Grantor Vs Grantee In A Trust

Description

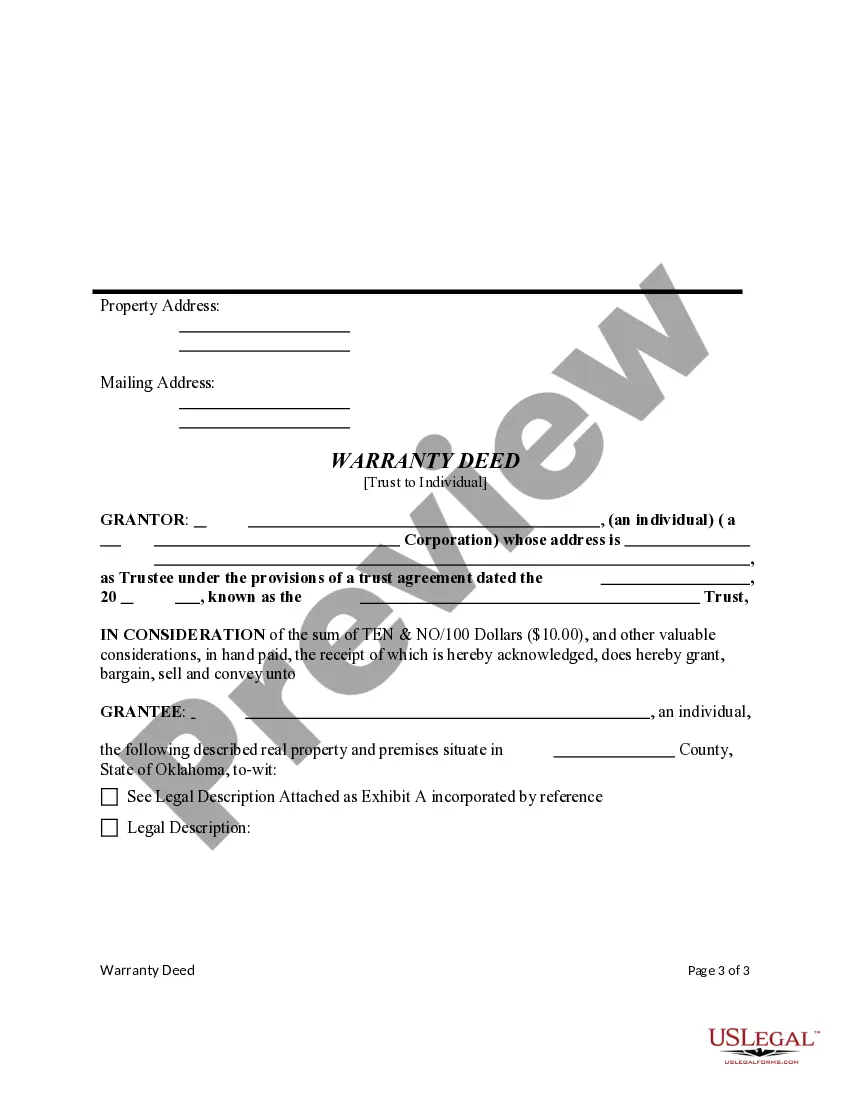

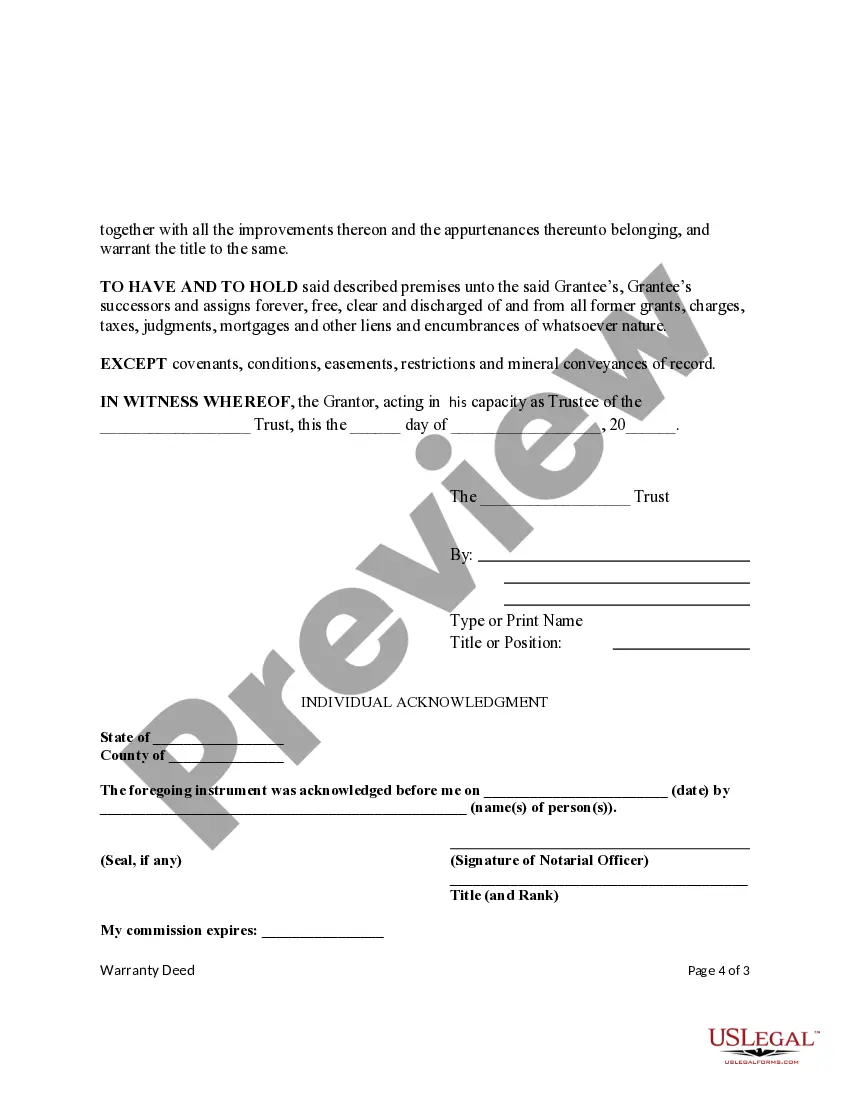

How to fill out Oklahoma Warranty Deed From A Trust As Grantor To An Individual As Grantee.?

Managing legal documents and processes can be a labor-intensive addition to your entire schedule.

Grantor Vs Grantee In A Trust and similar forms often require you to look for them and figure out how to complete them correctly.

Thus, if you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms readily available will significantly help.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms along with various resources to expedite your paperwork completion.

Is it your initial time using US Legal Forms? Sign up and create your account within minutes, granting you access to the form library and Grantor Vs Grantee In A Trust. Then, follow the steps below to complete your form: Be sure you have identified the correct form using the Preview feature and reviewing the form description. Choose Buy Now when you are prepared, and select the monthly subscription plan that suits your requirements. Click Download then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience assisting users in managing their legal documents. Find the form you need today and improve any process without exerting unnecessary effort.

- Explore the collection of pertinent documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific forms that are available at any moment for download.

- Safeguard your document management processes with an excellent service that enables you to prepare any form in minutes without additional or unforeseen charges.

- Simply Log In to your account, locate Grantor Vs Grantee In A Trust and retrieve it instantly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

The grantor of a trust is the person who creates the trust and contributes assets to it. This individual sets the terms and decides how the trust will operate, ultimately shaping the experiences of the grantee or beneficiary. Understanding the role of the grantor is crucial in the context of discussing grantor vs grantee in a trust. If you need more detailed guidance, the platform offered by US Legal Forms can assist you in drafting effective trust documents.

When the grantor of a trust passes away, the trust often becomes irrevocable, and a new Employer Identification Number (EIN) may be required for tax purposes. This change highlights the significance of understanding the differences in roles, especially in the context of grantor vs grantee in a trust. It’s advisable to consult a legal expert to navigate the complexities surrounding trust management after the grantor's death.

Generally, grantor trusts do not need to file a separate tax return, as their income is treated as the grantor's income. This characteristic simplifies tax reporting for the grantor, aligning with the discussion of grantor vs grantee in a trust. However, there can be exceptions based on the specific trust provisions or states involved. Consulting with a tax professional can provide clarity for your situation.

