Building Lease On Balance Sheet

Description

How to fill out Building Lease On Balance Sheet?

Properly crafted official documentation is one of the crucial safeguards for preventing issues and disputes, but obtaining it without a lawyer's help may require time.

Whether you are seeking to swiftly locate an updated Building Lease On Balance Sheet or other templates for employment, family, or business situations, US Legal Forms is always ready to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, all you need to do is Log In to your account and click the Download button next to the desired document. Furthermore, you can access the Building Lease On Balance Sheet any time later, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Conserve time and funds on preparing official documentation. Experience US Legal Forms today!

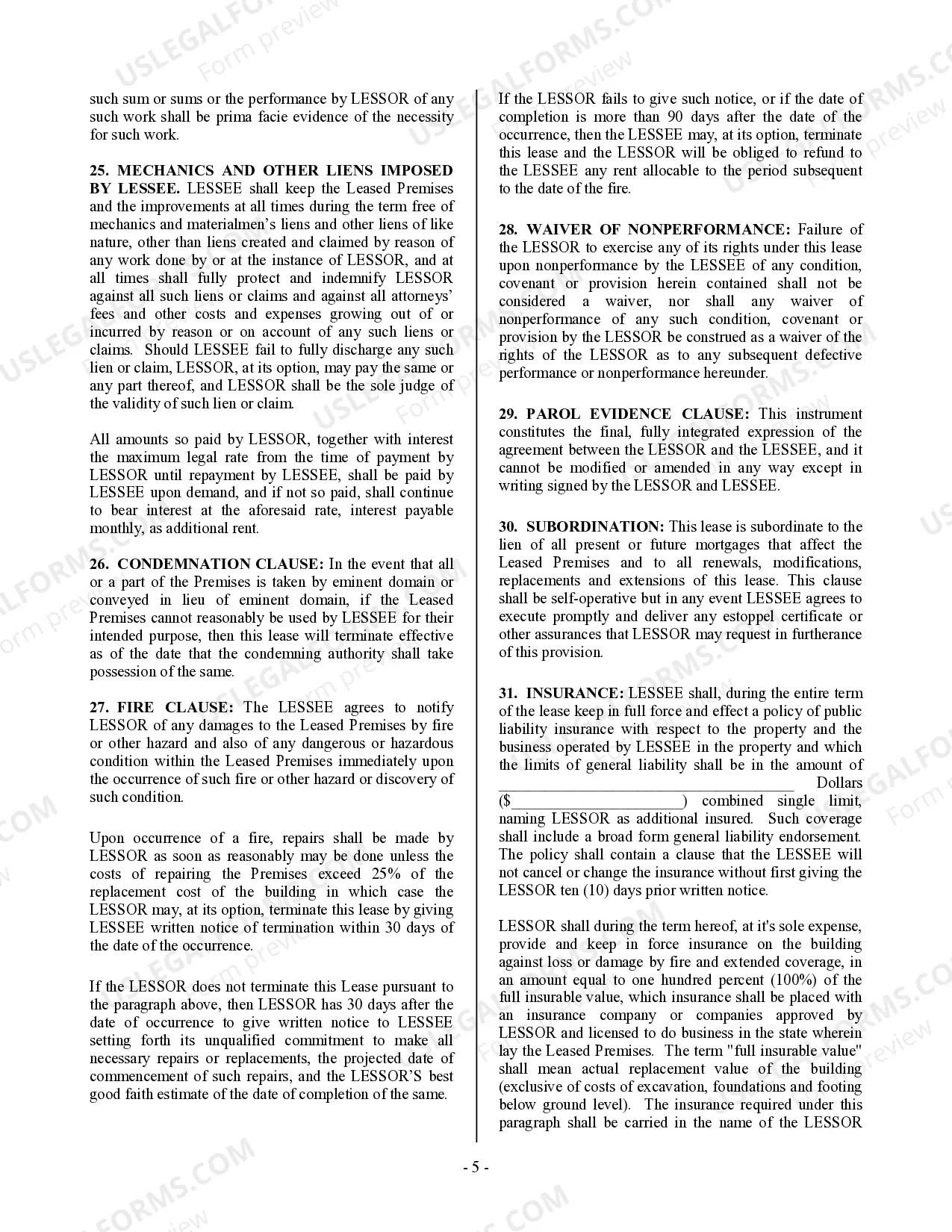

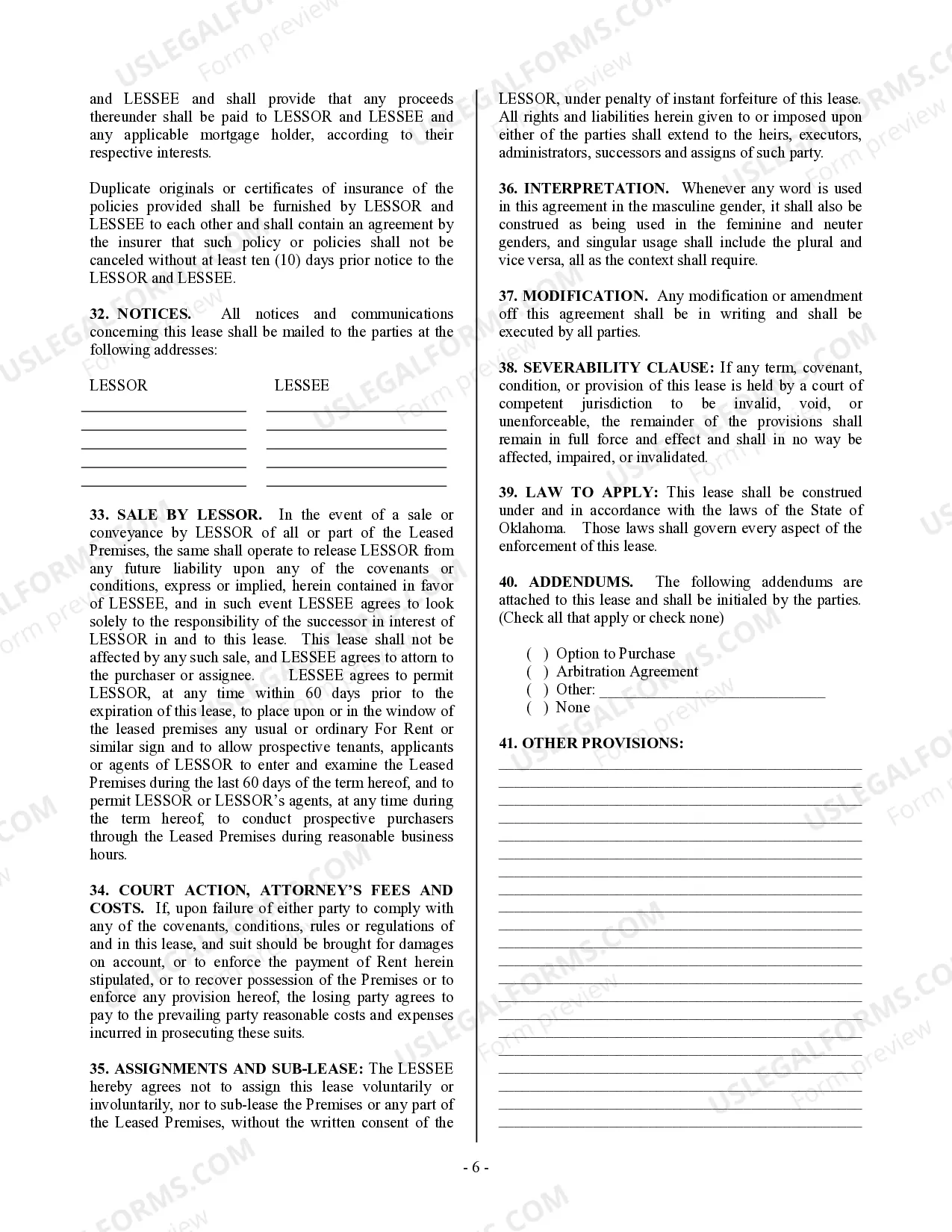

- Verify that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Press Buy Now once you identify the correct template.

- Choose the pricing option, Log Into your account, or create a new one.

- Select your preferred payment method to buy the subscription plan (using a credit card or PayPal).

- Choose either PDF or DOCX file format for your Building Lease On Balance Sheet.

- Hit Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Operating leases are considered a form of off-balance-sheet financing. This means a leased asset and associated liabilities (i.e. future rent payments) are not included on a company's balance sheet.

Lease liability recording it Once we have gathered our information, i.e., we know the lease term, the lease payment and the discount rate, we simply discount the liability over the lease term, using the discount rate. We then record the lease liability, or the resulting amount, on the balance sheet.

Under a capital lease, the leased asset is treated for accounting purposes as if it were actually owned by the lessee and is recorded on the balance sheet as such.

You never record the leased property as an asset. Under a capital lease, you treat the property on your financial statements as though you bought it.

Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income. It is retained by the lessor during and after the lease term and cannot contain a bargain purchase option.