Limited Liability Company With One Member

Description

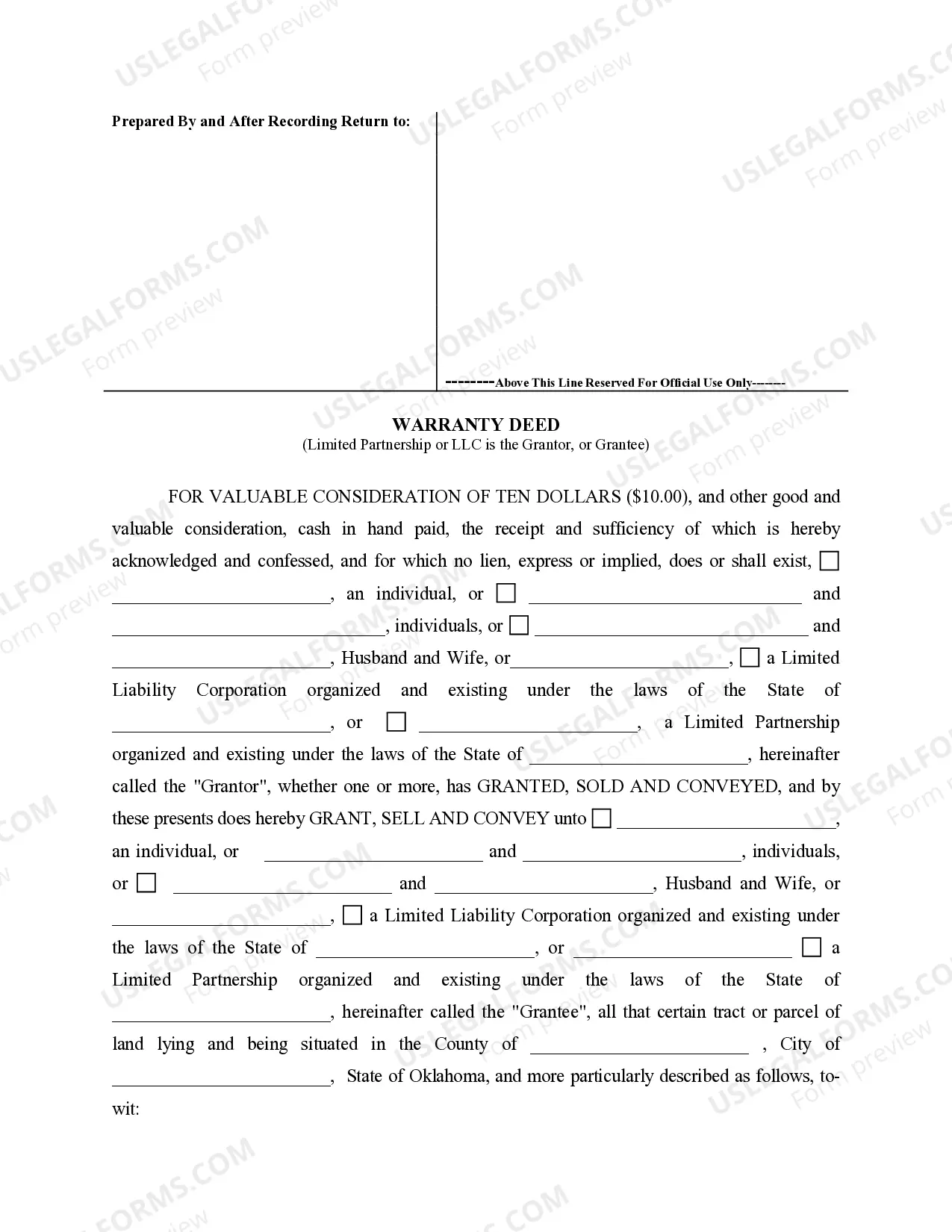

How to fill out Oklahoma Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- Log into your US Legal Forms account or create a new one if this is your first visit.

- Navigate to the search bar and enter 'limited liability company with one member' to find the correct form.

- Review the description and preview of the form to ensure it meets your local jurisdiction requirements.

- Select any additional templates you may need by using the search feature.

- Click on the 'Buy Now' button and choose your preferred subscription plan.

- Complete your purchase using your credit card or PayPal account.

- Download your completed form and save it for future reference.

Once you've followed these steps, you're well on your way to forming your limited liability company with one member. With US Legal Forms, you can rest assured knowing you have access to an extensive library of resources.

Start simplifying your legal document needs today and experience the convenience of US Legal Forms!

Form popularity

FAQ

LLC owners can effectively minimize their tax burden using strategic business deductions and credits. Taking advantage of allowable deductions, such as business-related expenses and losses, reduces taxable income. Additionally, employing accounting strategies, like making retirement contributions, can further decrease tax liabilities. For tailored support in navigating these complexities, consider using the UsLegalForms platform, which provides resources and guidance for your LLC needs.

member LLC often presents considerable tax advantages, particularly through passthrough taxation. This means the business income is taxed at your personal rates, which can be beneficial depending on your overall income. Additionally, it allows greater flexibility in managing distributions and profits, making it a preferred choice for many small business owners.

Yes, a limited liability company can absolutely have only one member. This structure is often referred to as a single-member LLC. It offers the same liability protection as multi-member LLCs, safeguarding your personal assets from business debts. This makes it an attractive option for entrepreneurs and freelancers.

A limited liability company with one member can write off various business expenses on taxes. You may deduct costs like equipment purchases, office supplies, and travel expenses related to your business. Additionally, you can deduct home office expenses if you use part of your home exclusively for business. Understanding these deductions is crucial to maximizing your tax savings.

Yes, a limited liability company with one member can hire W-2 employees. This means that workers receive a traditional paycheck, and you are responsible for withholding taxes. It's important to file the necessary forms with the IRS and respect labor laws to maintain compliance and protect your business.

Certainly, you can hire someone as a limited liability company with one member. Whether you need full-time employees or part-time workers, the process involves ensuring you meet legal requirements for employment. Consulting with a platform like uslegalforms can provide the tools and documentation you need to make hiring seamless.

A limited liability company with one member can hire people according to its operational needs. If you choose to hire employees, you must follow specific hiring protocols and comply with federal and state labor laws. Remember, hiring employees can add complexity, so consider using resources like uslegalforms to guide you through the necessary steps.

Yes, a limited liability company with one member can indeed be owned by another company, making it a great choice for business-to-business relationships. This structure allows the parent company to maintain liability protection while benefiting from the single-member LLC’s streamlined operations. It can be a strategic way to expand your business interests.

A limited liability company with one member can be a great option for many entrepreneurs. It provides personal liability protection, meaning your personal assets are generally shielded from business debts. Additionally, it offers tax flexibility, allowing you to choose how to report your business income.

To add an employee to a limited liability company with one member, you must first obtain an Employer Identification Number (EIN) from the IRS. Then, ensure compliance with state and federal employment laws by properly classifying the worker and handling payroll taxes. It’s essential to maintain accurate records and possibly adjust your operating agreement to reflect this new change.