Grantor And Grantee On Deed Of Trust Form

Description

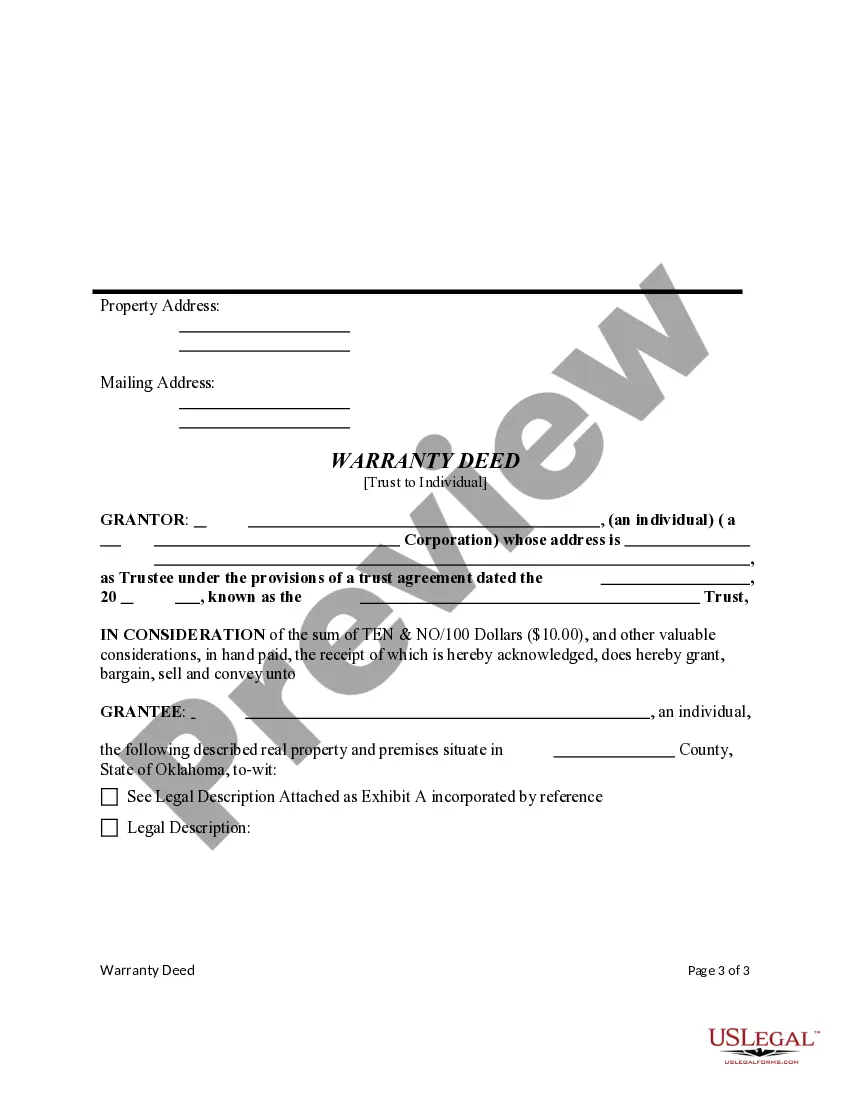

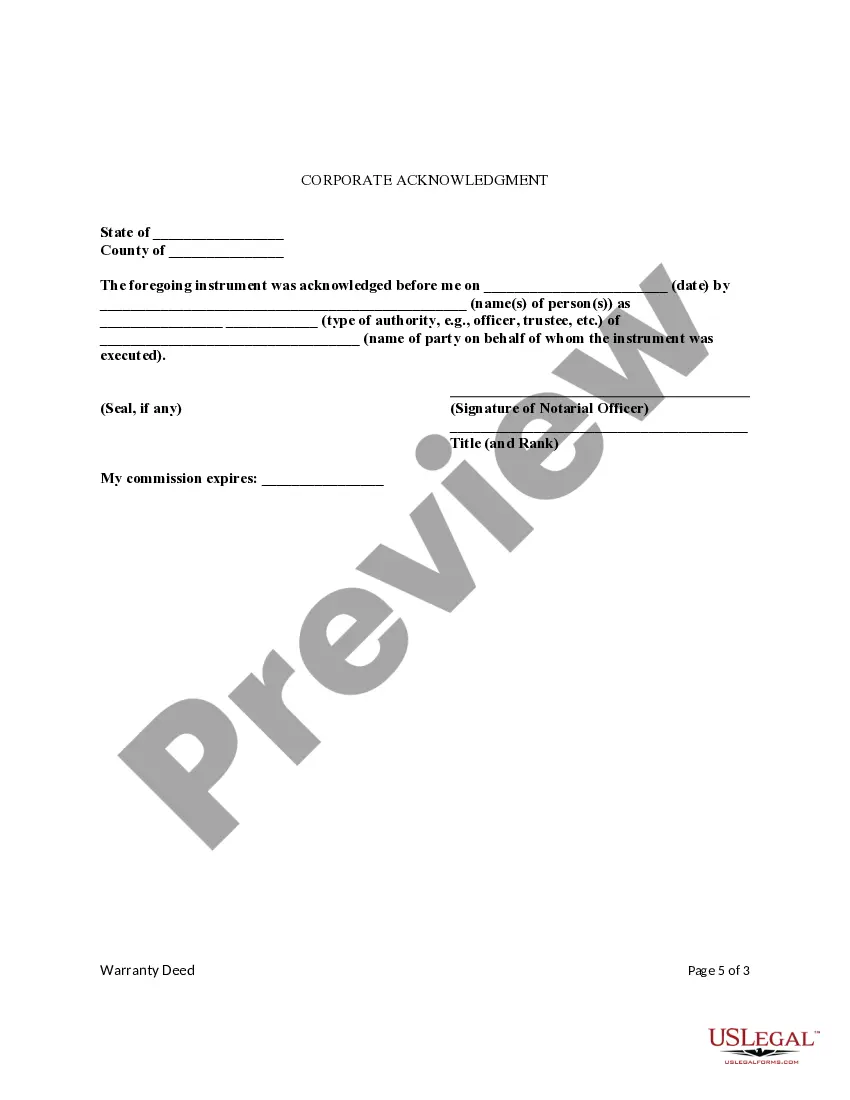

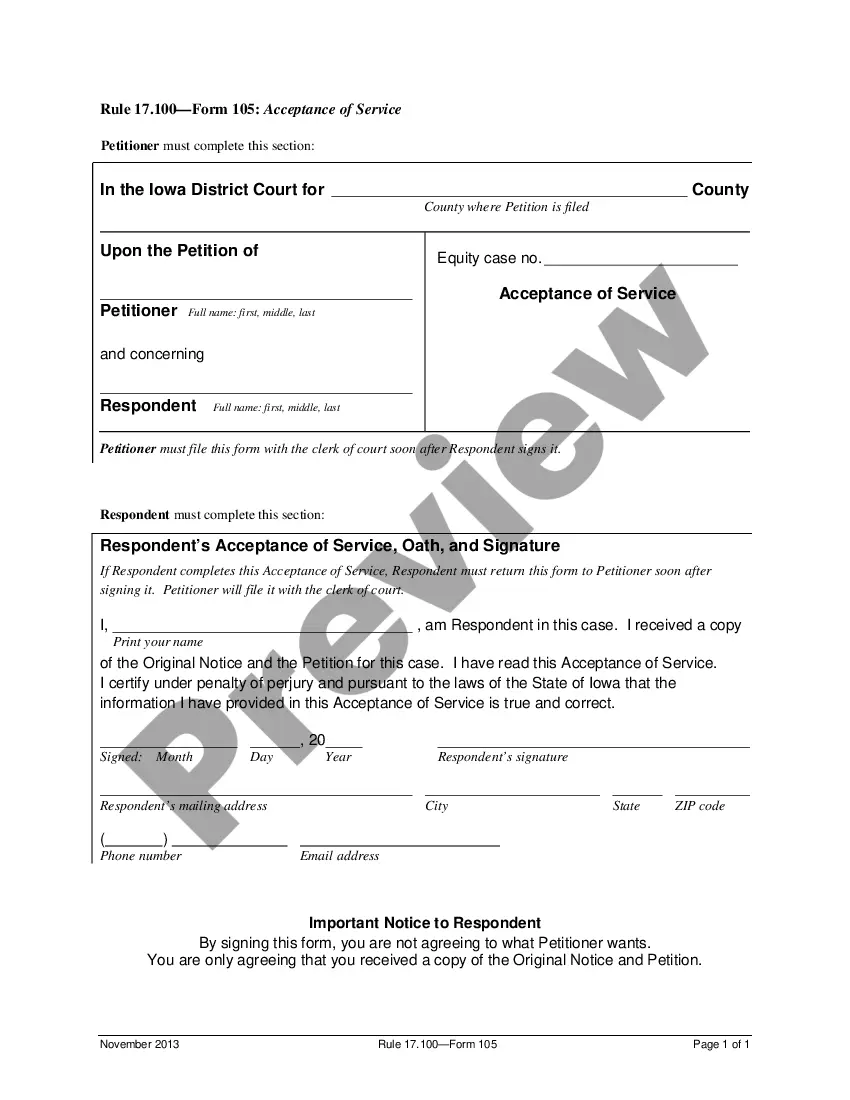

How to fill out Oklahoma Warranty Deed From A Trust As Grantor To An Individual As Grantee.?

Regardless of whether you handle documentation regularly or need to submit a legal paper infrequently, it is essential to have an information source where all the samples are pertinent and current.

The initial step you should take with a Grantor and Grantee on Deed of Trust Form is to ensure that it is the latest version, as this determines its eligibility for submission.

If you wish to simplify your search for the most recent document examples, look for them on US Legal Forms.

Utilize the search menu to locate the form you require.

- US Legal Forms serves as a directory of legal documents that includes almost any document sample you might need.

- Search for the templates you need, view their applicability immediately, and learn more about their usage.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Acquire the examples of the Grantor and Grantee on Deed of Trust Form in just a few clicks and keep them whenever needed in your profile.

- Having a US Legal Forms account will enhance your access to all required samples with greater ease and lesser complication.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need are readily available, eliminating the need to spend time searching for the correct template or verifying its relevance.

- To acquire a form without an account, adhere to these instructions.

Form popularity

FAQ

If a quitclaim deed is not recorded in California, it may create issues with property ownership and rights. The grantee may not have legal protection against claims from third parties, including creditors. It is vital to record the quitclaim deed to establish legal ownership and protect the interests of both the grantor and grantee on the deed of trust form. USLegalForms offers tools to assist you in ensuring your deed is properly recorded.

