a unique identifier for the person or entity that holds the lien on a property. This code is used to differentiate various lien holders and their respective claims, ensuring that records are organized and clear. For anyone navigating lien filing codes for New York, knowing the lien holder code is important to track who has a legal claim on the property.