One Other Corporation For 1120

Description

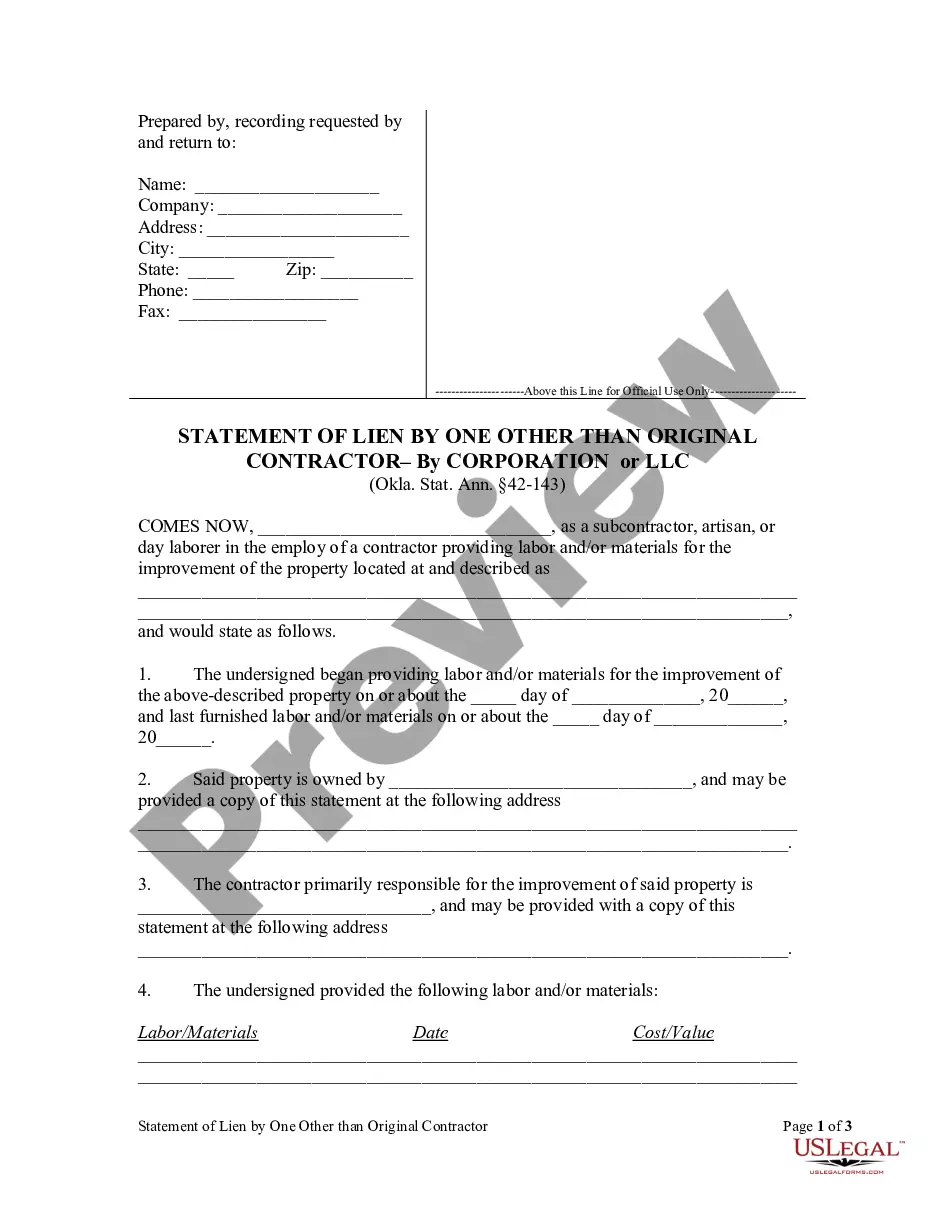

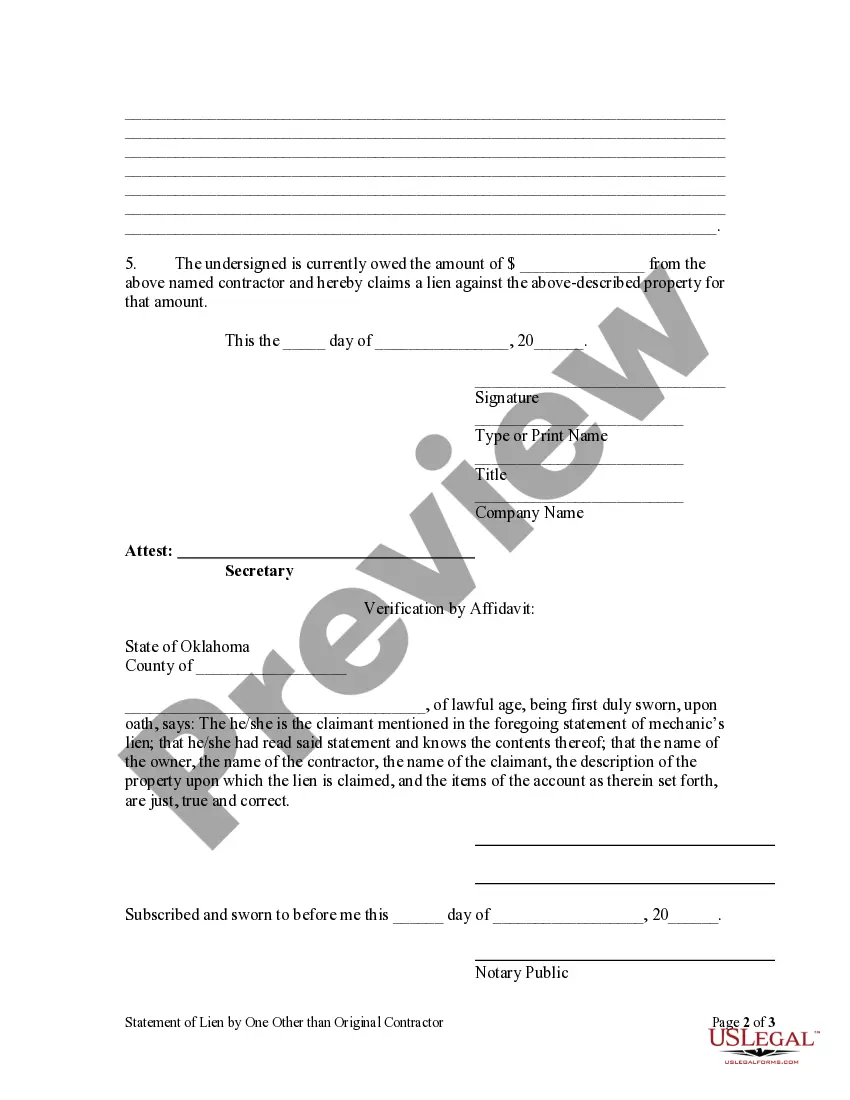

How to fill out Oklahoma Statement Of Lien - Subcontractor And Other By Corporation?

- If you're a returning user, log in to your account and check if your subscription is active to download the required form.

- New users should first review the available templates. Use the Preview mode to identify the correct document that aligns with your jurisdiction's needs.

- Should you find any discrepancies, utilize the Search function to locate the appropriate form. Ensure it fits your requirements before proceeding.

- Once you’ve pinpointed the right document, click on the Buy Now button to select your preferred subscription plan and register for an account.

- Enter your payment details, either through credit card or PayPal, to finalize your purchase.

- After completing your transaction, download the form to your device. You can access it anytime from the My Forms section of your profile.

US Legal Forms is an invaluable resource, boasting over 85,000 editable legal templates. Its robust collection surpasses competitors, offering the best value for your legal documentation needs.

Moreover, users can access expert guidance to ensure the forms are completed accurately. Start your journey with US Legal Forms today to streamline your documentation process!

Form popularity

FAQ

Yes, you can file Form 1120S yourself if you feel comfortable with the tax process. However, tax laws can be complex, and it may be beneficial to seek assistance from professionals or platforms like USLegalForms, which can provide resources and guidance. Understanding the nuances of the form is essential for accurate reporting, especially when dealing with One other corporation for 1120.

One perceived loophole for S Corporations is the ability to classify distributions as non-salary, allowing owners to avoid self-employment taxes on a portion of their income. By treating some income as distributions, rather than salary, owners can potentially save on taxes. However, it’s crucial to ensure compliance with IRS guidelines to avoid penalties. This tactic is a key consideration when analyzing One other corporation for 1120.

The two primary disadvantages of an S Corporation include limitations on the number of shareholders and restrictions on the type of stock that can be issued. For instance, S Corps cannot have more than 100 shareholders or issue multiple classes of shares. These limitations can impede growth and investment opportunities. Being aware of these factors is essential while considering forming One other corporation for 1120.

