Deed In Probate

Description

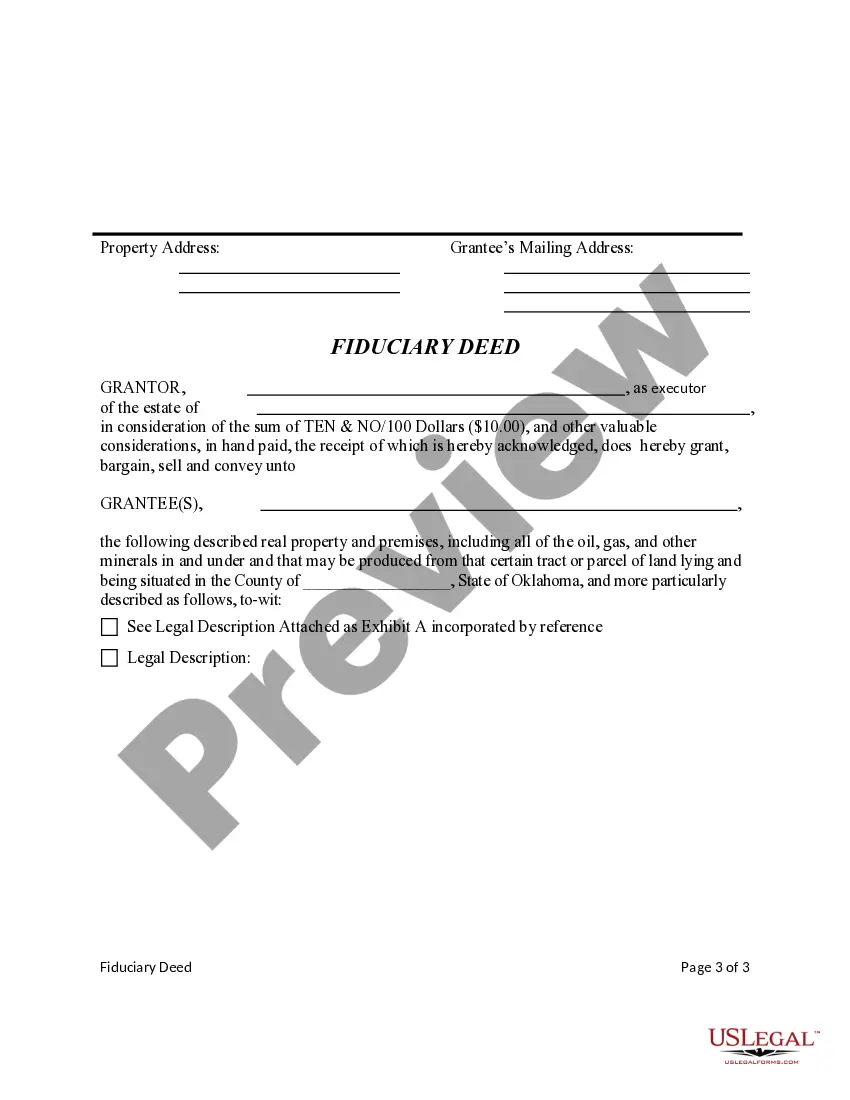

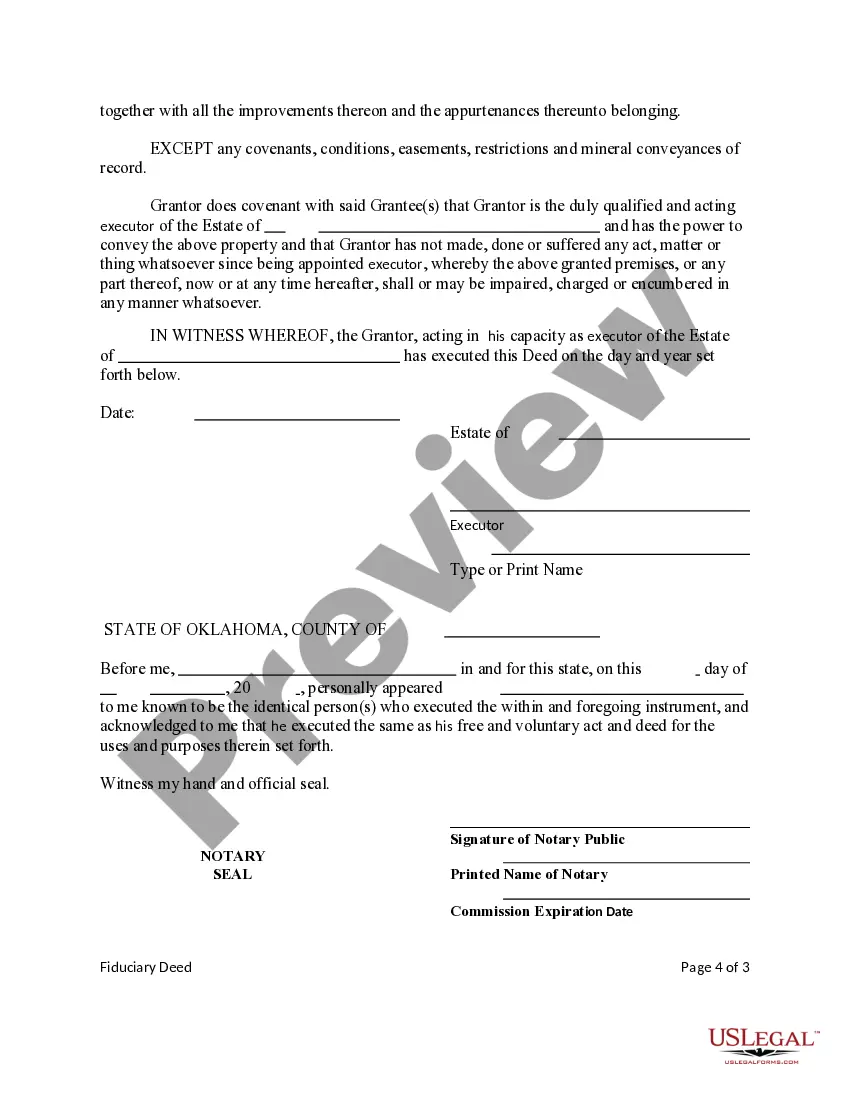

How to fill out Oklahoma Fiduciary Deed For Probate Estate - Testate Or Intestate?

Individuals commonly link legal documentation with something intricate that only an expert can manage.

In some respect, this is accurate, as creating a Deed In Probate requires extensive understanding of subject matter, including state and regional laws.

However, with US Legal Forms, everything has become more straightforward: pre-prepared legal templates for any personal and business circumstance pertinent to state laws are compiled in a single online archive and are now accessible to all.

You can either print your document or upload it to an online editor for faster completion. All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them anytime needed via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Sign up today!

- US Legal Forms offers over 85k current documents categorized by state and area of application, making it easy to search for a Deed In Probate or any other specific template in just minutes.

- Users who have previously registered and possess a valid subscription must Log In to their account and click Download to retrieve the document.

- New users to the service must register for an account and subscribe before downloading any forms.

- Here’s the detailed guide on how to obtain the Deed In Probate.

- Examine the page content thoroughly to confirm it meets your requirements.

- Review the form description or check it through the Preview function.

- If the preceding document does not meet your needs, locate another sample using the Search bar in the header.

- When you identify the appropriate Deed In Probate, click Buy Now.

- Select the subscription plan that aligns with your needs and financial plan.

- Create an account or Log In to move on to the payment screen.

- Complete your subscription payment via PayPal or with your credit card.

- Select the format for your document and click Download.

Form popularity

FAQ

Joint ownership, particularly with rights of survivorship, is one of the best types of ownership to avoid probate. In this arrangement, when one owner dies, the other automatically inherits the property without going through the deed in probate process. This seamless transfer provides significant advantages and minimizes administrative burdens for your loved ones. Be sure to evaluate the legal aspects of joint ownership and discuss it with an estate planning professional.

