Divorce Ok In The Bible

Description

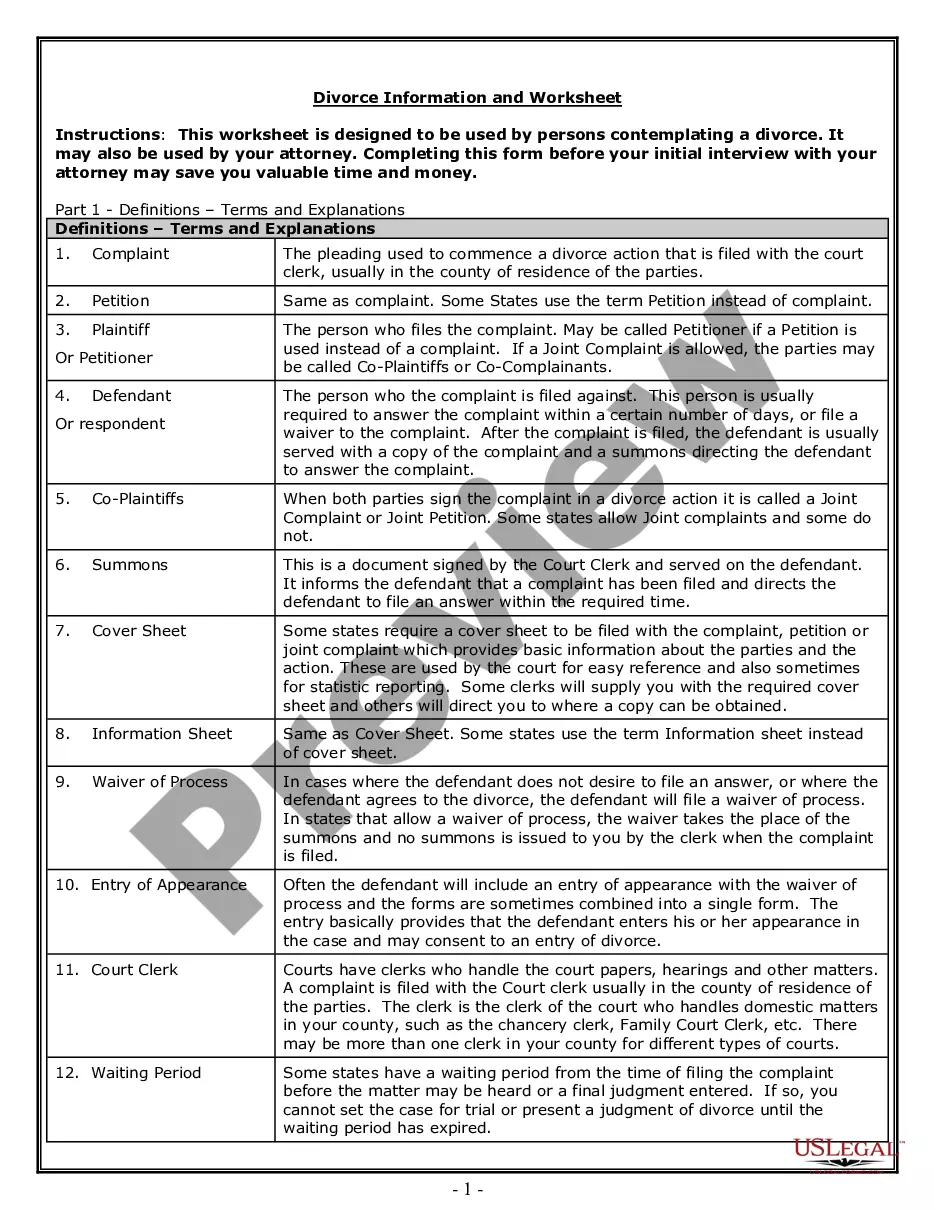

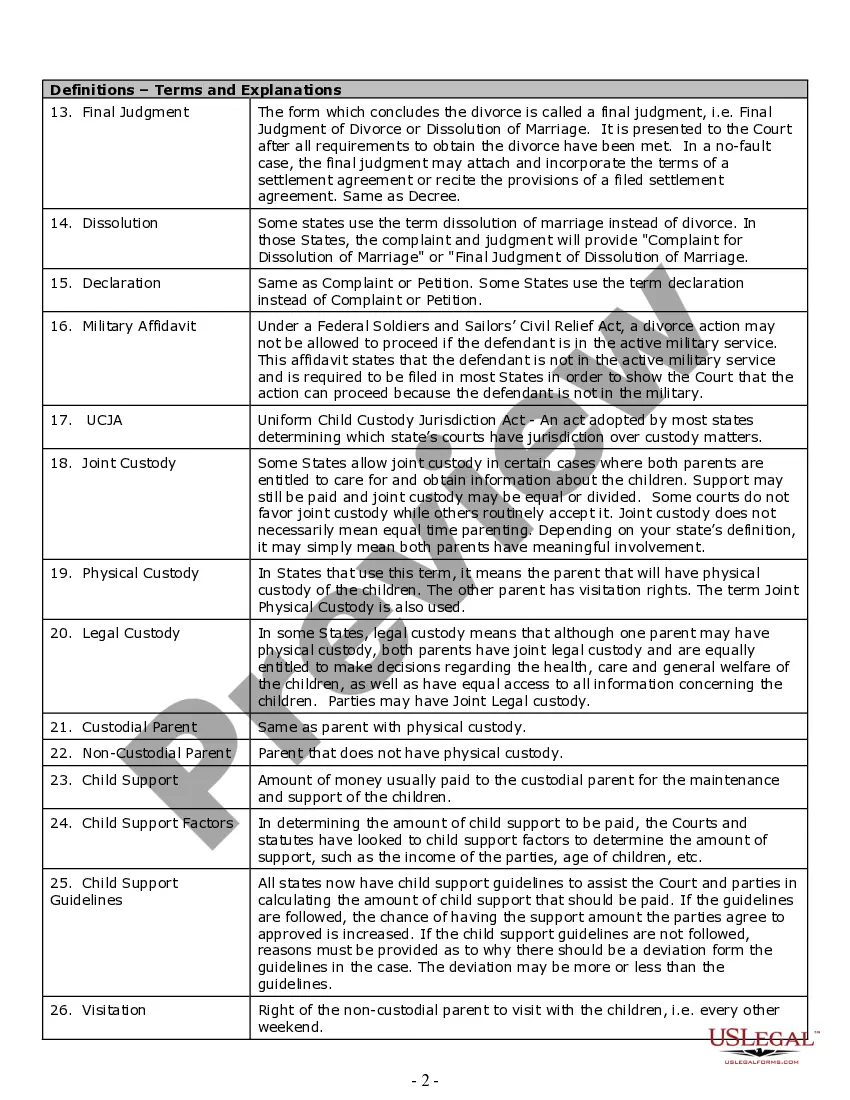

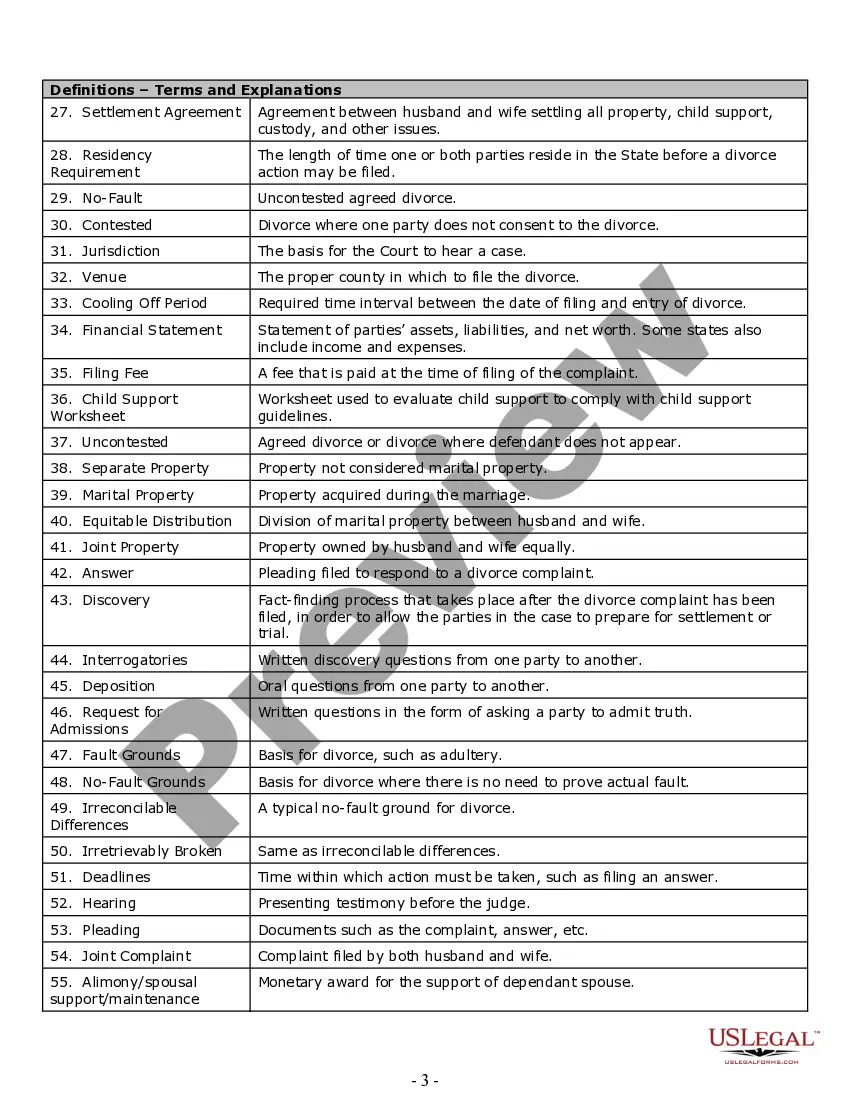

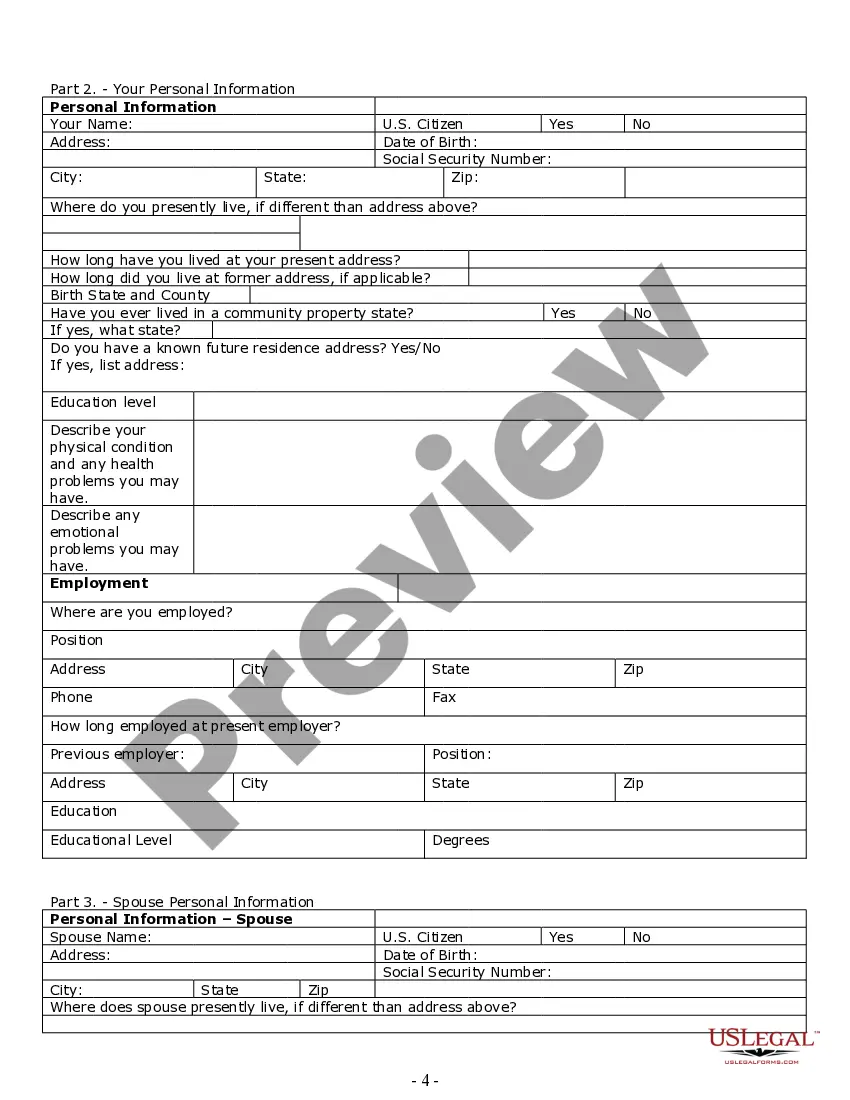

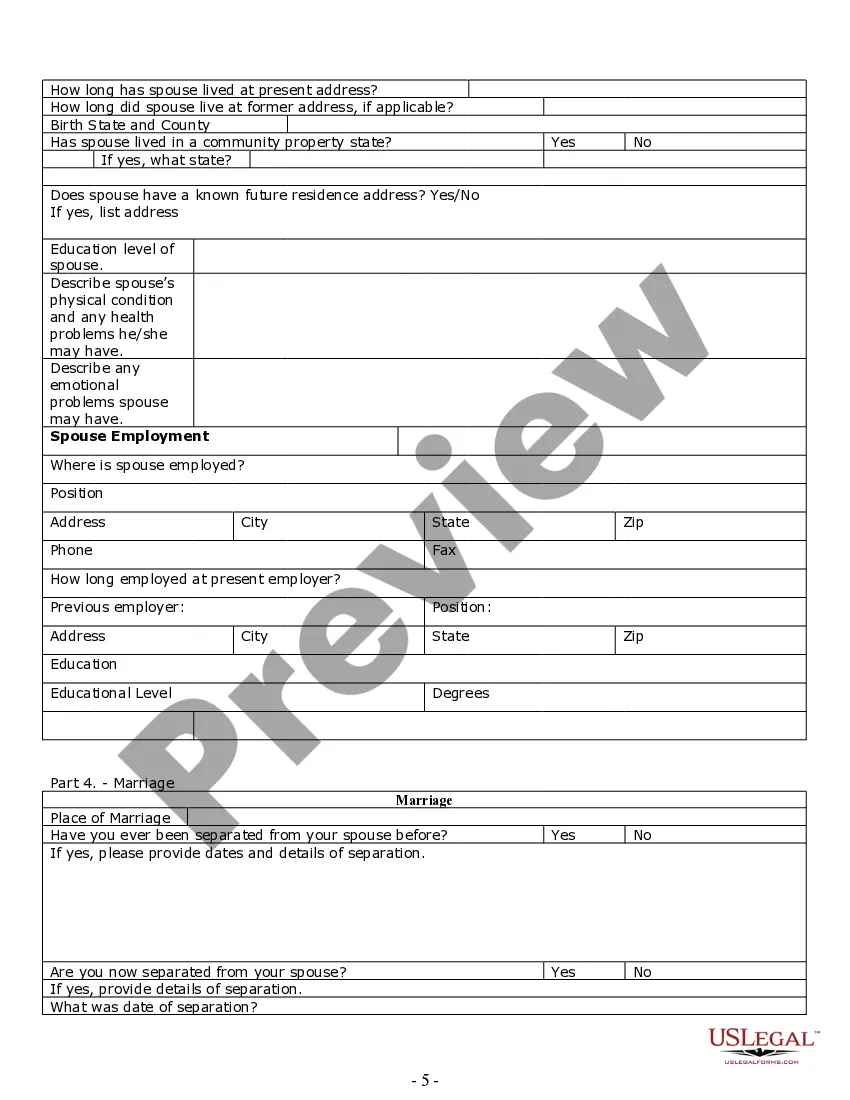

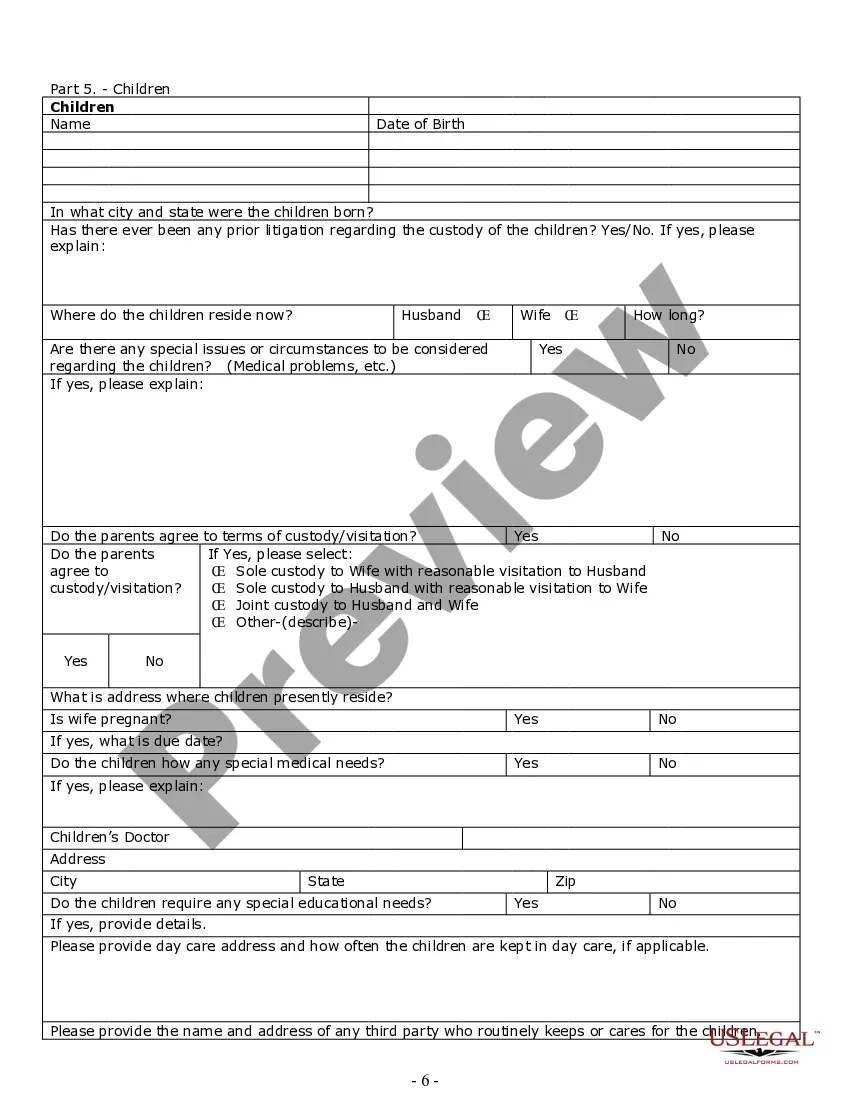

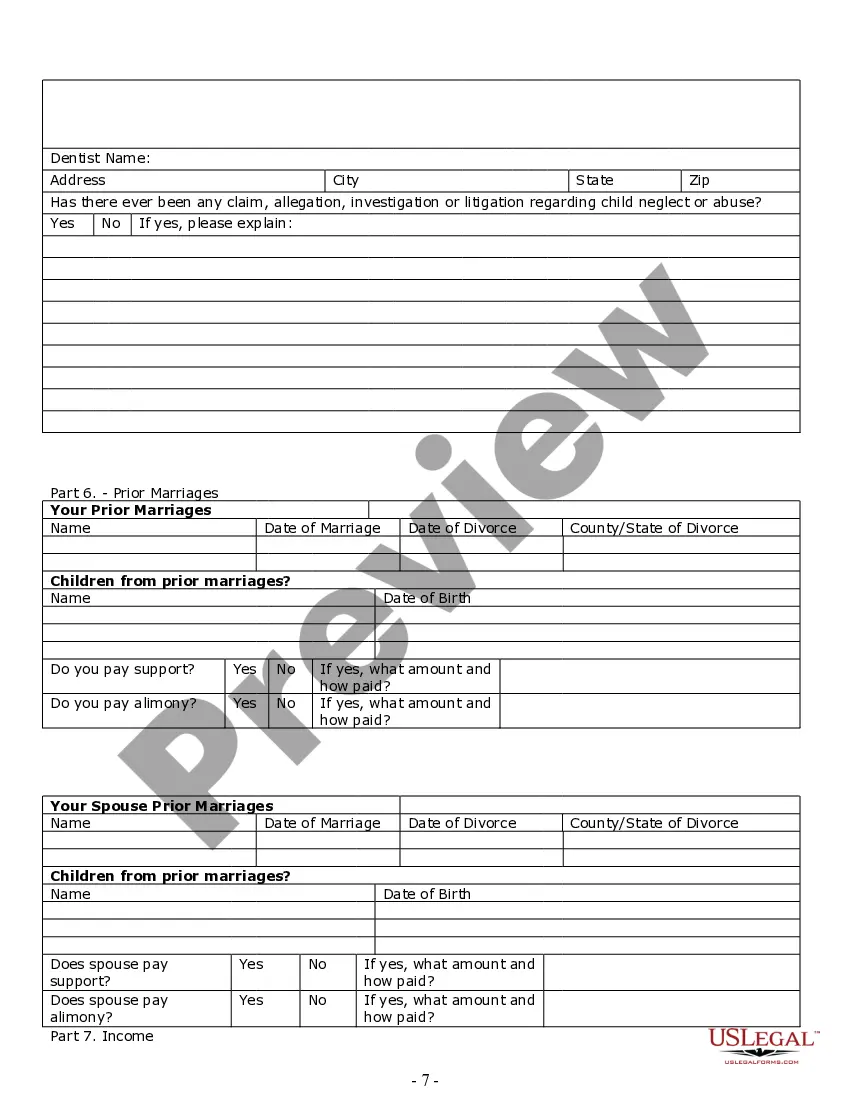

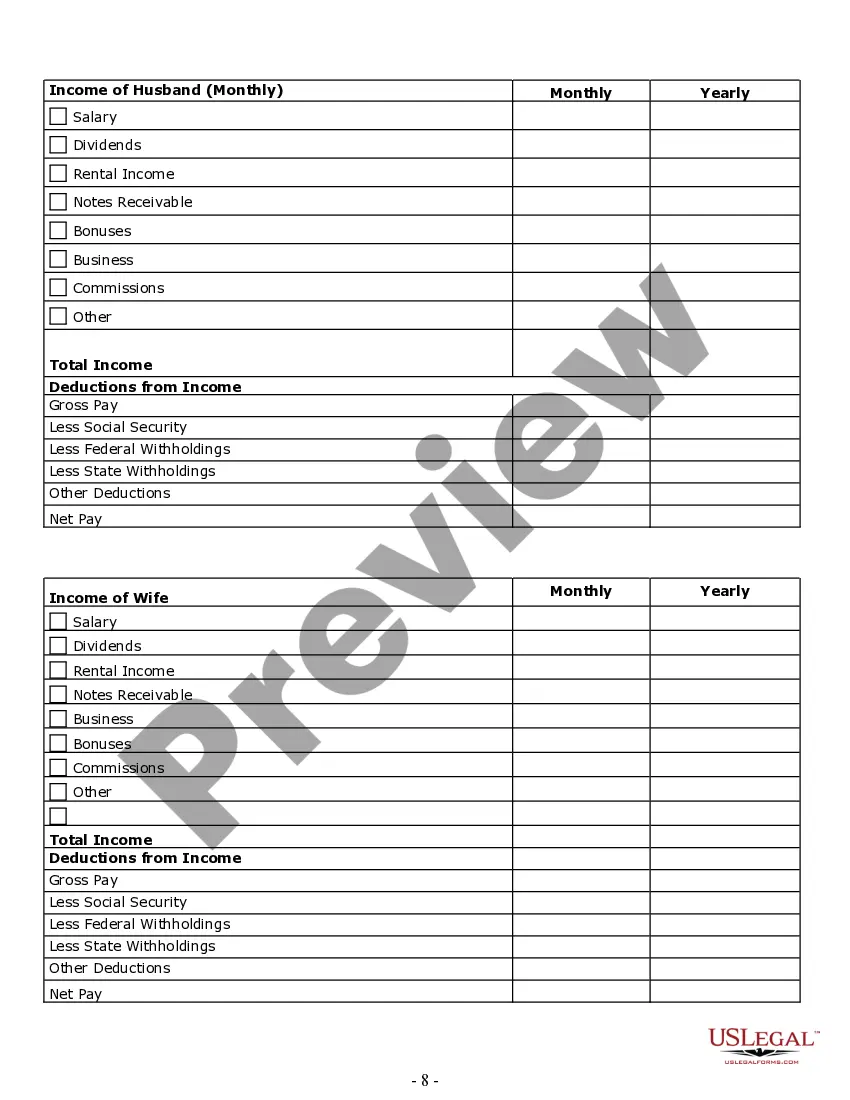

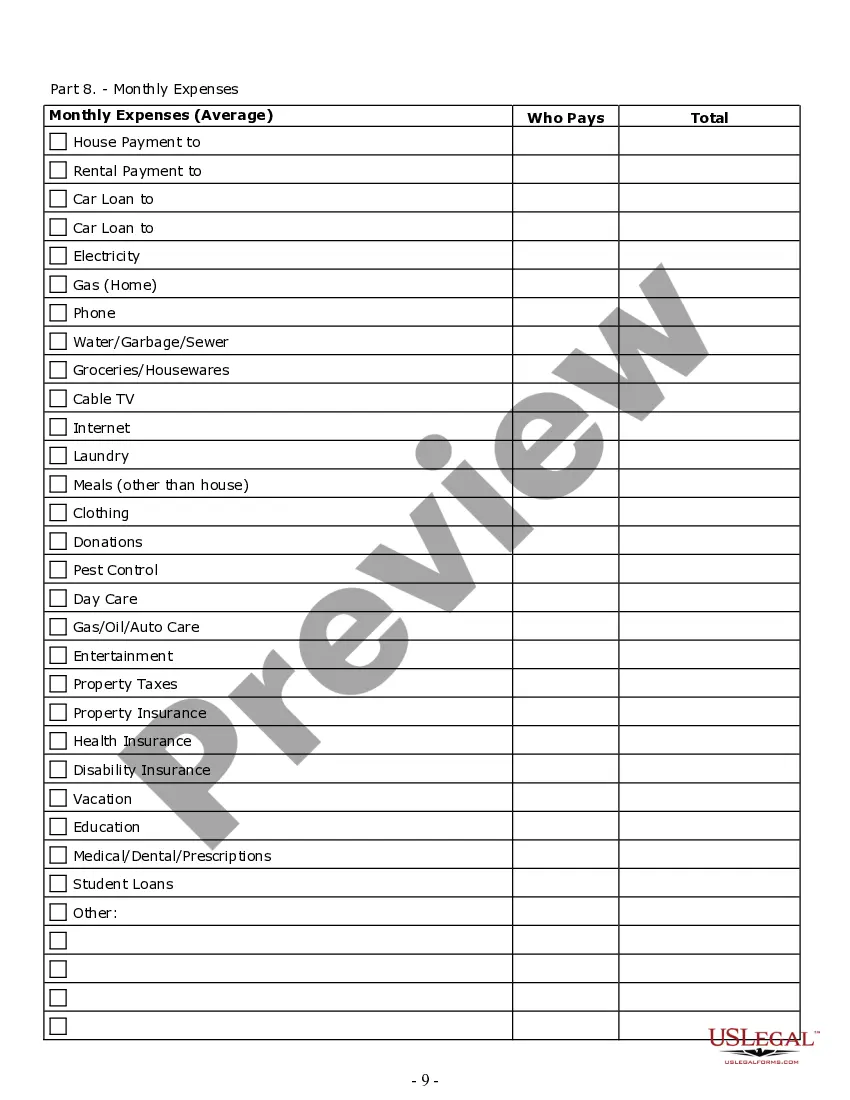

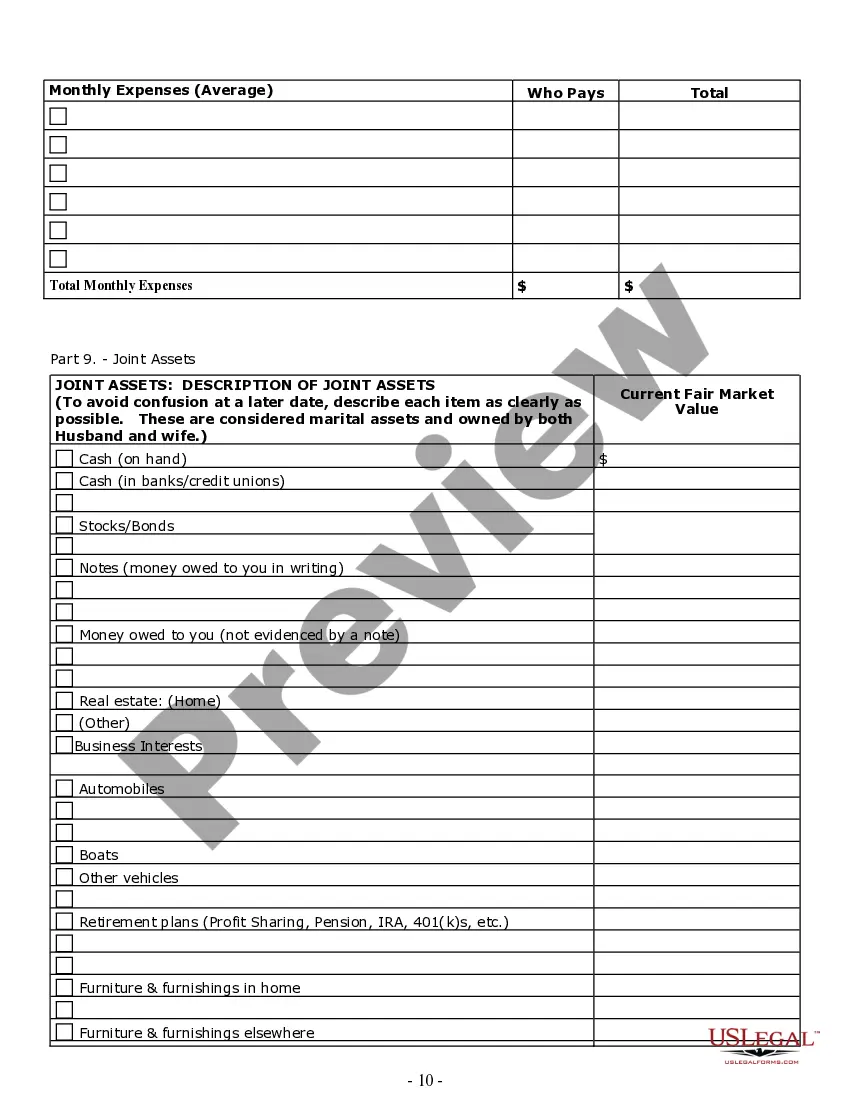

