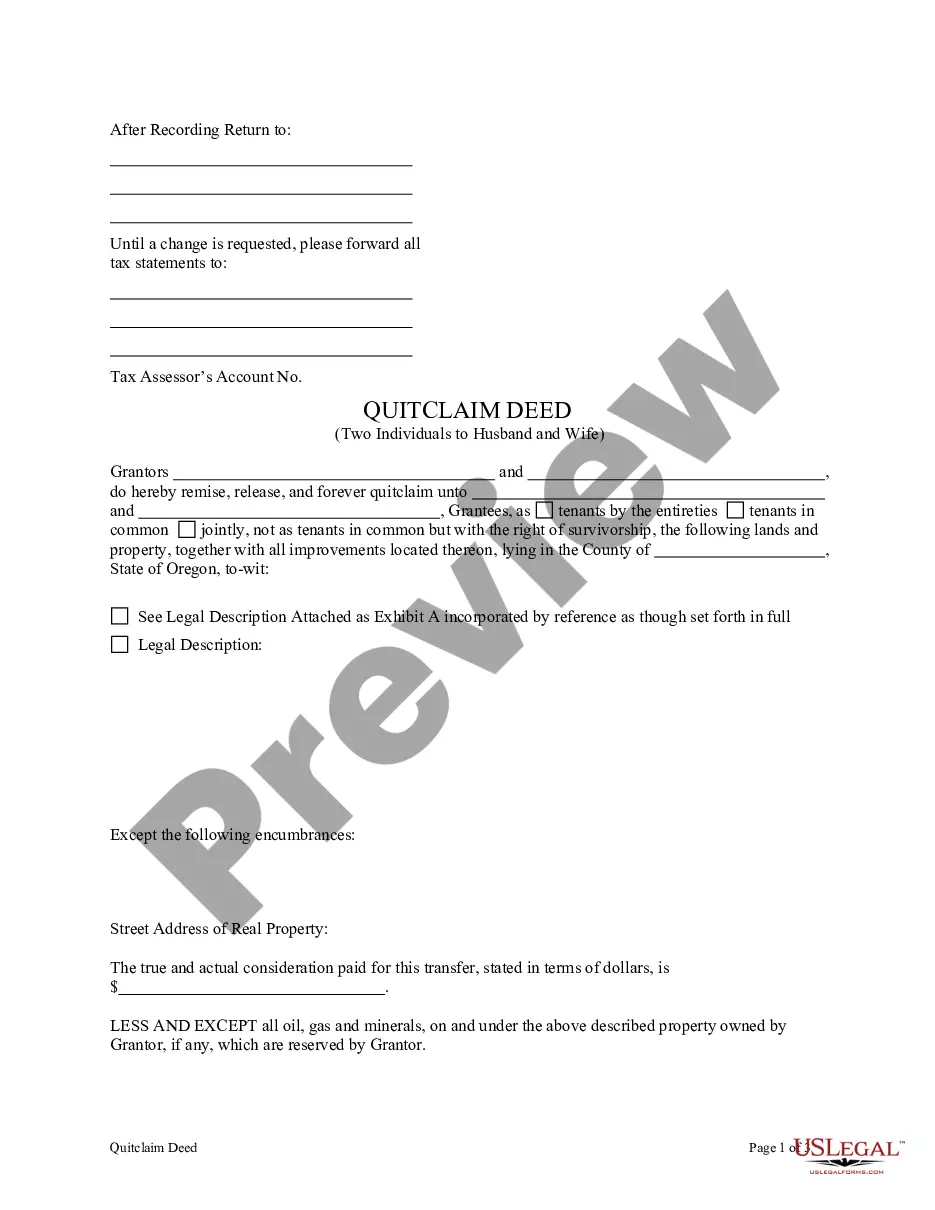

This Quitclaim Deed by Two Individuals to Husband and Wife form is a Quitclaim Deed where the Grantors are Two Individuals and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

Oregon Deed Of Trust Act

Description

How to fill out Oregon Deed Of Trust Act?

Maneuvering through the red tape of official documentation and formats can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate template to obtain an Oregon Deed Of Trust Act may be labor-intensive, as it needs to be accurate and valid to the last detail.

However, you will invest significantly less time searching for a fitting template if it originates from a trusted source.

Acquire the proper document in a few straightforward steps: Enter the title of the file in the search box. Locate the corresponding Oregon Deed Of Trust Act in the list of results. Review the description of the template or view its preview. When the document meets your requirements, click Buy Now. Choose your subscription plan. Use your email and set a password to create an account at US Legal Forms. Select a credit card or PayPal payment option. Save the template document on your device in the preferred format. US Legal Forms can significantly reduce the time spent confirming whether the form you found online meets your needs. Establish an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the correct documents online.

- US Legal Forms serves as a centralized hub to acquire the latest samples of forms, inquire about their usage, and download them for completion.

- It boasts a repository with over 85,000 forms relevant to various professional fields.

- When looking for an Oregon Deed Of Trust Act, you will have confidence in its validity as all forms are authenticated.

- Creating an account at US Legal Forms will guarantee you have all necessary samples readily available.

