Form Change

Description

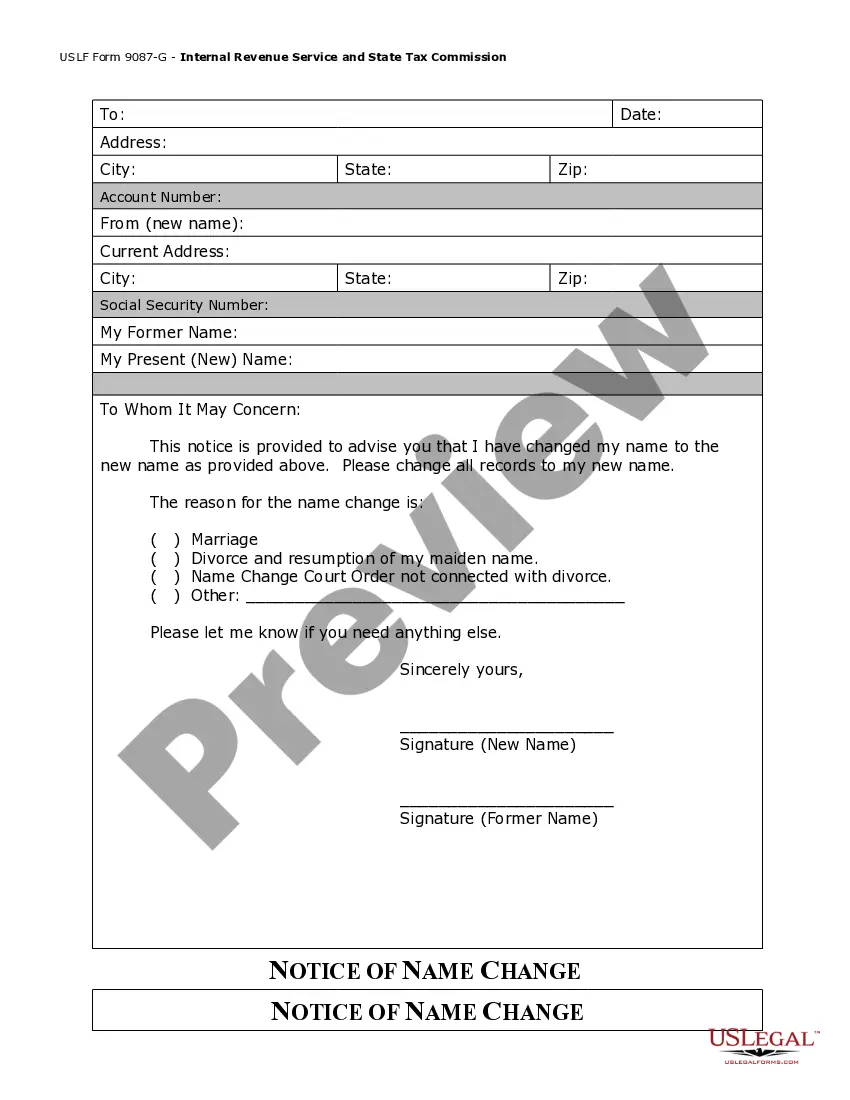

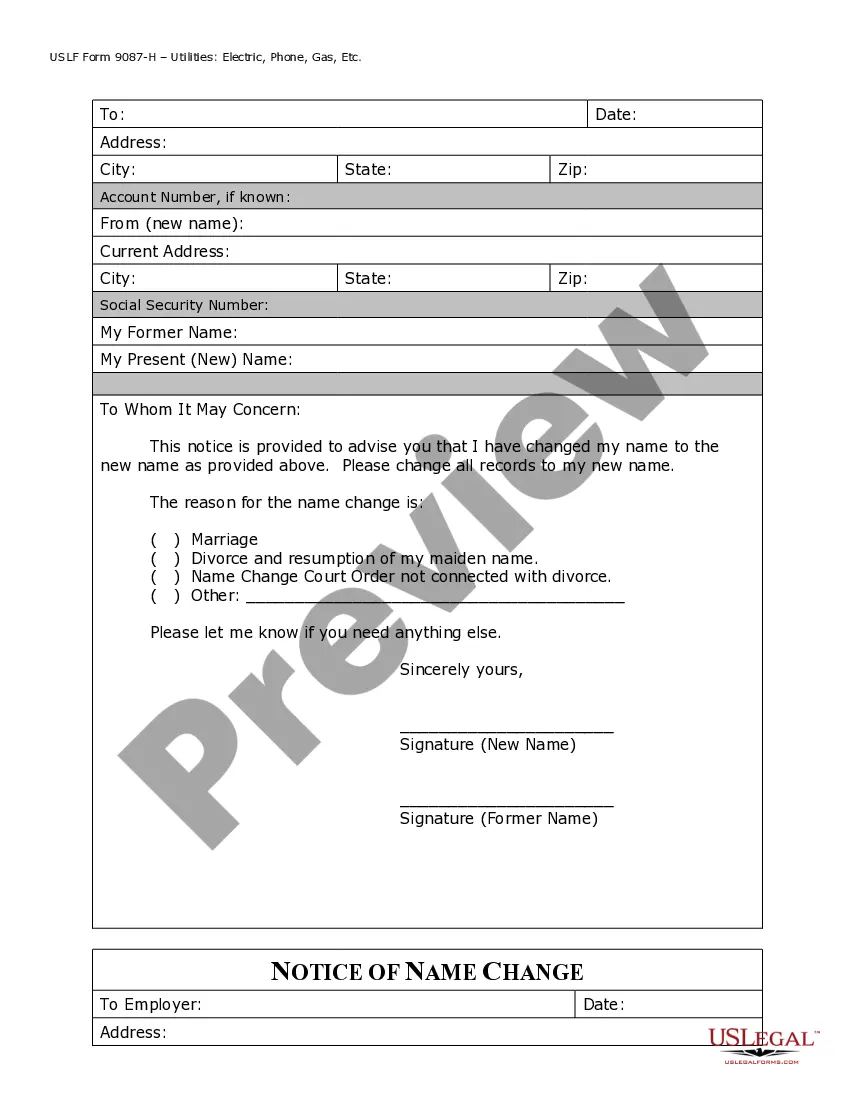

How to fill out Oklahoma Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- Log in to your US Legal Forms account if you have previously used the service; otherwise, create a new account.

- Browse through the extensive library and utilize the Preview mode to find the correct form that meets your needs and local jurisdiction.

- If the form doesn't suit your requirements, use the Search tab at the top to find another template.

- Select your desired document and click the Buy Now button to choose your preferred subscription plan.

- Complete the purchase by entering your payment details via credit card or PayPal.

- Download the completed form template directly to your device and access it anytime through the My Forms section in your profile.

With US Legal Forms, navigating the legal landscape becomes simple and efficient. Their extensive collection and user-friendly interface empower individuals and attorneys to access crucial legal documents with ease.

Start your form change process today and make your legal documentation easier than ever!

Form popularity

FAQ

Form 3115 is used to request a change in accounting method, which includes various aspects such as depreciation and inventory methods. By properly completing this form, you ensure compliance with IRS regulations while handling any necessary form change. It's a vital tool for taxpayers seeking adjustments.

The 481a method change allows taxpayers to adjust the basis of their assets when changing accounting methods. This adjustment ensures that income or deductions are not double-counted or omitted during a form change. Be sure to consult the IRS regulations when applying this adjustment.

The 3115 change in depreciation method refers to the process of making a tax election to switch how assets are depreciated. This requires completing Form 3115 and detailing the reasons for your form change. Implementing this correctly can optimize your tax situation.