How to fill out Oklahoma Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Obtaining legal document examples that comply with federal and state regulations is crucial, and the web provides numerous selections to choose from.

However, what is the benefit of spending time searching for the correct Divorce Ok In The Bible example online when the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms stands as the largest virtual legal repository, featuring over 85,000 editable templates created by attorneys for various business and personal situations.

Examine the template using the Preview functionality or via the text summary to verify it fulfills your requirements.

- They are effortless to navigate with all documents sorted by state and intended use.

- Our specialists stay updated on law modifications, ensuring your paperwork remains current and compliant when acquiring a Divorce Ok In The Bible from our platform.

- Acquiring a Divorce Ok In The Bible is quick and straightforward for both existing and new users.

- If you possess an account with an active subscription, sign in and store the document sample you need in your preferred format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

According to biblical scripture, a divorced woman may remarry, particularly if her former spouse has committed adultery. In Matthew , there's an indication that remarriage is permitted for the innocent party following a divorce. For those contemplating remarriage, examining these principles is crucial.

The lienholder should file a petition with the Court of Common Pleas for the county in which the property is located containing a statement of the contract on which the lien is based, the amount due, a description of the property subject to the lien and ?all other material facts and circumstances.? S.C.

The fee is $2.50 to record an electronic lien and $2.50 for subsequent transmittals for ELT corrections.

Within 6 months of the date of last delivery of materials or performance of labor. NOTE: If there is a payment bond the deadline is more than 90 days but less than one year after claimant's last delivery. PUBLIC: More than 90 days but less than one year after last delivery by claimant.

South Carolina requires payment to be made first, and that the lien waiver should be in writing. Both conditional and unconditional lien waivers are allowed, as long as the payment associated with the waiver has been met. South Carolina has no requirement that a written lien waiver must be notarized.

To record a lien on a South Carolina title, you must fill in Section F of the Title Application (SCDMV Form 400) with all of the following information: Lienholder's name. Lienholder's address. Date of lien.

In South Carolina, a claim of lien must be filed no later than 90 days after the last day on which the claimant furnished labor or materials to the project. Unlike many other states, South Carolina generally allows ?call-back? or warranty work to extend the time period in which a lien may be filed.

State tax liens are active for 10 years. You cannot sell or refinance your property until you pay off your tax lien and receive a clear title.

State tax liens are active for 10 years. You cannot sell or refinance your property until you pay off your tax lien and receive a clear title.