Yes, a grantor can choose not to be a trustee in managing a trust. This decision allows the grantor to appoint someone else to handle the trust's assets and make decisions. Understanding the roles of the grantor and the trustee is essential when considering a trust arrangement. Therefore, in the discussion of grantor vs grantee in a trust, it's important to recognize how these roles interact and the implications for asset management.

Typically, the grantor of a trust is the individual who wishes to pass on their assets during their lifetime or after death. This can be anyone wanting to ensure that their estate is managed according to their wishes. Understanding who the grantor is enhances your knowledge of grantor vs grantee in a trust, as it impacts how assets are allocated. For assistance in creating a trust, uslegalforms can streamline the process with user-friendly templates.

The grantor is the individual who creates the trust, while the trustee manages the trust according to the grantor's directions. In the discussion of grantor vs grantee in a trust, the trustee is responsible for administering the trust's assets and ensuring that beneficiaries receive their entitlements. Grasping this difference is crucial in trust planning, and uslegalforms provides tools to clarify these roles in your trust setup.

Yes, a trustee and grantor can indeed be the same person, especially in revocable trusts. This arrangement allows the grantor to maintain control over their assets while still enjoying the benefits of a trust. However, it's important to consider the implications of this setup, particularly in the context of grantor vs grantee in a trust. If you’re unsure, uslegalforms offers resources to guide you through the process.

The grantor in a trust is the individual who creates the trust and transfers assets into it. This person outlines the terms of the trust and determines how the assets will be managed and distributed. Understanding the role of the grantor is essential when exploring the concept of grantor vs grantee in a trust. If you're setting up a trust, uslegalforms can help you navigate the necessary documentation.

The grantor of a trust should ideally be an individual who wants to manage their assets for specific beneficiaries after their passing. This person can be the trust creator, establishing rules on how assets will be handled. By understanding the roles of grantor vs grantee in a trust, you can make informed choices about who should fulfill this important function in your estate planning.

In a trust, the grantor establishes the trust and decides how assets will be distributed, while the grantee is the recipient of those assets. The grantor's role is pivotal in setting the trust's terms, whereas the grantee's role is to benefit from the trust. Grasping the differences between grantor vs grantee in a trust ensures clarity in understanding your rights and responsibilities.