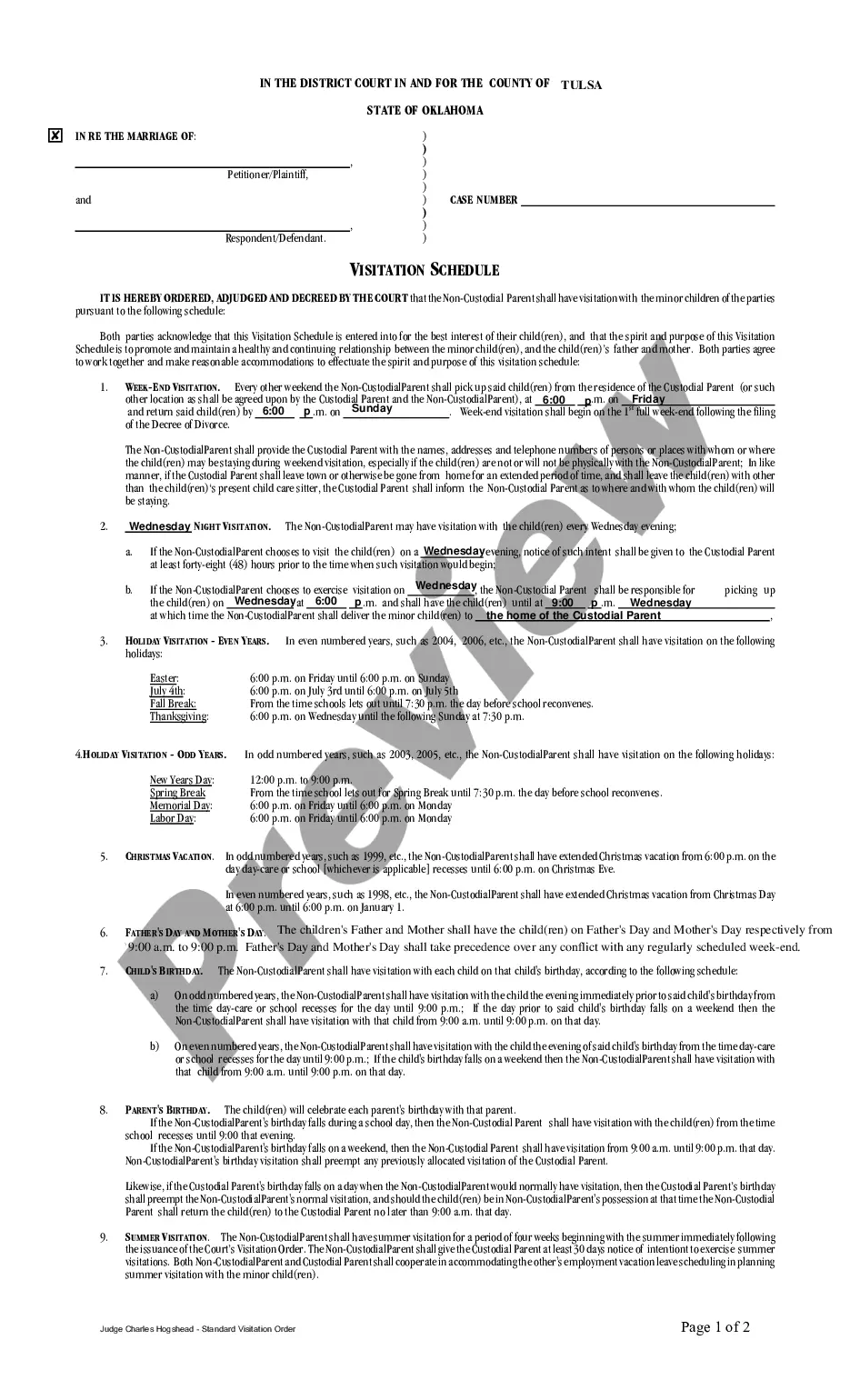

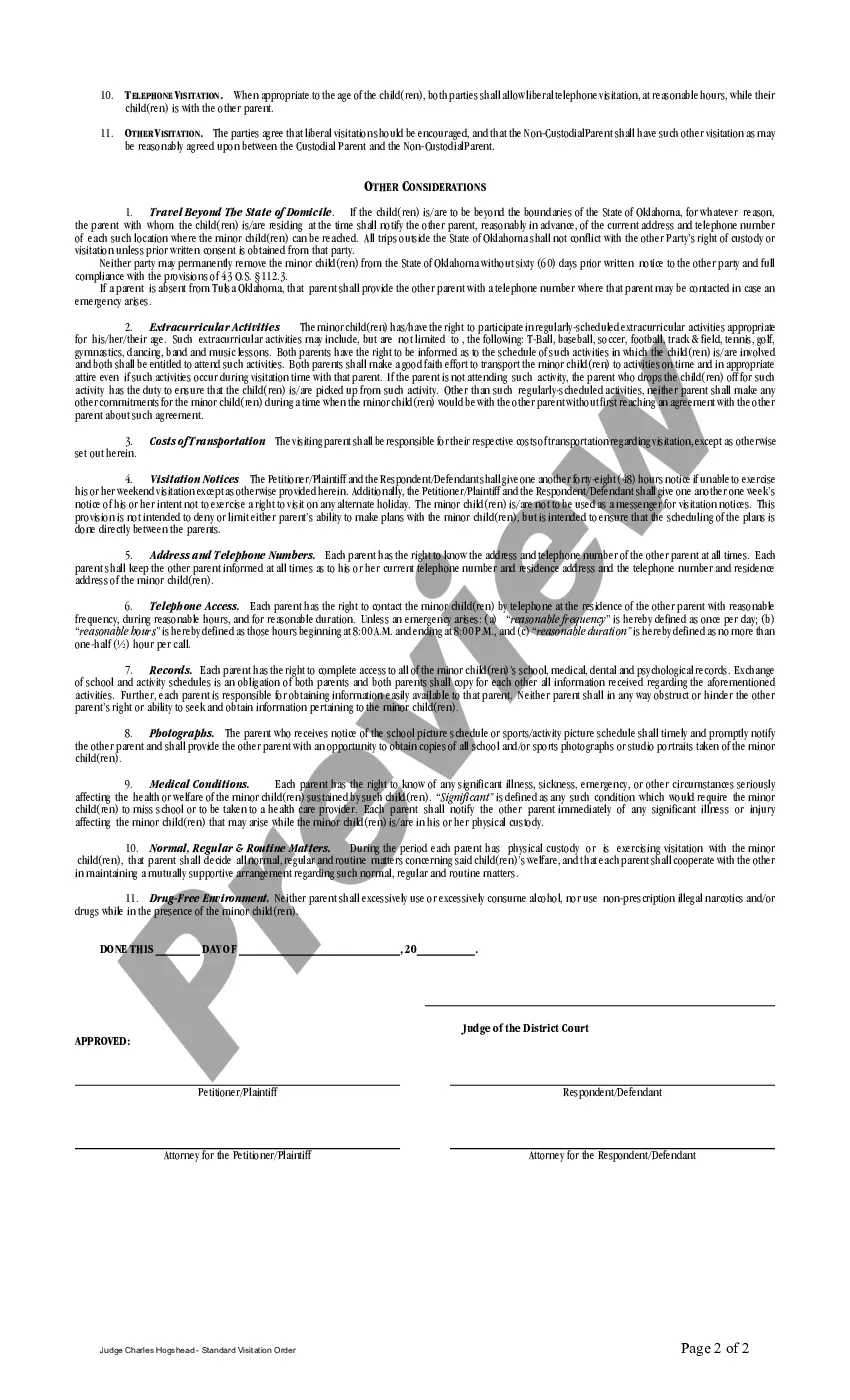

Oklahoma Standard Visitation Schedule For Joint Custody

Description

How to fill out Oklahoma Standard Visitation Schedule For Joint Custody?

Getting a go-to place to access the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents calls for accuracy and attention to detail, which is why it is crucial to take samples of Oklahoma Standard Visitation Schedule For Joint Custody only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the information about the document’s use and relevance for the situation and in your state or region.

Take the following steps to complete your Oklahoma Standard Visitation Schedule For Joint Custody:

- Use the catalog navigation or search field to locate your sample.

- Open the form’s description to see if it matches the requirements of your state and area.

- Open the form preview, if there is one, to make sure the form is the one you are looking for.

- Get back to the search and look for the correct template if the Oklahoma Standard Visitation Schedule For Joint Custody does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Select the pricing plan that suits your needs.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Select the file format for downloading Oklahoma Standard Visitation Schedule For Joint Custody.

- Once you have the form on your gadget, you may change it using the editor or print it and finish it manually.

Eliminate the headache that accompanies your legal paperwork. Check out the extensive US Legal Forms library to find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

What conditions must be met by law before giving money to friends? The borrower's approval is required before the loan may be made. The borrower must be able to pay back the loan. If the loan is not repaid within a reasonable amount of time, often one year, the lender must be able to collect on it.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

A lending agreement (loan agreement) is a formal contract between a lender and a borrower. Lending agreements spell out all the details of the loan, such as the principal amount, interest rate, amortization period, term, fees, payment terms and any covenants.

A Loan Agreement, also known as a Loan Contract or Personal Loan Agreement, is used to loan or borrow money with or without interest included. It typically covers the amount of the loan, the interest rate, the repayment terms, and other specific provisions and terms that will be explained in more detail below.

Definition. Loan Documentation refers broadly to the documents needed to legally enforce the loan agreement and properly analyze the borrower's financial capacity. Common loan documents are: promissory notes. note guarantees, financial statements.