Approved Transfer On Death Deed Form For Oregon

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

- If you're a returning user, log in to your account and click the Download button for your needed document. Ensure that your subscription is active; otherwise, renew it as per your payment plan.

- For new users, start by examining the Preview mode and form description. Verify that the selected document aligns with your requirements and complies with local jurisdiction.

- If you encounter any discrepancies, utilize the Search tab to find a more suitable template. Proceed only if it fits your needs.

- Purchase the document by selecting the Buy Now button and choosing your preferred subscription plan. Create an account to access the extensive resource library.

- Complete your payment by inputting your credit card details or using your PayPal account.

- Download the form and save it on your device. Access it anytime later under the My Forms section.

US Legal Forms stands out with its robust collection of over 85,000 editable legal documents, ensuring you find exactly what you need. Additionally, users have the capability to connect with premium experts for guidance, ensuring your documents are accurate and legally compliant.

Don't wait any longer to secure your legal forms. Start your journey with US Legal Forms today and experience hassle-free document preparation!

Form popularity

FAQ

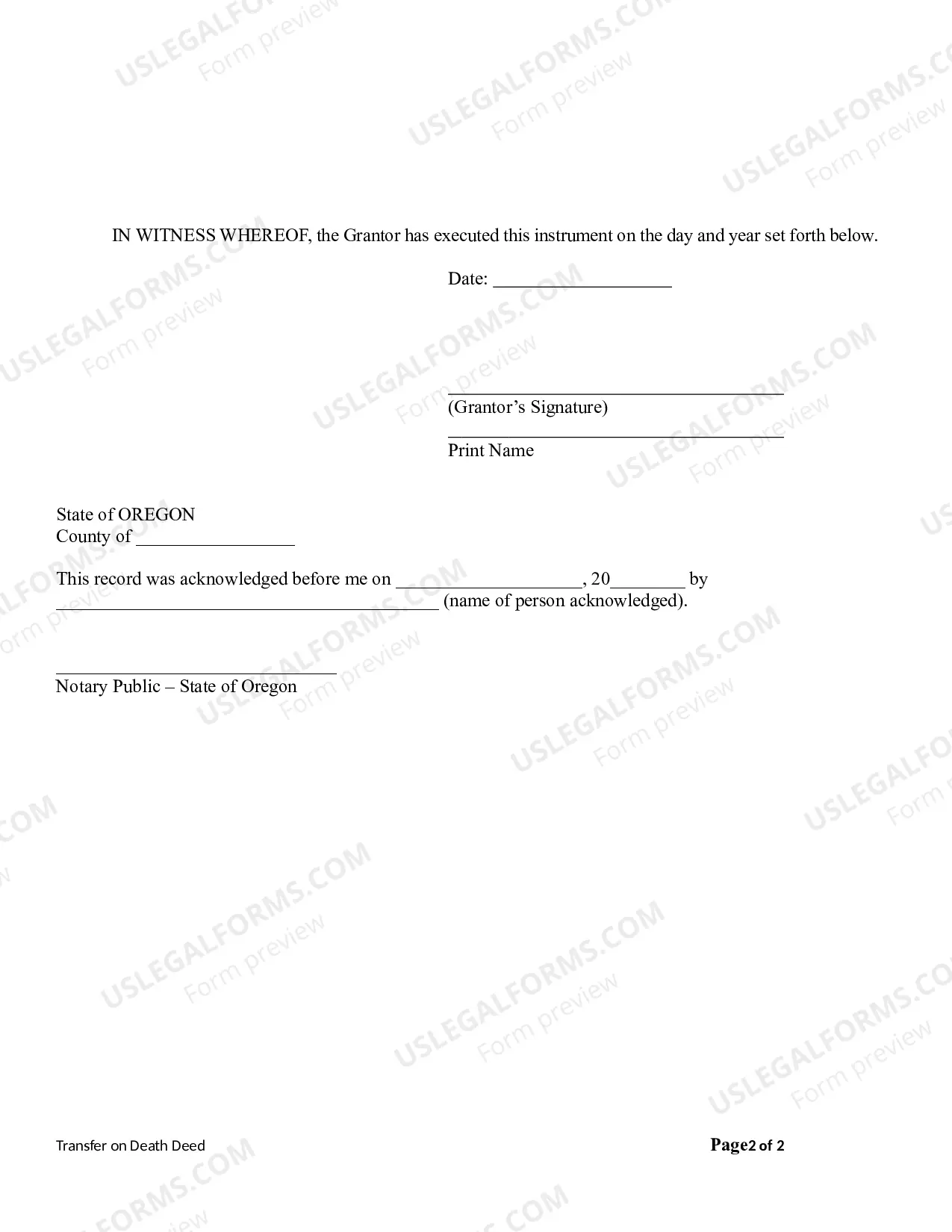

To file a transfer on death deed in Oregon, start by obtaining the appropriate approved transfer on death deed form for Oregon. Complete the document with precise information and ensure that it is notarized. Submit the executed deed to your local county clerk's office to officially record the transfer, allowing the designated beneficiary to inherit the property as planned.

Filing a transfer on death deed in Oregon involves completing the approved transfer on death deed form for Oregon and signing it in front of a notary. After that, you should file the signed deed with your county's clerk office. This method ensures that the transfer process is legally binding and recognized by the state.

While transfer on death deeds offer advantages, they also come with some disadvantages. One such concern is that if the property owner accumulates debts, creditors may still claim against the property after death. Furthermore, an approved transfer on death deed form for Oregon does not facilitate a gift during your lifetime, meaning you forfeit direct control of the property until you pass away.

Transferring ownership of a property in Oregon typically involves drafting a deed and filing it with the county clerk’s office. If you want to use an approved transfer on death deed form for Oregon, it allows you to designate a beneficiary who will inherit the property upon your death without going through probate. This process not only simplifies the transfer but also helps in avoiding potential legal complications for your heirs.

To write a transfer deed, you need essential information about the property, such as the legal description and address. You should also include the names of the property owner and the beneficiary. Using an approved transfer on death deed form for Oregon simplifies this process, ensuring you include all necessary details and comply with state requirements.

You can obtain an approved transfer on death deed form for Oregon through various sources, such as state government websites or authorized legal document providers. One reliable option is USLegalForms, which offers user-friendly templates that comply with state laws. By choosing USLegalForms, you ensure that you have access to the correct and officially sanctioned form. This approach simplifies the process and allows you to efficiently complete your estate planning.

Transferring property after death without a will in Oregon involves following the state's intestate succession laws. Typically, property goes to family members based on their relation to the deceased. However, using an approved transfer on death deed form for Oregon simplifies this process, ensuring your property is distributed according to your wishes without the complexities of intestacy.

A transfer on death deed generally does not avoid capital gains tax. When the beneficiaries sell the property, they may owe taxes based on the property's appreciated value. To address these concerns, acquiring an approved transfer on death deed form for Oregon is beneficial, but consider speaking with a tax professional for advice tailored to your situation.

The primary disadvantage of a TOD deed is that it does not provide protection against creditors. If debts exist at the time of death, creditors may place claims on the estate. Additionally, it’s vital to ensure that an approved transfer on death deed form for Oregon is completed correctly to avoid any future legal complications.

While a transfer on death deed offers benefits, it comes with drawbacks, such as a lack of immediate access for beneficiaries. This may create financial stress if funds are needed quickly. It’s crucial to weigh these factors against the advantages of having an approved transfer on death deed form for Oregon that facilitates a smoother transfer process.