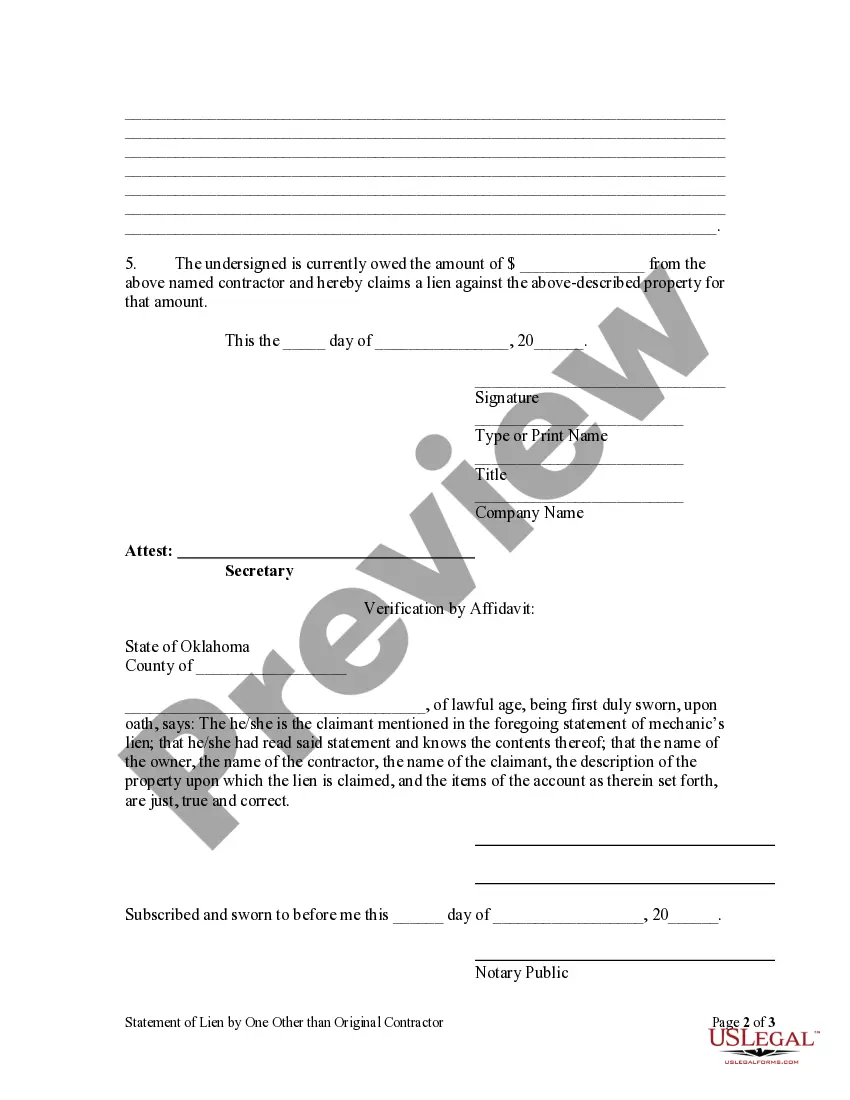

Any person who shall furnish any such material or lease or rent equipment used on said land or perform such labor as a subcontractor, or as an artisan or day laborer in the employ of the contractor, may obtain a lien upon such land, by filing with the county clerk of the county in which the land is situated, within ninety (90) days after the date upon which material or equipment used on said land was last furnished or labor last performed under such subcontract, a statement, verified by affidavit, setting forth the amount due from the contractor to the claimant, and the items thereof, as nearly as practicable, the name of the owner, the name of the contractor, the name of the claimant, and a legal description of the property upon which a lien is claimed.

Oklahoma Lien Correction Form

Description

Form popularity

FAQ

A lien entry form in Oklahoma is a legal document used to officially record a lien against a property. This form establishes a claim on the property, ensuring that creditors can collect debts if necessary. To correct any discrepancies in this record, you may need to use an Oklahoma lien correction form. Utilizing this form helps clarify or update necessary information, protecting your interests effectively.

To obtain a Title 42 in Oklahoma, which is used for transferring ownership of a vehicle, you need to complete the associated Oklahoma lien correction form. This includes providing proof of ownership, such as the original title or a bill of sale, along with a valid ID. Once you have all necessary documents, you can submit them to your local DMV for processing. uslegalforms simplifies this process by offering guidance and forms to ensure compliance.

Oklahoma is not a no title state; it does require vehicle titles for ownership. This means that owners must possess a title to register and transfer their vehicles legally. If you encounter issues with your title, using the Oklahoma lien correction form can help resolve them. With uslegalforms, you can find the necessary documents to clarify ownership disputes.

Oklahoma lien law allows a creditor to place a lien on a property as security for a debt. This ensures that the creditor has a claim to the property until the debt is satisfied. The law requires proper documentation and filing with local authorities to be recognized. For those needing to navigate this, the Oklahoma lien correction form is essential for managing and releasing liens effectively.

In Oklahoma, a lien release typically does not require notarization. Nonetheless, notarizing the document can add an extra layer of authenticity, which may be beneficial in certain situations. Using the Oklahoma lien correction form can simplify the release process and ensure all legal requirements are met, regardless of notarization.

To release a lien in Oklahoma, you must file a lien release form with the appropriate county clerk's office. This form confirms that the debt has been satisfied and that the lien is no longer valid. Utilizing the Oklahoma lien correction form helps streamline this process by providing the necessary information and ensuring compliance with local regulations.

In Oklahoma, a notary is not always required for title transfer. However, having a notary can help verify the identity of all parties involved in the transaction. Using the Oklahoma lien correction form can facilitate the process and provide clear documentation, ensuring that your title transfer is accurate and legally binding.

To obtain a lien release in Oklahoma, you must submit a lien release form to the appropriate county clerk's office. This typically requires proof that the debt has been satisfied, such as payment receipts. The Oklahoma lien correction form can also assist you in this process, ensuring that all necessary details are accurately documented.

Title 42 of the Oklahoma Statutes outlines the laws regarding property liens in the state. It establishes the process of recording, enforcing, and releasing liens, which is crucial for both creditors and debtors. Understanding these laws can enhance your use of the Oklahoma lien correction form, ensuring you follow the correct legal framework.

In Oklahoma, a lien generally lasts for five years from the date it is recorded. After this period, the lien may become inactive unless it is renewed or enforced through legal action. For those needing to manage lien expirations effectively, the Oklahoma lien correction form provides a clear path for updating or resolving any outstanding issues.