One Other Corporation With Us

Description

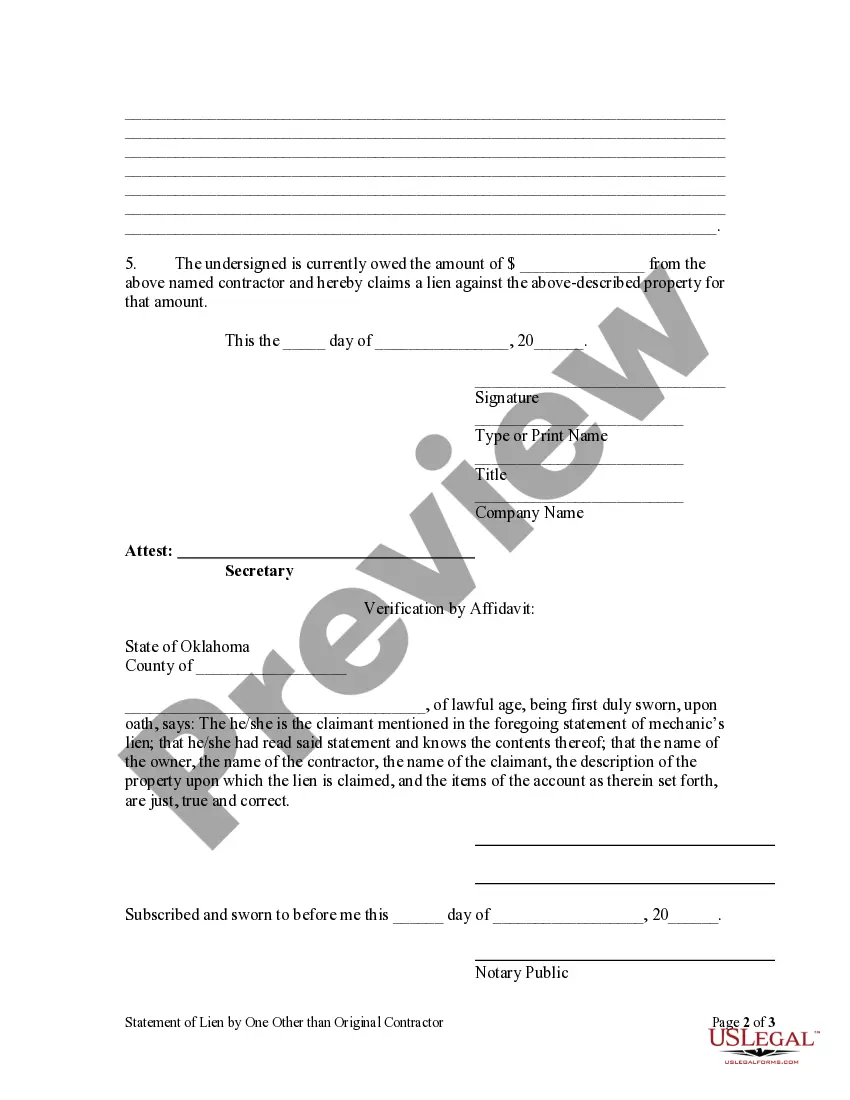

How to fill out Oklahoma Statement Of Lien - Subcontractor And Other By Corporation?

- If you are an existing user, start by logging in to your account and verifying your subscription status. Ensure it is active to download your essential form template.

- For first-time users, browse through the preview and description of forms to find one that aligns with your local jurisdiction requirements.

- If you need to adjust your choice, use the search bar to refine your results. Explore other templates until you find the perfect fit.

- Once satisfied, click the Buy Now button and select your desired subscription plan. Be sure to create an account for full access to our library.

- Complete your transaction by entering your credit card or utilizing your PayPal account for subscription payment.

- After purchasing, download your legal form to your device to begin filling it out. Access your downloaded forms at any time through the My Forms section of your account.

In conclusion, US Legal Forms is designed to empower users by providing a seamless experience in obtaining necessary legal documents. With its vast collection and expert assistance, managing legal aspects has never been more accessible.

Get started today with US Legal Forms and see how easy document processing can be!

Form popularity

FAQ

To classify your LLC as an S corp, you'll need to file Form 2553 with the IRS, ensuring you meet the eligibility criteria. This designation can provide tax benefits by allowing you to avoid double taxation on corporate income. If you're uncertain about this process, partnering with us to create one other corporation with us can simplify your transition and keep your business compliant.

Your classification as an S corp or LLC hinges on how you chose to set up your business during formation. If you haven't made a specific election, you might just be operating as a default LLC. To make the right decision for your business structure, you can explore options to form one other corporation with us for tailored advice and support.

To identify whether your LLC is taxed as a C corp or S corp, check your IRS tax filings and the election forms you submitted. If you filed Form 2553, your LLC is treated as an S corp for tax purposes. Understanding this difference is crucial in optimizing your tax strategy, and you can get assistance creating one other corporation with us to ensure proper classification.

Determining the type of LLC you own involves reviewing your formation documents and the state where it was established. Some LLCs elect to be taxed as S corps or C corps, which can impact your business operations. If you want clarity on your LLC's classification, you can explore forming one other corporation with us for expert guidance on structure and compliance.

Choosing between an LLC and an S corp depends on your business needs and goals. An LLC offers flexibility in management and is simpler to maintain, while an S corp may provide tax advantages. If you prefer limited liability and a straightforward structure, consider starting one other corporation with us as an LLC. However, if you're looking for potential tax benefits and plan to reinvest profits, an S corp could be the better option.

person company is a business exclusively owned and managed by a single individual. This format gives the owner complete control, making it easier to make quick decisions without the need for consensus among partners or shareholders. While it offers simplicity, it also means the owner assumes all risks and liabilities. Partnerships with a one other corporation with us can provide the necessary guidance and resources to help you manage your oneperson company effectively.

A company that is owned by one person is commonly called a sole proprietorship or a single-member LLC. This structure allows the owner to operate the business without the complexities that come with larger corporations. As the sole owner, you bear all the profits, responsibilities, and risks associated with the venture. To learn more about the benefits of establishing a one other corporation with us, consider your options in business ownership.

In the US, a one-person company is typically a business owned by a single individual who has full control over operations. This setup can take the form of a sole proprietorship or a single-member LLC, both providing distinct advantages regarding taxes and liability. Opting for a one-person company allows for direct decision-making and streamlined operations. Furthermore, one other corporation with us can assist you in choosing the best structure for your business needs.

person company is often referred to as a sole proprietorship or a singlemember LLC, depending on the legal structure. In this type of business, the owner retains full control and responsibility for all decisions and liabilities. This structure can be advantageous for entrepreneurs looking for simplicity in establishing their business. By choosing to partner with a one other corporation with us, you can seamlessly navigate the setup process.

person LLC, or limited liability company, in the USA is a business structure owned by a single individual. It provides personal liability protection while allowing the owner to report business income on their personal tax return. By forming a oneperson LLC, you can enjoy the flexibility and simplicity of managing a corporation while limiting your personal risk. If you're considering starting a business, explore how a one other corporation with us can support you in this journey.