Yes, there may be a penalty for filing an amended tax return, especially if it results in additional taxes owed. It's crucial to submit your amended return as soon as possible to minimize any late fees or interest. Always refer to IRS guidelines to understand the potential penalties.

To obtain a change in accounting method, you need to file Form 3115. This form allows you to make the necessary adjustments to your accounting practices in accordance with IRS requirements. Be sure to provide detailed explanations for your form change to avoid complications.

The penalty for amending a tax return can vary based on the circumstances. Generally, if you owe more taxes after the form change, you may incur interest and penalties on the unpaid amount. It’s best to resolve any tax discrepancy promptly to minimize any associated penalties.

Changing your tax forms involves identifying the necessary adjustments and completing the appropriate forms, such as Form 1040-X for individual returns. You should ensure that all changes are clearly stated, and the reasons for the form change are documented. Consider utilizing platforms like uslegalforms to streamline this process.

The form used for change in accounting method is Form 3115. This form helps taxpayers make adjustments when shifting from one accounting method to another. Properly filing this form ensures compliance with IRS regulations regarding your form change.

Yes, some tax preparation software allows you to file your amended return electronically. Check to see if your chosen software supports Form 1040-X for an efficient form change process. If electronic filing is not an option, mail the completed form instead.

To file an amended form, start by completing Form 1040-X. You need to report the changes you wish to make and provide the reasons behind each form change. Once completed, send it to the address specified for your state on the IRS website to ensure proper handling.