- You can store them in your history or add them to the My documents collection.

- You can access your saved forms from any device by simply selecting Log In on the library site.

- If you haven’t set up an account yet, you can always re-search for the template you require.

Form popularity

FAQ

Getting out of a trust deed involves several steps. First, you should review the terms outlined in the Oregon deed of trust act to understand your obligations. You might also consider refinancing your mortgage, which can replace the original deed of trust with a new one. Additionally, working with a knowledgeable professional or using platforms like USLegalForms can help you navigate this process effectively.

To transfer your property to a trust in Oregon, you will need to prepare and execute a new deed that names the trust as the property's new owner. This process complies with the guidelines set forth in the Oregon deed of trust act, ensuring your transfer is legally recognized. Additionally, it's wise to consult with a legal expert or use platforms like US Legal Forms to access resources and forms that simplify the process. By doing so, you secure your property’s future clearly and effectively.

Oregon is primarily a deed of trust state. This means that in Oregon, a deed of trust, which involves a third party called a trustee, is often used to secure loans. Under the Oregon deed of trust act, this system allows lenders to initiate foreclosure more efficiently compared to traditional mortgages. This distinction can influence your borrowing options, so it’s important to understand how it affects your financial decisions.

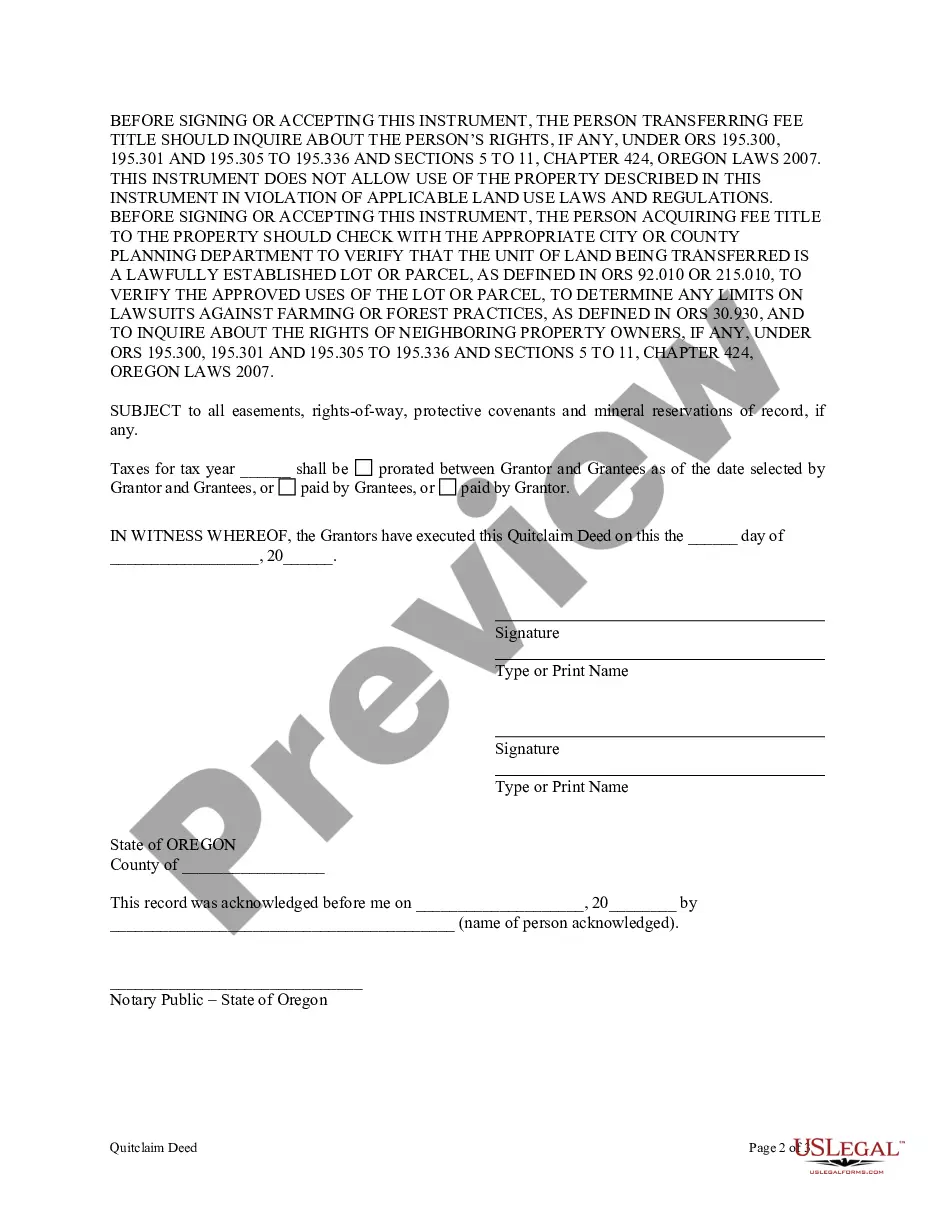

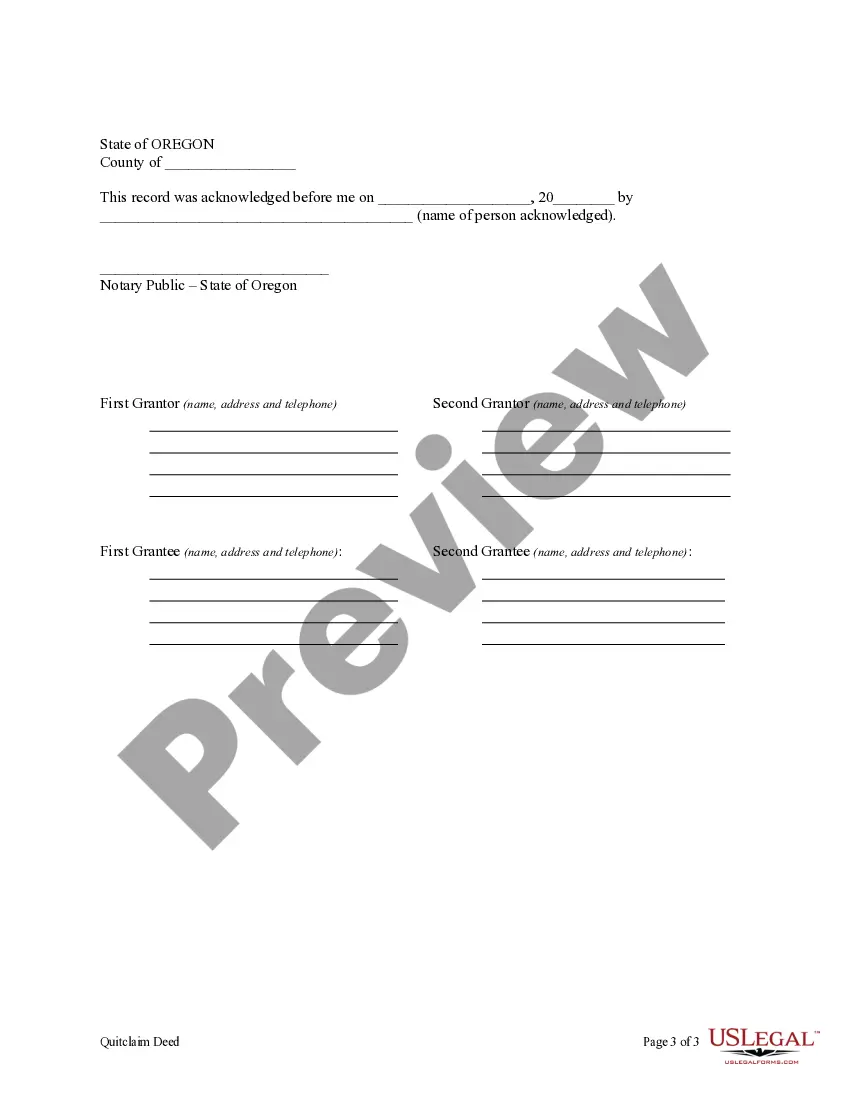

To record a deed in Oregon, you should first prepare the necessary documents as specified by the Oregon deed of trust act. Once completed, submit the deed to the county clerk's office where the property is located, along with the payment for recording fees. After processing, the clerk will stamp the document, making it part of the public record. If you need assistance with the recording process, platforms like USLegalForms can provide valuable resources and guidance.