The best deed to avoid probate is often a transfer-on-death (TOD) deed. This type of deed allows property owners to specify who receives their property after their death, effectively bypassing the deed in probate process. Once the owner passes, the beneficiaries can claim the property without waiting for court proceedings. Always consider legal advice to ensure you correctly implement this option and understand its implications.

A revocable living trust is typically regarded as the best type of trust to avoid probate. This trust allows you to manage your assets during your lifetime and directs the transfer of these assets upon your passing, all without going through the deed in probate. Unlike wills, which usually require court involvement, a living trust simplifies the process, providing quick access to your beneficiaries. Make sure to consult a professional to ensure it fits your estate planning strategy.

The best type of deed often depends on your specific needs, but a revocable living trust deed is generally advisable. This type of deed allows you to maintain control over your assets while ensuring they pass directly to your beneficiaries, bypassing the deed in probate process. By creating a revocable living trust, you can provide peace of mind that your wishes will be carried out without unnecessary delays or expenses. Always consult with a legal expert to find the most suitable option for your circumstances.

To transfer a deed on inherited property in Texas, the heir must first obtain the appropriate legal documents, such as a certified copy of the will or an order from the probate court. The deed in probate must be updated to reflect the new owner's name officially. This process may seem complicated, but platforms like US Legal Forms offer templates and guidance for navigating these requirements easily.

Property deeds transfer through probate once the probate court approves the distribution of the deceased's assets. The executor must provide the necessary documentation, including the will and a death certificate, to facilitate this. A deed in probate ensures that the property is legally passed to the rightful heir. To simplify this process, many find US Legal Forms beneficial for managing the required legal documents.

The process to transfer a deed in Texas typically takes a few weeks, depending on several factors such as the completeness of the paperwork and how busy the local office is. When dealing with a deed in probate, the executor must ensure all debts and taxes are settled before the transfer. In some cases, legal assistance may expedite the process. Using US Legal Forms can help streamline the documentation needed for the deed in probate.