Or Llc With Real Estate

Description

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

Utilizing legal document examples that comply with both federal and local regulations is essential, and the internet provides numerous choices to select from.

However, what is the benefit of spending time searching for the correct Or Llc With Real Estate template online when the US Legal Forms digital library already has those templates compiled in one location.

US Legal Forms is the premier online legal directory with more than 85,000 fillable templates created by attorneys for various business and personal matters.

Evaluate the template using the Preview option or the text description to confirm it meets your requirements. Search for an alternative sample using the search feature at the top of the page if needed. Click Buy Now once you have identified the appropriate form and select a subscription plan. Create an account or sign in and complete the payment using PayPal or a credit card. Select the suitable format for your Or Llc With Real Estate and download it. All documents you find via US Legal Forms are reusable. To re-download and fill out previously purchased forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists keep abreast of legal updates, ensuring that your form remains current and compliant when acquiring a Or Llc With Real Estate from our site.

- Getting a Or Llc With Real Estate is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the desired format.

- If you are a newcomer to our website, follow the steps outlined below.

Form popularity

FAQ

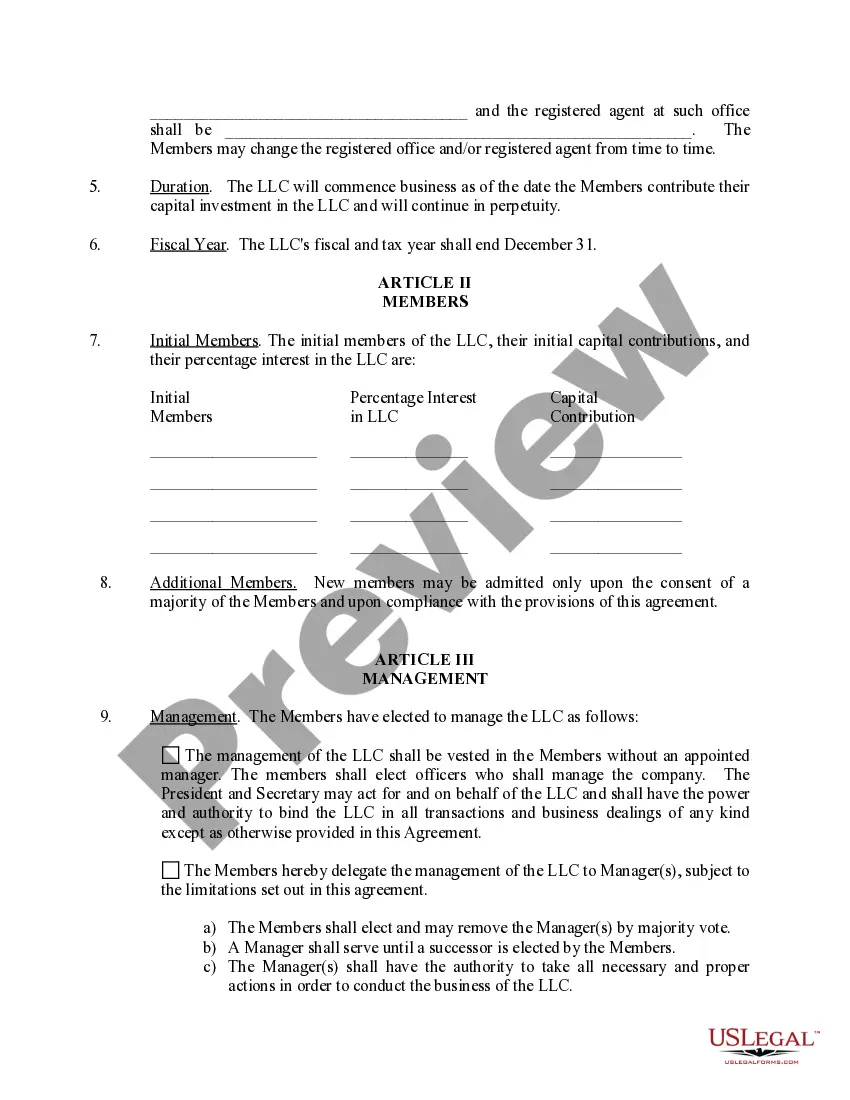

LLC. A limited liability company (LLC) is a common entity choice for real estate investors and offers many advantages. Choosing this structure for your real estate investment business allows you to limit your personal liability in the business to the money you contribute and the debts you co-sign for.

Disadvantages of LLCs for Rental Property 1 Disadvantages of LLCs for Rental Property. 2 Tax Complexity. 3 Setup Challenges. 4 Transferred Tax Obligations. 5 Asset Protection Not Guaranteed. 6 Financing Challenges. 7 Increasing Expenses. 8 Considerations and Conclusion.

The management flexibility, tax benefits and protection of personal assets offered by LLCs make it a great vehicle for investment opportunities. Since there can be more than one member, it's often the business entity of choice when multiple people are looking to invest in something as a group.

Setting up an LLC for investing is a safe way to build a group of investors and take advantage of the liability protection and tax benefits given to LLCs. Investing as an individual brings added risks to your personal finances and leaves you solely responsible for raising the money to invest.

An LLC has pros such as flow-through taxation and limited liability protection. However, there are also disadvantages such as the legal process of ?piercing the corporate veil? and being forced to dissolve the LLC if a member leaves.