A deed does not have to be recorded to have validity in Oregon, but recording offers significant benefits. According to the Oregon deed of trust act, providing public notice helps protect the interests of the parties involved, ensuring their rights are acknowledged. Recording a deed can also prevent future disputes over property ownership, making it a wise choice for homeowners and lenders alike. Thus, while not strictly necessary, recording is highly recommended.

In Oregon, a valid deed must meet specific criteria as outlined by the Oregon deed of trust act. These include having a clear property description, the names of the parties involved, and notarized signatures. Additionally, the deed must be in writing and comply with state laws regarding authentication. Meeting these requirements ensures that your deed is lawful and enforceable.

Yes, Oregon operates as a deed state, which means property ownership is primarily transferred through deeds. The Oregon deed of trust act governs the use of deeds, including the requirements and processes surrounding them. This system allows for clear documentation of property interests and provides legal protection for all parties involved. Therefore, understanding the implications of being a deed state is important for buyers, sellers, and lenders.

An unrecorded deed can be valid in Oregon, but it may face challenges. Under the Oregon deed of trust act, an unrecorded deed may still transfer ownership, but it may not protect rights against third parties. Recording the deed ensures transparency and helps establish priority over claims. Therefore, while an unrecorded deed has legal standing, recording it is strongly advised.

Yes, a trust deed in Oregon is considered a voluntary lien. When a borrower signs a deed of trust, they are willingly allowing the lender to place a lien on the property. This arrangement, as specified by the Oregon Deed of Trust Act, benefits both parties by providing security for the lender while allowing the borrower access to funds.

The Oregon Trust Deed Act provides the legal framework for deeds of trust in the state. It outlines the rights and responsibilities of all parties involved, including the borrower, lender, and trustee. By adhering to this act, lenders can effectively manage risks while borrowers can ensure their rights are protected.