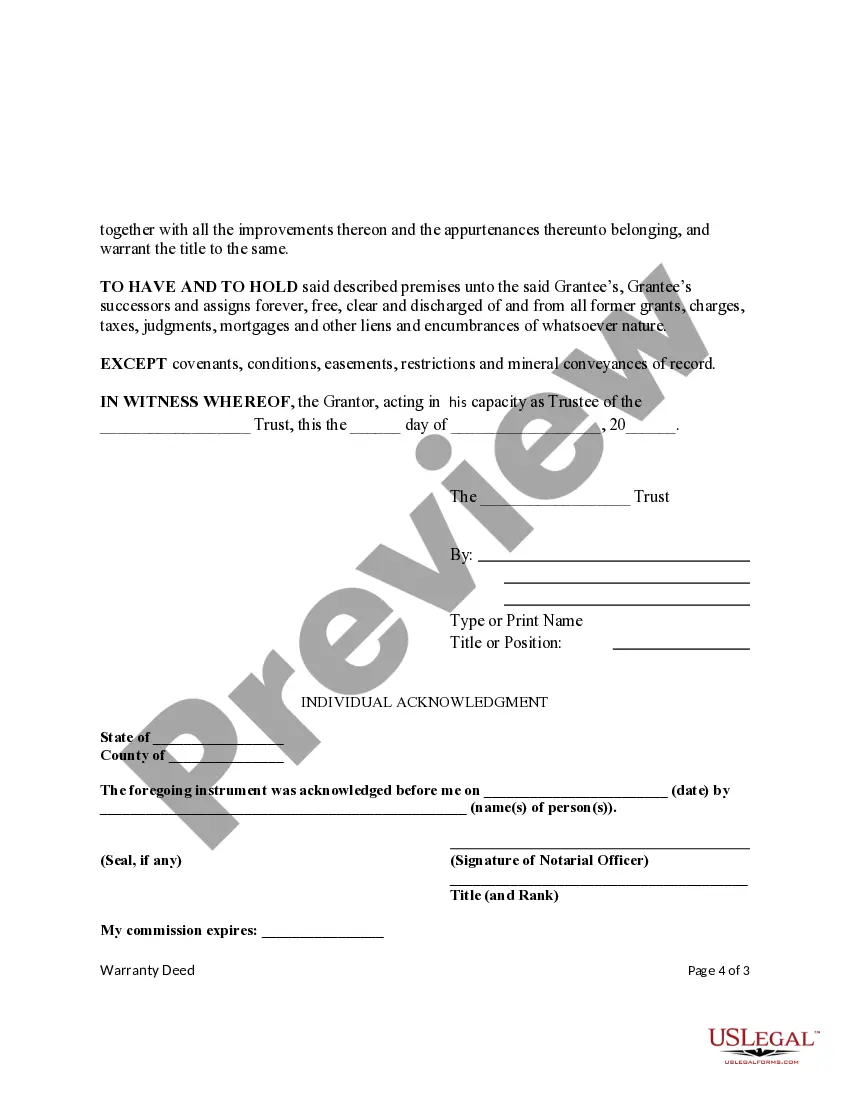

Filling out a quitclaim deed in California requires specific information about the property and the parties involved. You'll need to include the names of the grantor and grantee on the deed of trust form, along with a legal description of the property. Ensure that the deed is signed and dated by the grantor in the presence of a notary public. Using resources like USLegalForms can help you navigate the details and ensure accuracy.

Anyone can prepare a quitclaim deed in California, including the grantor or grantee themselves. However, it is advisable to consult a legal professional familiar with real estate law to ensure compliance with state regulations. Proper preparation of the deed protects both the grantor and grantee on the deed of trust form. Utilizing platforms like USLegalForms can simplify the process by providing templates and guidance.

The primary difference between a grantor and a guarantor lies in their roles within a transaction. A grantor transfers property rights through the deed of trust form, while a guarantor provides assurance or guarantees the obligations of another party without transferring any property rights. This distinction is vital for anyone engaging in real estate agreements.

The grantee is the buyer in a transaction involving the deed of trust form. This means that the individual or entity receiving property rights from a seller, who is the grantor, is considered the grantee. Recognizing these roles can help clarify responsibilities during the transaction process.

An example of a grantor and grantee scenario would be a homeowner selling their property to a new owner. Here, the homeowner acts as the grantor, transferring ownership to the buyer, who becomes the grantee. The deed of trust form outlines the specifics of this transfer, making the roles clear.

An example of a grantee could be a homebuyer who is purchasing a house from a seller. In this scenario, the buyer, as the grantee, receives the title and legal rights to the property once the deed of trust form is executed. This establishes a clear connection between the buyer and the property.

A grantee is an individual or entity that receives property or a benefit from a grantor through a deed of trust form. In the context of real estate transactions, the grantee takes on ownership or a right to the property outlined in the agreement. Understanding the role of the grantee is crucial for anyone involved in property transfers.

While both title and deed play critical roles in property ownership, title is generally considered more important because it represents the legal right to ownership. A deed facilitates the transfer of that title from the grantor to the grantee. In the context of the grantor and grantee on deed of trust form, having clear title ensures that the property transaction is valid. Ensuring clarity in both title and deed is essential for a smooth real estate process.

In the UK, a deed is a legal document that signifies the transfer of property ownership. A registered title, however, provides formal recognition of that ownership through a government registry. While both the grantor and grantee on deed of trust form are involved in the transaction, only a registered title provides public proof of ownership. Understanding this distinction can be crucial for international property transactions.