You can determine if your corporation is classified as S or C by checking your tax documents or your election status with the IRS. If your corporation filed Form 2553 and the IRS accepted it, you have an S Corporation. Otherwise, it is a C Corporation. Knowing this distinction is vital for appropriate tax treatment and understanding implications related to One other corporation for 1120.

Yes, many states require S Corporations to file an annual report. This report updates the state on corporate status, ownership changes, and business activities. Even though the S Corp itself plays a unique role in taxation, maintaining compliance with state regulations is essential. Understanding the annual reporting obligations is a crucial aspect of managing One other corporation for 1120.

No, an S Corporation does not file a separate tax return as a standard corporation does. Instead, it files Form 1120S, which reports income, deductions, and credits passed through to shareholders. This structure allows the profits and losses to be reported on the owners' personal tax returns, thus avoiding double taxation. This approach is critical for understanding how One other corporation for 1120 operates in tax law.

Determining when an S Corp becomes advantageous often depends on various factors, including state taxes and the nature of your business. Many experts suggest that if your business income exceeds $40,000 to $50,000, exploring an S Corp structure can be beneficial. Using one other corporation for 1120 in your planning can reveal if this structure suits your financial situation.

Generally, you do not file S Corp taxes with your personal taxes but report the S Corp’s income or loss on your personal tax return. This flow-through taxation structure allows the profits and losses of the S Corp to be distributed to the shareholders. When you file, remember to refer to one other corporation for 1120 for clarity on your responsibilities.

Yes, you can file your personal and S Corp taxes separately. This approach can allow you to manage your income and tax liabilities more effectively. Using one other corporation for 1120 can streamline the process, but be sure to keep your documentation organized to avoid any complications.

Form 1120 is primarily used for C Corporations, while an S Corporation typically uses Form 1120S. This distinction is important as each form has different implications for taxation. Understanding this helps you determine the right form based on your business structure, especially when you're considering one other corporation for 1120.