Life Estate Formula

Description

How to fill out Oregon Life Estate Deed From An Individual To An Individual.?

The Life Estate Template you view on this page is a versatile legal document crafted by experienced attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal experts with more than 85,000 authenticated, state-specific documents for various business and personal situations.

Register with US Legal Forms to have reliable legal templates for all of life’s circumstances at your command.

- Search for the document you require and examine it.

- Browse through the file you looked for and preview it or check the form details to confirm it meets your needs. If it doesn’t, utilize the search feature to find the appropriate one. Click 'Buy Now' once you have located the template you need.

- Register and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for a quick transaction. If you already have an account, Log In and review your subscription to proceed.

- Obtain the editable template.

- Choose the format you prefer for your Life Estate Template (PDF, Word, RTF) and save the document on your device.

- Complete and sign the paperwork.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Retrieve your paperwork again.

- Utilize the same document once again whenever required. Access the 'My documents' tab in your profile to redownload any documents you have previously obtained.

Form popularity

FAQ

To calculate an estate's value, you can use the life estate formula, which helps determine the worth of a property held under a life estate arrangement. First, assess the fair market value of the property. Next, consider the life expectancy of the individual holding the life estate. By applying actuarial tables and this information, you can calculate the present value of the future interest, which is crucial for understanding the total value of the estate.

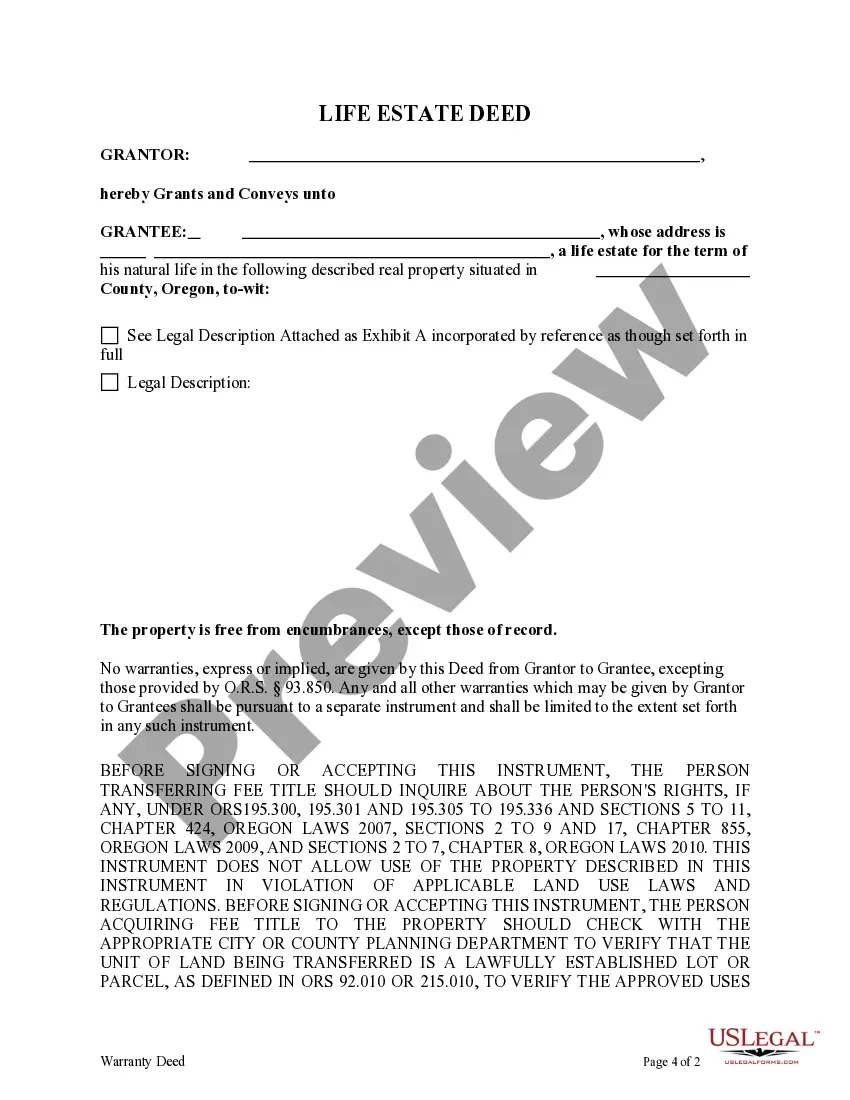

A life estate 100% refers to the full ownership rights someone holds over a property for their lifetime. This means you can live in, use, and benefit from the property during your life. However, once you pass away, the property transfers to another designated party, as specified in the life estate formula. Understanding this arrangement is crucial when planning your estate, and US Legal Forms provides tools to help you create the necessary documents.

The disadvantages of a life estate often include limitations on property control and potential complications in selling or transferring property. Additionally, if the life tenant incurs debts, creditors may have claims against the property. Understanding these aspects through a detailed life estate formula will prepare you for any challenges ahead.

Calculating your estate involves assessing all assets and liabilities to determine your net worth. You must account for properties, bank accounts, investments, and debts. Utilizing a life estate formula can be beneficial in evaluating how life estates fit into your overall estate plan and affect your beneficiaries.

Life estates can be an excellent solution depending on your personal and financial goals. They allow you to stay in your home while ensuring your heirs inherit the property smoothly. However, the answer may vary based on individual circumstances; using a life estate formula can provide clarity on whether this option suits you best.

While life estates offer several benefits, they also come with notable drawbacks. The life tenant cannot sell or use the property for profit without the consent of the remainder beneficiaries. Additionally, should any legal or financial issues arise, the life estate formula may complicate matters, making it essential to evaluate your situation thoroughly.

People often create life estates to retain control over their property while ensuring it passes smoothly to heirs. This arrangement can simplify the transfer of ownership, potentially avoiding lengthy probate processes. By utilizing a clear life estate formula, individuals can establish their wishes regarding property management and inheritance.

When you establish a life estate, you may face specific tax implications. The person holding the life estate typically retains responsibility for property taxes. However, the value of the life estate can impact your estate tax calculations. Understanding the life estate formula can help you navigate these financial aspects effectively.

Generally, a life estate itself does not file a tax return. However, the life tenant is responsible for reporting any income generated from the property on their personal tax return. The life estate formula can help understand the impact of such property income on taxes. Always consider seeking advice from a tax expert regarding your specific circumstances.

An example of a life estate clause might read: 'Upon the death of the life tenant, John Doe, the property shall pass to Jane Smith as the remainderman.' The life estate formula typically includes specific conditions and rights given to both parties. This clause ensures clarity about ownership and provides security for the future. Using a legal template can streamline this process.